Ariana Resources PLC Significant Gold Target At Kepez West

December 01 2014 - 2:55AM

UK Regulatory

TIDMAAU

1 December 2014

AIM: AAU

SIGNIFICANT GOLD TARGET AT KEPEZ WEST

Ariana Resources plc ("Ariana" or "the Company"), the gold exploration

and development company focused on Turkey, is pleased to announce a

resource target* on a zone of mineralisation delineated at the Kepez

West prospect ("Kepez West") following the analysis of geophysical and

geochemical data. Kepez West is one of several highly prospective

targets within the Kiziltepe Sector of the Red Rabbit Project ("Red

Rabbit"), which is targeted to commence gold production in 2015. The

Company holds a 73.5% interest in Red Rabbit in joint venture with

Proccea Construction.

Highlights:

-- Resource target of 100,000 oz gold* established over a 1,800m x 200m zone

across Kepez West and Far West.

-- Drilling planned to test the potential of the area to host open-pittable

gold resources.

-- Previous drilling at the eastern-end of Kepez West provided an intercept

of 9.6m @ 3 g/t Au + 119 Ag g/t from near surface.

-- Significant gold anomalism occupies a distinct ENE-oriented geophysical

trend that coincides precisely with a corridor of intense alteration.

-- IP/Resistivity geophysics reinforces the potential for down-dip

continuation of mineralisation, which is partly obscured by thin cover.

Dr. Kerim Sener, Managing Director, commented:

"Our confidence in the Kiziltepe Sector to host additional resources has

continued to improve as we have enhanced our understanding of the region

and drawn comparisons with analogous deposits worldwide. Notably, the

similarities between Kiziltepe and the Pajingo gold-silver mine in

Queensland, Australia, are striking. Such an example bodes

exceptionally well for the future of our Kiziltepe Mine and underpins

our logic of fully testing all surrounding prospect areas to better

define the scale of the resource potential.

"Our recent exploration efforts have further highlighted the scope for

the Kepez West prospect to provide for an enlarged resource base. This

area may host mineralisation of the same style and grade as that at our

primary reserve at Arzu South, which is located only 5km away.

Consequently, we have established a resource target at this location of

100,000 oz gold* for exploration planning and will look to prioritise

this area for drill-testing. Confirmation of such a resource would

potentially double our mineable resources for the Kiziltepe Sector."

* The target is an internal management target, which has not been

subject to independent verification or reporting under an acceptable AIM

Standard and should therefore not be relied upon by investors.

Kepez West Description

Mineralisation at Kepez West occurs within an ENE-trending zone of

argillic alteration and silicification associated with low-sulphidation

stockwork veins hosted by dacitic volcanic rocks, with higher-grade

mineralisation restricted to massive quartz veins which probably occupy

E-W trends. Previous surface sampling in the area has identified

several highly anomalous outcrop and float samples including 14.5 g/t Au

+ 39 g/t Ag, 9.7 g/t Au + 68 g/t Ag, 6.3 g/t Au + 32 g/t Ag, 5.9 g/t Au

+ 24 g/t Ag and 4.3 g/t Au + 30 g/t Ag (announced 23 September 2013).

In 2012, limited initial drilling in the area (eight holes totalling

478.3m) returned an intercept of 9.6m @ 3.0 g/t Au + 119 g/t Ag from

2.7m down-hole at the eastern-end of the Kepez West prospect in hole

KPZ-D08-12. Three other holes from the same drilling programme

encountered anomalous gold mineralisation (0.4 to 0.8 g/t Au) with

silver up to about 12 g/t over greater than 1m intervals, occurring

broadly within the same mineralised trend. Core logging showed that the

mineralisation is contained within a 1,800m x 200m fault zone which also

displays extensive argillic alteration. This zone may represent the top

of a vein system, which is partly obscured by a relatively thin layer of

unconsolidated cover rocks.

The Company has partial IP/Resistivity geophysics coverage over the vein

system at Kepez West, in addition to ground magnetics, and these

datasets are useful for the definition of drilling targets (Figure 1).

This data was integrated with field mapping and geochemistry datasets

and this process has highlighted the potential for the vein system to be

more extensive than the area drill-tested to date. In particular an

area to the west of Kepez West (referred to as Kepez Far West) has

returned several high-grade rock chip results. The mineralised and

altered zone appears to occupy a broadly ENE and partly arcuate trend,

which may be associated with a concentric structure developed on the

margin of a possible volcanic caldera.

Comparison of the current status of the Kepez West prospect area to the

status of the Arzu South vein system at Kiziltepe during its earliest

stage of exploration highlights several similarities (Figure 1). The

extent, style and grades of the mineralisation and types of alteration

are very similar. In particular, both prospects show a structurally

controlled corridor of arsenic (indicating mineralisation) and potassium

enrichment and manganese depletion (indicating alteration), which

coincides with significant gold and silver anomalism. Collectively,

this suggests that Kepez West holds significant resource potential, and

possibly of an order similar to that at Arzu South and North combined

(115,000 oz Au).

The Company is planning further work in this area to better define the

limits of the gold mineralisation and to refine the location and

orientation of principle mineralised structures. The high gold grades

encountered in places and the scale of the alteration footprint

indicates the potential for a significant gold system. The Company is

now planning further exploration and drilling in order to determine the

potential of this area to contain an open-pittable gold resource.

Figure 1: Soil XRF geochemical map of the Kepez West area, showing

manganese concentration in ppm, rock-chip gold grades and previous

drilling locations. Superimposed on this map are the major zones of

arsenic anomalism. Note that the zones of manganese depletion coincide

with the zones of arsenic anomalism and with areas from which gold and

silver bearing quartz veins have been mapped or inferred. Inset is a

map of the Arzu South and Arzu North vein system at Kiziltepe which is

rotated to a similar structural orientation as Kepez West for more

direct comparison. The greater detail shown in the XRF geochemical grid

at Kiziltepe is due to a much higher sample density at Kiziltepe than at

Kepez West.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited Tel: +44 (0) 20 7628 3396

Roland Cornish / Felicity Geidt

Beaufort Securities Limited Tel: +44 (0) 20 7382 8300

Saif Janjua

Loeb Aron & Company Ltd. Tel: +44 (0) 20 7628 1128

John Beresford-Peirse / Dr. Frank Lucas

St Brides Media & Finance Ltd Tel: +44 (0) 20 7236 1177

Susie Geliher / Lottie Brocklehurst

Editors' note:

Dr Kerim Sener, BSc (Hons), MSc, PhD, is the Managing Director of Ariana

Resources plc. A graduate of the University of Southampton in Geology,

he also holds a Master's degree from the Royal School of Mines (Imperial

College, London) in Mineral Exploration and a doctorate from the

University of Western Australia. He is a Fellow of The Geological

Society of London and has worked in geological research and mineral

consultancy in Southern Africa and Australia. He has read and approved

the technical disclosure in this regulatory announcement.

About Ariana Resources:

Ariana is an exploration and development company focused on epithermal

gold-silver and porphyry copper-gold deposits in Turkey. The Company is

developing a portfolio of prospective licences selected on the basis of

its in-house geological and remote-sensing database, on its own in

western Turkey and in Joint Venture with Eldorado Gold Corporation in

north-eastern Turkey. Eldorado owns 51% of this joint venture and are

fully funding all exploration work on the JV properties, while Ariana

owns 49%. The total resource inventory within this JV is 1.09 million

ounces of gold.

The Company's flagship assets are its Kiziltepe and Tavsan gold projects

which form the Red Rabbit Gold Project. Both contain a series of

prospects, within two prolific mineralised districts in the Western

Anatolian Volcanic and Extensional (WAVE) Province in western Turkey.

This Province hosts the largest operating gold mines in Turkey and

remains highly prospective for new porphyry and epithermal deposits.

These core projects, which are separated by a distance of 75km, are

presently being assessed as to their economic merits and now form part

of a Joint Venture with Proccea Construction Co. The total resource

inventory at the Red Rabbit Project stands at 475,000 ounces of gold

equivalent.

Beaufort Securities Limited and Loeb Aron & Company Ltd. are joint

brokers to the Company and Beaumont Cornish Limited is the Company's

Nominated Adviser.

For further information on Ariana you are invited to visit the Company's

website at www.arianaresources.com.

Ends

Significant Gold Target at Kepez West:

http://hugin.info/138153/R/1875466/660876.pdf

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Ariana Resources plc via Globenewswire

HUG#1875466

http://www.arianaresources.com/s/Home.asp

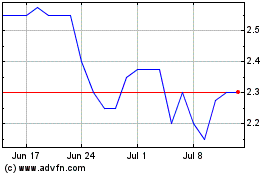

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Apr 2023 to Apr 2024