TIDMARBB TIDMSTB

RNS Number : 4789Z

Arbuthnot Banking Group PLC

27 May 2016

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES,

CANADA, AUSTRALIA, JAPAN OR THE REPUBLIC OF SOUTH AFRICA.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

SHALL NOT CONSTITUTE AN OFFER TO SELL OR ISSUE OR THE SOLICITATION

OF AN OFFER TO BUY, SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY ORDINARY

SHARES OF SECURE TRUST BANK PLC IN ANY JURISDICTION IN WHICH ANY

SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL.

This announcement should be read in its entirety.

27 May 2016

Arbuthnot Banking Group PLC ("Arbuthnot" or the "Company")

Proposed sale of ordinary shares in Secure Trust Bank PLC

("Secure Trust")

Arbuthnot today announces its intention to sell approximately

5.8 million ordinary shares of 40 pence each in Secure Trust (the

"Sale Shares"), such amount to potentially increase subject to

additional demand being secured, representing approximately 31.9

per cent. of Secure Trust's existing issued share capital, by way

of a secondary placing to institutional investors only (the

"Sale"). The Sale is expected to be priced at GBP25 per Sale Share

(the "Sale Shares Price") which represents a 10.7 per cent.

discount to the closing price of Secure Trust's ordinary shares

(the "Ordinary Shares") as of 26 May 2016.

Assuming completion of the Sale, the Company's interest in

Secure Trust will reduce from 51.9 per cent. to approximately 20.0

per cent. of Secure Trust's issued share capital and would generate

gross proceeds of approximately GBP145 million for Arbuthnot.

The Company has been informed by Secure Trust that its

intention, conditional on completion of the Sale, would be to

commence a process to seek to move to a Premium Listing on the Main

Market of the London Stock Exchange. As part of the intended move

to the main market Secure Trust will address its Corporate

Governance structure and Sir Henry Angest, non-executive Chairman

of Secure Trust and Chairman and Chief Executive Officer of

Arbuthnot has signalled his intention to commence a search for a

new independent Non-Executive Chairman of Secure Trust.

Arbuthnot has also been informed by Secure Trust that the

special dividend of 165 pence per Secure Trust ordinary share

relating to the sale of the Everyday Loans Group, which was

conditionally announced on 17 March 2016 (the "Special Dividend"),

is not expected to be declared until after completion of the Sale.

The record date of the Special Dividend is also expected to be

after the Sale has completed and accordingly, assuming the Sale

completes, the Special Dividend relating to the Sale Shares would

be received by the holders of the Sale Shares at the record date

for the Special Dividend and not Arbuthnot. The Sale Shares rank

pari passu in all respects with the Ordinary Shares.

As the proposed Sale, if completed, would represent a

fundamental change of business for Arbuthnot under the AIM Rules

for Companies, the Sale will be conditional upon a resolution (the

"Resolution") being passed by Arbuthnot's shareholders at a general

meeting of Arbuthnot (the "General Meeting") and will also be

subject to the satisfaction or waiver of certain customary

conditions. Sir Henry Angest proposes to sign an irrevocable

undertaking to procure that the votes pertaining to his 55.08 per

cent. beneficial holding in Arbuthnot are cast in favour of the

Resolution and as such the Resolution is expected to be passed when

it is put to shareholders.

At the time of Secure Trust's admission to trading on AIM in

November 2011, the Company indicated that over time it would be

willing to see its interest in Secure Trust be further diluted to

allow Secure Trust to grow as the opportunities arose, in an

appropriate way, to enhance value for all of Secure Trust's

shareholders. The growth of Secure Trust in the last four and half

years has been substantial, and the Company believes that now is

the appropriate time to reduce its holding in Secure Trust to a

non-controlling position, in order to broaden the range of

strategic options available to Secure Trust.

The Company intends to use the proceeds and capital generated

from the Sale to accelerate the growth of Arbuthnot and its

subsidiaries, including the private and commercial banking business

within Arbuthnot Latham & Co., Limited, as well as to invest in

and develop over time other businesses in accordance with the

Company's strategy.

The Sale will be managed by Stifel Nicolaus Europe Limited

(trading as Keefe Bruyette & Woods), acting as sole bookrunner

(the "Bookrunner"). Non-binding indications of interest have been

received from institutional investors for all of the Sale Shares at

the Sale Shares Price. The book for the Sale will open with

immediate effect following this announcement. Final pricing and

allocations are expected to be announced as soon as practicable

following the closing of the book, which will be at the absolute

discretion of the Bookrunner. The Sale is not being

underwritten.

Arbuthnot has confirmed that, following completion of the Sale,

it does not intend to sell any further ordinary shares in Secure

Trust for at least 180 days following completion of the Sale, other

than with the agreement of the Bookrunner.

A further announcement will be made in due course.

Expected timetable

Expected closing of the book and 27 May 2016

announcement

------------------------------------- ----------------

Expected posting of the Arbuthnot 27 May 2016

circular

------------------------------------- ----------------

Expected date of the General Meeting 14 June 2016

------------------------------------- ----------------

Anticipated date of completion By 16 June 2016

of the Sale

------------------------------------- ----------------

Enquiries:

Arbuthnot Banking Group PLC

Sir Henry Angest, Chairman Tel: 020 7012 2400

and Chief Executive

Andrew Salmon, Group Chief

Operating Officer

James Cobb, Group Finance Director

David Marshall, Director of

Communications

------------------------------------ ---------------------

Stifel Nicolaus Europe Limited Tel: 020 7710 7600

(Sole bookrunner)

Robin Mann

Gareth Hunt

Stewart Wallace

Keefe, Bruyette & Woods

Charles Lucas

------------------------------------ ---------------------

Canaccord Genuity Limited Tel: 020 7665 4500

(Nominated Adviser)

Sunil Duggal

------------------------------------ ---------------------

Bell Pottinger Tel: 020 3772 2566

(Financial PR)

Ben Woodford

Zoe Pocock

------------------------------------ ---------------------

Disclaimer

Stifel Nicolaus Europe Limited (trading as Keefe Bruyette &

Woods) is acting on the Sale and will not be responsible to anyone

other than its client for providing the protections afforded to its

clients, nor for providing advice in relation to the Sale, the

contents of this announcement, or any transaction or arrangement

referred to herein.

Canaccord Genuity Limited is the Company's Nominated Adviser.

The responsibilities of Canaccord Genuity Limited, as Nominated

Adviser under the AIM Rules and the AIM Rules for Nominated

Advisers, are owed solely to the London Stock Exchange and are not

owed to the Company, any Shareholder or any Director of the Company

or to any other person in in relation to the Sale, the contents of

this announcement, or any transaction or arrangement referred to

herein. Canaccord Genuity Limited is acting exclusively for the

Company and for no one else in relation to the Sale and will not be

responsible to any person other than the Company for providing the

protections afforded to its clients or for providing advice in

relation to the Sale.

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

This announcement is for information purposes only and does not

constitute or form part of an offer or invitation to acquire or

dispose of any securities of Secure Trust, or constitute a

solicitation of any offer to purchase or subscribe for securities

in any jurisdiction, including Canada, Australia, Japan or the

Republic of South Africa.

Secure Trust's shares may not, directly or indirectly, be

offered or sold within Canada, Australia Japan or the Republic of

South Africa or offered or sold to a resident of Canada, Australia,

Japan or the Republic of South Africa. No public offering of

securities is being made in the United States or elsewhere.

Neither this announcement nor any copy of it may be taken, or

transmitted or distributed, directly or indirectly, in or into or

distributed to persons in, the United States of America, its

territories or possessions or to any US person (within the meaning

of Regulation S under the US Securities Act of 1933, as amended).

Neither this announcement nor any copy of it may be taken,

transmitted or distributed, directly or indirectly, in or into

Australia, Canada, Japan or the Republic of South Africa. Any

failure to comply with this restriction may constitute a violation

of United States, Australian, Canadian, Japanese or South African

securities laws.

The distribution of this announcement in certain other

jurisdictions may be restricted by law and persons into whose

possession this announcement comes should inform themselves about,

and observe, any such restrictions.

MEMBERS OF THE GENERAL PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN

THE SALE. THIS ANNOUNCEMENT AND ANY OFFER OF SECURITIES TO WHICH IT

RELATES ARE ONLY ADDRESSED TO AND DIRECTED AT PERSONS (1) IN MEMBER

STATES OF THE EUROPEAN ECONOMIC AREA WHO ARE QUALIFIED INVESTORS

WITHIN THE MEANING OF ARTICLE 2(1) (E) OF EU DIRECTIVE 2003/71/EC,

AS AMENDED, INCLUDING BY THE 2010 PROSPECTUS DIRECTIVE AMENDING

DIRECTIVE 2010/73/EC TO THE EXTENT IMPLEMENTED IN THE RELEVANT

MEMBER STATE (THE "PROSPECTUS DIRECTIVE") ("QUALIFIED INVESTORS");

AND (2) IN THE UNITED KINGDOM WHO ARE QUALIFIED INVESTORS AND (A)

HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND

FALL WITHIN ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT

2000 (FINANCIAL PROMOTION) ORDER 2005, AS AMENDED, (THE "ORDER") OR

(B) FALL WITHIN ARTICLE 49(2)(A) TO (D) ("HIGH NET WORTH COMPANIES,

UNINCORPORATED ASSOCIATIONS, ETC.") OF THE ORDER OR (C) ARE PERSONS

TO WHOM THIS ANNOUNCEMENT AND ANY OFFER OF SECURITIES TO WHICH IT

RELATES MAY OTHERWISE LAWFULLY BE COMMUNICATED OR MADE (ALL SUCH

PERSONS REFERRED TO IN (1) AND (2) TOGETHER BEING REFERRED TO AS

"RELEVANT PERSONS"). THE INFORMATION REGARDING THE SALE SET OUT IN

THIS ANNOUNCEMENT MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO

ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO

WHICH THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT

PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS.

No prospectus or offering document has been or will be prepared

in connection with the Sale. Any investment decision to buy

securities in the Sale must be made solely on the basis of publicly

available information. Such information is not the responsibility

of and has not been independently verified by the Company or by

Stifel Nicolaus Europe Limited (trading as Keefe Bruyette &

Woods) or any of their respective affiliates.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISFQLLLQEFEBBX

(END) Dow Jones Newswires

May 27, 2016 02:00 ET (06:00 GMT)

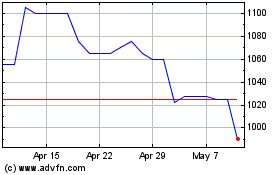

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arbuthnot Banking (LSE:ARBB)

Historical Stock Chart

From Apr 2023 to Apr 2024