Anglo Pacific Group PLC Results for the year -6-

March 25 2015 - 3:02AM

UK Regulatory

underlying performance. of which provide some assurance over

the receipt and accuracy of royalty

The Group depends on the operator income.

for the accurate calculation

and timely payment of royalties.

Achieving investment projections The Directors have significant experience

The Group's success largely of investing in the mining industry

depends upon its ability to and have considerable expertise in

acquire royalties at appropriate assessing the forward demand for commodities.

valuations. The Group uses consensus or lower

forecasts when valuing all royalty

This success is based on the investments, which reduces the risk

accuracy of investment assumptions of underperformance and a site visit

regarding the estimates of mineral is undertaken, where possible, to

reserves and resources and the assess the viability of the underlying

production estimates of mine project.

operators as well as the Group's

ability to make accurate assumptions The Executive Committee regularly

regarding the valuation, timing review the Group's financial performance,

and amount of revenues to be including the royalty income on a

derived from its royalties, month by month basis for any sign

particularly with respect to of underperformance.

royalties on development stage

properties.

Unknown defects in or disputes

relating to the royalties the

Group holds may prevent it from

realising all of the anticipated

benefits from its royalties.

Financial covenants associated

with secured debt The Group has a conservative approach

The Group's borrowings are secured to borrowings and sets internal leverage

and subject to certain financial limits which are relatively low compared

covenants, the failing of which to the financial limits permitted

could impact on the ability by the loan agreements.

of the Group to continue to

run its business independently. The Group prepares regular cash flow

projections which include forward

Indebtedness may increase the covenant projections such that timely

Group's vulnerability to general action can be taken if headroom deteriorates.

adverse economic and industry

conditions or require the Group

to dedicate a substantial portion

of its cash flow from operations

and proceeds of any equity issuances

to payments on its indebtedness,

rather than, for example, on

new acquisitions or dividend

payments, any of which may place

the Group at a competitive disadvantage

to its competitors that may

have less debt.

Financial risks

Risk description Mitigation

Liquidity risk The Group seeks to ensure that it

can meet all of its obligations as

they fall due by preparing regular

cash flow projections and highlighting

any currency requirements well in

advance of settlement. The Group has

a strong balance sheet, US$24m currently

undrawn on the US$30m three-year revolving

credit facility secured in February

2015 and potential access to the capital

markets to provide additional funding

to meet its obligations as well as

its investment objectives.

Credit risk The Group operates controlled treasury

policies which spreads the concentration

of the Group's cash balances amongst

separate financial institutions with

high credit ratings. The Group's credit

risk on monies advanced to explorers

and operators is taken into account

when assessing the fair value of these

assets at each reporting date. For

receivables, the Group presents these

on the balance sheet net of any amount

for doubtful debt. As these primarily

relate to the Kestrel royalty, the

credit risk is minimal due to the

world class nature of the operator.

Foreign exchange risk The Group's main foreign currency

exposure is to the US dollar as this

is the currency in which most of the

Group's royalty revenue is derived.

With respect to royalty acquisitions,

the Group is exposed to foreign exchange

risk when raising equity in pounds

sterling and transacting in US dollars.

The Directors take this into account

as part of the financing strategy

of each royalty acquisition.

Interest rate risk The Group has limited exposure to

interest rate risk, and its three-year

revolving credit facility is unhedged.

Other pricing risk The value of the Group's royalties

is underpinned by commodity prices

which may affect the future expected

cash flows. This is taken into account

at each reporting date in assessing

for impairment. The Group has a portfolio

of junior mining equity investments

which fluctuate in value based on

the active quoted share price. The

reduction in value of the portfolio

over the last few years has resulted

in a full impairment of unrealised

losses such that any further pricing

risk should be much less material

to the Group.

Condensed Consolidated Financial Statements

CONDENSED CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED DECEMBER 31, 2014

2014 2013

GBP'000 GBP'000

Royalty related income 3,481 14,731

Amortisation of royalties (759) (854)

Operating expenses (5,524) (3,275)

--------- ---------

Operating (loss)/profit before impairments, revaluations and gain/(losses) on disposals (2,802) 10,602

Gain/(Loss) on sale of mining and exploration interests 1,350 (6,398)

Gain on disposal of coal tenures 1,409 -

Impairment of mining and exploration interests (4,873) (26,321)

Impairment of royalty and exploration intangible assets (10,033) (8,313)

Impairment of royalty financial instruments (15,288) -

Impairment of property, plant and equipment (1,352) -

Revaluation of coal royalties (Kestrel) (11,822) (13,568)

Revaluation of royalty financial instruments - (8,735)

Finance income 439 789

Finance costs (1,408) (2,964)

Other income 1,981 2,012

--------- ---------

Loss before tax (42,399) (52,896)

Current income tax charge (1,386) (715)

Deferred income tax (charge)/credit (3,804) 11,114

--------- ---------

Loss attributable to equity holders (47,589) (42,497)

========= =========

Total and continuing loss per share

Basic and diluted loss per share (42.09p) (39.01p)

Condensed Consolidated Financial Statements

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

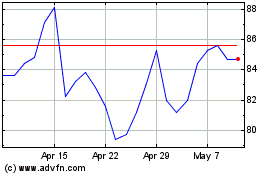

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Apr 2024 to May 2024

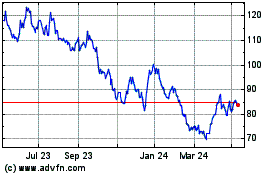

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From May 2023 to May 2024