TIDMAUR

RNS Number : 2876W

Aurum Mining PLC

06 November 2014

AURUM MINING PLC

("Aurum" or "the Company")

Interim Results for the six months ended 30 September 2014

Aurum Mining plc (AIM: AUR), the Spanish focused gold and

tungsten explorer, is pleased to report its interim results for the

six months ended 30 September 2014.

Contacts:

Aurum Mining plc www.aurummining.net

Chris Eadie, Chief Executive

Officer +44 (0) 20 7499 4000

WH Ireland Limited

Nominated Adviser & Broker www.wh-ireland.co.uk

Mike Coe, Ed Allsopp +44 (0) 117 945 3470

Aurum Mining Plc

Review of Activities

Aurum Mining plc (AIM: AUR) is pleased to announce its interim

results for the six months ended 30 September 2014.

The Company's 2014 Annual Report, which was published on 18

August 2014, outlined that the Board was changing the Company's

strategy and direction to ensure the growth and development of the

Company as a direct result of the very challenging market

conditions that are adversely impacting the junior mining sector.

The Annual Report went on to say that the Board would be working

closely in conjunction with the Company's major Shareholder to

identify and complete a transformational deal that will enhance the

prospects of the Company.

During the last couple of months the Board has looked at a

number of potential opportunities, both natural and non-natural

resource, and this will continue to be the focus of the next

period. Shareholders in AIM listed junior mining companies have

faced a long period of falling valuations and increased dilution

and with no end in sight for the ongoing downturn, the Board feels

that this change in strategic direction is unquestionably the right

thing for the Company to do.

The Board looks forward to keeping the market up to date with

progress.

Gold projects

In tandem with the new strategic approach, the Company will be

looking to drive value from the successful exploration work

undertaken on the gold projects to date. Aurum is working closely

with its joint venture partner Ormonde Mining plc ("Ormonde") (AIM:

ORM) to achieve this. There have been a number of discussions with

interested parties around structuring a deal for Aurum's stake in

the gold projects and a number of these discussions are on-going.

There is currently a very low level of activity taking place on the

gold projects, and in the short term the Company will refrain from

funding, resulting in a small dilution, which currently stands at

just over one per cent.

Morille tungsten project

Following the completion of the deal with Plymouth Minerals

Limited ("Plymouth") (ASX: PLH) in which Plymouth became Aurum's

partner on the Morille tungsten project, significant exploration

work has been carried out on the project. The Board has been

impressed by the energy and enthusiasm of Plymouth and the work

done to date has yielded some very promising results. The Board

looks forward to updating the market with further exploration

updates in the near future.

Key financials

For the six months to 30 September 2014, the Group reported a

loss of GBP172,000 compared to a loss of GBP259,000 for the same

period in 2013.

On 21 August 2014, the Company announced that it had raised

GBP60,000 (before expenses) through a placing of 4,800,000 new

Ordinary Shares. The funds of the placing are enabling the Company

to pursue its revised strategy.

On 31 October 2014, the twelve month anniversary of the disposal

of the Morille project, the Company received EUR50,000 of Plymouth

shares as final consideration from the transaction.

During this period of transition, cash management and cost

control have remained key priorities for the Company.

Administrative costs have been significantly reduced over recent

months and the full impact of these reductions will be seen in the

full year numbers.

Corporate

The Board would like to thank its Shareholders and advisers for

their input during this period. In particular the Board would like

to thank the Company's major Shareholder for the on-going support

it is receiving during this transitional period.

Qualified Person

Sean Finlay, Professional Geologist, Chartered Engineer,

Chairman of Aurum Mining plc, and a qualified person as defined in

the Guidance Note for Mining, Oil and Gas Companies, June 2009, of

the London Stock Exchange, has reviewed and approved the technical

information contained in this report.

Sean Finlay Chris Eadie

Chairman Chief Executive Officer

6 November 2014

CONSOLIDATED INCOME STATEMENT

for the six months ended 30 september 2014

Six months Six months Year ended

to 30 September to 30 September 31 March

2014 2013 2014

Notes GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Administrative expenses (172) (263) (479)

----------------- ----------------- -----------------

Operating loss (172) (263) (479)

Finance income - 4 1

----------------- ----------------- -----------------

Loss for the year before

taxation (172) (259) (478)

Taxation - - -

----------------- ----------------- -----------------

Loss for the year from

continuing operations (172) (259) (478)

Loss for the year from

discontinued operations - - (52)

----------------- ----------------- -----------------

Loss attributable to the

equity shareholders of

the parent company (172) (259) (530)

----------------- ----------------- -----------------

Loss per share expressed

in pence per share

From continuing operations

Basic and Diluted 2 (0.12)p (0.18)p (0.34)p

From discontinued operations

Basic and Diluted 2 - - (0.03)p

Total operations

Basic and Diluted 2 (0.12)p (0.18)p (0.37)p

CONSOLIDATED statement of COMPREHENSIVE INCOME

for the six months ended 30 september 2014

Six months Six months Year ended

to 30 September to 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Loss after taxation for the

financial year (172) (259) (530)

----------------- ----------------- -----------

Items that will or may be reclassified

to P&L:

Exchange translation differences - - -

on consolidation of Group entities

----------------- ----------------- -----------

Other comprehensive income - - -

Total comprehensive expense

attributable to the equity shareholders

of the parent company (172) ( 259) ( 530)

----------------- ----------------- -----------

ConSOLIDATED statement of financial position

as at 30 september 2014

Six months Six months Year ended

to 30 September to 30 September 31 March

2014 2013 2014

Assets Notes GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Non-current assets

Intangible assets 3 899 1,193 899

Investments 64 - 64

----------------- ----------------- -----------

Total non-current assets 963 1,193 963

----------------- ----------------- -----------

Current assets

Receivables 57 30 62

Cash and cash equivalents 67 269 214

----------------- ----------------- -----------

Total current assets 124 299 276

----------------- ----------------- -----------

Total assets 1,087 1,492 1,239

----------------- ----------------- -----------

Liabilities

Current liabilities

Trade and other payables 74 95 113

----------------- ----------------- -----------

Total current liabilities 74 95 113

----------------- ----------------- -----------

Total liabilities 74 95 113

----------------- ----------------- -----------

Net assets 1,013 1,397 1,126

----------------- ----------------- -----------

Capital and reserves attributable

to the equity holders of

the company

Share capital 4 1,461 1,413 1,413

Share premium 11,596 11,585 11,585

Retained deficit (12,044) (11,601) (11,872)

----------------- ----------------- -----------

Total Equity 1,013 1,397 1,126

----------------- ----------------- -----------

CONSOLIDATED statement of Changes in equity

Share premium Retained

Share capital deficit Total Equity

GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2014 1,413 11,585 (11,872) 1,126

Total comprehensive expense

for the year - - (172) (172)

Issue of shares net of issue

costs 48 11 - 59

At 30 September 2014 (unaudited) 1,461 11,596 (12,044) 1,013

-------------- ----------------- ----------------- ----------------

At 1 April 2013 1,413 11,585 (11,342) 1,656

Total comprehensive expense

for the year - - (259) (259)

At 30 September 2013 (unaudited) 1,413 11,585 (11,601) 1,397

------ ------- --------- ------

At 1 April 2013 1,413 11,585 (11,342) 1,656

Total comprehensive expense

for the year - - (530) (530)

At 31 March 2014 (audited) 1,413 11,585 (11,872) 1,126

------ ------- --------- ------

The following describes the nature and purpose of each reserve

within owners' equity.

Reserve Description and purpose

Share capital Amounts subscribed for share capital

at nominal value.

Share premium Amounts subscribed for share capital

in excess of nominal value.

Retained deficit Cumulative net gains and losses recognised

in the income statement less distributions

made.

CONSOLIDATED statement of cash flows

for the six months ended 30 september 2014

Six months

to 30 Six months Year ended

September to 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Unaudited

Cash flows from operating activities

Loss for the year before tax (172) (259) (530)

Adjustments for:

Finance income - (4) (1)

Disposal of subsidiaries - - 30

Exchange differences - 4 1

---------------- -------------------- --------------------

Cash flow from operating activities

before changes in working capital (172) (259) (500)

Decrease in other receivables 5 27 37

(Decrease) / increase in trade

and other payables (39) (4) 14

---------------- -------------------- --------------------

Net cash flow used in operating

activities (206) (236) (449)

---------------- -------------------- --------------------

Investing activities

Ormonde joint venture payments - (132) (159)

Expenditure on tungsten project - (61) -

Disposal of subsidiary net of

cash - - 124

---------------- -------------------- --------------------

Net cash flow used in investing

activities - (193) (35)

---------------- -------------------- --------------------

Financing activities

Proceeds from issue of share

capital 60 - -

Expenses paid in connection with

share issues (1) - -

---------------- -------------------- --------------------

Net cash flow from financing

activities 59 - -

---------------- -------------------- --------------------

Net decrease in cash and cash

equivalents (147) (429) (484)

---------------- -------------------- --------------------

Cash and cash equivalents at

the beginning of the period/

year 214 698 698

Effect of exchange rate changes

on cash and cash equivalents - - -

---------------- -------------------- --------------------

Cash and cash equivalents at

the end of the period/ year 67 269 214

---------------- -------------------- --------------------

Notes to the Consolidated Interim Financial Statements

For the half year ended 30 September 2014

1. Basis of preparation

The unaudited consolidated interim financial statements have

been prepared in accordance with International Financial Reporting

Standards, International Accounting Standards and Interpretations

(collectively IFRSs). The Group has not elected to comply with IAS

34 "Interim Financial Reporting" as permitted. The principal

accounting policies used in preparing the interim financial

statements are unchanged from those disclosed in the Group's Annual

Report for the year ended 31 March 2014 and are expected to be

consistent with those policies that will be in effect at the year

end except the Group has adopted a number of revised standards and

interpretations. However, none of these has had a material affect

on the Group's reporting. In addition the IASB has issued a number

of IFRS and IFRIC amendments and interpretations since the last

annual report.

The financial statements for the six months ended 30 September

2014 and 30 September 2013 are un-reviewed and unaudited. The

comparative financial information does not constitute statutory

financial statements as defined by Section 434 of the Companies Act

2006. The comparative financial information for the year ended 31

March 2014 is not the Company's full statutory accounts for that

period. A copy of those statutory financial statements has been

delivered to the registrar of companies. The auditors' report on

those accounts was unqualified, but did draw attention by way of

emphasis, in respect of the Group's ability to continue as a going

concern, but did not contain a statement under section 498 (2) or

498 (3) of the Companies Act 2006.

The Group financial statements are presented in Great Britain

Pounds Sterling, and all values are rounded to the nearest thousand

Pounds (GBP'000) except when otherwise indicated.

Going concern

Following a review of the Group's operations, its current

financial position and cash flow forecasts, the Directors do not

believe that the Group currently has sufficient cash resources to

continue in operational existence for the next twelve months.

However in addition to being able to reduce overheads still

further, the Company has assets for potential sale, deferred

consideration shares in Plymouth for disposal and a Letter of

Support from its major Shareholder which commits to underwrite the

Group's underlying operating costs until August 2015.

Based on the above the Directors have formed a view that the

Group will have financial resources available to it, in the twelve

months from the date of signing the interim financial statements,

to enable the Group to meet its financial commitments as they

arise. Accordingly, the Directors continue to adopt the going

concern basis for the preparation of these interim financial

statements.

2. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to the ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

For diluted loss per share, the weighted average number of

shares in issue is adjusted to assume conversion of all dilutive

potential ordinary shares.

As at 30 September 2014 there were 4,450,000 (30 September 2013:

4,450,000, 31 March 2014: 4,450,000) potentially dilutive ordinary

shares.

The effect of all potential ordinary shares arising from the

exercise of options is anti-dilutive and therefore diluted loss per

share has not been calculated.

Six months Six months Year ended

to 30 September to 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

Unaudited Unaudited audited

Net loss attributable to equity

holders of the parent:

From continuing operations (172) (259) (478)

From discontinued operations - - (52)

----------------------- ----------------- -----------

From total operations (172) (259) (530)

----------------------- ----------------- -----------

Six months Six months Year ended

to 30 September to 30 September 31 March

2014 2013 2014

Number Number Number

Unaudited Unaudited audited

Weighted average number of

shares:

Weighted average number of

shares 142,162,260 141,291,930 141,291,930

----------------- ----------------- ------------

3. Intangible assets

30 September 30 September 31 March

2014 2013 2014

GBP'000 GBP'000 GBP'000

Intangible assets Unaudited Unaudited Audited

Gold exploration 899 872 899

Tungsten project - 321 -

Total intangible assets 899 1,193 899

--------------- --------------- -----------

4. Share capital

Nominal

Number value Share premium Total

GBP'000 GBP'000 GBP'000

Authorised

Ordinary shares of GBP0.01 200,000,000 2,000 - 2,000

Allotted, issued and fully

paid ordinary shares of

GBP0.01

As at 1 April 2013 and

1 April 2014 141,291,930 1,413 11,585 12,998

Issue of shares net of

issue costs 4,800,000 48 11 59

As at 30 September 2014 146,091,930 1,461 11,596 13,057

------------ -------- -------------- --------

5. Events after the reporting period

Details of significant post reporting period events are included

within the Review of Activities.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LFFVFLVLEIIS

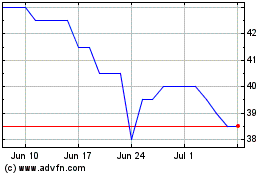

Shearwater (LSE:SWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

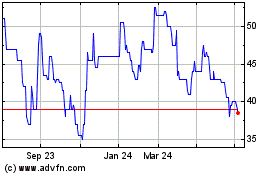

Shearwater (LSE:SWG)

Historical Stock Chart

From Apr 2023 to Apr 2024