TIDMARC

RNS Number : 5477Y

Arcontech Group PLC

06 March 2017

ARCONTECH GROUP PLC

("Arcontech" or the "Group")

INTERIM RESULTS FOR THE SIX MONTHSED 31 DECEMBER 2016

Arcontech (AIM: ARC), the provider of products and services for

real-time financial market data processing and trading, is pleased

to report its unaudited results for the six months ended 31

December 2016.

Highlights:

-- Turnover GBP1,115,232 (six months ended 31 December 2015: GBP1,132,246).

-- Profit before tax increased by 3% to GBP216,270 (six months

ended 31 December 2015: GBP209,660).

-- Annual run-rate of recurring revenues at 31 December 2016

increased by 21% to GBP2.3 million (at 31 December 2015: GBP1.9

million).

-- Net cash of GBP2,089,855 as at 31 December 2016 (31 December 2015: GBP1,538,519).

Richard Last, Chairman of Arcontech Group, said:

"The Board is pleased to report that the Group has continued to

make progress. Revenue lost in early 2015 has been replaced such

that recurring annual licence fees amounted to GBP2.3m as at 31

December 2016, a 21% increase compared to the level at 31 December

2015. In addition, the Group has continued to invest in product

development. The launch of a new desktop software solution is

gaining positive interest with existing customers. The Board

expects results for the full year will be ahead of current market

expectations and remains positive about the Group's prospects."

Enquiries:

020 7256

Arcontech Group plc 2300

Richard Last, Chairman and

Non-Executive Director

Matthew Jeffs, Chief Executive

020 7220

finnCap Ltd (Nomad & Broker) 0500

Carl Holmes/Simon Hicks

To access more information on the Group please visit:

www.arcontech.com

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

The interim report will only be available to view online

enabling the Group to communicate in a more environmentally

friendly and cost effective manner.

Chairman's Statement

I am pleased to report that Arcontech has continued to grow

profits in the six month period ended 31 December 2016, reporting

an operating profit of GBP212,006 (2015: GBP205,889) and profit

before tax of GBP216,270 (2015: GBP209,660) despite a small

reduction in turnover to GBP1,115,232 for the six month period

ended 31 December 2016, compared to GBP1,132,246 for the

corresponding period in 2015. This reflects the residual impact of

the termination of a significant contract with an Asia focussed

bank (announced on 26 March 2015), effective from 1 January 2016.

In the six month period ended 31 December 2016 the Group has

continued to grow its recurring annual licence fees to an

annualised GBP2.3 million by the end of this period, compared to

GBP1.9 million as at 31 December 2015. Fully diluted earnings per

share were 2.45 pence per share compared to 2.50 pence per share

for the corresponding period last year.

During the period we have continued to invest in the enhancement

of our existing products to remain innovative and be in a position

to respond to customers' changing needs. Additionally, we have

allocated development resource and investment to building a new

desktop software solution which is currently in the process of

undergoing proof of concept trials at five Tier 1 banks. We believe

this area holds significant potential for Arcontech.

Sales cycles remain long and unpredictable due mainly to the

size of the organisations that the Group has as customers and the

nature of our prospects. We continue to invest in sales and

marketing and have recently employed a salesman in Asia to support

our work with existing clients in the region and address the

growing Asian financial markets.

Financing

Arcontech had net cash balances at 31 December 2016 of

GBP2,089,855 (31 December 2015: GBP1,538,519). This reflects a cash

conversion of 200% of operating profit (2015: 220%) which is in

part due to timing of the collection of year-end debtors as well as

good profit performance for the period. We expect the Group to

maintain a good cash conversion ratio in the future.

The Group's positive financial position provides a sound basis

for continued investment in product development and increased

investment in sales and marketing resources and activity.

Dividend and Share Consolidation

At last year's Annual General Meeting shareholders supported the

resolution to consolidate our shares which has subsequently been

successfully completed. This paves the way to paying dividends as

the business continues to progress. Although no interim dividend is

proposed, subject to continued growth and meeting expectations for

the business, the Board will review the payment of a dividend in

respect of the full year ending 30 June 2017.

Employees

Arcontech is made up of a small, highly dedicated and productive

team of people without whom the Group would not have been able to

achieve the results, both financial and product-related. We thank

them and look forward to continuing to work together in the

future.

Outlook

The Board is pleased to report that the Group has continued to

make good progress. Revenue lost in early 2015 has been replaced

such that recurring annual licence fees amounted to GBP2.3m as at

31 December 2016, a 21% increase compared to the level at 31

December 2015. In addition, the Group has continued to invest in

product development. The launch of a new desktop software solution

is gaining positive interest with existing customers. The Board

expects results for the full year will be ahead of current market

expectations and remains positive about the Group's prospects.

Richard Last

Chairman and Non-Executive Director

GROUP INCOME STATEMENT AND STATEMENT OF COMPREHENSIVE INCOME

Six months Six months Year ended

ended ended 30 June

31 31

December December

2016 2015 2016

(unaudited) (unaudited) (audited)

GBP GBP GBP

Revenue 1,115,232 1,132,246 2,141,630

Administrative costs (903,226) (926,657) (1,849,257)

Operating profit 212,006 205,589 292,373

Finance income 4,264 4,071 9,956

Profit before taxation 216,270 209,660 302,329

Taxation 96,988 105,813 105,813

Profit for the period

after tax 313,258 315,473 408,142

Total comprehensive

income 313,258 315,473 408,142

Profit per share

(basic) 2.53p 2.63p 3.38p

Profit per share

(diluted) 2.45p 2.50p 3.25p

All of the results relate to continuing operations.

BALANCE SHEETS

31 December 31 December 30 June

2016 2015 2016

(unaudited) (unaudited) (audited)

GBP GBP GBP

Non-current assets

Goodwill 1,715,153 1,715,153 1,715,153

Property, plant

and equipment 43,557 49,840 44,785

Trade and other

receivables 141,750 141,750 141,750

Total non-current

assets 1,900,460 1,906,743 1,901,688

Current assets

Trade and other

receivables 592,378 589,294 265,360

Cash and cash equivalents 2,089,855 1,538,519 1,633,159

Total current assets 2,682,233 2,127,813 1,898,519

Current liabilities

Trade and other

payables (858,332) (609,223) (798,769)

Deferred income (1,155,942) (1,306,273) (769,159)

Total current liabilities (2,014,274) (1,915,496) (1,567,928)

Net current assets 667,959 212,317 330,591

Net assets 2,568,419 2,119,060 2,232,279

Equity

Share capital 1,548,886 1,536,672 1,541,732

Share premium account 4,286 9,430,312 2,024

Share option reserve 133,158 106,226 119,692

Retained earnings 882,089 (8,954,150) 568,831

2,568,419 2,119,060 2,232,279

GROUP CASH FLOW STATEMENT

Six months Six months Year ended

ended ended 30 June

31 31

December December

2016 2015 2016

(unaudited) (unaudited) (audited)

GBP GBP GBP

Net cash generated from

operating activities 450,431 481,898 567,420

Investing activities

Interest received 4,264 4,071 9,956

Proceeds of sales of - - -

plant and equipment

Purchases of plant and

equipment (7,415) (17,205) (21,056)

Net cash (invested in)/generated

from investing activities (3,151) (13,134) (11,100)

------------ ------------ ------------

Financing activities

Issue of shares 9,416 - 7,084

Net cash generated from

financing activities 9,416 - 7,084

------------ ------------ ------------

Net increase in cash

and cash equivalents 456,696 468,764 563,404

Cash and cash equivalents

at beginning of period 1,633,159 1,069,755 1,069,755

Cash and cash equivalents

at end of period 2,089,855 1,538,519 1,633,159

============ ============ ============

STATEMENT OF CHANGES IN EQUITY

Share Share Share-based Retained Total

capital premium payments earnings

reserve

GBP GBP GBP GBP GBP

At 1 July

2015 1,536,672 9,430,312 92,761 (9,269,623) 1,790,122

Total comprehensive

income for

the period - - - 315,473 315,473

Share-based

payments - - 13,465 - 13,465

At 31 December

2015 1,536,672 9,430,312 106,226 (8,954,150) 2,119,060

--------------------- ---------- ------------ ------------ ------------ ----------

Total comprehensive

income for

the period - - - 92,669 92,669

Cancellation

of share premium

account - (9,430,312) - 9,430,312 -

Issue of shares 5,060 2,024 - - 7,084

Share-based

payments - - 13,466 - 13,466

At 30 June

2016 1,541,732 2,024 119,692 568,831 2,232,279

--------------------- ---------- ------------ ------------ ------------ ----------

Total comprehensive

income for

the period - - - 313,258 313,258

Issue of shares 7,154 2,262 - - 9,416

Share-based

payments - - 13,466 - 13,466

At 31 December

2016 1,548,886 4,286 133,158 882,089 2,568,419

--------------------- ---------- ------------ ------------ ------------ ----------

NOTES TO THE FINANCIAL INFORMATION

1. The figures for the six months ended 31 December 2016 and 31

December 2015 are unaudited and do not constitute statutory

accounts. The interim results have been prepared using accounting

policies which are consistent with International Financial

Reporting Standards as adopted by the European Union and are

expected to be adopted in the next annual accounts.

2. The financial information for the year ended 30 June 2016 set

out in this interim report does not comprise the Group's statutory

accounts as defined in section 434 of the Companies Act 2006. The

statutory accounts for the year ended 30 June 2016, which were

prepared under International Financial Reporting Standards (IFRS)

as adopted for use in the EU, applied in accordance with the

provisions of the Companies Act 2006, have been delivered to the

Registrar of Companies. The auditors reported on those accounts;

their report was unqualified and did not contain a statement under

either Section 498(2) or Section 498(3) of the Companies Act 2006

and did not include references to any matters to which the auditor

drew attention by way of emphasis.

3. Copies of this statement are available from the Company

Secretary at the Company's registered office at 1(st) Floor 11-21

Paul Street, London, EC2A 4JU or from the Company's website at

www.arcontech.com.

4. Earnings per share have been calculated based on the profit

after tax and the weighted average number of shares in issue during

the half year ended 31 December 2016 of 12,360,981 (31 December

2015: 12,293,376; 30 June 2016: 12,297,590). The number of shares

for the period ended 31 December 2016 take into account the share

consolidation of 125:1 carried out in September 2016. The number of

shares for comparative periods has been restated accordingly.

The number of dilutive shares under option at 31 December 2016

was 427,317 (31 December 2015: 177,504; 30 June 2016: 213,457). The

calculation of diluted earnings per share assumes conversion of all

potentially dilutive ordinary shares, all of which arise from share

options. A calculation is done to determine the number of shares

that could have been acquired at the average market price during

the period, based upon the issue price of the outstanding share

options including future charges to be recognised under the share

based payment arrangements.

5. Taxation is based on the unaudited results and provision has

been estimated at the rate applicable to the Company at the time of

this statement and expected to be applied to the total annual

earnings. No corporation tax has been charged in the period as any

liability has been offset against tax losses brought forward from

prior years. The tax credit represents the cash recovery of

Research & Development tax credits during the period.

6. There were no dividends paid or proposed during the period (2015: Nil).

7. The Directors have elected not to apply IAS34 Interim financial reporting.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KELFBDXFZBBQ

(END) Dow Jones Newswires

March 06, 2017 02:00 ET (07:00 GMT)

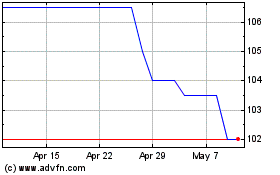

Arcontech (LSE:ARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arcontech (LSE:ARC)

Historical Stock Chart

From Apr 2023 to Apr 2024