Asian Shares Fall After China Data

May 05 2016 - 12:40AM

Dow Jones News

Trading in Asia was lackluster Thursday, as investors grew more

wary about a multiweek stock rally that is rapidly losing

steam.

Hong Kong's Hang Seng Index was down 0.5%, while the Shanghai

Composite Index was down 0.3%. Australia's S&P/ASX 200 was

roughly flat.

A few markets in the region were closed for holidays, including

South Korea and Japan, making for a quiet day of trading.

Investors were mostly focused on data showing that Chinese

services activity expanded in April, albeit at a slower pace than

in March. The Caixin China services purchasing managers index

slipped to 51.8 in April from 52.2 in March. A reading above 50

indicates an expansion.

Stocks in Hong Kong pared losses after the release of the PMI

data and the Australian dollar edged up against the U.S.

dollar.

Still, "it will be a concern that despite a large injection of

liquidity [by Chinese authorities], the service sector isn't

booming," said Andrew Sullivan, managing director at brokerage

Haitong International in Hong Kong.

Analysts said that Beijing will be expected to keep implementing

moderate stimulus given the economy still faces relatively strong

downward pressure.

Meanwhile, energy shares in the region were mixed.

In Australia, shares of BHP Billiton continued to fall—a 2.8%

loss on top of Wednesday's 9.4% drop. BHP, Vale and their Samarco

Mineraç ã o joint venture face a 155 billion real (US$43.68

billion) claim by Brazilian federal prosecutors for liabilities

stemming from a dam disaster last year.

Still, the energy sector was up 1% on the S&P/ASX 200,

broadly bouncing back from steep losses on Wednesday.

Investors in Australia also factored in data showing that the

country's trade deficit narrowed to 2.16 billion Australian dollars

(US$1.61 billion) in March, compared with a deficit of A$3.04

billion in February. The value of exports rose 4% in March from

February, while the value of imports rose 1% in the same period.

Separately, Australian retail sales rose 0.4% in March from a month

earlier.

Shares of National Australia Bank were up 2.8% after the firm

reported earnings for the first half of the year that were broadly

in line with analysts' expectations. The bank reported a net loss

of A$1.74 billion in the six months through March from a profit of

A$3.44 billion a year earlier amid its exit from the U.K. banking

business.

Dominique Fong, James Glynn and Robb M. Stewart contributed to

this article.

Write to Chao Deng at Chao.Deng@wsj.com

(END) Dow Jones Newswires

May 05, 2016 00:25 ET (04:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

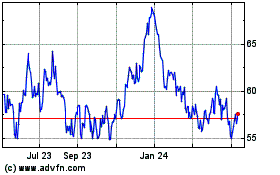

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

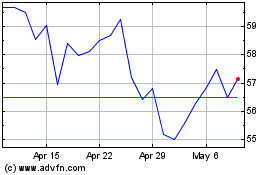

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024