TIDMAPF

RNS Number : 1199N

Anglo Pacific Group PLC

14 May 2015

News Release

May 14, 2015

Anglo Pacific Group PLC

Interim Management Statement

Anglo Pacific Group PLC ("Anglo Pacific", the "Company" or the

"Group") (LSE: APF, TSX: APY), the London and Toronto listed

royalty company, issues the following interim management statement

for the period January 1, 2014 to May 13, 2015. Unless otherwise

stated, all unaudited financial information is for the quarter

ended March 31, 2015.

Highlights

-- Anglo Pacific made significant progress in delivering on its

stated strategy in the first quarter

-- Acquisition of the Narrabri royalty for US$65.0 million along

with the associated, successful equity raise and obtaining a new

US$30.0 million revolving credit facility

-- Maiden royalty revenue earned for Narrabri and Maracás during

Q1 2015

-- Royalty income of GBP2.3 million in Q1 2015 (Q4 2014: GBP0.5

million, FY 2014: GBP3.5 million)

-- GBP1.7 million in cash generated from disposal of non-core

assets

-- Appointment of Patrick Meier as independent non-executive

director effective April 30, 2015

Royalty income

A significant part of the Group's strategy is to reduce

dependence on Kestrel royalty income. We were pleased to see this

happening in the first quarter as demonstrated by the first royalty

income being earned from the Group's two most recent royalty

acquisitions, Narrabri and Maracás, taking the number of producing

royalties in the portfolio to six. Combined with the Group's

existing producing royalties, overall royalty income in the first

quarter was GBP2.3 million compared with GBP0.5 million in the

previous quarter and GBP3.5 million in 2014 as a whole. We remain

confident that royalty income for 2015 will be significantly higher

than in 2014.

As previously communicated, an important agreement was reached

with Rio Tinto in 2014 to provide the Group with greater visibility

over the next twelve months of the projected tonnage within the

Group's private royalty land at the Kestrel mine. The Group is

increasingly confident in information provided from the mine to

forecast our future royalty revenues: the actual tonnage on which

our Q1 2015 royalty was based was in line with that previously

forecasted by Rio Tinto during 2014. The guidance we are now

receiving suggests that production and our share of that production

is increasing above Rio Tinto's previous forecasts and that our

expectation of production within our land rising to approximately

90% by 2017 is well on track.

Financial position

The disposal of non-core assets continued in the first quarter

of 2015, albeit at a slower pace, with GBP1.7 million in cash

generated from certain equity disposals. The market value of the

remaining equity portfolio at March 31, 2015 was GBP6.8 million.

The Group had GBP6.5 million in cash at March 31, 2015 with US$6.0

million drawn on its revolving credit facility, leaving $24.0

million undrawn.

Dividend

Following approval at the 2015 AGM, the final dividend for the

financial year ended December 31, 2014 of 4.00p per share will be

paid on August 7, 2015 to shareholders on the Group's share

register at the close of business on June 26, 2015. The shares will

be quoted ex-dividend on the London Stock Exchange on June 25, 2015

and the Toronto Stock Exchange on June 24, 2015.

In the medium term, the Board is committed to a minimum annual

total dividend of 8.00p per share subject to, amongst other things,

the level of adjusted earnings, proceeds from the disposals of

non-core assets and prospective investment opportunities. In the

longer term, the Board intends to adopt a dividend policy paying

dividends representing a minimum of 65% of adjusted earnings.

Julian Treger, Chief Executive Officer of the Company,

commented:

"The first quarter of 2015 has been encouraging for Anglo

Pacific with the first royalty income earned from our two recent

acquisitions, Narrabri and Maracás. We are also pleased with the

underlying production in Q1 2015 at Narrabri, which is ahead of our

expectations. In addition, we are increasingly confident about the

recovery of royalty income from Kestrel, supported by the level of

information now received from Rio Tinto."

For further information:

Anglo Pacific Group PLC +44 (0) 20 3435 7400

Julian Treger - Chief Executive

Officer

Kevin Flynn - Chief Financial

Officer and Company Secretary

Website: www.anglopacificgroup.com

BMO Capital Markets Limited +44 (0) 20 7664 8020

Jeffrey Couch / Neil Haycock /

Tom Rider

Macquarie Capital (Europe) Limited +44 (0) 20 3037 2000

Raj Khatri / Nicholas Harland / Ariel

Tepperman

Peel Hunt LLP +44 (0) 20 7418 8900

Matthew Armitt / Ross Allister

Bell Pottinger +44 (0) 20 3772 2500

Nick Lambert / Lorna Cobbett

Notes to Editors

About Anglo Pacific

Anglo Pacific Group PLC is a global natural resources royalty

company. The Company's strategy is to develop a leading

international diversified royalty company with a portfolio centred

on base metals and bulk materials, focusing on accelerating income

growth through acquiring royalties on projects that are currently

cash flow generating or are expected to be within the next 24

months. It is a continuing policy of the Company to pay a

substantial portion of these royalties to shareholders as

dividends.

Cautionary statement on forward-looking statements and related

information

Certain information contained in this announcement, including

any information as to future financial or operating performance and

other statements that express management's expectation or estimates

of future performance, constitute "forward looking statements". The

words "expects", "anticipates", "plans", "believes", "estimates",

"seeks", "intends", "targets", "projects", "forecasts", or negative

versions thereof and other similar expressions identify

forward-looking statements. Forward-looking statements are

necessarily based upon a number of estimates and assumptions that,

while considered reasonable by management, are inherently subject

to significant business, economic and competitive uncertainties and

contingencies. Further, forward-looking statements are not

guarantees of future performance and involve risks and

uncertainties which could cause actual results to differ materially

from those anticipated, estimated or intended in the

forward-looking statements. Furthermore, this announcement contains

information and statements that are based on certain estimates and

forecasts that have been provided to the Group by Kestrel Coal Pty

Ltd ("KCPL"), the accuracy of which KCPL does not warrant and on

which readers may not rely. The material assumptions and risks

relevant to the forward-looking statements in this announcement

include, but are not limited to: stability of the global economy;

stability of local government and legislative background;

continuing of ongoing operations at the properties underlying the

Group's portfolio of royalties in a manner consistent with past

practice; accuracy of public statements and disclosures (including

feasibility studies and estimates of reserve, resource, production,

grades, mine life, and cash cost) made by the owners and operators

of such underlying properties; accuracy of the information provided

to the Group by the owners and operators of such underlying

properties; no material adverse change in the price of the

commodities produced from the properties underlying the Group's

portfolio of royalties and investments; no material adverse change

in foreign exchange exposure; no adverse development in respect of

any property in which the Group holds a royalty or other interest,

including but not limited to unusual or unexpected geological

formations and natural disasters; successful completion of new

development projects; planned expansions or additional projects

being within the timelines anticipated and at anticipated

production levels; and maintenance of mining title. If any such

risks actually occur, they could materially adversely affect the

Group's business, financial condition or results of operations. For

additional information with respect to such risks and

uncertainties, please refer to the "Principal Risks and

Uncertainties" section of our most recent Annual Report and to the

"Risk Factors" section of our most recent Annual Information Form

available on www.sedar.com and the Group's website

www.anglopacificgroup.com. Readers are cautioned to consider these

and other factors, uncertainties and potential events carefully and

not to put undue reliance on forward-looking statements. The

forward-looking statements contained in this announcement are made

as of the date of this announcement only and the Group undertakes

no obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise, after the date on which the statements are made or to

reflect the occurrence of unanticipated events.

Third party information

As a royalty holder, the Group often has limited, if any, access

to non-public scientific and technical information in respect of

the properties underlying its portfolio of royalties, or such

information is subject to confidentiality provisions. As such, in

preparing this announcement, the Group has largely relied upon the

public disclosures of the owners and operators of the properties

underlying its portfolio of royalties, as available at the date of

this announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSMMGMKNFVGKZM

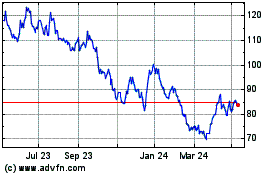

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

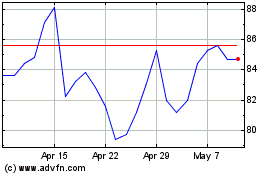

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Apr 2023 to Apr 2024