Key

Highlights

-

Third quarter operating income from continuing

operations of $79.7 million, down 7% over the 2014 period impacted

by separation costs and higher non-cash U.S. Pension expense

-

Third quarter adjusted EBITDA from continuing

operations of $128 million, up 5% over the 2014 period as results

benefited from favorable input costs

-

Worldwide Building Products delivered a record

EBITDA quarter up 6% over the prior year

LANCASTER, Pa., October 29, 2015 --Armstrong World

Industries, Inc. (NYSE: AWI), a global leader in the design and

manufacture of floors and ceilings systems, today reported third

quarter 2015 results.

| Third Quarter Results from continuing

operations |

|

|

|

|

|

|

|

|

|

|

|

(Amounts in millions except per share data) |

|

Three Months Ended September

30, |

|

|

|

|

|

2015 |

|

2014 |

|

Change |

|

| Net

sales |

|

$658.5 |

|

$678.9 |

|

(3.0%) |

|

|

Operating income |

|

79.7 |

|

85.8 |

|

(7.1%) |

|

| Net

income |

|

30.3 |

|

46.7 |

|

(35.1%) |

|

|

Diluted earnings per share |

|

$0.54 |

|

$0.84 |

|

(35.7%) |

|

Excluding the unfavorable impact from foreign

exchange of $29 million, consolidated net sales increased 1.3%

compared to the prior year period driven by higher volumes and

favorable price and mix performance.

Operating income declined compared to the prior

year period driven by increased SG&A expense to support

go-to-market initiatives in the Americas Resilient business, costs

associated with the previously announced separation project, higher

non-cash U.S. pension expense, unfavorable price and mix and higher

manufacturing costs; which were only partially offset by lower

input costs and the margin impact of higher volumes. Net

income was negatively impacted compared to the prior year by

foreign exchange rate losses on the translation of unhedged

cross-currency intercompany loans denominated in Russian Rubles

used to fund construction of a mineral fiber ceilings plant that

was completed in the first quarter of 2015 and by R&D tax

credits that had an outsized benefit in the prior year that did not

repeat.

"On a comparable foreign exchange basis sales

increased 1% in the third quarter with improvement across virtually

all of our businesses," said Matt Espe, CEO. "I'm especially

pleased to report that our Worldwide Building Products business

delivered yet another record adjusted EBITDA quarter despite

challenging conditions in emerging markets. Globally, ceiling

sales were up 2% and EBITDA up 6%, as our Americas business

continues to benefit from price over inflation, productivity

improvements and mix gains."

| Additional (non-GAAP*) Financial Metrics

from continuing operations |

|

|

|

|

|

|

|

|

|

(Amounts in millions except per share data) |

|

Three Months Ended September 30, |

|

|

|

|

|

2015 |

|

2014 |

|

Change |

|

Adjusted operating income |

|

$98 |

|

$93 |

|

5% |

|

Adjusted net income |

|

$45 |

|

$49 |

|

(8%) |

|

Adjusted diluted earnings per share |

|

$0.80 |

|

$0.88 |

|

(9%) |

| Free

cash flow |

|

$64 |

|

$60 |

|

8% |

| (Amounts in millions) |

|

Three Months Ended September 30, |

|

|

|

|

|

|

2015 |

|

2014 |

|

Change |

| Adjusted EBITDA |

|

|

|

|

|

|

|

|

Building Products |

|

$109 |

|

$103 |

|

6% |

|

|

Resilient Flooring |

|

24 |

|

25 |

|

(1%) |

|

|

Wood Flooring |

|

14 |

|

9 |

|

57% |

|

|

Unallocated Corporate |

|

(19) |

|

(15) |

|

(22%) |

| Consolidated Adjusted EBITDA |

|

$128 |

|

$122 |

|

5% |

*The Company uses the above non-GAAP adjusted

measures, as well as other non-GAAP measures mentioned below, in

managing the business and believes the adjustments provide

meaningful comparisons of operating performance between periods.

Adjusted operating income, adjusted EBITDA, adjusted net

income, and adjusted EPS exclude the impact of foreign exchange,

restructuring charges and related costs, impairments, the non-cash

impact of the U.S. pension plan, separation costs and certain other

gains and losses. Free cash flow is defined as cash from

operations and dividends received from the WAVE joint venture, less

expenditures for property and equipment, less restricted cash, and

is adjusted to remove the impact of cash used or proceeds received

for acquisitions and divestitures. The company believes free

cash flow is useful because it provides insight into the amount of

cash that the Company has available for discretionary uses, after

expenditures for capital commitments and adjustments for

acquisitions/divestitures. Adjusted figures are reported in

comparable dollars using the budgeted exchange rate for 2015, and

are reconciled to the most comparable GAAP measures in tables at

the end of this release.

Adjusted operating income and adjusted EBITDA both

improved by 5% in the third quarter of 2015 when compared to the

prior year period. The improvement in adjusted EBITDA was

driven by lower input costs, the margin impact of higher volumes

and higher earnings from WAVE which were only partially offset by

higher SG&A spending primarily to support go-to-market

initiatives in the Americas Resilient business, unfavorable price

and mix performance, and increased manufacturing expenses.

Adjusted earnings per share is calculated using a 39% adjusted tax

rate in both periods. The increase in free cash flow was

driven by improvements in working capital and lower capital

expenditures which were only partially offset by lower cash

earnings.

| Third Quarter Segment Highlights |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Building Products |

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

2015 |

|

|

2014 |

|

Change |

| Total

segment net sales |

|

$335.9 |

|

|

$351.7 |

|

(4.5%) |

|

Operating income |

|

$89.8 |

|

|

$86.6 |

|

3.7% |

Excluding the unfavorable impact of foreign

exchange of approximately $23 million, net sales increased as

favorable price and mix offset the impact of lower volumes,

primarily in EMEA and the Pacific Rim. Operating income

increased in the third quarter of 2015 as the margin impact of

lower volumes was more than offset by favorable price and mix

performance, lower manufacturing and input costs and higher

earnings from WAVE.

|

Resilient Flooring |

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

2015 |

|

|

2014 |

|

Change |

| Total

segment net sales |

|

$192.1 |

|

|

$190.2 |

|

1.0% |

|

Operating income |

|

$14.3 |

|

|

$14.9 |

|

(4.0%) |

Net sales increased driven by volume growth in

both the Americas and Pacific Rim, which was only partially offset

by unfavorable price and mix. Volume improvement in the

Americas commercial business was partially aided by favorable

market share shifts as a result of competitive product availability

issues and our service proposition relative to competition.

Operating income declined driven by unfavorable price and mix

performance, increased SG&A expenses to support go-to-market

initiatives in the Americas and higher manufacturing costs,

primarily due to LVT plant construction expenses, which were only

partially offset by lower input costs and the margin impact of

higher volumes. The comparison was also impacted by

approximately $3 million of charges related to the closure of our

Thomastown, Australia facility that was closed during the third

quarter of 2014.

|

Wood Flooring |

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

2015 |

|

|

2014 |

|

Change |

| Total

segment net sales |

|

$130.5 |

|

|

$137.0 |

|

(4.7%) |

|

Operating income |

|

$10.4 |

|

|

$2.0 |

|

Favorable |

Net sales decreased as positive mix performance

was unable to offset unfavorable price and volume declines as a

result of engineered wood product availability challenges.

Operating income improved driven by lower input costs which more

than offset the margin impact of unfavorable price and mix, lower

volumes, higher manufacturing expense and an increase in SG&A

expense. The comparison was also impacted by $4 million of

severance and other charges associated with the closure of our

engineered wood flooring plant in Kunshan China that was closed

during the third quarter of 2014.

Corporate

Unallocated corporate expense of $34.8 million increased from $17.7

million in the prior year due to increased U.S. pension costs of $7

million and separation costs of $7 million.

Year to Date Results from

continuing operations

| (Amounts in millions) |

Nine Months Ended September 30, |

|

| |

2015 |

2014 |

Change |

| Net sales (as reported) |

$1,842.6 |

$1,928.0 |

(4.4%) |

| Operating income (as reported) |

178.6 |

203.2 |

(12.1%) |

| Adjusted EBITDA |

315 |

309 |

2% |

| Free cash flow |

99 |

14 |

Favorable |

Excluding the unfavorable impact from foreign

exchange of $72 million, consolidated net sales decreased compared

to the prior year period as volume declines were only partially

offset by favorable price and mix.

Operating income declined by 12% driven primarily

by higher non-cash U.S. pension costs and costs associated with the

previously announced separation project. Adjusted EBITDA

improved slightly over the prior year period as lower input costs

and favorable price and mix offset higher SG&A expenses, the

margin impact of lower volumes, increased manufacturing expenses

and lower earnings from WAVE. The increase in free cash flow

was driven by improvements in working capital and lower capital

expenditures, which were only partially offset by lower cash

earnings and dividends from the WAVE joint venture.

Market Outlook and 2015 Guidance

(1)

"We're updating our full year sales guidance to

reflect third quarter results and the pressure we're experiencing

due to continued volatility in foreign exchange rates," said Dave

Schulz, CFO. "Despite pressure from foreign exchange

headwinds, we continue to expect to benefit from lower input costs,

primarily in our flooring businesses, and are increasing our full

year adjusted EBITDA and adjusted EPS guidance at the

midpoint."

The Company now expects full year sales to be in

the $2.4 to $2.45 billion range, adjusted EBITDA to be in the $370

to $390 million range and adjusted EPS to be in the range of $2.15

to $2.35 per diluted share.

(1) Sales

guidance includes the impact of foreign exchange. Guidance

metrics, other than sales, are presented using 2015 budgeted

foreign exchange rates. Adjusted EPS guidance for 2015 is

calculated based on an adjusted effective tax rate of 39%.

Earnings Webcast

Management will host a live Internet broadcast

beginning at 11:00 a.m. Eastern time today, to discuss third

quarter 2015 results, market outlook and 2015 guidance. This

event will be broadcast live on the Company's Web site. To

access the call and accompanying slide presentation, go to

www.armstrong.com and click "For Investors." The replay of

this event will also be available on the Company's Web site for up

to one year after the date of the call.

Uncertainties Affecting

Forward-Looking Statements

Disclosures in this release, including without

limitation, those relating to future financial results guidance and

our plan to separate our Flooring business from our Ceilings

(Building Products) business and in our other public documents and

comments contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Those

statements provide our future expectations or forecasts and can be

identified by our use of words such as "anticipate," "estimate,"

"expect," "project," "intend," "plan," "believe," "outlook,"

"target," "predict," "may," "will," "would," "could," "should,"

"seek," and other words or phrases of similar meaning in connection

with any discussion of future operating or financial

performance. Forward-looking statements,

by their nature, address matters that are uncertain and involve

risks because they relate to events and depend on circumstances

that may or may not occur in the future. As a result, our

actual results may differ materially from our expected results and

from those expressed in our forward-looking statements. A

more detailed discussion of the risks and uncertainties that could

cause our actual results to differ materially from those projected,

anticipated or implied is included in the "Risk Factors" and

"Management's Discussion and Analysis" sections of our reports on

Forms 10-K and 10-Q filed with the U.S. Securities and Exchange

Commission ("SEC"). Forward-looking statements speak only as

of the date they are made. We undertake no obligation to

update any forward-looking statements beyond what is required under

applicable securities law.

About Armstrong and Additional

Information

More details on the Company's performance can be

found in its quarterly report on Form 10-Q for the quarter ended

September 30, 2015 that the Company expects to file with the SEC

today.

Armstrong World Industries, Inc. is a global

leader in the design and manufacture of floors and ceilings.

In 2014, Armstrong's consolidated net sales from continuing

operations totaled approximately $2.5 billion. As of

September 30, 2015, Armstrong operated 32 plants in nine countries

and had approximately 7,600 employees worldwide.

Additional forward looking non-GAAP metrics are

available on the Company's web site at http://www.armstrong.com/

under the Investor Relations tab. The website is not part of this

release and references to our website address in this release are

intended to be inactive textual references only.

| As Reported Financial Highlights |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL HIGHLIGHTS |

| Armstrong World Industries,

Inc. and Subsidiaries |

| (amounts in millions, except

for per-share amounts, quarterly and year to date data is

unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended September 30, |

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

| Net sales |

$658.5 |

|

$678.9 |

|

$1,842.6 |

|

$1,928.0 |

| Costs of goods sold |

480.6 |

|

510.9 |

|

1,377.3 |

|

1,470.9 |

| Selling general and administrative expenses |

110.4 |

|

101.0 |

|

319.5 |

|

304.3 |

| Separation costs |

7.4 |

|

- |

|

16.8 |

|

- |

| Goodwill impairment |

- |

|

- |

|

- |

|

0.8 |

| Equity (earnings) from joint venture |

(19.6) |

|

(18.8) |

|

(49.6) |

|

(51.2) |

|

|

Operating income |

79.7 |

|

85.8 |

|

178.6 |

|

203.2 |

|

|

|

|

|

|

|

|

|

|

| Interest expense |

11.3 |

|

10.9 |

|

33.9 |

|

34.3 |

| Other non-operating expense |

14.0 |

|

2.6 |

|

15.5 |

|

9.2 |

| Other non-operating (income) |

(0.8) |

|

(0.7) |

|

(5.0) |

|

(1.9) |

|

|

Earnings from continuing operations before income taxes |

55.2 |

|

73.0 |

|

134.2 |

|

161.6 |

| Income tax expense |

24.9 |

|

26.3 |

|

70.2 |

|

70.2 |

|

|

Earnings from continuing operations |

$30.3 |

|

$46.7 |

|

$64.0 |

|

$91.4 |

| Net (loss) from discontinued operations, net of tax

(benefit) of $-, $-, $- and $- |

- |

|

(14.9) |

|

- |

|

(21.7) |

| Gain (loss) from disposal of discontinued business, net of

tax (benefit) of ($0.7), ($-), ($44.1) and ($1.2) |

1.5 |

|

(0.2) |

|

44.0 |

|

(2.3) |

|

|

Net

earnings (loss) from discontinued operations |

1.5 |

|

(15.1) |

|

44.0 |

|

(24.0) |

|

|

Net

earnings |

$31.8 |

|

$31.6 |

|

$108.0 |

|

$67.4 |

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

(13.4) |

|

(14.1) |

|

(21.3) |

|

(10.0) |

|

|

Derivative gain (loss) |

0.9 |

|

4.9 |

|

(0.2) |

|

(1.3) |

|

|

Pension and postretirement adjustments |

11.1 |

|

8.5 |

|

32.2 |

|

21.3 |

|

|

Total

other comprehensive (loss) income |

(1.4) |

|

(0.7) |

|

10.7 |

|

10.0 |

| Total comprehensive income |

$30.4 |

|

$30.9 |

|

$118.7 |

|

$77.4 |

|

|

|

|

|

|

|

|

|

|

| Earnings per share of common stock, continuing

operations |

|

|

|

|

|

|

|

|

|

Basic |

$0.54 |

|

$0.84 |

|

$1.14 |

|

$1.66 |

|

|

Diluted |

$0.54 |

|

$0.84 |

|

$1.14 |

|

$1.64 |

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per share of common stock,

discontinued operations |

|

|

|

|

|

|

|

|

|

Basic |

$0.03 |

|

($0.27) |

|

$0.79 |

|

($0.44) |

|

|

Diluted |

$0.03 |

|

($0.27) |

|

$0.78 |

|

($0.43) |

|

|

|

|

|

|

|

|

|

|

| Net earnings per share of common stock: |

|

|

|

|

|

|

|

|

|

Basic |

$0.57 |

|

$0.57 |

|

$1.93 |

|

$1.22 |

|

|

Diluted |

$0.57 |

|

$0.57 |

|

$1.92 |

|

$1.21 |

|

|

|

|

|

|

|

|

|

|

| Average number of common shares outstanding |

|

|

|

|

|

|

|

|

|

Basic |

55.5 |

|

55.0 |

|

55.4 |

|

54.9 |

|

|

Diluted |

55.9 |

|

55.5 |

|

55.8 |

|

55.4 |

| SEGMENT RESULTS |

| Armstrong World Industries,

Inc. and Subsidiaries |

| (amounts in millions) |

| (Unaudited) |

| |

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended September 30, |

| Net Sales |

2015 |

|

2014 |

|

2015 |

|

2014 |

| Building Products |

$335.9 |

|

$351.7 |

|

$934.0 |

|

$983.4 |

| Resilient Flooring |

192.1 |

|

190.2 |

|

548.8 |

|

550.1 |

| Wood Flooring |

130.5 |

|

137.0 |

|

359.8 |

|

394.5 |

|

|

Total

net sales |

$658.5 |

|

$678.9 |

|

$1,842.6 |

|

$1,928.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income (loss) |

|

|

|

|

|

|

|

| Building Products |

$89.8 |

|

$86.6 |

|

$213.8 |

|

$209.3 |

| Resilient Flooring |

14.3 |

|

14.9 |

|

43.4 |

|

46.0 |

| Wood Flooring |

10.4 |

|

2.0 |

|

11.7 |

|

4.5 |

| Unallocated Corporate (expense) |

(34.8) |

|

(17.7) |

|

(90.3) |

|

(56.6) |

|

|

Total

Operating Income |

$79.7 |

|

$85.8 |

|

$178.6 |

|

$203.2 |

| Selected Balance Sheet

Information |

| (amounts in millions) |

| Assets |

|

|

|

|

September 30, 2015 |

|

|

December 31, 2014 |

| Current assets |

|

|

|

|

$887.7 |

|

|

$811.5 |

| Property, plant and equipment, net |

|

1,067.1 |

|

|

1,062.4 |

| Other noncurrent assets |

|

|

|

|

739.6 |

|

|

732.3 |

|

|

Total

assets |

|

|

|

|

$2,694.4 |

|

|

$2,606.2 |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and shareholders' equity |

|

|

|

|

|

| Current liabilities |

|

|

|

|

$421.6 |

|

|

$388.1 |

| Noncurrent liabilities |

|

|

|

|

1,489.6 |

|

|

1,569.0 |

| Equity |

|

|

|

|

783.2 |

|

|

649.1 |

|

|

Total liabilities and shareholders' equity |

$2,694.4 |

|

|

$2,606.2 |

| Selected Cash Flow

Information |

| (amounts in millions) |

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

2015 |

|

|

2014 |

| Net

income |

|

$108.0 |

|

|

$67.4 |

| Other

adjustments to reconcile net income to net cash provided by

operating activities |

|

39.5 |

|

|

123.1 |

|

Changes in operating assets and liabilities, net |

|

(3.5) |

|

|

(79.4) |

| Net

cash provided by operating activities |

|

144.0 |

|

|

111.1 |

| Net

cash (used for) investing activities |

|

(45.3) |

|

|

(96.9) |

| Net

cash (used for) provided by financing activities |

|

(23.6) |

|

|

1.3 |

|

|

|

|

|

|

|

| Effect

of exchange rate changes on cash and cash equivalents |

|

(10.4) |

|

|

(2.3) |

| Net

increase in cash and cash equivalents |

|

64.7 |

|

|

13.2 |

| Cash

and cash equivalents, beginning of period |

|

185.3 |

|

|

135.2 |

| Cash

and cash equivalents, end of period |

|

$250.0 |

|

|

$148.4 |

| Cash

and cash equivalents at end of period of discontinued

operations |

|

- |

|

|

($2.4) |

| Cash

and cash equivalents at end of period of continuing operations |

|

$250.0 |

|

|

$150.8 |

Supplemental Reconciliations of GAAP to non-GAAP

Results (unaudited)

(Amounts in millions, except per share data)

To supplement its consolidated financial

statements presented in accordance with accounting principles

generally accepted in the United States (GAAP), the Company

provides additional measures of performance adjusted to exclude the

impact of foreign exchange, restructuring charges and related

costs, impairments, the non-cash impact of the U.S. pension plan,

separation costs and certain other gains and losses. Adjusted

figures are reported in comparable dollars using the budgeted

exchange rate for 2015. The Company uses these adjusted

performance measures in managing the business, including

communications with its Board of Directors and employees, and

believes that they provide users of this financial information with

meaningful comparisons of operating performance between current

results and results in prior periods. The Company believes that

these non-GAAP financial measures are appropriate to enhance

understanding of its past performance, as well as prospects for its

future performance. A reconciliation of these adjustments to

the most directly comparable GAAP measures is included in this

release and on the Company's website. These non-GAAP measures

should not be considered in isolation or as a substitute for the

most comparable GAAP measures. Non-GAAP financial measures

utilized by the Company may not be comparable to non-GAAP financial

measures used by other companies.

| CONSOLIDATED RESULTS FROM CONTINUING

OPERATIONS |

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

| Adjusted EBITDA |

|

|

$128 |

|

|

$122 |

|

|

$315 |

|

|

$309 |

| D&A/Fx* |

|

|

(30) |

|

|

(29) |

|

|

(89) |

|

|

(88) |

| Operating Income, Adjusted |

|

|

$98 |

|

|

$93 |

|

|

$226 |

|

|

$221 |

| Non-cash impact of U.S. Pension |

|

|

6 |

|

|

- |

|

|

19 |

|

|

1 |

| Separation costs |

|

|

7 |

|

|

- |

|

|

17 |

|

|

- |

| Cost reduction expenses (income) |

|

|

1 |

|

|

6 |

|

|

(1) |

|

|

10 |

| Multilayered Wood flooring duties |

|

|

- |

|

|

- |

|

|

4 |

|

|

- |

| Impairment |

|

|

- |

|

|

- |

|

|

- |

|

|

4 |

| Foreign exchange impact |

|

|

4 |

|

|

1 |

|

|

8 |

|

|

3 |

|

|

Operating Income, Reported |

|

|

$80 |

|

|

$86 |

|

|

$179 |

|

|

$203 |

*Excludes accelerated depreciation associated with

cost reduction initiatives reflected below. Actual D&A as

reported is; $29.5 million for the three months ended September 30,

2015, $35.4 million for the three months ended September 30, 2014,

$86.9 million for the nine months ended September 30, 2015, and

$98.1 million for the nine months ended September 30,

2014.

| BUILDING PRODUCTS |

|

|

|

|

|

| |

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

| |

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

| Adjusted EBITDA |

|

|

$109 |

|

|

$103 |

|

|

$267 |

|

|

$260 |

| D&A/Fx |

|

|

(18) |

|

|

(16) |

|

|

(52) |

|

|

(48) |

| Operating Income, Adjusted |

|

|

$91 |

|

|

$87 |

|

|

$215 |

|

|

$212 |

| Foreign exchange impact |

|

|

1 |

|

|

- |

|

|

1 |

|

|

3 |

|

|

Operating Income, Reported |

|

|

$90 |

|

|

$87 |

|

|

$214 |

|

|

$209 |

| RESILIENT FLOORING |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September

30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

| Adjusted EBITDA |

|

|

$24 |

|

|

$25 |

|

|

$67 |

|

|

$71 |

| D&A/Fx |

|

|

(7) |

|

|

(8) |

|

|

(20) |

|

|

(20) |

| Operating Income, Adjusted |

|

|

$17 |

|

|

$17 |

|

|

$47 |

|

|

$51 |

| Cost reduction expenses (income) |

|

|

1 |

|

|

2 |

|

|

(1) |

|

|

4 |

| Foreign exchange impact |

|

|

2 |

|

|

- |

|

|

5 |

|

|

1 |

|

|

Operating Income, Reported |

|

|

$14 |

|

|

$15 |

|

|

$43 |

|

|

$46 |

| WOOD FLOORING |

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

| Adjusted EBITDA (1) |

|

|

$14 |

|

|

$9 |

|

|

$27 |

|

|

$25 |

| D&A/Fx |

|

|

(3) |

|

|

(3) |

|

|

(9) |

|

|

(11) |

| Operating Income, Adjusted (1) |

|

|

$11 |

|

|

$6 |

|

|

$18 |

|

|

$14 |

| Cost reduction expenses |

|

|

- |

|

|

4 |

|

|

- |

|

|

6 |

| Multilayered Wood flooring duties |

|

|

- |

|

|

- |

|

|

4 |

|

|

- |

| Impairment |

|

|

- |

|

|

- |

|

|

- |

|

|

4 |

| Foreign exchange impact |

|

|

1 |

|

|

- |

|

|

2 |

|

|

(1) |

|

|

Operating Income, Reported(1) |

|

|

$10 |

|

|

$2 |

|

|

$12 |

|

|

$5 |

(1) Includes a

$4 million charge recorded in the second quarter of 2015 resulting

from new duty rates assigned by the U.S. Department of Commerce on

multilayered wood importers and a $1 million gain recorded in the

second quarter of 2014 related to a refund of previously paid

duties on imports of engineered wood flooring.

| UNALLOCATED CORPORATE |

|

|

|

|

|

|

| |

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

| |

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

| Adjusted EBITDA |

|

|

($19) |

|

|

($15) |

|

|

($46) |

|

|

($47) |

| D&A/Fx |

|

|

(2) |

|

|

(2) |

|

|

(8) |

|

|

(9) |

| Operating (Loss), Adjusted |

|

|

($21) |

|

|

($17) |

|

|

($54) |

|

|

($56) |

| Non-cash impact of U.S. Pension |

|

|

6 |

|

|

- |

|

|

19 |

|

|

1 |

| Separation costs |

|

|

7 |

|

|

- |

|

|

17 |

|

|

- |

| Foreign exchange impact |

|

|

1 |

|

|

1 |

|

|

- |

|

|

- |

|

|

Operating (Loss), Reported |

|

|

($35) |

|

|

($18) |

|

|

($90) |

|

|

($57) |

CASH FLOW(1) |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2015 |

|

|

2014 |

|

2015 |

|

2014 |

| Net cash

from operations |

|

$85 |

|

|

$89 |

|

$144 |

|

$111 |

| Less: net

cash (used for) investing |

|

(21) |

|

|

(29) |

|

(45) |

|

(97) |

| Free Cash Flow |

|

$64 |

|

|

$60 |

|

$99 |

|

$14 |

-

Cash flow includes cash flows attributable to

European Flooring business

|

| CONSOLIDATED RESULTS FROM CONTINUING

OPERATIONS |

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

Per Share |

|

Total |

|

Per Share |

|

Total |

|

Per Share |

|

Total |

|

Per Share |

|

Adjusted EBITDA |

|

$128 |

|

|

|

$122 |

|

|

|

$315 |

|

|

|

$309 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| D&A

as reported |

|

(30) |

|

|

|

(35) |

|

|

|

(87) |

|

|

|

(98) |

|

|

|

Fx/Accelerated Deprecation |

|

- |

|

|

|

6 |

|

|

|

(2) |

|

|

|

10 |

|

|

| Operating Income, Adjusted |

|

$98 |

|

|

|

$93 |

|

|

|

$226 |

|

|

|

$221 |

|

|

| Other

non-operating (expense) |

|

(24) |

|

|

|

(13) |

|

|

|

(44) |

|

|

|

(42) |

|

|

| Earnings Before Taxes, Adjusted |

|

74 |

|

|

|

80 |

|

|

|

182 |

|

|

|

179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

tax (expense) @ 39% for 2015 and 2014 |

|

(29) |

|

|

|

(31) |

|

|

|

(71) |

|

|

|

(70) |

|

|

| Net Earnings, Adjusted |

|

$45 |

|

$0.80 |

|

$49 |

|

$0.88 |

|

$111 |

|

$1.99 |

|

$109 |

|

$1.97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-tax adjustment items |

|

(12) |

|

|

|

(7) |

|

|

|

(28) |

|

|

|

(17) |

|

|

|

Non-cash impact of U.S. Pension |

|

(6) |

|

|

|

- |

|

|

|

(19) |

|

|

|

(1) |

|

|

|

Reversal of adjusted tax expense @ 39% for 2015 and 2014 |

|

29 |

|

|

|

31 |

|

|

|

71 |

|

|

|

70 |

|

|

|

Ordinary tax |

|

(18) |

|

|

|

(23) |

|

|

|

(42) |

|

|

|

(51) |

|

|

|

Unbenefitted foreign losses |

|

(6) |

|

|

|

(7) |

|

|

|

(22) |

|

|

|

(23) |

|

|

| Tax

adjustment items |

|

(2) |

|

|

|

4 |

|

|

|

(7) |

|

|

|

4 |

|

|

|

Net Earnings, Reported |

|

$30 |

|

$0.54 |

|

$47 |

|

$0.84 |

|

$64 |

|

$1.14 |

|

$91 |

|

$1.64 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: Armstrong World Industries

AWI Reports Third Quarter 2015

Results

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Armstrong World Industries, Inc. via

Globenewswire

HUG#1962255

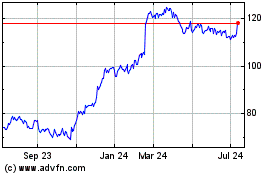

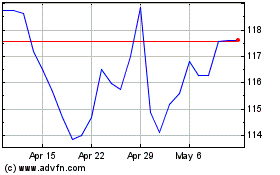

Armstrong World Industries (NYSE:AWI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Armstrong World Industries (NYSE:AWI)

Historical Stock Chart

From Apr 2023 to Apr 2024