Anglo Pacific Group PLC Royalty Update: Kestrel (2086T)

July 16 2015 - 2:00AM

UK Regulatory

TIDMAPF

RNS Number : 2086T

Anglo Pacific Group PLC

16 July 2015

News Release

July 16, 2015

Anglo Pacific Group PLC

Royalty Update: Kestrel

Anglo Pacific Group PLC ("Anglo Pacific", or the "Company")

(LSE: APF, TSX: APY), the London and Toronto listed royalty

company, is pleased to provide an update on Kestrel, the Company's

primary royalty asset.

Production rates at the Kestrel mine have improved following a

panel change out during Q4 2014. Kestrel production during Q2 2015

totalled 1.118 mt (Q2 2014: 0.72 mt) and during H1 2015 totalled

2.252 mt (H1 2014: 1.59 mt). Kestrel production within the Anglo

Pacific royalty area during H1 2015 was 22%, and in line with the

Company's previous guidance of 20% to 25%.

In accordance with Anglo Pacific's Kestrel information rights,

Rio Tinto has provided updated tonnage sales forecasts which

confirms that the second half of this year is in line with, or

slightly above the Company's previous guidance of 70% to 75% of

production within Anglo Pacific's royalty area. Full year 2016

guidance of 60% to 65% of Kestrel production within the Company's

royalty area remains unchanged.

Julian Treger, Chief Executive Officer of Anglo Pacific,

commented:

"The first two quarters of 2015 have been encouraging for Anglo

Pacific with revenues from the Company's Kestrel royalty continuing

to perform in line with our expectations. Kestrel production within

the Company's royalty area remains on track to increase

significantly in the second half of 2015, and will further underpin

Anglo Pacific's dividend."

For further information:

Anglo Pacific Group PLC +44 (0) 20 3435 7400

Julian Treger, Chief Executive Officer

Kevin Flynn, Chief Financial Officer

Bell Pottinger +44 (0) 20 3772 2500

Nick Lambert / Lorna Cobbett

Notes to Editors

About Anglo Pacific

Anglo Pacific is a global natural resources royalty company. The

Company's strategy is to develop a leading international

diversified royalty company with a portfolio centred on base metals

and bulk materials, focusing on accelerating income growth through

acquiring royalties on projects that are currently cash flow

generating or are expected to be within the next 24 months. It is a

continuing policy of the Company to pay a substantial portion of

these royalties to shareholders as dividends.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCPKADQPBKKQOD

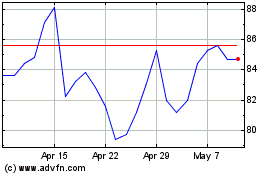

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

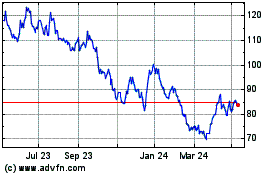

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Apr 2023 to Apr 2024