Ashmore Group PLC Trading Statement (5473M)

October 14 2016 - 2:00AM

UK Regulatory

TIDMASHM

RNS Number : 5473M

Ashmore Group PLC

14 October 2016

Ashmore Group plc

+0700 14 October 2016

FIRST QUARTER ASSETS UNDER MANAGEMENT STATEMENT

Ashmore Group plc ("Ashmore", "the Group"), the specialist

Emerging Markets asset manager, announces today the following

update to its assets under management ("AuM") in respect of the

quarter ended 30 September 2016.

Assets under management

Actual Estimated Movement

30 September

30 June 2016 2016 Q1 vs Q4

Theme (US$ billion) (US$ billion) (%)

---------------- --------------- --------------- ----------

External debt 11.7 12.2 +4%

---------------- --------------- --------------- ----------

Local currency 13.3 13.7 +3%

---------------- --------------- --------------- ----------

Corporate

debt 5.0 5.3 +6%

---------------- --------------- --------------- ----------

Blended debt 13.7 14.5 +6%

---------------- --------------- --------------- ----------

Equities 3.1 3.0 -3%

---------------- --------------- --------------- ----------

Alternatives 1.5 1.5 -

---------------- --------------- --------------- ----------

Multi-asset 1.2 1.2 -

---------------- --------------- --------------- ----------

Overlay /

liquidity 3.1 3.2 +3%

---------------- --------------- --------------- ----------

Total 52.6 54.6 +4%

---------------- --------------- --------------- ----------

Assets under management increased by US$2.0 billion during the

period, driven solely by positive investment performance. Net flows

were flat for the three months.

The neutral net flow for the quarter results from small net

inflows into the blended debt, local currency, corporate debt and

overlay/liquidity themes, offset by equally small net outflows from

equities, external debt, and multi-asset. Flows were flat in the

alternatives theme during the period.

Positive investment performance was delivered across the liquid

asset classes of blended debt, external debt, local currency,

corporate debt, equities and multi-asset, reflecting the ongoing

rally in Emerging Markets and Ashmore's strong relative

performance. Performance was neutral in alternatives and

overlay/liquidity.

Mark Coombs, Chief Executive Officer, Ashmore Group plc,

commented:

"The continued improvement in net flows is encouraging in what

is typically a quiet quarter. The stability of Emerging Markets

over recent months contrasts with the volatility experienced during

the same period in 2015 and 2014. The ongoing recovery in Emerging

Markets asset prices through 2016 and the attractive returns on

offer across a diverse range of investment themes are causing

investors to reconsider their underweight positions. This

inevitably takes time, but Ashmore's consistent investment

processes are delivering strong outperformance across fixed income

and equities, putting Ashmore in a good position to capture

allocations."

For further information please contact:

Ashmore Group plc

Paul Measday

Investor Relations +44 (0)20 3077 6278

FTI Consulting

Andrew Walton +44 (0)20 3727 1514

Kit Dunford +44 (0)20 3727 1143

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLIFEEIFLSLIR

(END) Dow Jones Newswires

October 14, 2016 02:00 ET (06:00 GMT)

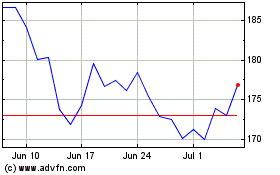

Ashmore (LSE:ASHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

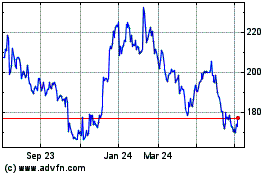

Ashmore (LSE:ASHM)

Historical Stock Chart

From Apr 2023 to Apr 2024