TIDMAAU

RNS Number : 7913P

Ariana Resources PLC

05 September 2017

5 September 2017

AIM: AAU

EXCITING RESULTS ACROSS HOT GOLD CORRIDOR

Ariana Resources plc ("Ariana" or "the Company"), the gold

exploration and development company operating in Turkey, is

encouraged to announce the completion of its initial exploration

across the Hot Gold Corridor and within its wholly-owned Salinbas

Gold Project ("Salinbas" or "the Project"). The Hot Gold Corridor

is named after the 4Moz Hot Maden deposit located approximately 4km

south of the Project licences (Figure 1).

Highlights:

-- Several high-priority pXRF geochemical targets identified

which demonstrate potential for further "Salinbas-type" epithermal

mineralisation and/or systems related to copper-gold

porphyries.

-- Ardala North target has been prioritised for immediate work

as it demonstrates significant multi-element anomalism and the

potential for gold-silver mineralisation.

-- Anomalous geochemical results obtained between Hizarliyayla

and Salinbas show potential for additional zones of

mineralisation.

-- Project-scale geological mapping and Phase Two pXRF

geochemical sampling has recently commenced, with several new

target zones now confirmed.

Dr. Kerim Sener, Managing Director, commented:

"These exciting initial results confirm our understanding of the

potential of the Hot Gold Corridor to contain significant gold and

base-metal dominant mineralised systems. In particular, the Ardala

North target, covering an area of 1.5 x 0.5km, now represents one

of the most strongly and consistently anomalous areas for copper,

lead and zinc within the Project, with significant potential for

coincident gold and silver. We have now upgraded the Hizarliyayla

area to a priority exploration target due to multi-element

anomalism representative of high-level epithermal mineralisation,

which in part is capped by limestone units. It is highly

significant that Hizarliyayla is partly hosted within the same

stratigraphic sequence as the 4Moz Hot Maden project roughly 7km to

the south.

Several new targets have already been identified and occur in

the region separating Salinbas from Hizarliyayla, in an area

dominated by limestone units. As we expected, mineralisation has

now been identified in the periphery of these limestones, which

reflects the specific structural setting of the Salinbas orebody.

Consequently, we predict that other "Salinbas-type" deposits will

occur within the region and our exploration strategy will be

expanded and targeted accordingly.

Due to the significance of these results, we have recently

completed a site visit to meet with the team and to plan and

prioritise the next stage of our work. This work is now well

underway and we look forward to providing a flow of updates in the

months ahead."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Phase One pXRF Programme

The Company has recently completed a 65km(2) portable X-ray

Fluorescence (pXRF) soil geochemical sampling programme across its

Salinbas Project licences in Artvin Province, northeastern Turkey

(Figure 1). A total of 3,552 pXRF soil samples were collected from

road and track cuttings along over 210km of mapped access routes

within the Ardala, Hizarliyayla and Salinbas licences. The

programme was also designed to complete initial follow-up of

several existing targets defined earlier in the year (see release

of 18 January 2017). In addition, the exploration team explored the

8km gap between the Salinbas and Hizarliyayla prospects.

Soil samples were processed on site and analysed at the

Company's drill-core storage depot located in Ardanuc, a drive of

approximately 45 minutes from the Salinbas deposit. Samples were

analysed in batches of 50 using an Olympus handheld portable XRF

analyser with blank and multi-element standards routinely analysed

every 100 readings. The results highlighted twenty significantly

anomalous areas for further follow-up. Six areas display

geochemical signatures which are anomalous in arsenic (As), copper

(Cu), molybdenum (Mo), sulphur (S) and zinc (Zn). These are

elements typically associated with porphyry-type mineralisation.

The remaining areas are anomalous in antimony (Sb), arsenic (As),

lead (Pb), mercury (Hg), silver (Ag) and zinc, which are elements

commonly associated with epithermal mineralisation.

A target previously identified in the area north of the main

Ardala Porphyry (now referred to as Ardala North), was followed-up

during this programme and returned with 16 significantly anomalous

results elevated in Ag, As, Cu, Pb, S and Zn. Due to the magnitude

of the anomalism and its coherence over an area of 1.5 x 0.5km,

this target has now been classified as highly significant and

prioritised for immediate further work. Early results have shown

that the anomalism relates to several zones of contact

mineralisation occurring between the Ardala Porphyry and overlying

limestone units. Several intensely manganese-rich brecciated

limestone units have also been mapped, which likely relate to

higher-grade gold zones occurring in the Ardala Carapace.

Results over the Hizarliyayla prospect define a 2km(2) area

highly anomalous in As, Cu, S and Zn. Historic rock-chip assay

results in this area also demonstrated consistent gold

mineralisation ranging from 1.36 g/t Au to 0.20 g/t Au for 47

samples. A 0.25km(2) high-temperature kaolinite and alunite

alteration zone is evident from a recent ASTER remote-sensing

study. Significantly the main alteration zone identified by ASTER

at Hizarliyayla has not been tested with drilling and many of the

historic samples relate to pyritic mineralisation in the upper part

and periphery of the system. Also the soil and rock-chip

geochemistry of Hizarliyayla compares well to that occurring at Hot

Maden (7.5km to the south). Such observations make the Hizarliyayla

prospect one of the most significant exploration targets in the

region.

Other anomalies within the licences include Agillar, Derinkoy

North and Hizarliyayla Far East. The Agillar target is located 4km

south of the Salinbas deposit and displays a dominant Cu and Zn

association. The Derinkoy North target is located 2.5km north of

the gold-silver epithermal mineralisation documented at the

Derinkoy prospect. Derinkoy North is associated with a sulphur-rich

kaolinite-illite alteration zone and contains pXRF copper

anomalies. The Hizarliyayla Far East target is primarily anomalous

in copper with sporadic mercury.

Following this pXRF sampling programme, the exploration team is

preparing to follow-up all anomalies while completing detailed

geological mapping across the project area. This mapping will cover

100km(2) and will merge all 1:1,500 prospect-scale geological

mapping across the tenements with 1:10,000 district-scale mapping

in order to compile a single coherent geological dataset. This

dataset will be used along with geochemical and available

geophysical data to define new drilling targets.

Phase Two pXRF Programme

Phase Two pXRF follow-up soil samples are currently being

collected from a gridded area around the Ardala Porphyry. This area

is significant due to the high grades, up to 7.02 g/t Au,

encountered within parts of the alteration zone surrounding the

porphyry. Improving the understanding of the area is also important

to fully establish the distribution of mineralisation within the

structural corridor that links Ardala to Salinbas. Further work is

also being conducted on the south-eastern periphery of the porphyry

which will add confidence to a cluster of six significant and

coherent soil assay samples that range up to 2.1g/t Au, an

important target which remains untested by drilling. Further

gridded pXRF soil sampling will be undertaken across other target

areas as appropriate.

New geological mapping at 1:1,500 scale is also underway across

the project area. This work is leading towards a new understanding

of the structural controls on mineralisation, the ore body position

at Salinbas and its relationship to underlying porphyry intrusions.

Several new targets have already been generated from this detailed

mapping, which will extend south from the Ardala/Salinbas areas and

encompass all other prospects including Hizarliyayla. The

exploration team will be continuing to map and sample throughout

the Hot Gold Corridor for at least the next month.

SEE LINK BELOW FOR: Map of the Salinbas Project area, showing

some of the key geochemical target areas identified by pXRF across

the Hot Gold Corridor, with ASTER remote-sensing data and

topography forming the map base. The coincidence of areas of known

mineralisation and alteration is significant, although several

alteration targets are obscured by forestation.

FIGURE 1

http://www.rns-pdf.londonstockexchange.com/rns/7913P_-2017-9-4.pdf

Salinbas Project

The Salinbas Project is located in the Pontide Metallogenic

Province in northeastern Turkey and lies approximately 80km

southeast of the coastal city of Hopa and 20km east of Artvin. The

project comprises three notable prospects: Salinbas, Ardala and

Hizarliyayla (Figure 1). The project comprises three licences which

are owned 100% by Ariana through the operating subsidiary, Pontid

Madencilik San. ve Tic. Ltd. Two of the licences are in process at

the General Directorate of Mining Affairs for conversion to

operational status by early 2018.

Salinbas is the most notable of the prospect areas, having been

identified in 2009 following rock-chip sampling and trenching,

which included 33m at 9.6 g/t Au and 46m at 8.3 g/t Au. Follow-up

drilling identified a gently dipping mineralised body emplaced

along a thrust zone to the east of a series of breccia pipes and

the main body of the Ardala Cu-Au-Mo porphyry. The best intercepts

in initial shallow drilling included 9.5m @ 6.48 g/t Au + 39.4 g/t

Ag, 11.3m @ 4.98 g/t Au + 42.8 g/t Ag and 25m @ 3.34 g/t Au + 7.9

g/t Ag. Best intercepts from further drilling included 31.10m @

1.38g/t Au, 17.90m @ 2.09 g/t Au and 9.20m @ 2.25 g/t Au, with most

mineralised intercepts obtained from less than 70m below surface. A

total of 11,709m drilling for 86 drill holes has been completed on

Salinbas to date and has defined a tabular resource (Table 2) which

dips towards the east at 25 degrees. Substantial vertical relief

exists between the top of the mineralisation at Salinbas Peak

(1,320m above sea level) to the lower limits of the current

resource (780m above sea level) in the vicinity of the Ardala

porphyry.

Table 2: Classified JORC 2012 Mineral Resource estimate for

Salinbas (dated 1 April 2015). The resource was modelled on the

basis of geology and a lower cut-off of 0.5 g/t Au. Numbers may not

sum due to rounding.

JORC Classification Tonnage Grade Grade Ounces Ounces

(Mt) Au (g/t) Ag (g/t) Au Ag

--------------------- -------- ---------- ---------- -------- ----------

Indicated 2.29 2.11 11.9 155,500 877,700

--------------------- -------- ---------- ---------- -------- ----------

Inferred 7.67 2.00 9.7 493,300 2,396,400

--------------------- -------- ---------- ---------- -------- ----------

TOTAL 9.96 2.03 10.2 648,900 3,274,200

--------------------- -------- ---------- ---------- -------- ----------

Limited exploration drilling between Salinbas and the Ardala

porphyry to the east has also been conducted. Highly encouraging

results from these holes confirmed the need for further exploration

in this area and suggest the continuity of mineralisation from the

Ardala porphyry in the valley floor to the Salinbas system on the

ridge, representing a vertical distance of 675m and a horizontal

distance of close to 2km. The best recent intercepts from drilling

in the area connecting the Salinbas system to the Ardala system

include 81.5m @ 1.28 g/t Au + 10.5 g/t Ag, 34.5m @ 2.21 g/t Au +

10.7 g/t Ag and 18.2m @ 2.20 g/t Au + 25.6 g/t Ag. Further

establishing the links between these two areas will be an important

objective for future drilling programmes.

A scoping study focused on Salinbas and completed in 2015 (see

announcement on 1 April 2015), demonstrated potential for the

project to yield strong financial returns, with NPV (8%) at

US$108M, pre-tax IRR of 28%, and payback secured within

approximately 3.3 years over the Life of Mine ("LoM") at a gold

price of US$1,250/oz. This demonstrates that a potentially viable

resource development opportunity already exists at Salinbas and

that future exploration work will probably reinforce this view.

The nearby Ardala area hosts a porphyry copper-gold (plus

molybdenum) mineralised system associated with a series of nested

quartz-diorite intrusions of Eocene age within an Upper Cretaceous

volcano-sedimentary sequence. Geological mapping, soil, rock-chip

and drill sample data, and a ground magnetic survey outlined the

mineralised porphyry and in 2013 a JORC Mineral Resource was

established (Table 3). Exposed parts of the porphyry have

dimensions of 600 x 700m and interpretation of magnetic data

suggests further lateral continuity beneath limestone units over an

area of 1,000m x 1,000m in extent. Previous exploration also

focused specifically on the mineralised intrusions, while

surrounding gold-bearing skarns (peak grade 5.16 g/t Au and 0.2% Cu

in rock-chips) and related disseminated mineralisation in the

host-rocks remain largely untested. The best intercepts from recent

drilling in the Ardala area include 119.5m @ 0.71g/t Au + 0.21% Cu

+ 0.01% Mo, 236.3m @ 0.34 g/t Au + 0.06% Cu and 122.9m @ 0.58 g/t

Au + 0.05% Cu, which tested an area of mineralised porphyry and

immediately adjacent limestone. Deeper (>150m) high-grade

intercepts outside of the porphyry at Ardala include 4.2m @ 6.74

g/t Au, 2.8m @ 3.34 g/t Au + 38.96 g/t Ag + 2.56% Zn, 2.0m @ 5.29

g/t Au + 13.5 g/t Ag, indicating the potential for other styles of

higher grade mineralisation sitting adjacent to the porphyry.

Table 3: Classified JORC 2004 Mineral Resource estimate for

Ardala (dated 13 April 2013). Separate resource domains were

established for the Au, Cu and Mo components of the Ardala

porphyry. There is a 95% coincidence of the Au and Cu domains, and

a 40-50% coincidence of the Au and Mo domains.

JORC Classification Tonnage Grade (ppm) Tonnes Ounces Element

(Mt) Metal Metal

--------------------- -------- ------------ ------- -------- --------

4.66 2,175 10,000 Cu

--------------------- -------- ------------ ------- -------- --------

18.00 136 2,400 Mo

-------- ------------ ------- -------- --------

Inferred 16.27 0.60 323,000 Au

--------------------- -------- ------------ ------- -------- --------

Contacts:

Ariana Resources plc Tel: +44 (0) 20

7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited Tel: +44 (0) 20

7628 3396

Roland Cornish / Felicity

Geidt

Beaufort Securities Limited Tel: +44 (0) 20

7382 8300

Jon Belliss

Panmure Gordon (UK) Limited Tel: +44 (0) 20

7886 2500

Adam James / Tom Salvesen

Editors' Note:

Competent Person

Dr Kerim Sener, BSc (Hons), MSc, PhD, is the Managing Director

of Ariana Resources plc. A graduate of the University of

Southampton in Geology, he also holds a Master's degree from the

Royal School of Mines (Imperial College, London) in Mineral

Exploration and a doctorate from the University of Western

Australia. He is a Fellow of The Geological Society of London and

has worked in geological research and mineral consultancy in

Africa, Australia and Europe. He has read and approved the

technical disclosure in this regulatory announcement.

About Ariana Resources

Ariana is an exploration and development company focused on

epithermal gold-silver and porphyry copper-gold deposits in Turkey.

The Company is developing a portfolio of prospective licences

originally selected on the basis of its in-house geological and

remote-sensing database.

The Company's flagship assets are its Kiziltepe and Tavsan gold

projects which form the Red Rabbit Gold Project. Both contain a

series of prospects, within two prolific mineralised districts in

the Western Anatolian Volcanic and Extensional (WAVE) Province in

western Turkey. This Province hosts the largest operating gold

mines in Turkey and remains highly prospective for new porphyry and

epithermal deposits. These core projects, which are separated by a

distance of 75km, form part of a 50:50 Joint Venture with Proccea

Construction Co. The Kiziltepe Sector of the Red Rabbit Project is

fully-permitted and is currently in production. The total resource

inventory at the Red Rabbit Project and wider project area stands

at c. 605,000 ounces of gold equivalent. At Kiziltepe a Net Smelter

Return ("NSR") royalty of up to 2.5% on production is payable to

Franco-Nevada Corporation. At Tavsan an NSR royalty of up to 2% on

future production is payable to Sandstorm Gold.

In north-eastern Turkey, Ariana owns 100% of the Salinbas Gold

Project, comprising the Salinbas gold-silver deposit and the Ardala

copper-gold-molybdenum porphyry among other prospects. The total

resource inventory of the Salinbas project area is c. 1 million

ounces of gold equivalent. A NSR royalty of up to 2% on future

production is payable to Eldorado Gold Corporation.

Beaufort Securities Limited and Panmure Gordon (UK) Limited are

joint brokers to the Company and Beaumont Cornish Limited is the

Company's Nominated Adviser.

For further information on Ariana you are invited to visit the

Company's website at www.arianaresources.com.

Glossary of Technical Terms:

"Ag" the chemical symbol for silver;

"Au" the chemical symbol for gold;

"g/t" grams per tonne;

"Indicated resource" a part of a mineral resource for which

tonnage, densities, shape, physical characteristics, grade and

mineral content can be estimated with a reasonable level of

confidence. It is based on exploration, sampling and testing

information gathered through appropriate techniques from locations

such as outcrops, trenches, pits, workings and drill holes. The

locations are too widely or inappropriately spaced to confirm

geological and/or grade continuity but are spaced closely enough

for continuity to be assumed;

"Inferred resource" a part of a mineral resource for which

tonnage, grade and mineral content can be estimated with a low

level of confidence. It is inferred from geological evidence and

has assumed, but not verified, geological and/or grade continuity.

It is based on information gathered through appropriate techniques

from locations such as outcrops, trenches, pits, workings and drill

holes that may be limited or of uncertain quality and

reliability;

"JORC" the Joint Ore Reserves Committee;

"pXRF" portable X-ray Fluorescence handheld device that uses

X-rays to excite matter at the atomic level. A built in CPU and

display on the back of the unit provide live geochemical results

within seconds for elements ranging from magnesium through to the

heaviest metals such as uranium. A three filter 50 second sample

scan is typical. Taking multiple readings across a sample grid

allows the user to very rapidly build up a geochemical map,

outlining potential pathfinder elements associated with

mineralisation, lithological boundaries and intensity or zoning of

mineralised areas;

"m" Metres;

"oz" Ounces;

"t" Tonnes;

Ends

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLUSRWRBBAKRAR

(END) Dow Jones Newswires

September 05, 2017 02:00 ET (06:00 GMT)

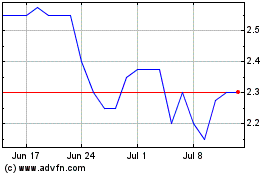

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Apr 2023 to Apr 2024