TIDMAZN

RNS Number : 7428G

AstraZeneca PLC

06 March 2015

AstraZeneca REFINES ITS FINANCIAL REPORTING

in line with evolving business model

6 March 2015

AstraZeneca today announces an update to the presentation of its

Statement of Comprehensive Income, which will see revenue from

externalisation becoming more visible to enhance transparency for

investors. The change is effective from 1 January 2015 and will be

reported as part of the Company's first quarter financial results

on 24 April 2015. The impact is presentational and therefore does

not impact Reported or Core profit.

As previously outlined, AstraZeneca's business model includes an

increasing level of externalisation activity to create value from

the strong science that exists in the pipeline. This will benefit

patients whilst sharpening further the focus on our main therapy

areas - Respiratory, Inflammation & Autoimmunity;

Cardiovascular & Metabolic Disease and Oncology. The Company's

two biotech centres, the Innovative Medicines Unit and MedImmune,

continue to increase R&D productivity. Consequently AstraZeneca

will consider opportunities to out-licence technologies and

potential new medicines to ensure these reach patients as quickly

as possible.

The updated financial reporting structure reflects the Company's

entrepreneurial approach and provides a clear picture of a growing

additional revenue stream.

Historically, reported revenue reflected only product sales

(formerly known as sales revenue), with externalisation revenue

forming part of other operating income presented below cost of

goods sold (COGS). From 1 January 2015 externalisation revenue,

alongside product sales, contribute to total revenue, which is

shown above COGS. Externalisation revenue includes development,

commercialisation, partnership and out-licence revenue, such as

royalties and milestone receipts, together with income from

services or repeatable licences.

Income will be recorded as externalisation revenue when the

Company has an ongoing interest in the product and/or it is

repeatable business and there is no derecognition of an intangible

asset. Disposals of assets and businesses, where AstraZeneca does

not retain an interest, will continue to be recorded in other

operating income.

The Company has updated its revenue accounting policy with

effect from 1 January 2015 and the prior-year financial results

will be restated accordingly. An illustration of the change to the

presentation of prior-period Core financial performance is shown in

the appendix. These numbers are unaudited and are indicative of the

impact of the change in policy.

2015 Financial Guidance

To reflect the change outlined above, the Company today provides

2015 total revenue guidance. Total revenue is expected to decline

by mid single-digit percent at constant exchange rates (CER). This

is consistent with previous guidance stating that sales revenue was

expected to decline by mid single-digit percent at CER. Core EPS

guidance is unchanged and Core EPS is expected to increase by low

single-digit percent at CER.

The Company also provides the following non-guidance information

related to currency sensitivity: Based on current exchange rates(1)

, total revenue is expected to decline by low double-digit percent.

This is consistent with previous expectations stating an

anticipated sales revenue decline of low double-digit percent. Core

EPS is expected to be broadly in line with 2014. For additional

currency sensitivity information, please see below:

Average exchange Impact of 5% weakening

rates versus in exchange rate versus

USD USD ($m)(2)

--------- ----------------------- ----------------------------

YTD Core

Primary Feb Change Total operating

Currency relevance 2014 2015(1) % revenue profit

--------- ---------- ----------- ---------- ------ -------- ------------

Product

EUR sales 0.75 0.87 (13) (194) (119)

Product

JPY sales 105.87 118.55 (11) (105) (75)

Product

CNY sales 6.16 6.23 (1) (113) (48)

SEK Costs 6.86 8.22 (16) (5) 95

GBP Costs 0.61 0.66 (7) (34) 104

Other(3) (213) (123)

---------------------------------- ----------- ---------- ------ -------- ------------

(1) Based on average daily spot rates YTD to the end of February

2015.

(2) Based on 2014 actual group currency exposures.

(3) Other important currencies include AUD, BRL, CAD, KRW and

RUB.

ENDS -

Appendix

Impact of Revenue Accounting Changes

All numbers shown below are at actual exchange rates in $m

unless otherwise stated.

Core Q1 2013 Core Q2 2013 Core Q3 2013 Core Q4 2013 Core FY 2013

Restated As Restated As Restated As Restated As Restated As

Formerly Formerly Formerly Formerly Formerly

Presented Presented Presented Presented Presented

Product Sales 6,385 6,385 6,232 6,232 6,250 6,250 6,844 6,844 25,711 25,711

Externalisation

Revenue 12 - 47 - 12 - 12 - 83 -

Total Revenue 6,397 6,385 6,279 6,232 6,262 6,250 6,856 6,844 25,794 25,711

--------- ---------- --------- ---------- --------- ---------- --------- ---------- --------- ----------

Cost of Sales (1,136) (1,136) (1,105) (1,105) (1,103) (1,103) (1,289) (1,289) (4,633) (4,633)

Gross Profit 5,261 5,249 5,174 5,127 5,159 5,147 5,567 5,555 21,161 21,078

Distribution (77) (77) (76) (76) (81) (81) (72) (72) (306) (306)

R&D (963) (963) (1,040) (1,040) (1,061) (1,061) (1,205) (1,205) (4,269) (4,269)

SG&A (2,055) (2,055) (2,173) (2,173) (2,154) (2,154) (2,483) (2,483) (8,865) (8,865)

Other Income 158 170 171 218 164 176 176 188 669 752

Operating Profit 2,324 2,324 2,056 2,056 2,027 2,027 1,983 1,983 8,390 8,390

----------------- --------- ---------- --------- ---------- --------- ---------- --------- ---------- --------- ----------

All numbers shown below are at actual exchange rates in $m

unless otherwise stated.

Core Q1 2014 Core Q2 2014 Core Q3 2014 Core Q4 2014 Core FY 2014

Restated As Restated As Restated As Restated As Restated As

Formerly Formerly Formerly Formerly Formerly

Presented Presented Presented Presented Presented

Product Sales 6,416 6,416 6,454 6,454 6,542 6,542 6,683 6,683 26,095 26,095

Externalisation

Revenue 49 - 302 - 69 - 41 - 461 -

Total Revenue 6,465 6,416 6,756 6,454 6,611 6,542 6,724 6,683 26,556 26,095

--------- ---------- --------- ---------- --------- ---------- --------- ---------- --------- ----------

Cost of Sales (1,193) (1,193) (1,156) (1,156) (1,180) (1,180) (1,359) (1,359) (4,888) (4,888)

Gross Profit 5,272 5,223 5,600 5,298 5,431 5,362 5,365 5,324 21,668 21,207

Distribution (72) (72) (77) (77) (87) (87) (88) (88) (324) (324)

R&D (1,098) (1,098) (1,208) (1,208) (1,275) (1,275) (1,360) (1,360) (4,941) (4,941)

SG&A (2,317) (2,317) (2,460) (2,460) (2,486) (2,486) (2,953) (2,953) (10,216) (10,216)

Other Income 167 216 176 478 187 256 220 261 750 1,211

Operating Profit 1,952 1,952 2,031 2,031 1,770 1,770 1,184 1,184 6,937 6,937

----------------- --------- ---------- --------- ---------- --------- ---------- --------- ---------- --------- ----------

NOTES TO EDITORS

About AstraZeneca

AstraZeneca is a global, innovation-driven biopharmaceutical

business that focuses on the discovery, development and

commercialisation of prescription medicines, primarily for the

treatment of cardiovascular, metabolic, respiratory, inflammation,

autoimmune, oncology, infection and neuroscience diseases.

AstraZeneca operates in over 100 countries and its innovative

medicines are used by millions of patients worldwide.

CONTACTS

Media Enquiries

Esra Erkal-Paler +44 20 7604 8030 (UK/Global)

Vanessa Rhodes +44 20 7604 8037 (UK/Global)

Ayesha Bharmal +44 20 7604 8034 (UK/Global)

Jacob Lund +46 8 553 260 20 (Sweden)

Investor Enquiries

Thomas Kudsk Larsen +44 20 7604 8199 mob: +44 7818 524185

Karl Hård +44 20 7604 8123 mob: +44 7789 654364

Eugenia Litz +44 20 7604 8233 mob: +44 7884 735627

Craig Marks +44 20 7604 8591 mob: +44 7881 615764

Christer Gruvris +44 20 7604 8126 mob: +44 7827 836825

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUGUGCWUPAUQQ

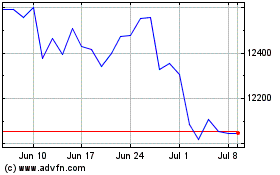

Astrazeneca (LSE:AZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

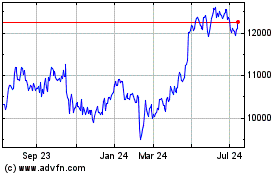

Astrazeneca (LSE:AZN)

Historical Stock Chart

From Apr 2023 to Apr 2024