AngloGold Ashanti's Widening Net Loss Beats Forecasts

February 22 2016 - 3:30AM

Dow Jones News

JOHANNESBURG—AngloGold Ashanti Ltd. reported a loss of $70

million in 2015, compared with a loss of $39 million a year

earlier, beating expectations as the company continued to focus on

reducing debt and improving margins even as gold prices continued

to fall.

Analysts had forecast a 2015 loss of 23 cents a share, compared

with the actual loss of 20 cents a share, according to Thomson One.

The Johannesburg-based mining company reported an 18% drop in

revenue to $4.17 billion, beating expectations for a 25% slide from

2014.

The company reported a profit of 16 cents a share for the fourth

quarter of 2015, handily beating expectations for earnings of 5

cents a share and up from a loss of 14 cents a share in the three

months ended Dec. 31, 2014, as AngloGold benefited from a weaker

rand and lower oil prices.

As miners have had to dig ever deeper to reach South Africa's

gold deposits, massive cost increases including labor and

electricity have hit profitability as gold prices have tumbled in

the global market. AngloGold has been aided by better margins in

its international operations, which now account for 75% of the

group's production.

Still, the company has cut overhead expenditure by more than

two-thirds since the end of 2012 to combat gold prices, which are

down more than 35% from 2011 highs above $1,900 an ounce. The

company received an average price of $1,158 an ounce in 2015, down

8.4% from $1,264 in 2014.

AngloGold's net debt fell by 30% to $2.19 billion in the 12

months ended Dec. 31 from 2014, achieving the company's stated goal

of reducing debt by $1 billion during the current downturn in gold

prices. A joint venture to develop and operate the company's Obuasi

mine in Ghana with Randgold Resources Ltd. that could have helped

reduce that debt further fell through in December.

"It's still a high grade, long life asset," Srinivasan

Venkatakrishnan, the company's chief executive told reporters

Monday. "We are still confident in getting a joint venture partner

in the mine." He added that the company is working with the

government to complete a feasibility study as soon as possible.

AngloGold produced 3,830,000 ounces of gold from continuing

operations during the 12 months ended Dec. 31, down 9.3% from a

year earlier. Still, all-in sustaining costs dropped 11% from 2014

to $910 an ounce.

AngloGold's shares are currently trading up 60% year-to-date on

the Johannesburg Stock Exchange, boosted by a 15% rise in the gold

price to above $1,200 an ounce.

Write to Alexandra Wexler at alexandra.wexler@wsj.com

(END) Dow Jones Newswires

February 22, 2016 03:15 ET (08:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

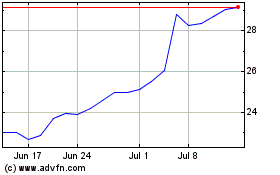

AngloGold Ashanti (NYSE:AU)

Historical Stock Chart

From Aug 2024 to Sep 2024

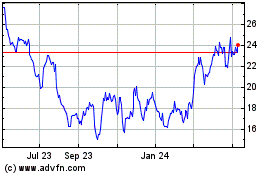

AngloGold Ashanti (NYSE:AU)

Historical Stock Chart

From Sep 2023 to Sep 2024