Anglo Pacific Group PLC Director/PDMR Shareholding (4989I)

March 26 2015 - 4:00AM

UK Regulatory

TIDMAPF

RNS Number : 4989I

Anglo Pacific Group PLC

26 March 2015

News Release

March 26, 2015

Anglo Pacific Group PLC

Directors' Share Dealings

Anglo Pacific Group PLC (the "Company") (LSE: APF, TSX: APY)

announces that it received notification on March 25, 2015 of the

following transactions by connected persons of Mr. Julian Treger,

Chief Executive Officer, Mr. Michael Blyth, Chairman and Mr. Kevin

Flynn, Chief Financial Officer of the Company.

On March 25, 2015, Mr. Treger acquired 15,000 ordinary shares of

2 pence each in the Company ("Shares") via his pension fund, at a

price of GBP0.865 per Share. Furthermore, on March 25, 2015, Mrs.

Carolyn Blyth, Mr. Blyth's spouse, bought 11,800 Shares at a price

of GBP0.83 per Share and Mrs. Louise Flynn, Mr. Flynn's spouse,

bought 7,530 Shares at a price of GBP0.857 per Share. The

transactions took place on the London Stock Exchange.

Following this notification, the total beneficial holding of

Shares by Mr. Treger and his connected persons is now 5,406,464

shares, representing 3.18% of the issued ordinary share capital of

the Company. The total beneficial holding of Shares by Mr. Blyth

and his connected persons is now 73,172 shares and the total

beneficial holding of Shares by Mr. Flynn and his connected persons

is 9,918 shares, representing 0.04% and 0.006% of the issued

ordinary share capital of the Company respectively.

This notification is intended to satisfy the Company's

obligations under Disclosure and Transparency Rule 3.1.4R.

For further information:

Anglo Pacific Group PLC +44 (0) 20 3435 7400

Julian Treger, Chief Executive Officer

Kevin Flynn, Chief Financial Officer

BMO Capital Markets Limited +44 (0) 20 7236 1010

Neil Haycock / Tom Rider

Macquarie Capital (Europe) Limited +44 (0) 20 3037 2000

Ken Fleming / Ariel Tepperman / Nicholas Harland

Peel Hunt LLP +44 (0) 20 7418 8900

Matthew Armitt / Ross Allister

Bell Pottinger +44 (0) 20 3772 2500

Nick Lambert / Lorna Cobbett

Notes to Editors

About Anglo Pacific

Anglo Pacific Group PLC is a global natural resources royalty

company. The Company's strategy is to develop a leading

international diversified royalty company with a portfolio centred

on base metals and bulk materials, focusing on accelerating income

growth through acquiring royalties on projects that are currently

cash flow generating or are expected to be within the next 24

months. It is a continuing policy of the Company to pay a

substantial portion of these royalties to shareholders as

dividends.

This information is provided by RNS

The company news service from the London Stock Exchange

END

RDSLELLLEXFEBBZ

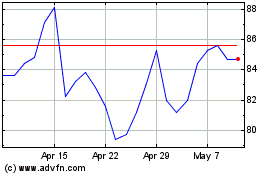

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

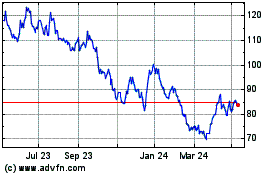

Ecora Resources (LSE:ECOR)

Historical Stock Chart

From Apr 2023 to Apr 2024