Antofagasta Copper Output, Tax Outlook Miss Views --Update

January 27 2016 - 8:47AM

Dow Jones News

By Alex MacDonald

LONDON--Chilean copper producer Antofagasta PLC (ANTO.LN) said

Wednesday that its copper output rose last quarter due to new mines

in its portfolio and signalled that production would continue to

grow this year, albeit less than several analysts had expected.

The FTSE-100 miner also warned that it expects its effective tax

rate to jump to a range of between 60% and 65% for 2015 compared

with 46% the year before when its reports its full-year results on

March 15. This is due to non-deductible items such as international

exploration costs that are expected to have a greater weighting

amid lower earnings expectations stemming from a protracted

commodities price rout.

In terms of output, the miner said copper production rose 8.2%

to 169,900 metric tons for the three months ended Dec. 31, compared

with the third quarter due in part to contributions from its

recently commissioned Antucoya mine and the purchase of a 50% stake

in the Zaldivar mine from Barrick Gold Corp. (ABX.T) in

December.

This however wasn't enough to stem a 10.6% drop in copper output

to 630,300 tons last year stemming from lost production due to

heavy rainfall in the Atacama desert, where several of its mines

are located, water-scarcity related protests at its flagship Los

Pelambres mine, and delays in the ramp up of its Antucoya mine due

to equipment failures. The figure was broadly in line with a

guidance of 635,000 tons that had been revised.

Gold output also fell 21% to 213,900 ounces last year, even

though it rose 22% to 55,700 ounces in the fourth quarter compared

with the previous quarter.

At 1302 GMT, the company's shares were down 3.3% at 365.3 pence

a share while the FTSE 350 mining index was down 1.3%.

Citigroup analysts said in a note that the effective tax rate

was significantly higher than consensus forecast of 36%. "This

implies that consensus 2015 earnings could be entirely wiped off,

resulting in net loss outcome versus current expectation of $91

million net profit," the Citi analysts said.

Looking ahead, the company plans to produce between 710,000 tons

and 740,000 tons of copper, 245,000 ounces to 275,000 ounces of

gold and 8,000 tons to 9,000 tons of molybdenum this year due to

the ramp up of its Centinela Concentrates project as well as the

full-year contribution from its Antucoya and Zaldivar mines.

Canaccord Geunity analyst Nick Hatch said the production

guidance was 12% to 16% below his expectations however the

company's cash cost guidance was better than expected.

Antofagasta plans to reduced its cash cost after credits from

the sale of byproducts such as gold and molydenum to $1.35 a pound

in 2016, down 10% from the year before.

Net cash costs rose 4.9% last year to $1.50 a pound, missing the

company's guidance of $1.47 a pound.

Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

January 27, 2016 08:32 ET (13:32 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

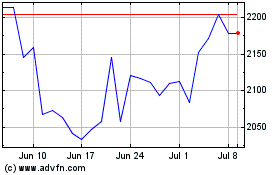

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Aug 2024 to Sep 2024

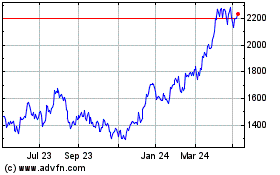

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Sep 2023 to Sep 2024