TIDMAOR

RNS Number : 3738V

AorTech International PLC

07 August 2015

AorTech International plc

("AorTech", "the Company" or "the Group")

Audited results for the year ended 31 March 2015

AorTech International plc (AIM: AOR), the biomaterials and

medical device IP company, today announces its results for the year

ended 31 March 2015.

Financial summary

-- Group revenue from continuing operations doubled from

previous year to US$844k

-- Operating profit of US$81k (2014: US$440k loss) before

amortisation costs and exceptional items

-- Loss from continuing operations more than halved from US$823k

to US$326k

Other developments

-- Continuing reduction in administrative expenses, following

completion of exit from US

-- Consideration being given to capitalising on existing IP and

experience of past development work to create Polymer Heart

Valves

-- Share Capital reorganisation proposed

For further information contact:

AorTech International plc

Eddie McDaid, Chief Executive Tel: +44 (0)7802 920869

AorTech International plc

Bill Brown, Chairman Tel: +44 (0)7730 718296

finnCap Limited

Jonny Franklin-Adams/ Giles Rolls Tel: +44 20 7220 0500

A copy of this announcement will be available at

www.aortech.com/investor/announcements. The content of the website

referred to in this announcement is not incorporated into and does

not form part of this announcement.

About AorTech:

AorTech has developed biostable, implantable polymers, including

Elast-Eon(TM) and ECSil(TM) the world's leading long-term

implantable co-polymers, now manufactured on their behalf by

Biomerics LLC in Utah, USA. With several million implants and seven

years of successful clinical use, AorTech polymers are being

developed and used in cardiology and urological applications,

including pacing leads, cardiac cannulae, stents and implantable

sensor technology. Devices manufactured from AorTech polymers have

numerous US FDA PMA approvals, 510k's, CE Marks, Australian TGA and

Japanese Ministry of Health approvals.

Elast-Eon(TM) and ECSil(TM)'s biostability is comparable to

silicone while exhibiting excellent mechanical, blood contacting

and flex-fatigue properties. These polymers can be processed using

conventional thermoplastic extrusion and moulding techniques. A

range of materials in a variety of application-specific

formulations for use in medical devices and components are

available.

CHAIRMAN'S STATEMENT

I am pleased to report that in the financial year to 31 March

2015 we experienced an improvement in the business with revenues

and other income more than doubling from $419,000 to $857,000. The

administrative expenses in operating the business before the costs

of the litigation fell from $859,000 to $776,000, resulting in a

net profit before exceptional items and IP amortisation of $81,000.

Exceptional costs relating to the litigation against Frank Maguire

and related parties amounted to $204,000 which compares to the cost

incurred at the 6-month stage of $212,000, the reduction in the

second half of the year being a further recovery from our insurers

net of the excess on the insurance policy payable by AorTech. Over

the course of the year, the cash position fell from $642,000 to

$360,000. At the interim stage however, the cash position stood at

$335,000 and there has therefore been progress during the second

half.

Litigation

As previously reported in our interim accounts and in our recent

update to shareholders released on 16 April 2015, the Company

continues to pursue a legal action against the former CEO Frank

Maguire. This litigation has been extended and has commenced

against Foldax, the Company of which Mr Maguire is presently CEO,

together with other associated parties. This litigation which was

started in California has now been transferred to Utah to sit

alongside the case against Frank Maguire. As previously announced,

Mr Maguire has made a counter claim for alleged non-payment of

expenses amounting to $168,000.

No provision has been made in these financial statements for any

potential gains or losses as the action has not progressed

sufficiently.

Your Board continues to pursue this action against Mr Maguire,

Foldax and other connected parties in order to protect the

interests of AorTech and its shareholders.

Biomerics Manufacturing Licence

As reported in last year's Accounts, a licence with Biomerics

LLC was concluded for the manufacture and distribution of AorTech's

Elast-Eon(TM) materials.

We expressed some disappointment in the progress of this licence

in our 2014 Interim Results but I am now pleased to confirm that

there has been progress on the contractual relationship between

AorTech and Biomerics with an amendment to the original agreement

concluded since the year end. This amended agreement incorporates

several commercial changes including further capital expenditure by

both companies. AorTech's capital expenditure commitment will be

paid from future royalties.

The further positive news on this agreement is the commitment of

a long term supply of Elast-Eon(TM) to one of AorTech's major

licensees together with further enquiries from other potential

customers regarding receiving supplies of Elast-Eon(TM).

Other Licensees

I am pleased to report, as demonstrated in the growth of

AorTech's revenue, the continued increase of royalties from

existing licensees. The licensees who have achieved

commercialisation are continuing to see increased sales which

should in turn result in increased royalties to AorTech.

Those licensees who have yet to achieve full commercialisation

are continuing the development of their products through the

Regulatory process. It is important to recognise that AorTech's

future success is dependent upon the continued growth and success

of its licensees.

In AorTech's Interim results of 30 September 2014 we reported

that there was a balance due from a licensee of $175,000 which had

not been provided against since a Blue Chip Company had a secondary

obligation in respect of this debt. The debt has subsequently

increased to $275,000. Since the year end AorTech has received a

lump sum settlement from the Blue Chip Company in order to have it

released from its secondary obligation. No provision has been made

against this debt in these accounts but should AorTech's action

for

recovery of the debt not be fully successful, any under recovery

will be effectively offset in cash terms against the settlement

figure received since the year end.

Cash

As previously indicated, although cash fell from $642,000 to

$360,000 during the year, there was an improvement in cash in the

second half.

In order to achieve this financial position your Board has had

to rigorously monitor and control overheads and, indeed, Directors'

salaries have been maintained at a reduced level and in certain

instances Directors' salaries have been deferred.

I am pleased to report that the Company's cash position has

increased since the financial year end and anticipate that the

Company should be cash flow positive during the current financial

year 2015/2016.

Heart Valve

Now that the polymer licensing business has been stabilised and

has some positive momentum, we have been able to spend time and

resource in reviewing exactly where AorTech stands with the Heart

Valve project. Over the years, there have been three major

development phases of the polymer heart valve. The first attempt

was some 13 years ago when AorTech undertook the development

itself. This attempt failed when a non-regulatory trial in juvenile

sheep had a very disappointing conclusion. The valve was redesigned

to change the stress profile on leaflets and the manufacturing

process revised to ensure a better quality leaflet finish. The new

design was licensed to a large medical device Company that

undertook its own rigorous testing. The data from these tests

remain the property of that licensee but the overall results were

very encouraging. Unfortunately, the licensee did not pursue the

project as we understand all their valve R&D efforts were being

diverted to their trans-catheter project. A second major license

was entered into in 2007 and was taken back in late 2011. During

the course of this license, further design changes were made and a

range of durability and animal trials undertaken. Much of the

testing work was positive although there were also some adverse

issues which arose.

From the review of the history of the Heart Valve project it is

apparent that, despite these adverse issues, there are many

positive results that indicate the exciting potential in AorTech's

polymer heart valve. The recent development and early introduction

of a TAVI valve into the heart valve market provides exciting new

possibilities for the introduction of a heart valve made from a

polymeric material. The root causes of the failures are now well

understood and taking the positive aspects from all three projects

suggests that replicating previous trials would get a positive

outcome for both In Vitro and In Vivo testing. To reach the stage

of human trials, all of the testing carried out to date will need

to be redone under regulatory conditions which would require

quality and manufacturing systems of a substantially higher

standard than when AorTech manufactured valves for testing in the

past. Seeking any subsequent deal with an industry major would

require successful data from the above trials.

The opportunity for the Polymer Heart Valve remains the

durability of a mechanical valve with the hemodynamics of a tissue

valve. Cost of manufacture would be considerably lower than other

prosthetic valves and the leaflet technology would be perfect for

TAVI.

AorTech's technology, know-how and IP in the Polymer Valve area

is only one of the ingredients required for success. The two other

key inputs are people with the necessary Quality, Regulatory,

Clinical and Manufacturing experience together with access to

capital. In order to capitalise on the development work of the last

15 years for the benefit of AorTech shareholders, we are

considering whether there is the opportunity of bringing a team

together with the necessary experience and track record in the

device industry that could be supported by external finance.

Share Capital Reorganisation

The Company's shares are currently trading at a price

significantly below their nominal value of 250 pence per share. At

the close of trading on 5 August 2015 the Company's Closing Price

was 25.5 pence per Existing Ordinary Share. Accordingly, subject to

Shareholder approval at the Company's AGM which is expected to be

held on 24 September 2015, the Directors propose to reorganise the

Company's share capital as explained below, with a view to reducing

the nominal value of the Existing Ordinary Shares.

Pursuant to the Share Capital Reorganisation, it is proposed

that each Existing Ordinary Share with a nominal value of 250 pence

will be sub-divided and redesignated into one Ordinary Share of 5

pence and one Deferred Share of 245 pence.

Following the Share Capital Reorganisation each Shareholder will

hold the same number of Ordinary Shares that he or she held

immediately beforehand, with a nominal value per Ordinary Share of

5 pence.

The Ordinary Shares resulting from the Share Capital

Reorganisation will have exactly the same rights as those currently

accruing to the Existing Ordinary Shares under the Articles,

including those relating to voting and entitlement to

dividends.

The Deferred Shares will have very limited rights and will

effectively be valueless. They will have no voting rights and will

have no rights as to dividends and only very limited rights on a

return of capital. They will not be admitted to or listed on any

stock exchange and will not be freely transferable. The rights

attaching to the Deferred Shares are set out in the Articles as

amended pursuant to resolution 7 to be passed at the AGM. The

amendments to the Articles are being made principally to set out

the rights attaching to the Deferred Shares.

Resolution 8 contained in the Notice of General Meeting at the

end of this document will, if passed by Shareholders, effect the

proposed Share Capital Reorganisation as detailed above. If

approved, the Share Capital Reorganisation will take place at 6pm

on 24 September 2015. Application will be made to the London Stock

Exchange for the admission to trading and dealings on AIM in the

new Ordinary Shares arising from the Share Capital Reorganisation,

becoming effective at 8am on 25 September 2015.

The Company does not propose to issue new share certificates to

the existing Shareholders as a result of the Share Capital

Reorganisation. The existing share certificates which have been

issued to the Shareholders in respect of their holdings of Existing

Ordinary Shares will remain valid in respect of the New Ordinary

Shares following completion of the Share Capital

Reorganisation.

CREST accounts of Shareholders will not be credited in respect

of any entitlement to Deferred Shares.

Loan Notes

In October 2012 the Company issued Loan Notes to obtain the

necessary funding to allow it to continue to operate. The Loan Note

holders still have the right to receive from the Company a payment

of a sum equal to 15% of sums paid to shareholders on a Change of

Control. Resolution 9 being proposed at the AGM seeks shareholder

approval for the Board to take all necessary steps to allow the

Company to allot shares in exchange for the surrender of these

rights. 8.26% of the Loan Notes are owned by Directors or their

connected parties. Bill Brown and Eddie McDaid, and connected

parties, will therefore abstain from voting on this resolution.

Recommendation

Gordon Wright, acting as an independent Director, believes

resolution 9 to be in the best interests of the Company and the

Shareholders as a whole and recommends you to vote in favour of

that resolution as he intends to do in respect of his beneficial

holdings amounting, in aggregate, to 308,311 Existing Ordinary

Shares representing 6.38 per cent of the existing total voting

rights. As noted above, Bill Brown and Eddie McDaid, and connected

parties, will abstain from voting on this resolution.

Your Board believes resolutions 7 and 8 to be in the best

interests of the Company and the Shareholders as a whole.

Accordingly, the Directors unanimously recommend you to vote in

favour of those Resolutions to be proposed at the General Meeting.

All of the Directors intend to vote in favour of Resolutions 7 and

8 in respect of their beneficial holdings, amounting, in aggregate,

to 667,632 Existing Ordinary Shares, representing 13.81 per cent,

of the existing total voting rights.

Roy Mitchell

During the past year Roy served as finance director and his

contribution was invaluable to the Company during that time. His

forensic analysis of documentation provided additional evidence and

support in AorTech's litigation action. I wish, on behalf of the

Board, to thank Roy for his expertise and contribution during these

past twelve months.

Conclusion

Despite the time and commitment required in the litigation

action, the past year has been one of relative success. Revenue

from license fees and royalties are now greater than overheads, the

Company was cash positive in the second half of the year, progress

is being made with our key licensees and we expect the year 2015/16

to be one of further progress.

Bill Brown

Chairman

6 August 2015

Consolidated income statement

Year ended 31 March 2015 Year ended 31 March 2014

Pre-exceptional Pre-exceptional

items Exceptional items Exceptional

items Total items Total

Notes US$000 US$000 US$000 US$000 US$000 US$000

Revenue 3 844 - 844 418 - 418

Other income 13 - 13 1 - 1

Administrative

expenses (776) (204) (980) (859) (83) (942)

Other expenses

- amortisation

of intangible

assets 11 (332) - (332) (241) - (241)

-------------

Operating

(loss) /

profit 3 (251) (204) (455) (681) (83) (764)

Finance income

/ (expense) 8 - 129 129 - (59) (59)

----------------- ------------------ --------- ---------------- ------------- ----------------

Loss from

continuing

operations

attributable

to owners of

the parent

company 5 (251) (75) (326) (681) (142) (823)

Loss from

discontinued

operations 17 (44) - (44) (486) - (486)

----------------- ------------------ --------- ---------------- ------------- ----------------

Loss

attributable

to

owners of the

parent

company (295) (75) (370) (1,167) (142) (1,309)

Loss per share

Basic and

diluted (US

cents per

share) 10 (7.66) (27.09)

Consolidated statement of comprehensive income

Year

ended Year ended

31 March 31 March

2015 2014

US$000 US$000

Loss for the year (370) (1,309)

Other comprehensive income:

Exchange differences on translating

foreign operations 17 (51)

Income tax relating to other comprehensive

income - -

------------ ------------------

Other comprehensive income for the

year, net of tax 17 (51)

------------ ------------------

Total comprehensive income for the

year, attributable

to owners of the parent company (353) (1,360)

No items of other comprehensive income can be subsequently

reclassified to profit and loss

Consolidated balance sheet

31 March 31 March

2015 2014

US$000 US$000

Notes

Assets

Non current assets

Intangible assets 11 1,546 1,861

Trade and other receivables 14 - 300

Total non current assets 1,546 2,161

-------------- ------------------

Current assets

Inventories 12 - 46

Trade and other receivables 14 737 401

Cash and cash equivalents 15 360 642

Total current assets 1,097 1,089

-------------- ------------------

Total assets 2,643 3,250

-------------- ------------------

Liabilities

Current liabilities

Trade and other payables 16 (192) (306)

Total current liabilities (192) (306)

-------------- ------------------

Non current liabilities

Change of control redemption premium 16 (53) (193)

-------------- ------------------

Total non current liabilities (53) (193)

Total liabilities (245) (499)

Net assets 2,398 2,751

============== ==================

Equity

Issued capital 20 17,937 20,144

Share premium 20 3,474 3,901

Other reserve (2,974) (3,340)

Foreign exchange reserve 6,076 3,791

Profit and loss account (22,115) (21,745)

Total equity attributable to equity

holders of the parent 2,398 2,751

============== ==================

The Consolidated financial statements were approved by the Board

on 6 August 2015 and were signed on its behalf by

W D Brown, Chairman and E McDaid, Director

Company number SC170071

Consolidated cash flow statement

Year Year

ended ended

31 March 31 March

2015 2014

US$000 US$000

Cash flows from operating activities

Group loss after tax (326) (823)

Adjustments for:

Amortisation of intangible assets 332 241

Finance (income) / expense (129) 59

Increase in trade and other receivables 36 102

(Decrease) / increase in trade and other

payables (254) 69

---------------------- ----------

Net cash flow from continuing operations (341) (352)

Net cash flow from discontinued operations 2 312

---------------------- ----------

Net cash flow from operating activities (339) (40)

Cash flows from investing activities

Purchase of intangible assets - (439)

---------------------- ----------

Net cash flow from continuing operations - (439)

Net cash flow from discontinued operations - -

Net cash flow from investing activities - (439)

---------------------- ----------

Cash flows from financing activities

Interest paid - -

Proceeds from issue of loan notes - -

Repayment of loan notes - -

Redemption premium paid to loan note holders - -

---------------------- ----------

Net cash flow from financing activities - -

---------------------- ----------

Net decrease in cash and cash equivalents (339) (479)

Foreign exchange movements on cash held

in foreign currencies 57 134

Cash and cash equivalents at beginning

of year 642 987

Cash and cash equivalents at end of year 360 642

====================== ==========

Consolidated statement of changes in

equity

Profit

Issued Foreign and

Share Share Other exchange loss Total

capital premium reserve reserve account equity

US$000 US$000 US$000 US$000 US$000 US$000

Balance at 31 March 2013 18,351 3,555 (3,043) 5,684 (20,436) 4,111

Transactions with owners - - - - - -

Loss for the year - - - - (1,309) (1,309)

Other comprehensive income

Exchange difference on

translating

foreign operations 1,793 346 (297) (1,893) - (51)

Total comprehensive income

for the year 1,793 346 (297) (1,893) (1,309) (1,360)

--------- ------------ --------- ---------------- ------------- --------

Balance at 31 March 2014 20,144 3,901 (3,340) 3,791 (21,745) 2,751

Transactions with owners - - - - - -

Loss for the year - - - - (370) (370)

Other comprehensive income

Exchange difference on translating

foreign operations (2,207) (427) 366 2,285 - 17

Total comprehensive income

for the year (2,207) (427) 366 2,285 (370) (353)

--------- ------ --------- ----------------- --------- -------

Balance at 31 March 2015 17,937 3,474 (2,974) 6,076 (22,115) 2,398

========= ====== ========= ================= ========= =======

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of preparation

The Consolidated financial statements are for the year ended 31

March 2015. They have been prepared in compliance with

International Financial Reporting Standards (IFRS) and IFRS

Interpretations Committee (IFRIC) interpretations as adopted by the

European Union as at 31 March 2015.

The Consolidated financial statements have been prepared under

the historical cost convention.

The accounting policies remain unchanged from the previous

year.

2. Going concern

After considering the year end cash position, making appropriate

enquiries and reviewing budgets and profit and cash flow forecasts

to 31 March 2021, the Directors have formed a judgement at the time

of approving the financial statements that there is a reasonable

expectation that the Group has sufficient resources to continue in

operational existence for the foreseeable future. For this reason

the Directors consider the adoption of the going concern basis in

preparing the Consolidated financial statements is appropriate.

3. Preliminary announcement

The summary accounts set out above do not constitute statutory

accounts as defined by Section 434 of the UK Companies Act 2006.

The summarised consolidated balance sheet at 31 March 2015, the

summarised consolidated income statement, the summarised

consolidated statement of comprehensive income, the summarised

consolidated statement of changes in equity and the summarised

consolidated cash flow statement for the year then ended have been

extracted from the Group's statutory financial statements for the

year ended 31 March 2015 upon which the auditor's opinion is

unqualified and did not contain a statement under either sections

498(2) or 498(3) of the Companies Act 2006. The audit report for

the year ended 31 March 2014 did not contain statements under

Section 498(2) or Section 498(3) of the Companies Act 2006. The

statutory financial statements for the year ended 31 March 2014

have been delivered to the Registrar of Companies. The 31 March

2015 accounts were approved by the Directors on 6 August 2015, but

have not yet been delivered to the Registrar of Companies.

4. Earnings per share

The basic loss per Ordinary share of 7.66 US cents (2014: loss

of 27.09 US cents) is calculated on the loss of the Group of

US$370,000 (2014: loss of US$1,309,000) and on 4,832,778 (2014:

4,832,778) equity shares, being the number of shares in issue

during the year. Of this, 6.75 US cents (2014: 17.03 US cents) is

calculated on the loss from continuing operations, whilst a loss of

0.916 US cents (2014: loss of 10.06 US cents) results from

discontinued operations.

The diluted earnings per share is not materially different from

the basic earnings per share. The diluted loss per share does not

differ from the basic loss per share as the exercise of share

options would have the effect of reducing the loss per share and is

therefore not dilutive under the terms of IAS 33.

5. Discontinued operations

On 1 October 2013, the Group signed an agreement with Biomerics

LLC for the manufacture and distribution of our patented materials,

including to our existing licensees. In the opinion of the

Directors, the Biomerics transaction transformed the Group into a

pure intellectual property company. As a consequence, results

attributable to manufacturing activity constitute a discontinued

operation, and have been presented as such in the prior year

figures in the Income Statement.

The results of the discontinued manufacturing operations are

shown in more detail below.

Pre-exceptional Pre-exceptional

items Exceptional items items Exceptional items

Total Total

2015 2015 2015 2014 2014 2014

$000 $000 $000 $000 $000 $000

Revenue - - - 245 - 245

Other income - - - 13 - 13

Cost of sales (44) - (44) (211) - (211)

Administrative

expenses - - - (537) - (537)

Profit on

disposal of

property,

plant and

equipment - - - 4 - 4

----------------- ------------------ ------- ------------------ ------------------ -------

Operating

(loss) /

profit (44) - (44) (486) - (486)

----------------- ------------------ ------- ------------------ ------------------ -------

Notice of Annual General Meeting

Notice of the eightteenth Annual General Meeting of AorTech

International Plc will be posted with the Annual Report and

Accounts and will be held in the offices of Kergan Stewart LLP, 163

Bath Street, Glasgow G2 4SQ on Thursday, 24 September 2014 at

11:00am.

Posting and availability of accounts

The annual report and accounts for the year ended 31 March 2015

will be sent by post to all registered shareholders on 25 August

2014. Additional copies will be available for a month thereafter

from the Company's Weybridge office. Alternatively, the document

may be viewed on, or downloaded from, the Company's website:

www.aortech.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PFMFTMBMMBMA

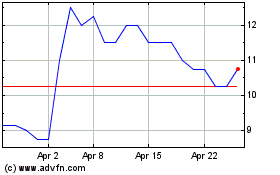

Rua Life Sciences (LSE:RUA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rua Life Sciences (LSE:RUA)

Historical Stock Chart

From Apr 2023 to Apr 2024