Ashmore Group PLC Trading Statement (8094L)

January 14 2016 - 2:00AM

UK Regulatory

TIDMASHM

RNS Number : 8094L

Ashmore Group PLC

14 January 2016

Ashmore Group plc

+0700 14 January 2016

SECOND QUARTER ASSETS UNDER MANAGEMENT STATEMENT

Ashmore Group plc ("Ashmore", "the Group"), the specialist

Emerging Markets asset manager, announces today the following

update to its assets under management ("AuM") in respect of the

quarter ended 31 December 2015.

Assets under management

Actual Estimated Movement

30 September 31 December

2015 2015 Q2 vs Q1

Theme (US$ billion) (US$ billion) (%)

---------------- --------------- --------------- ----------

External debt 10.7 10.8 +1%

---------------- --------------- --------------- ----------

Local currency 13.6 12.0 -12%

---------------- --------------- --------------- ----------

Corporate

debt 5.7 4.8 -16%

---------------- --------------- --------------- ----------

Blended debt 13.4 13.3 -1%

---------------- --------------- --------------- ----------

Equities 3.1 3.2 +3%

---------------- --------------- --------------- ----------

Alternatives 0.8 1.4 +75%

---------------- --------------- --------------- ----------

Multi-asset 1.3 1.2 -8%

---------------- --------------- --------------- ----------

Overlay /

liquidity 2.5 2.7 +8%

---------------- --------------- --------------- ----------

Total 51.1 49.4 -3%

---------------- --------------- --------------- ----------

Assets under management declined by US$1.7 billion over the

period as a result of net outflows. Investment performance was

flat.

Net inflows to alternatives and overlay/liquidity were offset by

net outflows from local currency and corporate debt, predominantly

by institutional clients in Europe and Asia Pacific. Net flows in

the other investment themes were essentially neutral. The growth in

alternatives AuM arose from inflows into a 25-year infrastructure

debt fund in Colombia and a capital raising to fund healthcare

investments in the UAE.

Investment performance over the period was broadly flat in each

of the investment themes, reflecting weaker markets at the end of

the quarter that offset the strong market recovery in October.

Mark Coombs, Chief Executive Officer, Ashmore Group plc,

commented:

"Some market uncertainty has been removed with the long-awaited

increase in US interest rates. As anticipated, the initial market

reaction was benign, following a period in which Emerging Markets

asset prices had adjusted to the prospect of higher rates.

Historically, the early stages of US rate cycles have provided a

supportive backdrop for Emerging Markets fixed income, and

attractive yields across sovereign and corporate markets suggest

these asset classes are well placed to enjoy decent performance.

The market weakness and volatility experienced in early 2016,

notably in Chinese equity markets, will doubtless lead to some

investors maintaining a cautious stance; considering the price

adjustments of the past 18 months, this approach will risk missing

some very good performance in Emerging Markets assets as their

attractive fundamentals begin to show through."

Notes

1. For the translation of US dollar-denominated balance sheet

items, the GBP/USD exchange rate was 1.4736 at 31 December 2015 (30

June 2015: 1.5712, 31 December 2014: 1.5577). For the translation

of US dollar management fees, the average GBP/USD exchange rate

achieved for the first half of the financial year was 1.5291 (H1

2014/15: 1.6289).

Ashmore will announce its interim results in respect of the six

months ended 31 December 2015 on 11 February 2016.

For further information please contact:

Ashmore Group plc

Paul Measday

Investor Relations +44 (0)20 3077 6278

FTI Consulting

Andrew Walton +44 (0)20 3727 1514

Paul Marriott +44 (0)20 3727 1341

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFITLEIVLIR

(END) Dow Jones Newswires

January 14, 2016 02:00 ET (07:00 GMT)

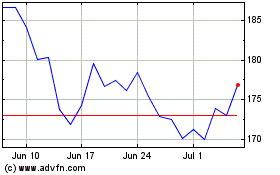

Ashmore (LSE:ASHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

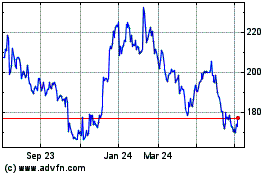

Ashmore (LSE:ASHM)

Historical Stock Chart

From Apr 2023 to Apr 2024