Antofagasta 2016 Earnings Rise

March 14 2017 - 4:08AM

Dow Jones News

By Razak Musah Baba

LONDON--Antofagasta PLC (ANTO.LN) on Tuesday reported a rise in

2016 earnings after a strong performance from its Centinela copper

mine helped boost production.

The Chilean miner's full-year earnings before interest, taxes,

depreciation and amortization, or Ebitda, rose 79% to $1.63 billion

from $910.1 million a year earlier. Revenue rose 12% to $3.62

billion from $3.23 billion.

Antofagasta declared a final dividend of 15.3 cents a share,

bringing the full-year dividend to 18.4 cents a share.

"The successful integration of Zaldívar and the ramp-up of

Antucoya--alongside the completion of the expansion of Centinela

Concentrates--have contributed to a 12.5% rise in copper production

to 709,400 tons," Chief Exceutive Iván Arriagada said. In 2017, the

company foresees incremental expansion at its Los Pelambres

project, the CEO added.

Antofagasta said capital expenditure for 2017 is estimated at

less than $900 million with some $100 million carried over from

2016. Capital expenditure in 2016 was down by 24% to $795.1

million, compared to 2015.

-Write to Razak Musah Baba at razak.baba@wsj.com; Twitter:

@Raztweet

(END) Dow Jones Newswires

March 14, 2017 03:53 ET (07:53 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

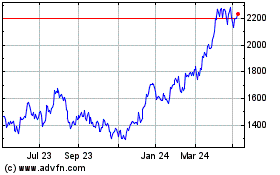

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

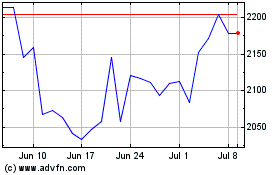

Antofagasta (LSE:ANTO)

Historical Stock Chart

From Apr 2023 to Apr 2024