TIDMANCR

RNS Number : 5804O

Animalcare Group PLC

10 February 2016

Animalcare Group plc

("Animalcare" or the "Group")

Half Yearly Report

Animalcare Group plc (AIM: ANCR), a leading supplier of

veterinary medicines, announces interim results for the six months

ended 31(st) December 2015. The Board is pleased to report good

progress during the period, achieving top line growth during a

phase of significantly increased investment to execute the Group's

strategy to drive growth from 2017 onwards.

Animalcare is made up of three product groups: Licensed

Veterinary Medicines, Companion Animal Identification and Animal

Welfare Products.

Financial Highlights

6 months to 6 months to

31(st) Dec 31(st) Dec

2015 2014 % change

-------------------------------- ----------- ----------- --------

Revenue GBP7.11m GBP6.93m +2.7%

-------------------------------- ----------- ----------- --------

Underlying* operating profit GBP1.55m GBP1.79m (13.2%)

-------------------------------- ----------- ----------- --------

Profit before tax GBP1.53m GBP1.76m (12.9%)

-------------------------------- ----------- ----------- --------

Basic underlying* earnings per

share 6.2p 6.8p (8.8%)

-------------------------------- ----------- ----------- --------

Interim dividend 1.8p 1.8p -

-------------------------------- ----------- ----------- --------

Product development expenditure GBP0.60m GBP0.20m +207.0%

-------------------------------- ----------- ----------- --------

Cash and cash equivalents GBP6.10m GBP5.04m +21.1%

-------------------------------- ----------- ----------- --------

* Underlying measures are before the effect of exceptional and

other items. These are analysed in note 3.

Operational Highlights

-- Solid revenue growth from our Licensed Veterinary Medicines

group, up 4.2% to GBP4.58m (2014: GBP4.40m) against strong

comparatives which benefited from a circa GBP0.2m non-recurring

benefit from sales of Buprecare as a result of competitor supply

issues.

-- New mini microchip launched in a rapidly changing market.

-- Planned focus on our export business started in the period

and already delivering commercial benefit.

-- Continued focus on investment to support future growth,

reflected in the GBP0.16m increase in overheads and a three-fold

increase in our product development pipeline expenditure to

GBP0.60m.

-- Strong financial position maintained, with Group cash

balances increasing by GBP0.32m to GBP6.10m since 30(th) June

2015.

James Lambert, Chairman of Animalcare Group plc, said: "The

business has continued to perform well during the first six months

of its financial year with sales up by 2.7% to over GBP7.1m which

is particularly pleasing against a very strong first half in FY15.

Given the top line growth during the period and increased levels of

investment for the future success of Animalcare, your Board remains

confident about the prospects and outcome for the full year and

beyond."

Animalcare Group plc Tel: 01904 487 687

Iain Menneer, Chief Executive Officer

Chris Brewster, Chief Financial

Officer

Panmure Gordon (Nominated Adviser Tel: 020 7886 2500

and Broker)

Freddy Crossley/Peter Steel

Walbrook PR Ltd Tel: 020 7933 8780 or animalcare@walbrookpr.com

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07584 391 303

Chairman's Statement

Animalcare continues to focus on three product groups: Licensed

Veterinary Medicines, Companion Animal Identification and Animal

Welfare Products; all sold through veterinary practices. The

business has continued to perform well during the first six months

of its financial year with sales up by 2.7% to over GBP7.1m which

is particularly pleasing against a very strong first half in FY15,

when we benefitted from a competitor supply issue in one of our key

pharmaceutical products.

Sales of Licensed Veterinary Medicines increased by 4.2% and

this was after growth of 10.6% in the first half of FY15. The sales

of our older licensed veterinary products held up well and we

increased our export sales during the period.

Companion Animal Identification fell back by 5.2% to GBP1.2m,

which was in line with our 2013 period sales. This was largely due

to phasing of sales promotional activity during the period. The

companion animal microchipping market has also become significantly

more competitive ahead of compulsory microchipping in England,

Wales and Scotland in April 2016.

Animal Welfare Products showed growth of 5.1%, predominantly due

to increased sales of our Infusion Accessories range. During the

period we upgraded our range of disinfectants in preparation for

the upcoming implementation of the new EU Biocidal Product

Regulations. This will offer an opportunity to grow market share as

these new regulations are effected.

Operating cash flow continued to be strong during the period and

even after much increased levels of capital investment in new

products and a final dividend paid during the half, our cash

position has improved by GBP0.3m to GBP6.1m.

The new product development programme has made good progress

during the half with our in-house team working on several new

licences in line with our core strategy. We expect the benefits of

the increased spending on these projects will start to show in the

2017 financial year.

Overheads increased during the half by GBP0.2m in line with our

strategy of investing in our people, including a larger and better

trained sales force and an increase in marketing spend. This is all

focused in preparation for our new pipeline of Licensed Veterinary

Medicines delivering growth from 2017 onwards.

As a result of the increased investment mentioned above basic

earnings per share reduced from 6.8p to 6.2p, still substantially

above the 5.5p achieved during the first half of FY14. Your Board

proposes to maintain the interim dividend of 1.8p per share.

Given the top line growth during the period and increased levels

of investment for the future success of Animalcare, your Board

remains confident about the prospects and outcome for the full year

and beyond.

James Lambert

Chairman

Business Review

Introduction

The Group continues to make good progress in line with its

strategy, delivering top line growth during a period of

significantly increased investment in both our product development

pipeline and our employee base.

Revenues increased by 2.7% to GBP7.11m (2014: GBP6.93m) with

continued solid growth continuing within our Licensed Veterinary

Medicines group. This was against strong comparatives which

benefitted from a circa GBP0.2m non-recurring benefit from sales of

Buprecare as a result of supply issues with a competitor

product.

Strategically, we continue to focus on making the necessary

investment in our business to support future growth. This has

resulted in operating expenses increasing by GBP0.16m to GBP2.33m,

contributing to the 13.2% decline in underlying operating profit to

GBP1.55m (2014: GBP1.79m).

We have maintained a strong financial position, with Group cash

balances increasing by GBP0.32m since 30(th) June 2015 to GBP6.10m.

This increase in cash has been delivered despite the circa

three-fold rise in our product development expenditure to GBP0.60m,

demonstrating our consistently strong operating cash

generation.

Operating results

6 months to 6 months to

31(st) Dec 31(st) Dec

Revenue GBP'000 2015 2014 % change

-------------------------------- ----------- ----------- --------

Licensed Veterinary Medicines 4,583 4,396 4.2%

-------------------------------- ----------- ----------- --------

Companion Animal Identification 1,196 1,261 (5.2%)

-------------------------------- ----------- ----------- --------

Animal Welfare Products 1,335 1,271 5.0%

-------------------------------- ----------- ----------- --------

TOTAL 7,114 6,928 2.7%

-------------------------------- ----------- ----------- --------

The Licensed Veterinary Medicines group, which represents 64% of

total revenue, again delivered good growth, with sales up 4.2%

versus the prior period to GBP4.58m. This is particularly pleasing

against the very strong comparatives which showed growth of 10.6%

on H1 FY14 due in part to by the circa GBP0.2m non-recurring

benefit from sales of Buprecare as noted above. The overall growth

of 4.2% primarily reflects strong sales growth of products launched

during FY15, notably Synthadon and Pet Remedy.

Companion Animal Identification sales were down 5.2% to

GBP1.20m. The companion animal identification market has become

significantly more competitive ahead of compulsory microchipping in

England, Wales and Scotland in April 2016. This imminent change in

the law has prompted a modest uptake of microchipping however price

competition amongst suppliers has increased. During the last six

months, the market has seen a rapid movement towards smaller

microchips. We have taken active measures to address this market

change with the introduction of our own mini microchip.

The decline was partly offset by an increase in sales of export

equine chips; we noted phasing of orders adversely impacted FY15.

In addition, revenues from our follow on services, in particular

insurance, performed well increasing by 7.2%.

(MORE TO FOLLOW) Dow Jones Newswires

February 10, 2016 02:00 ET (07:00 GMT)

Our Animal Welfare Products group grew by 5.0% to GBP1.34m

driven primarily by increased sales of our Infusion Accessories

range which represent 55% of this product group's total revenues.

We continue to see benefit from the synergies between our IV Fluid

range and these associated products. During the period we upgraded

our range of disinfectants in preparation for the upcoming

implementation of the new EU Biocidal Product Regulations which

will offer an opportunity to grow market share as the new

regulations are implemented.

Gross profit decreased by 1.8% to GBP3.9m (2014: GBP4.0m)

primarily driven by a decline in gross margins to 54.6% (2014:

57.1%). This reflects a number of factors including the prior

period non-recurring Buprecare benefit noted above and increased

export revenues from our Licensed Veterinary Medicines group which

generally, due to the distribution model, attract a lower margin

than UK based sales.

Underlying operating profit decreased by 13.2% to GBP1.55m

(2014: GBP1.79m) and our operating margin reduced by 400 basis

points to 21.8% however the latter is in line with that achieved

during FY14, a more comparable period which excludes the

non-recurring Buprecare sales benefit. The maintenance of

normalised operating margins highlights that whilst overheads

increased by GBP0.2m to GBP2.3m, as we continue to make the

necessary investment in particular in our employee base, the

increase in investment is controlled and measured.

Cash flow

The Group cash position increased by GBP0.32m to GBP6.10m

compared to GBP5.78m at 30(th) June 2015. Cash generated by

operations continues to be strong at GBP1.96m (2014: GBP2.55m) as

we maintain robust control over our working capital. As expected

our stock position has increased modestly versus FY15 year end,

reflecting the growth in sales and contingency stocking in relation

to a new supply arrangement for one of our key product ranges.

The increase in cash has been delivered in a period which saw a

significant increase in our product development expenditure as

shown in the following chart, which can be viewed using the link

below:

http://www.rns-pdf.londonstockexchange.com/rns/5804O_-2016-2-9.pdf

The three-fold increase in capital expenditure vs 2014

highlights that this important activity for the Group is

progressing well and has benefitted from the additions made to the

Technical and Business Development teams during FY14. We expect

overall FY16 expenditure on our product development pipeline to be

in the range of GBP1.0m to GBP1.5m.

Earnings per share ("EPS")

Basic underlying EPS decreased by 8.8% to 6.2 pence (2014: 6.8

pence). The statutory basic EPS decreased by 7.6% to 6.1 pence

(2014: 6.6 pence) reflecting the lower cost of exceptional items in

the period.

Dividend

The Board is pleased to announce a maintained interim dividend

of 1.8 pence per share (2014: 1.8 pence per share) reflecting the

continued confidence in the medium to long-term growth prospects of

the Group. This follows the 11% increase in the total dividend for

FY15. The interim dividend will be paid on 6(th) May 2016 to

shareholders on the register on 8(th) April 2016. The Ordinary

shares will become ex-dividend on 7(th) April 2016.

The Board will continue to monitor the Group's cash position to

ensure an appropriate balance between investment for future growth

and dividend flow to deliver overall value for our

shareholders.

Product pipeline

In line with our strategy of product development and investment,

good progress has been made in our product development pipeline, as

evidenced by the significant increase in capital expenditure noted

above. Development work has continued to focus on identifying new

product opportunities and also ways to deliver significant

commercial benefit from our existing pharmaceutical products.

The table below highlights the overall position of our pipeline

compared to the previous period:

Identification Feasibility Development Regulatory Commercial

----- --------------- ------------ ------------ --------------- -----------------

2015 26 Projects 12 Projects 7 Projects 4 NPD & 3 Product launches

EPD Projects (H2 FY16) - 1

----- --------------- ------------ ------------ --------------- -----------------

2014 34 Projects 9 Projects 7 Projects 3 NPD Projects Product launches

- nil

----- --------------- ------------ ------------ --------------- -----------------

One Existing Product Development product will be commercialised

early in H2 delivering significant commercial benefit. Three other

in-house product development projects are expected to receive

regulatory approval during H2, with commercialisation soon

thereafter.

In addition, we continue to seek distribution opportunities to

complement our in-house pipeline and one new product will be

launched on distribution in H2.

Summary and outlook

We have continued to make strong progress in executing our

strategy to drive growth from 2017 onwards. The primary focus

remains on reinvesting the Group's free cash in our business to

support future growth, with the estimated rate of expenditure on

our product development pipeline circa GBP1.0m to GBP1.5m per

annum.

Export revenues have improved in the period and the new Head of

Export Development has made good progress in evaluating existing

and new territories and partners to increase our geographic

footprint.

The UK veterinary market has consolidated further during the

period, presenting revenue growth opportunities albeit at reduced

margins.

The introduction of compulsory microchipping in England, Wales

and Scotland in April 2016 has presented certain challenges as we

highlighted earlier, however as we move past this legislation

change, Animalcare has plans in place to maximise the value from

this segment beyond the current financial year.

Overall, the Group remains well positioned and remains confident

in delivering our near and medium term targets.

Iain Menneer Chris Brewster

Chief Executive Officer Chief Financial Officer

Condensed Consolidated Statement of Comprehensive Income -

Unaudited

Six months ended 31(st) December 2015

6 months ended 31(st) December 6 months ended 31(st) December

2015 2014

------------------------- ---- --------------------------------------- --------------------------------------

Exceptional

and other Underlying Exceptional and

Underlying items (i) Total results other items (i) Total

Note results GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

========================= ==== ---------------- ----------- -------- ========== ================ ========

Revenue 7,114 - 7,114 6,928 - 6,928

------------------------- ---- ---------------- ----------- -------- ---------- ---------------- --------

Cost of sales (3,230) (3,230) (2,971) - (2,971)

========================= ==== ---------------- ----------- -------- ========== ================ ========

Gross profit 3,884 - 3,884 3,957 - 3,957

------------------------- ---- ---------------- ----------- -------- ---------- ---------------- --------

Distribution

costs (121) - (121) (135) - (135)

------------------------- ---- ---------------- ----------- -------- ---------- ---------------- --------

Administrative

expenses (2,140) (59) (2,199) (1,948) (49) (1,997)

========================= ==== ---------------- ----------- -------- ========== ================ ========

Research &

development

expenses (70) - (70) (84) - (84)

========================= ==== ---------------- ----------- -------- ========== ================ ========

Operating profit/loss 1,553 (59) 1,494 1,790 (49) 1,741

------------------------- ---- ---------------- ----------- -------- ---------- ---------------- --------

Finance income/(expense) 13 21 34 13 1 14

========================= ==== ---------------- ----------- -------- ========== ================ ========

Profit/(loss)

before tax 1,566 (38) 1,528 1,803 (48) 1,755

------------------------- ---- ---------------- ----------- -------- ---------- ---------------- --------

Income tax

(expense)/credit (257) 7 (250) (374) 10 (364)

========================= ==== ---------------- ----------- -------- ========== ================ ========

Total comprehensive

income/(loss)

for the period 1,309 (31) 1,278 1,429 (38) 1,391

------------------------- ---- ---------------- ----------- -------- ---------- ---------------- --------

Basic earnings

per share 6 6.2p 6.1p 6.8p 6.6p

------------------------- ---- ---------------- ----------- -------- ---------- ---------------- --------

Fully diluted

(MORE TO FOLLOW) Dow Jones Newswires

February 10, 2016 02:00 ET (07:00 GMT)

earnings per

share 6 6.1p 6.0p 6.8p 6.6p

------------------------- ---- ---------------- ----------- -------- ---------- ---------------- --------

Total comprehensive income/(loss) for the period is attributable

to the equity holders of the parent.

(i) In order to aid understanding of underlying business

performance, the Directors have presented underlying results before

the effect of exceptional and other items. These items are analysed

in note 3.

Condensed Consolidated Statement of Comprehensive Income -

Audited

Year ended 30(th) June 2015

Exceptional

Underlying and other items

results (i) Total

Note GBP'000 GBP'000 GBP'000

----------------------------------- ---- ---------- ---------------- --------

Revenue 13,536 - 13,536

----------------------------------- ---- ---------- ---------------- --------

Cost of sales (5,963) - (5,963)

----------------------------------- ---- ---------- ---------------- --------

Gross profit 7,573 - 7,573

----------------------------------- ---- ---------- ---------------- --------

Distribution costs (279) - (279)

----------------------------------- ---- ---------- ---------------- --------

Administrative expenses (4,041) (110) (4,151)

----------------------------------- ---- ---------- ---------------- --------

Research & development expenditure (143) - (143)

----------------------------------- ---- ---------- ---------------- --------

Operating profit/(loss) 3,110 (110) 3,000

----------------------------------- ---- ---------- ---------------- --------

Finance income 27 27

----------------------------------- ---- ---------- ---------------- --------

Finance expense - (17) (17)

----------------------------------- ---- ---------- ---------------- --------

Profit/(loss) before tax 3,137 (127) 3,010

----------------------------------- ---- ---------- ---------------- --------

Income tax (expense)/credit (502) 26 (476)

----------------------------------- ---- ---------- ---------------- --------

Total comprehensive income/(loss)

for the year 2,635 (101) 2,534

----------------------------------- ---- ---------- ---------------- --------

Basic earnings per share 6 12.6p 12.1p

----------------------------------- ---- ---------- ---------------- --------

Fully diluted earnings per

share 6 12.5p 12.0p

----------------------------------- ---- ---------- ---------------- --------

Total comprehensive income/(loss) for the year is attributable

to the equity holders of the parent.

(i) In order to aid understanding of underlying business

performance, the directors have presented underlying results before

the effect of exceptional costs and other items. These items are

analysed in note 3.

Condensed Consolidated Statement of Changes in Shareholders'

Equity

Six months ended 31(st) December 2015

Year ended

6 months ended 6 months ended 30(th) June

31(st) December 31(st) December 2015

2015 Unaudited 2014 Unaudited Audited

Note GBP'000 GBP'000 GBP'000

---------------------------- ---- ---------------- ---------------- ------------

Balance at beginning

of period 20,991 19,453 19,453

---------------------------- ---- ---------------- ---------------- ------------

Total comprehensive

income for the period 1,278 1,391 2,534

---------------------------- ---- ---------------- ---------------- ------------

Transactions with owners

of the Company, recognised

in equity:

---------------------------- ---- ---------------- ---------------- ------------

Dividends paid 5 (904) (838) (1,217)

---------------------------- ---- ---------------- ---------------- ------------

Issue of share capital 46 11 82

---------------------------- ---- ---------------- ---------------- ------------

Share-based payments 60 73 139

---------------------------- ---- ---------------- ---------------- ------------

Balance at end of period 21,471 20,090 20,991

---------------------------- ---- ---------------- ---------------- ------------

Condensed Consolidated Balance Sheets

31(st) December 2015

31(st) December 31(st) December

2015 2014 30(th) June 2015

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------ --------------- --------------- ----------------

Non-current assets

------------------------------ --------------- --------------- ----------------

Goodwill 12,711 12,711 12,711

------------------------------ --------------- --------------- ----------------

Other intangible assets 2,257 1,395 1,780

------------------------------ --------------- --------------- ----------------

Property, plant and equipment 271 330 306

------------------------------ --------------- --------------- ----------------

15,239 14,436 14,797

------------------------------ --------------- --------------- ----------------

Current assets

------------------------------ --------------- --------------- ----------------

Inventories 1,700 1,938 1,653

------------------------------ --------------- --------------- ----------------

Trade and other receivables 1,909 2,165 2,247

------------------------------ --------------- --------------- ----------------

Cash and cash equivalents 6,098 5,037 5,777

------------------------------ --------------- --------------- ----------------

9,707 9,140 9,677

------------------------------ --------------- --------------- ----------------

Total assets 24,946 23,576 24,474

------------------------------ --------------- --------------- ----------------

Current liabilities

------------------------------ --------------- --------------- ----------------

Trade and other payables (2,090) (1,976) (2,186)

------------------------------ --------------- --------------- ----------------

Current tax liabilities (301) (481) (212)

------------------------------ --------------- --------------- ----------------

Deferred income (233) (242) (234)

------------------------------ --------------- --------------- ----------------

(2,624) (2,699) (2,632)

------------------------------ --------------- --------------- ----------------

Net current assets 7,057 6,441 7,045

------------------------------ --------------- --------------- ----------------

Non-current liabilities

------------------------------ --------------- --------------- ----------------

Deferred income (724) (703) (724)

------------------------------ --------------- --------------- ----------------

Deferred tax liabilities (127) (84) (127)

------------------------------ --------------- --------------- ----------------

(851) (787) (851)

------------------------------ --------------- --------------- ----------------

Total liabilities (3,475) (3,486) (3,483)

------------------------------ --------------- --------------- ----------------

Net assets 21,471 20,090 20,991

------------------------------ --------------- --------------- ----------------

Capital and reserves

------------------------------ --------------- --------------- ----------------

Called up share capital 4,211 4,194 4,204

------------------------------ --------------- --------------- ----------------

Share premium account 6,500 6,400 6,461

------------------------------ --------------- --------------- ----------------

(MORE TO FOLLOW) Dow Jones Newswires

February 10, 2016 02:00 ET (07:00 GMT)

Retained earnings 10,760 9,496 10,326

------------------------------ --------------- --------------- ----------------

Equity attributable to

equity holders of the parent 21,471 20,090 20,991

------------------------------ --------------- --------------- ----------------

Cash Flow Statements

Six months ended 31(st) December 2015

6 months ended 6 months ended Year ended

31(st) December 31(st) December 30(th) June

2015 Unaudited 2014 Unaudited 2015 Audited

GBP'000 GBP'000 GBP'000

----------------------------------- ---------------- ---------------- -------------

Comprehensive income for

the period before tax 1,528 1,755 3,010

----------------------------------- ---------------- ---------------- -------------

Adjustments for:

----------------------------------- ---------------- ---------------- -------------

Depreciation of property,

plant and equipment 61 55 73

----------------------------------- ---------------- ---------------- -------------

Amortisation of intangible

assets 129 141 359

----------------------------------- ---------------- ---------------- -------------

Finance income (13) (13) (27)

----------------------------------- ---------------- ---------------- -------------

Share-based payment award 60 73 139

----------------------------------- ---------------- ---------------- -------------

Release of deferred income - (26) (14)

----------------------------------- ---------------- ---------------- -------------

Operating cash flows before

movements in working capital 1,765 1,985 3,540

----------------------------------- ---------------- ---------------- -------------

(Increase)/decrease in inventories (47) 482 767

----------------------------------- ---------------- ---------------- -------------

Decrease/(increase) in receivables 337 (282) (392)

----------------------------------- ---------------- ---------------- -------------

Increase/(decrease) in payables (96) 368 608

----------------------------------- ---------------- ---------------- -------------

Cash generated by operations 1,959 2,553 4,523

----------------------------------- ---------------- ---------------- -------------

Income taxes paid (161) (293) (631)

----------------------------------- ---------------- ---------------- -------------

Net cash flow from operating

activities 1,798 2,260 3,892

----------------------------------- ---------------- ---------------- -------------

Investing activities:

----------------------------------- ---------------- ---------------- -------------

Payments to acquire intangible

assets (598) (195) (812)

----------------------------------- ---------------- ---------------- -------------

Payments to acquire property,

plant and equipment (34) (26) (7)

----------------------------------- ---------------- ---------------- -------------

Interest received 13 13 27

----------------------------------- ---------------- ---------------- -------------

Net cash used in investing

activities (619) (208) (792)

----------------------------------- ---------------- ---------------- -------------

Financing:

----------------------------------- ---------------- ---------------- -------------

Receipts from issue of share

capital 46 11 82

----------------------------------- ---------------- ---------------- -------------

Equity dividends paid (904) (838) (1,217)

----------------------------------- ---------------- ---------------- -------------

Net cash used in financing

activities (858) (827) (1,135)

----------------------------------- ---------------- ---------------- -------------

Net increase in cash and

cash equivalents 321 1,225 1,965

----------------------------------- ---------------- ---------------- -------------

Cash and cash equivalents

at start of period 5,777 3,812 3,812

----------------------------------- ---------------- ---------------- -------------

Cash and cash equivalents

at end of period 6,098 5,037 5,777

----------------------------------- ---------------- ---------------- -------------

Comprising:

----------------------------------- ---------------- ---------------- -------------

Cash and cash equivalents 6,098 5,037 5,777

----------------------------------- ---------------- ---------------- -------------

Condensed Notes to the Financial Statements

31(st) December 2015

1. GENERAL INFORMATION

Animalcare Group plc ("the Company") is a company incorporated

in England and Wales under the Companies Act 2006 and is domiciled

in the United Kingdom. The condensed set of financial statements as

at, and for, the six months ended 31(st) December 2015 comprises

the Company and its subsidiary, Animalcare Ltd (together referred

to as the "Group"). The nature of the Group's operations and its

principal activities are set out in the latest Annual Report.

This Interim Report does not constitute statutory accounts as

defined in Section 435 of the Companies Act 2006. The information

contained herein has not been reviewed by the Group's auditor.

The prior year comparatives are derived from the audited

financial information as set out in the Group's Annual Report for

the year ended 30(th) June 2015 and the unaudited financial

information in the Group's Interim Report for the six months ended

31(st) December 2014. The comparative figures for the financial

year ended 30(th) June 2015 are not the Group's statutory accounts.

Those accounts have been reported on by the Group's auditor and

delivered to the Registrar of Companies. The report of the auditor

was (i) unqualified, (ii) did not include any reference to matters

to which the auditors drew attention without qualifying their

report and (iii) did not contain a statement under section 498(2)

or (3) of the Companies Act 2006.

The Interim Report for the six months ended 31(st) December 2015

was approved by the Board of Directors and authorised for issue on

10(th) February 2016.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation and accounting policies

Except as described below, the condensed consolidated interim

financial information for the six months ended 31(st) December 2015

has been prepared using accounting policies consistent with those

of the Company's annual accounts for the year ended 30(th) June

2015, which were prepared in accordance with IFRSs as adopted by

the European Union.

Taxes on income in the interim periods are accrued using the

estimated tax rate that would be applicable for the full financial

year.

The following new standards and interpretations are mandatory

for the first time for the financial period beginning 1(st) July

2015:

Annual Improvements to IFRSs 2010-2012 Cycle

Annual Improvements to IFRSs 2011-2013 Cycle

Adoption where applicable has not had a material effect on the

Group's financial information.

Going concern

The principal risks and uncertainties facing the Group remain

those set out in the latest Annual Report.

For the purposes of their assessment of the appropriateness of

the preparation of the interim financial information on a going

concern basis, the Directors have considered the current cash

position and forecasts of future trading including working capital

and investment requirements.

During the period the Group met its day-to-day general corporate

and working capital requirements through existing cash resources.

At 31(st) December 2015 the Group had cash on hand of GBP6.1

million (30(th) June 2015: GBP5.8 million).

The Group's forecasts and projections, taking account of

reasonable possible changes in trading performance, show that the

Group should have sufficient cash resources to meet its

requirements for at least the next 12 months. Accordingly, the

adoption of the going concern basis in preparing the interim

financial information remains appropriate.

3. EXCEPTIONAL AND OTHER ITEMS

(MORE TO FOLLOW) Dow Jones Newswires

February 10, 2016 02:00 ET (07:00 GMT)

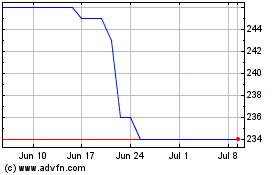

Animalcare (LSE:ANCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Animalcare (LSE:ANCR)

Historical Stock Chart

From Apr 2023 to Apr 2024