TIDMASPL

RNS Number : 3768X

Aseana Properties Limited

28 August 2015

28 August 2015

Aseana Properties Limited

("Aseana" or the "Company")

Half-Year Results for the Six Months Ended 30 June 2015

Aseana Properties Limited (LSE: ASPL), a property developer

investing in Malaysia and Vietnam, listed on the Main Market of the

London Stock Exchange, announces its half-year results for the

six-month period ended 30 June 2015.

Operational highlights:

-- On 22 June 2015, Aseana Properties Limited ("Aseana" or

the "Company") announced that at the Extraordinary General

Meeting ("June EGM") and the Annual General Meeting ("AGM"),

shareholders have supported the Board's recommendations

to approve the continuation of Aseana for the next three

years to June 2018, to adopt a new divestment/ investment

policy to realise its assets in an orderly manner and to

make capital distributions of not less than US$20.0 million

in 2015 based on current cash balances and expected receivables

from realised assets. On 27 August 2015, Aseana held a further

Extraordinary General Meeting ("August EGM"), at which shareholders

approved amendments to the memorandum and articles of association

of the Company and its share capital structure to facilitate

a return of capital to shareholders.

-- Sale of properties at SENI Mont' Kiara stood at approximately

96.0% to date. A further 2.5% is reserved with deposit paid.

-- The RuMa Hotel and Residences ("The RuMa") achieved approximately

49.0% sales based on sales and purchase agreement signed.

-- The Aloft Kuala Lumpur Sentral Hotel ("Aloft") is the Gold

Winner of FIABCI World Prix d'Excellence Awards 2015 in

the hotel category. Aloft achieved occupancy of 75.6% for

the six-month period ended 30 June 2015.

-- Four Points by Sheraton Sandakan Hotel ("FPSS") recorded

an occupancy rate of 36.1% for the six-month period ended

30 June 2015.

-- Successfully realised VND76.5 billion (US$3.5 million) of

its investment in Nam Long Investment Corporation ("Nam

Long"), through placement of 3.8 million Nam Long shares.

Following the block disposal and subsequent entry of a new

investor into Nam Long in July 2015, Aseana's effective

stake in Nam Long has been reduced from 11.6% to 8.3%.

Financial highlights:

-- Unaudited revenue of US$16.9 million for the six-month period

ended 30 June 2015 (30 June 2014 (unaudited): US$31.5 million)

-- Unaudited loss before tax for the six-month period ended

30 June 2015 of US$5.1 million (30 June 2014 (unaudited):

loss of US$4.8 million)

-- Unaudited loss after tax for the six-month period ended

30 June 2015 of US$6.6 million (30 June 2014 (unaudited):

loss of US$7.7 million)

-- Unaudited consolidated comprehensive loss of US$14.1 million

for the six months period ended 30 June 2015 (30 June 2014

(unaudited): loss of US$6.7 million)

-- Unaudited net asset value of US$148.2 million at 30 June

2015 (31 December 2014 (audited): US$160.5 million) or US$0.699

per share* (31 December 2014 (audited): US$0.757 per share)

-- Unaudited realisable net asset value of US$229.7 million

at 30 June 2015 (31 December 2014 (unaudited): US$247.7

million) or US$1.084 per share* (31 December 2014 (unaudited):

US$1.168 per share)

* NAV per share and RNAV per share as at 30 June 2015 are

calculated based on 212,025,000 voting shares (31 December 2014:

212,025,000 voting shares).

Commenting on the results, Mohammed Azlan Hashim, Chairman of

Aseana, said:

"The H1 2015 results are reflective of the challenging market

conditions in both Malaysia and Vietnam, in particular Malaysia

which is currently experiencing a much softer property market due

to current economic conditions and the weakening Malaysian Ringgit.

The Company will continue to pursue an opportunistic yet cautious

approach in managing and maximising the realisation value of all

its assets."

The Group has also published its Quarterly Investment Update

(including updates on projects and RNAV figures) for the period to

30 June 2015, which can be obtained on its website at

www.aseanaproperties.com/quarterly.htm.

For further information:

Aseana Properties Limited Tel: 603 6411 6388

Chan Chee Kian Email: cheekian.chan@ireka.com.my

N+1 Singer Tel: 020 7496 3000

James Maxwell / Liz Yong (Corporate Email: liz.yong@n1singer.com

Finance)

Sam Greatrex (Sales)

Tavistock Tel: 020 7920 3150

Jeremy Carey / Faye Walters Email: jcarey@tavistock.co.uk

Notes to Editors:

London-listed Aseana Properties Limited (LSE: ASPL) is a

property developer investing in Malaysia and Vietnam.

Ireka Development Management Sdn Bhd ("IDM") is the exclusive

Development Manager for Aseana. It is a wholly-owned subsidiary of

Ireka Corporation Berhad, a company listed on the Bursa Malaysia

since 1993, which has over 45 years' experience in construction and

property development. IDM is responsible for the day-to-day

management of Aseana's property portfolio and the introduction and

facilitation of new investment opportunities.

CHAIRMAN'S STATEMENT

Introduction

I am pleased to report on the half-year results for Aseana

Properties Limited ("Aseana") and its group of companies ("the

Group") for the six months ended 30 June 2015.

In recent months, the global economy has been rocked by a

startling string of events such as the dramatic decline in oil

prices, strengthening of the United States Dollar ("US Dollar" or

"US$"), the uncertainty in Europe which is amplified by the

meltdown of the Greek economy, the slowdown in China and also the

much anticipated shift in US monetary policy. Risks remain tilted

to the downside, with some pre-existing risks receding but new ones

emerging. Despite a strong growth in the early part of the year,

the continuous slide in crude oil prices, subdued external demands

and the effect of the new tax regime have dampened the Malaysian

economy. In addition, the Malaysian Ringgit ("RM") sunk to its

seventeen-year low against the US Dollar in August as a result of

external factors, particularly the prospects that the United

States's monetary policy could be normalised, as well as concerns

over the political instability and the state of Malaysia's public

finances.

In Vietnam, the economy is continuing its path to recovery and

Vietnam is regaining its high growth momentum despite more

difficult global economic situation. Vietnam's Gross Domestic

Product ("GDP") grew 6.3% during the first half of 2015, surpassing

the growth during the same period last year. In a move to maintain

Vietnam's exports and to sustain growth relative to other South

East Asian economies, the State Bank of Vietnam ("SBV") had in May

2015, devalued the Vietnamese Dong ("VND") against the US Dollar by

1.0% to VND21,673 for the second time during the year following the

first devaluation in January 2015. Vietnam's total Foreign Direct

Investment ("FDI") disbursement reached US$6.3 billion in the first

half of 2015, an increase of 9.6% year-on-year.

Results

For the six months ended 30 June 2015, the Group recorded

unaudited revenue of US$16.9 million (H1 2014 (unaudited): US$31.5

million), which was mainly attributable to the sale of completed

units in SENI Mont' Kiara. No revenue was recognised for The RuMa,

in accordance with IFRIC 15 - Agreements for Construction of Real

Estate which prescribes that revenue be recognised only when the

properties are completed and occupancy permits are issued.

The Group recorded an unaudited loss before tax for the period

of US$5.1 million (H1 2014 (unaudited): loss of US$4.8 million),

predominantly due to operating losses and financing costs of City

International Hospital of US$5.1 million and of Four Points by

Sheraton Sandakan Hotel and Harbour Mall Sandakan totaling US$2.5

million. These are offset by profit from SENI Mont' Kiara of US$3.7

million.

.

The Group's unaudited loss after tax for the six-months ended 30

June 2015 stood at US$6.6 million (30 June 2014 (unaudited): loss

of US$7.7 million). The Group's unaudited consolidated

comprehensive loss for the period of US$14.1 million (30 June 2014

(unaudited): loss of US$6.7 million) has included a foreign

currency translation loss of US$8.1 million (30 June 2014

(unaudited): gain of US$1.0 million) which was attributable to the

weakening of the Malaysian Ringgit against the US Dollar by 7.9%

and an increase in fair value of the share of investment in Nam

Long of US$0.6 million.

Unaudited net asset value for the Group for the period under

review decreased to US$148.2 million (31 December 2014 (audited):

US$160.5 million) due to losses incurred for the period. This is

equivalent to US$0.699 per share (31 December 2014 (audited):

US$0.757 per share).

Unaudited realisable net asset value for the Group has also

decreased to US$229.7 million as at 30 June 2015 (31 December 2014

(unaudited): US$247.7 million) in line with the drop in net asset

value for the Group coupled with the weakening of the Malaysian

Ringgit against the US Dollar. This is equivalent to US$1.084 per

share (31 December 2014 (unaudited): US$1.168 per share).

Review of Activities and Property Portfolio

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

Sales status (based on Sales and Purchase agreements

signed):

Projects % sales as

% sales as at

at December

31 July 2015 2014

-------------------------------- -------------- -----------

Tiffani by i-ZEN 99% 99%

SENI Mont' Kiara

* Proceeds received 95% 91%

* Pending completion 1% 2%

The RuMa Hotel and Residences 49% 47%

-------------------------------- -------------- -----------

Malaysia

On the whole, the lackluster market condition coupled with the

political uncertainty in Malaysia have affected the sales

performance of both SENI Mont' Kiara and The RuMa. SENI Mont' Kiara

recorded approximately 96.0% sales to date, based on sales and

purchase agreements signed.

Meanwhile, sales at The RuMa, the only project currently under

development, remained at approximately 49.0% to date. The Manager

is broadening its marketing focus to overseas markets such as

Taiwan, Singapore, Japan and the Middle Eastern countries where

there has been favourable response to prime properties in Malaysia

on the back of a weaker Malaysian Ringgit. Construction of the main

building is underway with completion expected in Q3 2017.

Having been recently awarded the Gold Winner of FIABCI World

Prix d'Excellence Awards 2015 in the hotel category, the 482-room

Aloft hotel is continuing its commendable results by achieving an

occupancy rate of 75.6% for the six-month period up to 30 June

2015.

The business environment and tourism industry in Sabah remain

subdued as a result of a number of unfortunate events last year,

compounded by the most recent kidnapping incident in Sandakan. This

has resulted in countries such as the United States of America,

United Kingdom, Canada, Australia and New Zealand maintaining

adverse travel advisory notices to the coastal areas of eastern

Sabah, including Sandakan. Subsequent to the incident, the national

security forces have intensified surveillance and control around

the harbour front area where The Harbour Mall Sandakan ("HMS") and

FPSS are both located. To date, HMS is 59.2% tenanted, while FPSS

achieved an occupancy rate of 36.1% for the six-month period up to

30 June 2015.

Following the approval of the proposals at the June EGM and AGM,

which included continuation of Aseana for the next three years to

June 2018 and adoption of a new divestment investment policy to

orderly realise its assets, Aseana will continue its efforts to

dispose the remaining units at SENI Mont' Kiara and to increase the

sale of The RuMa. The Company will also focus on improving the

performance of the operating assets in preparation for their

eventual sale in line with the Company's new divestment policy.

Vietnam

As at 31 July 2015, City International Hospital ("CIH") had

registered 2,384 in-patient days (31 July 2014: 1,429), equivalent

to a daily average of 11 in-patient days (31 July 2014: 7), with

average revenue per in-patient day of US$526.8 (31 July 2014:

US$450.5). Outpatient visits as at 31 July 2015 had reached 10,232

visits (31 July 2014: 4,913), equivalent to an average of 65

outpatients daily (31 July 2014: 31), which generated average

revenue per visit of US$101.6 (31 July 2014: US$110.6). The

operation of the Hospital is still going through a period of

stabilisation and the Manager is working closely with Parkway

Pantai Limited to improve the performance of the hospital through

numerous marketing campaigns, introduction of new service lines and

targeted sales.

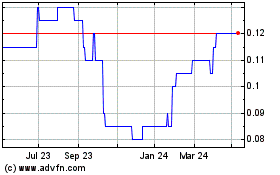

To date, Aseana has successfully realised VND76.5 billion

(US$3.5 million) of its investment in Nam Long Investment

Corporation ("Nam Long"), through the placement of 3.8 million

shares of Nam Long. Following the block disposal and entry of a new

investor into Nam Long, Aseana's effective stake in Nam Long has

been reduced from 11.6% to 8.3%. The disposal reflects the

Company's on-going effort to strategically reduce its holding in

Nam Long at the appropriate time and price, and to optimize its

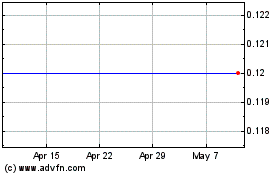

investment portfolio. At the date of this publication, Nam Long

shares closed at VND19,500 per share, improving from VND19,000 per

share as at 30 June 2015.

MOHAMMED AZLAN HASHIM

Chairman

27 August 2015

DEVELOPMENT MANAGER'S REVIEW

Malaysia Economic Update

The Malaysian economy registered a Gross Domestic Product growth

("GDP") of 4.9% in the second quarter of 2015 and expanded 5.3% in

in the first half of 2015. The outlook reflects the overall

strength of Malaysia's domestic economy amid ongoing fiscal

consolidation, weak global trade and lower commodity prices. The

introduction of the Goods and Services Tax ("GST") in April 2015

and the elimination of fuel subsidies have helped Malaysia weather

the oil price shock. However, the domestic headwinds that grappled

the country during the first six months of the year are expected to

creep into the second half, with the weakening of the Ringgit, the

controversies surrounding the debt-laden strategic investment fund

as well as the uncertain political situation in the country. The

Malaysian Ringgit plunged to a seventeen-year low in August 2015

and is currently the worst performing currency in Asia. Further to

that, the Malaysian foreign exchange reserves fell to a five-year

low of US$100.5 billion in July 2015.

In tandem with the uncertainties surrounding the country's

economic and political situation, both the Business Conditions

Index ("BCI") and Consumer Sentiment Index ("CSI") issued by the

Malaysian Institute of Economic Research ("MIER") exhibited a

declining trend in the second quarter of 2015. The BCI fell to 95.4

points (Q1 2015: 101.0 points) on the back of a gloomy outlook for

domestic and export orders, coupled with a dip in utilization rate

in the manufacturing industry. Meanwhile, the CSI tumbled further

to 71.7 points (Q1 2015: 72.6 points) as a result of subdued

employment and financial outlook which affected consumers' spending

power.

Notwithstanding the above, both Fitch Ratings and Standard &

Poor's Ratings Services have recently affirmed Malaysia's foreign

currency Issuer Default Rating ("IDR") at "A-" and local currency

IDR at "A". In addition, Standard & Poor's has maintained

Malaysia's outlook at "Stable", whilst Fitch Ratings has revised

its outlook on Malaysia from "Negative" to "Stable". These positive

ratings reflect Malaysia's strong external position and

considerable monetary flexibility notwithstanding the current

economic headwinds and increase in Malaysia's contingent sovereign

liabilities.

On the back of moderate global growth, the central bank of

Malaysia had in July 2015 maintained the Overnight Policy Rate

("OPR") at 3.25%, of which is supportive of the country's economy

activity. However, risks to global growth and financial conditions

have risen and the bank has cited that the latest indicators

pointed to a more moderate second quarter gross domestic product

growth for Malaysia.

Overview of Property Market in Klang Valley, Malaysia

Offices

-- Five new office buildings were completed in Q2 2015, increasing

the total supply of office space in the Klang Valley to

108.1 million sq.ft. Overall occupancy rate remained stable

at 81% (Q1 2015: 81%).

-- Market rentals and prices remained stable while rental yield

remained between 5.5% and 8%.

-- En-bloc transactions during the quarter: (i) Menara Raja

Laut (Secondary A 27 storeys) was sold at a price of RM553

psf (US$147 psf); (ii) Wisma Amanah Raya (Secondary A 15

storeys) was transacted at RM507 psf (US$134 psf).

-- Occupancy rate is expected to remain stable in short term,

with new supply of 4.42 million sq.ft. by end 2015. However

the economy uncertainties, weakening currency and softening

foreign investment sentiment are expected to have negative

pressure on occupancy and rental rates.

Retail

-- Market prices and market rentals for retail centres in Klang

Valley were generally stable in Q2 2015.

-- Average occupancy rate in Klang Valley remained stable at

82.0% in Q2 2015 (Q1 2015: 82.0%).

-- Five new retail centres were completed during Q2 2015.

Residential

-- Twenty four projects with 7,583 units of condominium in

Klang Valley were completed in Q2 2015.

-- Eighteen projects with 6,202 units were launched in Q2 2015.

-- Market prices and market rental rates for condominiums were

generally stable in Q2 2015. However, the market continues

to see a slowdown in sales especially in the higher end

properties.

-- Selected new launches: (i) The Robertson - South Tower (Level

33 - 42) (121 units), launched in March 2015 with an average

price of RM1,400 psf (US$371 psf) achieved 40% take-up rate;

(ii) Damai Residence (31 units), launched in April 2015

with an average price of RM1,000 psf (US$265 psf) is 30%

sold.

Hospitality

-- In Q2 2015, average daily room rate for hotels comparable

to Aloft Kuala Lumpur Sentral (inclusive of Aloft) decreased

y-o-y by 4.9% to RM347 per room per night.

-- Average occupancy rate for hotels comparable to Aloft (inclusive

of Aloft) dropped by 5% to 69% in Q2 2015 compared to the

same period in 2014.

-- 6.48 million tourists visited Malaysia in Q1 2015, representing

a decrease of 8.6% compared to same period in 2014.

--- -----------------------------------------------------------------

Source: Bank Negara Malaysia website, Jones Lang Wootton Q2

report, MIER, various publications

Exchange rate - 30 June 2015: US$1:RM3.7736

Vietnam Economic Update

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

Strong economic activity in 2015 has set the stage for

acceleration in Vietnam's GDP growth. Vietnam's GDP in the second

quarter of 2015 reached a five-year high, hitting 6.4%. The result

brought Vietnam's GDP growth for the first half of 2015 to 6.3%,

much higher than the same period five years ago. The World Bank has

recently revised Vietnam's 2015 GDP growth forecast upwards by 0.4%

to 6% on the back of continued strong performance in the

manufacturing sector, exports and foreign investment. Recovery in

domestic demand and foreign direct investment ("FDI") inflows that

continue to support investments and exports are benefitting the

country's economy.

In an effort to boost the slowing exports, the State Bank of

Vietnam ("SBV") has devalued the Vietnamese Dong, twice so far this

year, most recently in May. As a result, the increased interbank

exchange rates have put significant impacts on the prices of a

number of imported commodities and materials which further led to

an increase in the prices of various domestic products. Inflation

remains under control, with the Consumer Price Index ("CPI")

increasing just 0.9% year-on-year. As a result of the low

inflation, the SBV is expected to maintain its monetary policy

which is likely to remain accommodative to spur growth.

Attracting FDI has always been a key part of Vietnam's external

economic affairs. Equipped with one of the most dynamic economies,

young and low cost labour force together with a government

committed to creating a fair and attractive business environment,

Vietnam is seen to be the perfect destination for foreign

investors. According to the Ministry of Planning and Investment

("MPI"), Vietnam attracted US$5.5 billion in FDI in the first six

months of the year, down 19.8% year-on-year. However, disbursed FDI

increased by 9.6% year-on-year to US$6.3 billion. The

implementation of the new Housing Law and the Real Estate Business

Law from 1 July 2015 onwards is expected to be significant and will

play a pivotal role in opening up the Vietnam real estate market to

overseas investment.

Vietnam has also experienced a slump in its trade activities as

evidenced by an increase it its trade deficit of US$3.8 billion

during the first half of the year. The expanding trade deficit is a

result of lower world commodity prices coupled with its economy's

dependency on imported machinery and raw materials. Concerns over

the stability of the Vietnamese Dong as a result of the increasing

trade deficit along with the tendencies of investment capital

withdrawals from developing economies will trigger stabilisation

efforts from the Vietnamese government. Meanwhile, Vietnam's credit

growth was at 6.3%, the highest compared to the same period for the

last three years. The robust credit growth is an outcome of strong

growth in the manufacturing sector, loosening of credit packages

that allowed banks to lend more freely and the encouraging results

seen in Vietnam's overall economic recovery.

Falling foreign tourist arrivals to Vietnam after the anti-China

protests in 2014 have prompted the Vietnamese government into

action to take measures to boost the long neglected tourism sector.

The number of foreign tourists visiting Vietnam has decreased by

11.3% year-on-year for the first six months of 2015. In July 2015,

authorities dropped visa requirements for tourists from five

European countries - France, Germany, the United Kingdom, Spain and

Italy. The visa-free policy is expected to lure back European

tourists to Vietnam on the back of weaker Euro against the US

Dollar.

Overview of Property Market in Vietnam

Offices

-- One Grade C office building was completed in Q2 2015, increasing

the total supply to 1.47mil sqm by 3% y-o-y and stable q-o-q.

-- Overall occupancy rate improved by 2% q-o-q and y-o-y to

93%.

-- Average rental rates remained stable in Q2 2015 at US$25

psm per month.

-- Total office take-up area increased by 6% q-o-q largely

contributed by the take-up of Grade C office building areas.

Retail

-- Retail stock increased by 5% q-o-q due to the opening of

two shopping centres (Vivo City mall, district 7 and Take

Plaza 2, district 3) and one supermarket (within Vivo City

Mall, district 7).

-- Average rental rate in Q2 2015 decreased by 1% q-o-q to

US$60 psm per month, while average occupancy remained stable

at 92%.

Residential

-- Eleven new apartment projects and new phases of eight existing

apartment projects were launched in Q2 2015. Total stock

increased by 9% q-o-q and 27% y-o-y.

-- Overall apartments' absorption rate stood at 19%, a decrease

of 2% q-o-q but up by 2% y-o-y. Transaction volume was registered

at approx. 5,000 units, highest since Q4 2010.

-- One villa and townhouse mixed project (91 units), one townhouse

project (258 units) and two villa projects (121 units),

were launched in Q2 2015, increasing the supply of villa/townhouse

by 3% q-o-q and 216% y-o-y. Two new projects with sixty

two land plots were launched in Q2 2015. Primary land plot

supply decreased by 43% q-o-q and 33% y-o-y.

-- Villa/townhouse market's absorption rates increased by 3%

q-o-q while the absorption rate for land plot improved by

6% q-o-q.

Hospitality

-- Six new 3-star hotels with 469 rooms were opened, one 5-star

hotel which started operation in Q1 2015 opened an additional

218 rooms and one 3-star hotel has reopened with 71 rooms

in Q2 2015. However, one hotel closed 20 rooms for internal

use. Overall, the hotel stock was up by 6% q-o-q and 10%

y-o-y.

-- Average occupancy rate was at 64%, decreased by 6% q-o-q

but up by 3% y-o-y in Q2 2015, while average room rate decreased

by 5% q-o-q and 3% y-o-y at US$78 per room per night. The

decline in average room rate is mainly due to tougher competition

from new entries and increasing supply of 3-star hotels.

-- Fourteen units of serviced apartments were completed in

Q2 2015. Average occupancy rate increased by 3% q-o-q and

y-o-y at 85%.

--- --------------------------------------------------------------------

Source: General Statistics Office of Vietnam, Savills, CBRE,

various publications

Exchange rate - 30 June 2015: US$1:VND21,810

LAI VOON HON

President / Chief Executive Officer

Ireka Development Management Sdn. Bhd.

Development Manager

27 August 2015

PROPERTY PORTFOLIO AS AT 30 JUNE 2015

Project Type Effective Approx.

Ownership Gross

Floor Approx.

Area Land Area Actual/Scheduled

(sq m) (sq m) completion

------------------------------ ----------------------- ----------- -------- ----------- ------------------------

Completed projects

---------------------------------------------------------------------------------------------------------------------

Tiffani by i-ZEN Completed August

Kuala Lumpur, Malaysia Luxury condominiums 100.0% 81,000 15,000 2009

------------------------------ ----------------------- ----------- -------- ----------- ------------------------

Phase 1: Completed

April 2011

SENI Mont' Kiara Phase 2: Completed

Kuala Lumpur, Malaysia Luxury condominiums 100.0% 225,000 36,000 October 2011

------------------------------ ----------------------- ----------- -------- ----------- ------------------------

Retail lots Completed

2009

Retail mall: Completed

Retail lots, March 2012

Sandakan Harbour Square hotel and retail Hotel: Completed

Sandakan, Sabah, Malaysia mall 100.0% 126,000 48,000 May 2012

------------------------------ ----------------------- ----------- -------- ----------- ------------------------

Aloft Kuala Lumpur Business-class

Sentral hotel hotel (a Starwood Completed in January

Kuala Lumpur, Malaysia Hotel) 100.0% 28,000 5,000 2013

------------------------------ ----------------------- ----------- -------- ----------- ------------------------

Phase 1: City International

Hospital, International

Hi-tech Healthcare

Park,

Ho Chi Minh City, Private general Completed in March

Vietnam hospital 72.3% 48,000 25,000 2013

------------------------------ ----------------------- ----------- -------- ----------- ------------------------

Project under development

---------------------------------------------------------------------------------------------------------------------

The RuMa Hotel and Luxury residential

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

Residences Kuala Lumpur, tower and boutique Third quarter of

Malaysia hotel 70.0% 40,000 4,000 2017

------------------------------ ----------------------- ----------- -------- ----------- ------------------------

Listed equity investment

---------------------------------------------------------------------------------------------------------------------

Listed equity investment Listed equity 10.1% n/a n/a n/a

in Nam Long Investment investment

Corporation,

an established developer

in Ho Chi Minh City,

Vietnam

------------------------------ ----------------------- ----------- -------- ----------- ------------------------

Undeveloped projects

---------------------------------------------------------------------------------------------------------------------

Waterside Estates,

Ho Chi Minh City, Villas and

Vietnam high-rise apartments 55.0% 94,000 57,000 n/a

------------------------------ ----------------------- ----------- -------- ----------- ------------------------

Other developments Commercial

in International Healthcare and residential

Park, development

Ho Chi Minh City, with healthcare

Vietnam theme 72.3% 972,000 351,000 n/a

------------------------------ ----------------------- ----------- -------- ----------- ------------------------

Kota Kinabalu seafront (i) Boutique 100.0% n/a 327,000 n/a

resort & residences resort hotel

resort villas

Kota Kinabalu, Sabah, (ii) Resort 80.0%

Malaysia homes

------------------------------ ----------------------- ----------- -------- ----------- ------------------------

n/a: Not available / not applicable

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

SIX MONTHS ENDED 30 JUNE 2015

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

Continuing activities Notes US$'000 US$'000 US$'000

---------------------------------------------- ------ ----------- ----------- ----------------

Revenue 16,891 31,494 85,102

Cost of sales 5 (12,723) (24,953) (51,821)

---------------------------------------------- ------ ----------- ----------- ----------------

Gross profit 4,168 6,541 33,281

Other income 14,140 13,349 27,369

Administrative expenses (874) (366) (1,193)

Foreign exchange gain/(loss) 6 547 (9) 716

Management fees (1,598) (1,653) (3,344)

Marketing expenses (140) (591) (823)

Other operating expenses (15,947) (16,265) (32,715)

---------------------------------------------- ------ ----------- ----------- ----------------

Operating profit 296 1,006 23,291

----------- ----------- ----------------

Finance income 194 227 577

Finance costs (5,565) (5,760) (13,760)

----------- ----------- ----------------

Net finance costs (5,371) (5,533) (13,183)

Gain on disposal of investment

in an associate - - 5,641

Share of loss of equity-accounted

associate, net of tax - (229) (335)

---------------------------------------------- ------ ----------- ----------- ----------------

Net (loss)/profit before taxation (5,075) (4,756) 15,414

Taxation 7 (1,542) (2,906) (9,387)

---------------------------------------------- ------ ----------- ----------- ----------------

(Loss)/profit for the period/year (6,617) (7,662) 6,027

---------------------------------------------- ------ ----------- ----------- ----------------

Other comprehensive income/(expense),

net of tax

Items that are or may be reclassified

subsequently to profit or loss

Foreign currency translation

differences for foreign operations (8,086) 977 (7,388)

Increase in fair value of available-for-sale

investments 626 26 125

---------------------------------------------- ------ ----------- ----------- ----------------

Total other comprehensive

(expense)/income for the period/year (7,460) 1,003 (7,263)

------

Total comprehensive

loss for the period/year (14,077) (6,659) (1,236)

------

(Loss)/profit attributable to:

Equity holders of the parent (4,428) (5,198) 9,091

Non-controlling interests (2,189) (2,464) (3,064)

---------------------------------------------- ------ ----------- ----------- ----------------

Total (6,617) (7,662) 6,027

---------------------------------------------- ------ ----------- ----------- ----------------

Total comprehensive

loss attributable to:

Equity holders of the parent (11,492) (3,939) 2,074

Non-controlling interests (2,585) (2,720) (3,310)

---------------------------------------------- ------ ----------- ----------- ----------------

Total (14,077) (6,659) (1,236)

---------------------------------------------- ------ ----------- ----------- ----------------

(Loss)/earnings per share

Basic and diluted (US cents) 8 (2.09) (2.45) 4.29

---------------------------------------------- ------ ----------- ----------- ----------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2015

Unaudited Unaudited Audited

-------------------------------- ------

As at As at As at

30 June 30 June 31 December

2015 2014 2014

Notes US$'000 US$'000 US$'000

-------------------------------- ------ ---------- ------------ -------------

Non-current assets

Property, plant and equipment 944 1,091 1,018

Investment in an associate - 2,023 -

Available-for-sale investments 11,834 12,723 12,822

Intangible assets 8,668 13,208 8,798

Deferred tax assets 1,652 682 1,683

-------------------------------- ------ ---------- ------------ -------------

Total non-current assets 23,098 29,727 24,321

-------------------------------- ------ ---------- ------------ -------------

Current assets

Inventories 356,001 416,597 381,778

Held-for-trading financial

instrument 55 388 4,041

Trade and other receivables 8,832 13,446 8,359

Prepayment 444 1,205 337

Amount due from an associate - 943 -

Current tax assets 900 127 513

Cash and cash equivalents 25,775 26,911 26,011

-------------------------------- ------ ---------- ------------ -------------

Total current assets 392,007 459,617 421,039

-------------------------------- ------ ---------- ------------ -------------

TOTAL ASSETS 415,105 489,344 445,360

-------------------------------- ------ ---------- ------------ -------------

Equity

Share capital 10,601 10,601 10,601

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

Share premium 218,926 218,926 218,926

Capital redemption reserve 1,899 1,899 1,899

Translation reserve (17,937) (1,872) (10,247)

Fair value reserve 877 152 251

Accumulated losses (66,159) (75,074) (60,932)

-------------------------------- ------ ---------- ------------ -------------

Shareholders' equity 148,207 154,632 160,498

Non-controlling interests 9,158 9,271 10,187

-------------------------------- ------ ---------- ------------ -------------

Total equity 157,365 163,903 170,685

-------------------------------- ------ ---------- ------------ -------------

Non-current liabilities

Amount due to non-controlling

interests 1,155 1,085 1,120

Loans and borrowings 9 55,536 68,972 53,364

Medium term notes 10 10,369 143,333 84,993

-------------------------------- ------ ---------- ------------ -------------

Total non-current liabilities 67,060 213,390 139,477

-------------------------------- ------ ---------- ------------ -------------

Current liabilities

Trade and other payables 38,990 79,474 40,510

Amount due to non-controlling

interests 10,490 9,587 10,222

Loans and borrowings 9 14,412 6,934 19,274

Medium term notes 10 124,285 14,013 60,237

Current tax liabilities 2,503 2,043 4,955

-------------------------------- ------ ---------- ------------ -------------

Total current liabilities 190,680 112,051 135,198

-------------------------------- ------ ---------- ------------ -------------

Total liabilities 257,740 325,441 274,675

-------------------------------- ------ ---------- ------------ -------------

TOTAL EQUITY AND LIABILITIES 415,105 489,344 445,360

-------------------------------- ------ ---------- ------------ -------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD ENDED 30 JUNE 2015 - UNAUDITED

Total Equity

Attributable

Capital Fair to Equity Non-

Share Share Redemption Translation Value Accumulated Holders of Controlling Total

Capital Premium Reserve Reserve Reserve Losses the Parent Interests Equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------- --------- --------- ------------ ------------ --------- ------------ ------------- ------------- ---------

At 1 January

2015 10,601 218,926 1,899 (10,247) 251 (60,932) 160,498 10,187 170,685

Changes in

ownership

interests

in subsidiaries - - - - - (799) (799) 799 -

Non-controlling

interests

contribution - - - - - - - 757 757

Loss for the

period - - - - - (4,428) (4,428) (2,189) (6,617)

Total other

comprehensive

expense - - - (7,690) 626 - (7,064) (396) (7,460)

--------- --------- ------------ ------------ --------- ------------ ------------- ------------- ---------

Total

comprehensive

loss - - - (7,690) 626 (4,428) (11,492) (2,585) (14,077)

----------------- --------- --------- ------------ ------------ --------- ------------ ------------- ------------- ---------

Shareholders'

equity at

30 June 2015 10,601 218,926 1,899 (17,937) 877 (66,159) 148,207 9,158 157,365

================= ========= ========= ============ ============ ========= ============ ============= ============= =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD ENDED 30 JUNE 2014 - UNAUDITED

Total Equity

Attributable

Capital Fair to Equity Non-

Share Share Redemption Translation Value Accumulated Holders of Controlling Total

Capital Premium Reserve Reserve Reserve Losses the Parent Interests Equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------- --------- --------- ------------ ------------ --------- ------------ ------------- ------------- ---------

At 1 January

2014 10,601 218,926 1,899 (3,105) 126 (69,876) 158,571 11,429 170,000

Non-controlling

interests

contribution - - - - - - - 562 562

Loss for the

period - - - - - (5,198) (5,198) (2,464) (7,662)

Total other

comprehensive

income - - - 1,233 26 - 1,259 (256) 1,003

--------- --------- ------------ ------------ --------- ------------ ------------- ------------- ---------

Total

comprehensive

loss - - - 1,233 26 (5,198) (3,939) (2,720) (6,659)

----------------- --------- --------- ------------ ------------ --------- ------------ ------------- ------------- ---------

Shareholders'

equity at

30 June 2014 10,601 218,926 1,899 (1,872) 152 (75,074) 154,632 9,271 163,903

================= ========= ========= ============ ============ ========= ============ ============= ============= =========

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2014 - AUDITED

Total

Equity

Attributable

to Equity

Capital Fair Holders Non-

Share Share Redemption Translation Value Accumulated of the Controlling Total

Capital Premium Reserve Reserve Reserve Losses Parent Interests Equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

----------------- --------- ---------- ------------ ------------- -------- ------------- ------------- ------------- ----------

1 January

2014 10,601 218,926 1,899 (3,105) 126 (69,876) 158,571 11,429 170,000

Changes

in ownership

interests

in subsidiaries - - - - - (147) (147) 147 -

Non-controlling

interests

contribution - - - - - - - 1,921 1,921

--------- ---------- ------------ ------------- -------- ------------- ------------- ------------- ----------

Profit of

the year - - - - - 9,091 9,091 (3,064) 6,027

Total other

comprehensive

expense - - - (7,142) 125 - (7,017) (246) (7,263)

--------- ---------- ------------ ------------- -------- ------------- ------------- ------------- ----------

Total

comprehensive

loss - - - (7,142) 125 9,091 2,074 (3,310) (1,236)

Shareholders'

equity at

31 December

2014 10,601 218,926 1,899 (10,247) 251 (60,932) 160,498 10,187 170,685

================= ========= ========== ============ ============= ======== ============= ============= ============= ==========

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

CONSOLIDATED STATEMENT OF CASH FLOWS

SIX MONTHS ENDED 30 JUNE 2015

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

US$'000 US$'000 US$'000

----------------------------------------------- ----------- ----------- -----------------------

Cash Flows from Operating Activities

Net (loss)/ profit before taxation (5,075) (4,756) 15,414

Finance income (194) (227) (577)

Finance costs 5,565 5,760 13,760

Unrealised foreign exchange (gain)/

loss (718) 1 (291)

Impairment of goodwill 129 317 4,727

Depreciation of property, plant

and equipment 53 59 122

Gain on disposal of available-for-sale

investments (214) - -

Gain on disposal of investment in

an associate - - (5,641)

Gain on disposal of property, plant

and equipment - - (3)

Share of loss of equity-accounted

associate, net of

tax - 229 335

Fair value loss/(gain) on amount

due to non-

controlling interests 35 - (320)

Fair value loss/(gain) on held-for-trading

financial instrument - (1) (39)

----------------------------------------------- ----------- ----------- -----------------------

Operating (loss)/profit before changes

in working capital (419) 1,382 27,487

Changes in working capital:

Decrease in inventories 4,983 16,711 29,437

(Increase)/ decrease in trade and

other

receivables and prepayment (1,054) (4,597) 647

Decrease in trade and other payables (220) (5,497) (40,615)

----------------------------------------------- ----------- ----------- -----------------------

Cash generated from operations 3,290 7,999 16,956

Interest paid (5,565) (5,760) (13,760)

Tax paid (4,253) (2,197) (6,679)

----------------------------------------------- ----------- ----------- -----------------------

Net cash (used in)/generated from

operating activities (6,528) 42 (3,483)

----------------------------------------------- ----------- ----------- -----------------------

Cash Flows From Investing Activities

(Advances to)/ repayment from associate - (88) 853

Proceeds from disposal of available-for-sale

investments 1,827 - -

Proceeds from disposal of investment

in an

associate - - 5,306

Proceeds from disposal of property,

plant and

equipment - - 12

Disposal of/(purchase of) held-for-trading

financial instrument 3,689 - (3,651)

Purchase of property, plant and

equipment - (13) (20)

Finance income received 194 227 577

----------------------------------------------- ----------- ----------- -----------------------

Net cash generated from investing

activities 5,710 126 3,077

----------------------------------------------- ----------- ----------- -----------------------

CONSOLIDATED STATEMENT OF CASH FLOWS (CONT'D)

SIX MONTHS ENDED 30 JUNE 2015

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

US$'000 US$'000 US$'000

--------------------------------------------- -------------- ----------- -------------

Cash Flows From Financing Activities

Advances from non-controlling interests 772 486 1,635

Issuance of ordinary shares of subsidiaries

to non-controlling interests 757 562 1,921

Repayment of loans and borrowings (9,773) (6,212) (16,858)

Drawdown of loans and borrowings 10,121 7,075 17,108

Decrease/(increase) in pledged deposits

placed in licensed banks 411 (30) -

--------------------------------------------- -------------- ----------- -------------

Net cash generated from financing

activities 2,288 1,881 3,806

--------------------------------------------- -------------- ----------- -------------

Net changes in cash and cash equivalents

during the period/year 1,470 2,049 3,400

Effect of changes in exchange rates (621) 247 (1,355)

Cash and cash equivalents at the

beginning of the period/year 16,211 14,166 14,166

--------------------------------------------- -------------- ----------- -------------

Cash and cash equivalents at the

end of the period/year 17,060 16,462 16,211

--------------------------------------------- -------------- ----------- -------------

Cash and Cash Equivalents

Cash and cash equivalents included in the consolidated statement

of cash flows comprise the following consolidated statement of financial

position amounts:

Cash and bank balances 11,975 8,125 12,057

Short term bank deposits 13,800 18,786 13,954

--------------------------------------------- -------------- ----------- -------------

25,775 26,911 26,011

Less: Deposits pledged ( 8,715) (10,449) (9,800)

--------------------------------------------- -------------- ----------- -------------

Cash and cash equivalents 17,060 16,462 16,211

--------------------------------------------- -------------- ----------- -------------

During the financial period/year, US$757,000 (30 June 2014:

US$562,000; 31 December 2014: US$1,921,000) of ordinary shares of

subsidiaries were issued to non-controlling shareholders, which was

satisfied via cash consideration.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE SIX

MONTHS ENDED 30 JUNE 2015

1 General Information

The principal activities of the Group are acquisition,

development and redevelopment of upscale residential, commercial,

hospitality and healthcare projects in the major cities of Malaysia

and Vietnam. The Group typically invests in development projects at

the pre-construction stage and may also selectively invests in

projects in construction and newly completed projects with

potential capital appreciation.

2 Summary of Significant Accounting Policies

2.1 Basis of Preparation

The interim condensed consolidated financial statements for the

six months ended 30 June 2015 has been prepared in accordance with

IAS 34, Interim Financial Reporting.

The interim condensed consolidated financial statements should

be read in conjunction with the annual financial statements for the

year ended 31 December 2014 which has been prepared in accordance

with IFRS.

Taxes on income in the interim period are accrued using the tax

rate that would be applicable to expected total annual

earnings.

The interim results have not been audited nor reviewed and do

not constitute statutory financial statements.

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

The preparation of financial statements in conformity with IFRS

requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of expenses during

the reporting period. Although these estimates are based on

management's best knowledge of the amount, event or actions, actual

results ultimately may differ from those estimates.

The accounting policies applied are consistent with those of the

annual financial statements for the year ended 31 December 2014 as

described in those annual financial statements.

The interim report and financial statements were approved by the

Board of Directors on 27 August 2015.

3 SegmentAL Information

The Group's assets and business activities are managed by Ireka

Development Management Sdn. Bhd. ("IDM") as the Development Manager

under a management agreement dated 27 March 2007.

Segmental information represents the level at which financial

information is reported to the Executive Management of IDM, being

the chief operating decision maker as defined in IFRS 8. The

Executive Management consists of the Chief Executive Officer, the

Chief Financial Officer, Chief Operating Officer and Chief

Investment Officer of IDM. The management determines the operating

segments based on reports reviewed and used by the Executive

Management for strategic decision making and resource allocation.

For management purposes, the Group is organised into project

units.

The Group's reportable operating segments are as follows:

(i) Investment Holding Companies - investing activities;

(ii) Ireka Land Sdn. Bhd. - develops Tiffani by i-ZEN;

(iii) ICSD Ventures Sdn. Bhd. - owns and operates Harbour Mall

Sandakan and Four Points by Sheraton Sandakan Hotel;

(iv) Amatir Resources Sdn. Bhd. - develops SENI Mont' Kiara;

(v) Iringan Flora Sdn. Bhd. - owns and operates Aloft Kuala

Lumpur Sentral Hotel;

(vi) Urban DNA Sdn. Bhd.- develops The RuMa Hotel and

Residences; and

(vii) Hoa Lam-Shangri-La Healthcare Group - master developer of

International Healthcare Park;

owns and operates City International Hospital.

Other non-reportable segments comprise the Group's other

development projects. None of these segments meets any of the

quantitative thresholds for determining reportable segments in 2015

and 2014.

Information regarding the operations of each reportable segment

is included below. The Executive Management monitors the operating

results of each segment for the purpose of performance assessments

and making decisions on resource allocation. Performance is based

on segment gross profit/(loss) and profit/ (loss) before taxation,

which the Executive Management believes are the most relevant in

evaluating the results relative to other entities in the industry.

Segment assets and liabilities are presented inclusive of

inter-segment balances and inter-segment pricing is determined on

an arm's length basis.

The Group's revenue generating development projects are in

Malaysia and Vietnam.

Operating Segments - ended 30 June 2015 - Unaudited

Ireka ICSD Iringan Urban Hoa

Investment Land Ventures Amatir Flora DNA Lam-Shangri-La

Holding Sdn. Sdn. Resources Sdn. Sdn. Healthcare

Companies Bhd. Bhd. Sdn. Bhd. Bhd. Bhd. Group Total

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ------------ -------- ---------- ----------- --------- --------- --------------- ---------

Segment

(loss)/profit

before

taxation (415) (224) (2,499) 3,717 519 (569) (5,570) (5,041)

=============== ============ ======== ========== =========== ========= ========= =============== =========

Included in

the measure

of segment

(loss)/profit

are:

Revenue - - - 16,891 - - - 16,891

Revenue from

hotel

operations - - 1,851 - 9,089 - - 10,940

Revenue from

mall

operations - - 588 - - - - 588

Revenue from

hospital

operations - - - - - - 1,894 1,894

Cost of

acquisition

written -

down # - - - (2,388) - - - (2,388)

Impairment of

goodwill - - - (129) - - - (129)

Marketing

expenses - - - (21) - (119) - (140)

Expenses from

hotel

operations - - (2,238) - (6,246) - - (8,484)

Expenses from

mall

operations - - (776) - - - - (776)

Expenses from

hospital

operations - - - - - - (5,433) (5,433)

Depreciation

of property,

plant and

equipment - - (4) - (4) - (45) (53)

Finance costs - - (1,924) - (2,213) - (1,428) (5,565)

Finance income 10 1 142 17 2 4 18 194

=============== ============ ======== ========== =========== ========= ========= =============== =========

Segment assets 21,589 5,032 94,535 28,957 71,207 59,260 98,725 379,305

Included in

the measure

of segment

assets are:

Addition to

non-current

assets other

than

financial

instruments

and deferred

tax assets - - - - - - - -

=============== ============ ======== ========== =========== ========= ========= =============== =========

# Cost of acquisition relates to the fair value adjustment in relation to the inventories upon

the acquisition of certain subsidiaries of the Group. The cost of acquisition written down is

charged to profit or loss as part of cost of sales upon the sales of these inventories.

Reconciliation of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Profit or loss US$'000

------------------------------------ --------

Total loss for reportable segments (5,041)

Other non-reportable segments (34)

Consolidated loss before taxation (5,075)

==================================== ========

Operating Segments - ended 30 June 2014 - Unaudited

Hoa

Investment Ireka ICSD Amatir Iringan Urban Lam-Shangri-La

Holding Land Ventures Resources Flora DNA Healthcare

Companies Sdn. Sdn. Sdn. Bhd. Sdn. Sdn. Group Total

Bhd. Bhd. Bhd. Bhd.

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ------------ ---------- ---------- ----------- ---------- ---------- --------------- ---------

Segment

(loss)/profit

before

taxation (694) 415 (2,929) 4,939 (245) (742) (5,418) (4,674)

=============== ============ ========== ========== =========== ========== ========== =============== =========

Included in

the measure

of segment

(loss)/profit

are:

Revenue - 4,069 - 27,425 - - - 31,494

Revenue from

hotel

operations - - 2,056 - 9,184 - - 11,240

Revenue from

mall

operations - - 547 - - - - 547

Revenue from

hospital

operations - - - - - - 814 814

Cost of

acquisition

written - - -

down # - (110) - (5,844) - - - (5,954)

Impairment of -

goodwill - - - (317) - - - (317)

Marketing

expenses - - - (226) - (365) - (591)

Expenses from

hotel

operations - - (2,374) - (6,843) - - (9,217)

Expenses from

mall

operations - - (871) - - - - (871)

Expenses from

hospital

operations - - - - - - (4,753) (4,753)

Depreciation

of property,

plant and

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

equipment - - (5) - (4) - (48) (57)

Finance costs - - (2,130) - (2,469) - (1,161) (5,760)

Finance income 2 7 152 34 12 3 17 227

=============== ============ ========== ========== =========== ========== ========== =============== =========

Segment assets 16,911 4,687 107,704 67,744 81,327 53,675 117,201 449,249

Included in the measure

of segment assets

are:

Addition to non-current

assets other than

financial instruments

and deferred tax assets - - 12 - - 1 - 13

========================== ======= ====== ======== ======= ======= ======= ======== ========

# Cost of acquisition relates to the fair value adjustment in

relation to the inventories upon the acquisition of certain

subsidiaries of the Group. The cost of acquisition written down is

charged to profit or loss as part of cost of sales upon the sales

of these inventories.

Reconciliation of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Profit or loss US$'000

------------------------------------ --------

Total loss for reportable segments (4,674)

Other non-reportable segments (80)

Depreciation (2)

Consolidated loss before taxation (4,756)

==================================== ========

Operating Segments - ended 31 December 2014 - Audited

Hoa

Investment Ireka ICSD Amatir Iringan Urban Lam-Shangri-La

Holding Land Ventures Resources Flora DNA Healthcare

Companies Sdn. Sdn. Sdn. Bhd. Sdn. Sdn. Group Total

Bhd. Bhd. Bhd. Bhd.

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ------------ ---------- ---------- ----------- ---------- ---------- --------------- ---------

Segment

profit/(loss)

before

taxation 3,100 99 (5,436) 16,607 569 (1,474) 1,366 14,831

=============== ============ ========== ========== =========== ========== ========== =============== =========

Included in

the measure

of segment

profit/(loss)

are:

Revenue - 4,839 - 50,923 - - 29,340 85,102

Revenue from

hotel

operations - - 4,323 - 18,171 - - 22,494

Revenue from

mall

operations - - 1,027 - - - - 1,027

Revenue from

hospital

operations - - - - - - 2,525 2,525

Cost of

acquisition

written

down # - (150) - (8,329) - - - (8,479)

Impairment of

goodwill - - - (451) - - (4,276) (4,727)

Marketing

expenses - - - (266) - (557) - (823)

Expenses from

hotel

operations - - (4,507) - (12,499) - - (17,006)

Expenses from

mall

operations - - (1,789) - - - - (1,789)

Expenses from

hospital

operations - - - - - - (9,702) (9,702)

Depreciation

of property,

plant and

equipment - - (10) - (9) - (99) (118)

Finance costs - - (4,328) - (4,906) - (4,526) (13,760)

Finance income 24 11 312 115 20 14 81 577

--------------- ------------ ---------- ---------- ----------- ---------- ---------- --------------- ---------

Segment assets 19,471 5,150 100,570 45,938 76,447 58,587 101,643 407,806

Included in the measure

of segment assets

are:

Addition to non-current

assets other than

financial instruments

and deferred tax assets - - - - - 1 19 20

========================== ======= ====== ======== ======= ======= ======= ======== ========

# Cost of acquisition relates to the fair value adjustment in

relation to the inventories upon the acquisition of certain

subsidiaries of the Group. The cost of acquisition written down is

charged to profit or loss as part of cost of sales upon the sales

of these inventories.

Reconciliation of reportable segment revenues, profit or loss,

assets and liabilities and other material items

Profit or loss US$'000

-------------------------------------- --------

Total profit for reportable segments 14,831

Other non-reportable segments 587

Depreciation (4)

Consolidated profit before taxation 15,414

====================================== ========

30 June 2015 - Unaudited Addition to

US$'000 non-current

Revenue Depreciation Finance costs Finance income Segment assets assets

-------------------------- -------- ------------- -------------- --------------- --------------- -------------

Total reportable segment 16,891 (53) (5,565) 194 379,305 -

Other non-reportable

segments - - - - 35,800 -

-------------------------- -------- ------------- -------------- --------------- --------------- -------------

Consolidated total 16,891 (53) (5,565) 194 415,105 -

========================== ======== ============= ============== =============== =============== =============

30 June 2014 - Unaudited Addition to

US$'000 non-current

Revenue Depreciation Finance costs Finance income Segment assets assets

-------------------------- -------- ------------- -------------- --------------- --------------- -------------

Total reportable segment 31,494 (57) (5,760) 227 449,249 13

Other non-reportable

segments - (2) - - 40,095 -

-------------------------- -------- ------------- -------------- --------------- --------------- -------------

Consolidated total 31,494 (59) (5,760) 227 489,344 13

========================== ======== ============= ============== =============== =============== =============

31 December 2014 - Audited Addition to

US$'000 non-current

Revenue Depreciation Finance costs Finance income Segment assets assets

---------------------------- -------- ------------- -------------- --------------- --------------- -------------

Total reportable segment 85,102 (118) (13,760) 577 407,806 20

Other non-reportable

segments - (4) - - 37,554 -

---------------------------- -------- ------------- -------------- --------------- --------------- -------------

Consolidated total 85,102 (122) (13,760) 577 445,360 20

============================ ======== ============= ============== =============== =============== =============

Geographical Information - ended 30 June 2015 - Unaudited

Malaysia Vietnam Consolidated

US$'000 US$'000 US$'000

-------------------- --------- -------- -------------

Revenue 16,891 - 16,891

Non-current assets 3,932 19,166 23,098

==================== ========= ======== =============

For the financial period ended 30 June 2015, no single customer

exceeded 10% of the Group's total revenue.

Geographical Information - ended 30 June 2014 - Unaudited

Malaysia Vietnam Consolidated

US$'000 US$'000 US$'000

-------------------- --------- -------- -------------

Revenue 31,494 - 31,494

Non-current assets 5,288 24,439 29,727

==================== ========= ======== =============

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

For the financial period ended 30 June 2014, no single customer

exceeded 10% of the Group's total revenue.

Geographical Information - ended 31 December 2014 - Audited

Malaysia Vietnam Consolidated

US$'000 US$'000 US$'000

-------------------- ---------- -------- -------------

Revenue 55,762 29,340 85,102

Non-current assets 4,104 20,217 24,321

==================== ========== ======== =============

For the year ended 31 December 2014, one customer exceeded 10%

of the Group's total revenue as follows:

US$'000 Segments

---------------------- ------------------- -------------------

Hoa Lam-Shangri-La

AEON Vietnam Co. Ltd. 22,991 Healthcare Group

====================== =================== ===================

4 Seasonality

The Group's business operations have not been materially

affected by seasonal factors for the period under review.

5 Cost of Sales

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

US$'000 US$'000 US$'000

------------------------------------ ----------- ----------- -------------

Direct costs attributable:

Completed units 12,594 24,636 36,856

Land held for property development - - 10,238

Impairment of intangible assets 129 317 4,727

------------------------------------ ----------- ----------- -------------

12,723 24,953 51,821

------------------------------------ ----------- ----------- -------------

6 Foreign exchange GAIN/(loss)

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

US$'000 US$'000 US$'000

----------------------------------- ----------- ----------- ---------------

Foreign exchange gain/(loss)

comprises:

Realised foreign exchange (loss)/

gain (171) (8) 425

Unrealised foreign exchange

gain/ (loss) 718 (1) 291

547 (9) 716

----------------------------------- ----------- ----------- ---------------

7 Taxation

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

US$'000 US$'000 US$'000

--------------------------------------- ----------- ----------- --------------

Current tax expense 1,637 2,980 10,587

Deferred tax credit (95) (74) (1,200)

--------------------------------------- ----------- ----------- --------------

Total tax expense for the period/year 1,542 2,906 9,387

--------------------------------------- ----------- ----------- --------------

The numerical reconciliation between the income tax expense and

the product of accounting results multiplied by the applicable tax

rate is computed as follows:

Unaudited Unaudited Audited

Six months Six months Year

ended ended Ended

30 June 30 June 31 December

2015 2014 2014

US$'000 US$'000 US$'000

--------------------------------------- ----------- ----------- -------------

Net (loss)/profit before taxation (5,075) (4,756) 15,414

--------------------------------------- ----------- ----------- -------------

Income tax at a rate of 25% (1,269) (1,189) 3,853

Add :

Tax effect of expenses not deductible

in determining taxable profit 1,241 1,596 2,063

Movement of unrecognised deferred

tax benefits 1,284 1,673 2,621

Tax effect of different tax rates

in subsidiaries 1,025 1,027 1,784

Less :

Tax effect of income not taxable

in determining taxable profit (499) (201) (1,415)

Under provision in respect of prior

period/year (240) - 481

--------------------------------------- ----------- ----------- -------------

Total tax expense for the period/year 1,542 2,906 9,387

--------------------------------------- ----------- ----------- -------------

The applicable corporate tax rate in Malaysia is 25%.

The Company is treated as a tax resident of Jersey for the

purpose of Jersey tax laws and is subject to a tax rate of 0%.

The applicable corporate tax rates in Singapore and Vietnam are

17% and 22% respectively.

A subsidiary of the Group, Hoa Lam-Shangri-La Healthcare Ltd

Liability Co is granted preferential corporate tax rate of 10% for

the results of the hospital operations. The preferential income tax

is given by the government of Vietnam due to the subsidiary's

involvement in the healthcare and education industries.

A Goods and Services Tax was introduced in Jersey in May 2008.

The Company has been registered as an International Services Entity

so it does not have to charge or pay local GST. The cost for this

registration is GBP200 per annum.

The Directors intend to conduct the Group's affairs such that

the central management and control is not exercised in the United

Kingdom and so that neither the Company nor any of its subsidiaries

carries on any trade in the United Kingdom. The Company and its

subsidiaries will thus not be residents in the United Kingdom for

taxation purposes. On this basis, they will not be liable for

United Kingdom taxation on their income and gains other than income

derived from a United Kingdom source.

8 (LOSS)/Earnings Per Share

Basic and diluted (loss)/earnings per ordinary share

The calculation of basic and diluted (loss)/earnings per

ordinary share for the period/year ended was based on the

(loss)/profit attributable to equity holders of the parent and a

weighted average number of ordinary shares outstanding, calculated

as below:

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2015 2014 2014

US$'000 US$'000 US$'000

----------------------------------- ------------------- ----------- -------------

(Loss)/earnings attributable

to equity holders of the parent (4,428) (5,198) 9,091

Weighted average number of shares 212,025 212,025 212,025

(Loss)/earnings per share

Basic and diluted (US cents) (2.09) (2.45) 4.29

----------------------------------- ------------------- ----------- -------------

9 Loans and Borrowings

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2015 2014 2014

US$'000 US$'000 US$'000

--------------------------- ---------- ---------- -------------

Non-current

Bank loans 55,518 68,936 53,338

Finance lease liabilities 18 36 26

---------------------------- ---------- ---------- -------------

55,536 68,972 53,364

--------------------------- ---------- ---------- -------------

Current

Bank loans 14,400 6,920 19,262

Finance lease liabilities 12 14 12

---------------------------- ---------- ---------- -------------

14,412 6,934 19,274

--------------------------- ---------- ---------- -------------

69,948 75,906 72,638

--------------------------- ---------- ---------- -------------

(MORE TO FOLLOW) Dow Jones Newswires

August 28, 2015 02:01 ET (06:01 GMT)

The effective interest rates on the bank loans and finance lease

arrangement for the period ranged from 5.25% to 12.50% (30 June

204: 5.25% to 14.90%; 31 December 2014: 5.25% to 17.70%) per annum

and 2.50% to 3.50% (30 June 2014: 2.50%; 31 December 2014: 2.50% to

3.50%) per annum respectively.

Borrowings are denominated in Malaysian Ringgit, United States

Dollars and Vietnamese Dong.

Bank loans are repayable by monthly, quarterly or semi-annually

instalments.

Bank loans are secured by land held for property development,

work-in-progress, operating assets of the Group, pledged deposits

and some by the corporate guarantee of the Company.

Finance lease liabilities are payable as follows:

Present value

of minimum

Future minimum lease payment

lease payment Interest 30 June

30 June 30 June 2015

Unaudited 2015 US$'000 2015 US$'000 US$'000

---------------------------- --------------- -------------- ---------------

Within one year 14 2 12

Between one and five years 21 3 18

---------------------------- --------------- -------------- ---------------

35 5 30

---------------------------- --------------- -------------- ---------------

Present value

of minimum

Future minimum lease payment

lease payment Interest 30 June

30 June 30 June 2014

Unaudited 2014 US$'000 2014 US$'000 US$'000

---------------------------- --------------- -------------- ---------------

Within one year 16 2 14

Between one and five years 42 6 36

---------------------------- --------------- -------------- ---------------

58 8 50

---------------------------- --------------- -------------- ---------------

Present value

of minimum

Future minimum Interest lease payment

lease payment 31 December 31 December

31 December 2014 2014

Audited 2014 US$'000 US$'000 US$'000

---------------------------- --------------- ------------- ---------------

Within one year 15 3 12

Between one and five years 30 4 26

---------------------------- --------------- ------------- ---------------

45 7 38

---------------------------- --------------- ------------- ---------------

10 Medium Term Notes

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2015 2014 2014

US$'000 US$'000 US$'000

----------------------------------- ---------- ---------- ------------

Outstanding medium term notes 136,210 160,060 147,004

Net transaction costs (1,556) (2,714) (1,774)

Less:

Repayment due within twelve

months (124,285) (14,013) (60,237)

----------------------------------- ---------- ---------- ------------

Repayment due after twelve months 10,369 143,333 84,993

----------------------------------- ---------- ---------- ------------

The medium term notes ("MTN") were issued pursuant to a

programme with a tenure of ten (10) years from the first issue date

of the notes. The MTN were issued by a subsidiary, to fund two

development projects known as Sandakan Harbour Square and Aloft

Kuala Lumpur Sentral Hotel in Malaysia. US$64.93 million (RM245.00

million) was drawn down in 2011 for Sandakan Harbour Square.

US$3.97 million (RM15.00 million) was drawn down in 2012 for Aloft

Kuala Lumpur Sentral Hotel and the remaining US$67.31 million

(RM254 million) in 2013. The Group secured a rollover of MTN

amounting US$11.93 million (RM45 million) which was due for

repayment on 8 December 2014 to be repaid on 8 December 2017. No

repayments were made in the current financial period.

The weighted average interest rate of the MTN was 5.56% per

annum at the statement of financial position date. The effective

interest rates of the MTN and their outstanding amounts are as

follows:

Interest rate

Maturity Dates % per annum US$'000

------------------------- ------------------ -------------- ----------

Series 1 Tranche FG 8 December

003 2017 5.90 6,625

Series 1 Tranche BG 8 December

003 2017 5.85 5,300

Series 1 Tranche FG 8 December

002 2015 5.46 11,925

Series 1 Tranche BG 8 December

002 2015 5.41 7,950

Series 2 Tranche FG 8 December

001 2015 5.46 18,550

Series 2 Tranche BG 8 December

001 2015 5.41 14,575

Series 3 Tranche FG001 1 October 2015 5.40 2,650

Series 3 Tranche BG001 1 October 2015 5.35 1,325

29 January

Series 3 Tranche FG002 2016 5.50 3,975

29 January

Series 3 Tranche BG002 2016 5.45 2,650

Series 3 Tranche FG003 8 April 2016 5.65 34,185

Series 3 Tranche BG003 8 April 2016 5.58 26,500

------------------------- ------------------ -------------- ----------

136,210

-------------------------------------------- -------------- ----------

The medium term notes are secured by way of:

(i) bank guarantee from two financial institutions in respect of the BG Tranches;

(ii) financial guarantee insurance policy from Danajamin

Nasional Berhad in respect to the FG Tranches;

(iii) a first fixed and floating charge over the present and

future assets and properties of Silver Sparrow Berhad, ICSD

Ventures Sdn. Bhd. and Iringan Flora Sdn. Bhd. by way of a

debenture;

(iv) a third party first legal fixed charge over ICSD Ventures Sdn. Bhd.'s assets and land;

(v) assignment of all Iringan Flora Sdn. Bhd.'s present and

future rights, title, interest and benefits in and under the Sales

and Purchase Agreement to purchase the Aloft Kuala Lumpur Sentral

Hotel from Excellent Bonanza Sdn. Bhd.;

(vi) first fixed land charge over the Aloft Kuala Lumpur Sentral

Hotel and the Aloft Kuala Lumpur Sentral Hotel's land (to be

executed upon construction completion);

(vii) a corporate guarantee by Aseana Properties Limited;

(viii) letter of undertaking from Aseana Properties Limited to

provide financial and other forms of support to ICSD Ventures Sdn.

Bhd. to finance any cost overruns associated with the development

of the Sandakan Harbour Square;

(ix) assignment of all its present and future rights, interest

and benefits under the ICSD Ventures Sdn. Bhd.'s and Iringan Flora

Sdn. Bhd.'s Put Option Agreements and the proceeds from the Harbour

Mall Sandakan, Four Points by Sheraton Sandakan Hotel and Aloft

Kuala Lumpur Sentral Hotel;

(x) assignment over the disbursement account, revenue account,