TIDMAEP

RNS Number : 3910W

Anglo-Eastern Plantations PLC

26 April 2016

Anglo-Eastern Plantations Plc

("AEP", "Group" or "Company")

Preliminary announcement of results for year ended 31 December

2015

Anglo-Eastern Plantations Plc, and its subsidiaries are a major

producer of palm oil and rubber with plantations across Indonesia

and Malaysia amounting to some 128,600 hectares, has today released

its results for the year ended 31 December 2015.

Financial Highlights

2015 2014

$m $m

Revenue 196.5 251.3

Profit before tax

- before biological asset

("BA") adjustment 45.0 85.0

- after biological asset

adjustment (19.1) 51.2

EPS before BA adjustment 69.39cts 132.26cts

EPS after BA adjustment (37.58)cts 77.61cts

Dividend (pence) 1.75p 3.0p

Dividend (cents) 2.5*cts 4.5cts

Note: * Based on exchange rate at 22 April 2016 of

$1.4409/GBP

Enquiries:

Anglo-Eastern Plantations

Plc

Dato' John Lim Ewe Chuan +44 (0)20 7216 4621

Panmure Gordon & Co.

Andrew Godber +44 (0)20 7886 2500

Chairman's Statement

The Group achieved record production of fresh fruit bunches

("FFB") in 2015. The crop production of 900,400mt, was 5% higher

than the previous year (2014: 857,400mt) broadly in line with 9%

increase in matured trees. The mills similarly recorded the highest

purchase of external FFB in recent years. FFB bought-in from

surrounding smallholders in 2015 was 678,200mt (2014: 626,200mt),

8% higher, as the Group offered competitive prices for the external

crops. The mills as a result processed 9% more FFB, and increased

crude palm oil ("CPO") production by 9% to 321,400mt (2014:

294,200mt).

FFB harvest in Kalimantan exceeded expectation and was higher

than last year's production by 65% as matured trees increased from

4,650ha to 7,790ha. This made up for the lower production in other

established regions in North Sumatera, Riau and Bengkulu which were

adversely affected by four months of drought caused by the El Nino

weather phenomenon. The dry spell compounded by the indiscriminate

open burning by villagers to clear their land for planting resulted

in an unprecedented haze that blanketed parts of Indonesia for

months. Sporadic fire from surrounding land encroached onto our

plantations resulting in damages of up to 175ha of palm oil in

South Sumatera and Kalimantan. The fire burned the ground weeds,

cover crops and scorched lower fronds but most of the affected

palms will survive and recover. The quick response from our fire

patrol teams equipped with proper fire-fighting gear helped to

quickly contain the spread of fire. In the aftermath of the forest

fires, it was reported that the Indonesian government investigated

more than 200 companies and sanctioned 23 companies with suspension

to permanent revocation of operating licenses. I am pleased to

report that the Group is not involved in open burning and that

normal rainfall has since returned.

Despite the increase in crop and CPO production, revenue and

profitability suffered as CPO prices fell to a 7-year low. The

average CPO Rotterdam price in 2015 was 25% lower at $613/mt,

compared to $815/mt in 2014. The Group's revenue was lower by 22%

at $196.5 million, compared to $251.3 million achieved in 2014. For

the year the Indonesian Rupiah depreciated by 13% against the US

dollar, the Group's reporting currency, which also partly explains

the lower revenue.

The Group operating profit for 2015, before the biological asset

("BA") adjustment was $42.7 million, 46% lower compared to $78.8

million achieved in 2014. Earnings per share, before BA adjustment

decreased to 69.39cts, from 132.26cts in 2014. The Group suffered

an operating loss for 2015 at $21.4 million after a downward BA

adjustment of $64.1 million as compared to 2014 operating profit of

$45.1 million after a downward BA adjustment of $33.7 million.

Profit was eroded by losses from five newly matured plantations in

Bengkulu, Bangka and Kalimantan. With the current low CPO prices,

it will take another three to four years for these plantations to

turn in a profit when the FFB yield reaches its optimum level.

At a recent 2015 Indonesian Palm Oil Conference in Bali,

vegetable oil analysts forecast that CPO will trade between a

moderate price band of $550/mt to $770/mt by middle of 2016. We

have seen a pick-up in CPO price in December 2015 to close at

$560/mt on concern of lower production arising from the effect of

El Nino. Despite this, challenging times are ahead for the Group

and the palm oil industry. Earlier this year, the Indian government

in its effort to reduce the import of vegetable oil had permitted

100% foreign direct investment in oil palm plantations in India

from mid-November 2015. This caused some flutter in the global

edible oils industry which is understandable as India is currently

the largest consumer of CPO. The slowdown in the Chinese economy

and weaker Chinese Yuan continue to hurt the export of CPO. There

are however signs that the world's second largest economy and

second largest consumer of CPO is stabilizing and clarity on the

timing of US interest rate hikes are bolstering speculation that

commodities will rebound from the worst year since 2008. China's

recent move from a one-child to two-child policy may also bode well

for the future of CPO as increased population will drive the demand

for vegetable oil.

The over production of crude oil remains a major concern as

crude oil prices had plunged to recent twelve year low which

undermines the competitiveness of CPO as a source of biodiesel.

In spite of the challenging market conditions the Board has

continued to invest in the development of new assets. The Group

planted 3,416ha of oil palms in 2015 of which 1,590ha comprised of

replanting. This was less than planned, due primarily to delays in

finalising agreements with villagers for land compensation payments

in Bengkulu, Bangka and Kalimantan.

The 45mt/hr mill in Central Kalimantan built at a cost of $11.2

million has started commercial operation in the third quarter of

2015. At the same time a biogas plant estimated to cost $2.5

million is also being constructed at this mill. Upon completion of

the biogas plant by the middle of 2016, it will help reduce the

mill reliance on fossil fuel and at the same time reduces the

Group's carbon foot print. This will be the second biogas plant

within the Group.

The Board is mindful that given the anticipated further capital

commitments the level of dividend needs to be balanced against the

planned expenditure. The Board is also mindful of shareholders'

sentiment and therefore declared a final dividend of 1.75p per

share in respect of the year to 31 December 2015 (2014: 3.0p).

Subject to the approval by shareholders at the Annual General

Meeting, the final dividend will be paid on 11 July 2016 to those

shareholders on the register on 10 June 2016.

Last year I highlighted the introduction of the new Law on

Plantation by the Indonesian Government in October 2014. The new

law inter-alia mandated the Government to prioritise domestic

investments in the plantation business development and restricts

foreign investments in the same sector based on types of plantation

crops, business scale and conditions of a particular region; and

possibly in the future, may set a cap on foreign investments.

Following the introduction of the new Law on Plantation by the

Indonesian Government in October 2014, the Indonesian Government

has recently announced plans to push through a moratorium on new

concessions for oil palm plantations in a bid to protect the

environment.

On behalf of the Board of Directors, I would like to convey our

sincere thanks to our management and all employees of the Group for

their dedication, loyalty, resourcefulness, commitment and

contribution to the success of the Group.

I would also like to take this opportunity to thank

shareholders, business associates, government authorities and all

other stakeholders for their continued confidence, understanding

and support for the Group.

Madam Lim Siew Kim

Chairman

26 April 2016

Strategic Report

Business Model

The Group will continue to focus on its strength and expertise

which is planting more oil palms which includes replanting old

palms with low yield, replace old rubber trees with palm trees and

building more mills to process the FFB. The Group has over the

years created value to shareholders through expansion in a

responsible way. We have in the last few years bought and invested

in new tracts of land and portions remain to be planted. Good land

at reasonable price has become more scarce. The Indonesian

government has in 2014 moved to introduce a law to cap the size of

new plantations owned by foreign companies. The Group remains

committed to use its available resources to develop the land bank

in Indonesia as regulatory constraints permit.

The Group's objectives are to provide appropriate returns to

investors in the long term from operation as well as expansion of

the Group's business, to foster economic progress in the localities

of the Group's activities and to develop the Group's operations in

accordance with the best corporate social responsibility and

sustainability standards.

We believe that sustainable success for the Group is best

achieved by acting in the long-term interests of our shareholders,

our partners and society.

Our Strategy

(MORE TO FOLLOW) Dow Jones Newswires

April 26, 2016 11:00 ET (15:00 GMT)

The Group's objectives are to provide an appropriate level of

returns to the investors and to enhance shareholders' value.

Profitability however is very much dependent on the CPO price which

is volatile and determined by supply and demand. In the short term,

CPO price remains under pressure due to the abundance of vegetable

oil and the falling crude oil prices which undermine the potential

of CPO as a source for biodiesel. Nevertheless the Group believes

in the long-term viability of palm oil which remains a cheap and

the most productive source of vegetable oil in a growing

population.

The Group's strategies therefore focus on maximising yield per

hectare above 22mt/ha, mill production efficiency of 110%,

minimising production costs below $300/mt and streamlining estate

management. For the year under review, the Group achieved a yield

of 18.4mt/ha, 109% mill efficiency and production cost of $250/mt

on Indonesia operations. This compared to 2014 yield of 19.1mt/ha,

115% mill efficiency and production cost of $255/mt. Despite stiff

competition for external crops from surrounding millers, the Group

is committed to purchase more external crops from third parties at

competitive, yet fair prices, to maximise the production efficiency

of the mills. With higher throughput, the mills achieved economy of

scales in production. A mill achieves 100% mill efficiency when it

operates 16 hours a day for 300 days per annum.

In line with the commitment to reduce its carbon foot prints,

the Group plans to construct in stages biogas plants at all its

mills to trap the methane gas to generate electrical power and at

the same time reduces the consumption of fossil fuel. It plans to

reduce the greenhouse gas emissions per metric ton of CPO produced

in the next two to three years.

The Group will continue to follow-up and offer competitive and

fair compensation to villagers so that land can be cleared and

planted.

Financial Review

The financial statements have been prepared in accordance with

International Financial Reporting Standards and its interpretations

(IFRS and IFRIC interpretations) issued by the International

Accounting Standards Board ("IASB") as adopted by the European

Union ("EU") and with those parts of the Companies Act 2006

applicable to companies preparing their accounts under IFRS.

For the year ended 31 December 2015, revenue for the Group was

$196.5 million, 22% lower than $251.3 million reported in 2014 due

primarily to the lower CPO price and the weakened of Rupiah against

US Dollar. CPO price hit a 7-year low as palm oil inventory reaches

new all-time high. The average exchange rate of Rupiah against US

Dollar in 2015 was 13,392, 13% lower than 2014 of 11,861.

Group operating profit for 2015 before biological asset

adjustment was $42.7 million, 46% less than $78.8 million in 2014.

With the current low CPO prices, fives subsidiaries with

substantial newly matured oil palms incurred losses and are

expected to breakeven in about three to four years when the FFB

yield reaches the optimum production level.

FFB production for 2015 was 900,400mt, 5% higher than the

857,400mt produced in 2014. The yield remains below expectation due

to wide spread flooding in North Sumatera at the beginning of the

year, followed by 4 months of extreme dry weather between the third

and fourth quarters of the year across Indonesia and Malaysia and a

higher proportion of young palms. FFB bought-in from local

smallholders for 2015 was 678,200mt (2014: 626,200mt), 8% higher

compared to 2014. The supply of third party crops was lower in the

third and fourth quarters of 2015 due to dry weather. The drought

induced tree stress resulted in late ripening of the fruits. During

the year, FFB processed by the Group's mills was 1.51 million mt,

9% higher than last year of 1.38 million mt and CPO production was

9% higher at 321,400mt, compared to 294,200mt in 2014.

Loss before tax and after BA adjustment for the Group was $19.1

million, 137% lower compared to a profit of $51.2 million in 2014.

The BA adjustment was a debit of $64.1 million, compared to a debit

of $33.7 million in 2014. The CPO price for 2015 remained weak. It

ended the year at $560/mt far lower than the 10-year average CPO

price at $750/mt, which is normally used in the calculation of BA.

Therefore a benchmarking exercise was made to ensure the directors'

best estimate of the price sustainable over the longer term is

being used. The directors adopted the recommendation of the valuer

who has suggested applying a ratio of 70% of the current CPO price

and 30% of the historical price (10-year average) given the

assumption to calculate CPO price over the past 10 years is no

longer considered to be appropriate. As a result, the directors

adopted the CPO price of $625/mt which falls within the valuer's

recommended range of $600/mt to $650/mt and the World Bank forecast

of CPO price for 2016 at $600/mt. The lower biological value was

due to the weakening of Rupiah against US Dollar and also was due

to a higher discount rate applied in the determination of

biological assets from 16.4% to 16.8%. The higher discount rate is

a reflection of the increased sovereign risks in Indonesia.

However, this is the last year bearer plants will be fair valued

given the change to the IAS 41 which is effective on 1 January

2016.

The average CPO price for 2015 was $613/mt, 25% lower than 2014

of $815/mt.

Due to the material fluctuation of Rupiah and Malaysia Ringgit

against US Dollar, a simulation was conducted on the 2014 income

statement's major items by applying year 2015 average rate onto

these major items. The simulation enabled comparison on a like for

like basis eliminating the exchange element. The result is

exhibited in the table below:

2015 2014 Difference

$000 $000 $000

Revenue 196,451 222,322 (25,871)

Cost of sales (145,897) (145,697) (200)

Gross profit 50,554 76,625 (26,071)

BA adjustment (64,121) (29,759) (34,362)

Operating profit before

BA adjustment 42,728 69,663 (26,935)

Loss before tax after

BA adjustment (19,074) 45,443 (64,517)

With the elimination of the exchange element, the revenue for

2015 was lower as a result of the lower CPO price. Despite the

increase in production tonnage, the cost of sales for 2015 only

increased marginally. The difference of BA adjustment between 2015

and 2014 was greater after the elimination of exchange element.

Earnings per share before BA adjustment decreased by 48% to

69.39cts compared to 132.26cts in 2014. Earnings per share after BA

adjustment fell from 77.61cts to (37.58)cts.

Going Concern

The Group's balance sheet remains strong notwithstanding an

unrealised exchange loss on translation of foreign subsidiaries of

$54.6 million compensated by a land revaluation gain of $3.7

million net of deferred tax. As at 31 December 2015, the Group had

cash and cash equivalents of $104.6 million and borrowings of $34.6

million, giving it a net cash position of $70.0 million, compared

to $91.0 million in 2014. Net Group's borrowings in the year

reduced to $34.6 million (2014: $34.9 million). For these reasons,

the Group adopts a going concern basis of accounting and believe

the Group will continue operation and meet its liabilities for the

foreseeable future.

Business Review

Indonesia

FFB production in North Sumatera, which aggregates the estates

of Tasik, Anak Tasik, Labuhan Bilik, Blankahan, Rambung, Sg Musam

and Cahaya Pelita ("CPA"), produced 325,200mt in 2015 (2014:

342,900mt), 5% lower than 2014. In January 2015, CPA experienced

heavy rainfall that inundated over 2,000ha of the plantation. The

evacuation of FFB was not possible until the flood receded. A

larger budget will be allocated to build canals and water gates as

part of its flood mitigation program at CPA. In October 2015,

strong wind in Rambung estate damaged nearly 6,500 matured rubber

trees covering an area of 13ha. The area affected will be replanted

with oil palms. Dry weather for a period of four months in between

the third and fourth quarters of 2015 interrupted the ripening of

FFB in Tasik, Anak Tasik and Labuhan Bilik. Over 1,400ha of ageing

oil palm was replanted in Tasik in 2015. Replanting was necessary

due to declining yield as workers find it difficult to harvest the

palm trees which were about 30 years old as they have reached an

average height of 16 to 18 metres tall.

Ganoderma fungus and Upper Stem Rot which attacks the productive

palms in Anak Tasik, Blankahan and Rambung remains a threat. Water

management, good sanitation and high standards of agronomic

practices remain the main priority to avoid spreading of the

diseases. This includes proper disposal of severely diseased palms

after detection. Soil mounding on infected palms was carried out to

lengthen the economic life span of oil palms. Replanting is

scheduled in 2016 at Anak Tasik due to significant decline in yield

attributed to Ganoderma attack. There was no serious insect damage

by Oryctes beetle, other leaf eating pests, wild animals and

rats.

FFB production in Bengkulu and South Sumatera, which aggregates

the estates of Puding Mas, Alno, KKST, ELAP and RAA produced

317,400mt (2014: 304,200mt), 4% higher than 2014. With the dry

weather in Bengkulu, about 165km of roads were resurfaced with

gravel and laterite soil while another 550km of roads were graded

and compacted to improve transport of FFB. As most of the estates

are situated close to forest reserves, wild boars and herds of

elephants continued to damage palm trees. Deep trenches and fencing

provide temporary relief. The protracted negotiation with the

villagers over land compensation will have an effect on the future

planting in Bengkulu and South Sumatera. CPO production in Alno

increased significantly by 27% due to higher purchase of FFB from

smallholders and marginally higher own crop production.

(MORE TO FOLLOW) Dow Jones Newswires

April 26, 2016 11:00 ET (15:00 GMT)

FFB production in the Riau region, comprising Bina Pitri

estates, produced 122,500mt in 2015 (2014: 116,700mt), 5% higher

than 2014. This was achieved despite the region experiencing severe

drought and haze resulting from indiscriminate open burning by

farmers from July to September 2015 when rainfall averaged below

100mm per month. CPO production improved by 10% due to the higher

purchase of FFB from smallholders, despite the competitiveness for

external crops from millers. Our mill offered higher prices for

external crops raising the mill utilization rate at the expense of

a lower operating margin.

FFB production in Kalimantan which comprises of the Sawit Graha

Manunggal estates produced 108,100mt in 2015 (2014: 65,700mt)

mainly from newly matured oil palm area of 7,792ha. FFB yield has

surpassed expectation, despite the sandy soil condition. FFB yield

from young trees averaged 14mt/ha. As in other regions in

Indonesia, the low rainfall over a four month period of 2015 is

likely to affect the FFB production in 2016. A comprehensive soil

and water conservation management including applying empty fruit

bunch ("EFB") mulching, fronds cut placement, proper drain

maintenance have been conducted in sandy soil to minimise early

decline in palm trees population due to soil erosion.

Overall bought-in crops for Indonesian operations were 8% higher

at 678,200mt for the year 2015 (2014: 626,200mt). The average oil

extraction rate from our mills was 21.2% in 2015 (2014: 21.3%).

Malaysia

FFB production in 2015 was 3% lower at 27,200mt, compared to

28,000mt in 2014. The Malaysian operations faced severe shortage in

workers due to difficulty in recruiting foreign workers hampering

harvesting and estate work. New incentives and increase in monthly

wages were also not sufficient to retain workers after their

initial two-year contract expired. In 2015, the Malaysian

plantations had $0.7 million pre-tax profit after BA adjustment

compared to a pre-tax loss of $0.9 million in 2014.

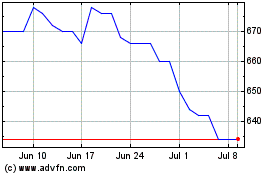

Commodity Prices

The CPO CIF Rotterdam price started the year at $700/mt (2014:

$890/mt) and reached a peak of $707/mt in March 2015 before

retreating to a 7-year low in August 2015. It staged a slight

recovery due to larger imports after price drop to record low and

on concern of lower production in 2016. It ended the year at

$560/mt (2014: $700/mt), averaging $613/mt for the year (2014:

$815/mt).

The soft demand for palm oil due to the abundance of soya oil is

likely to curb a quick recovery of the CPO price. The depressed

crude oil prices for much of 2015 did not help to boost the

competitiveness of CPO as a source of biodiesel. It is widely

reported that the El Nino weather phenomenon which brought severe

drought across Indonesia and Malaysia for four months in 2015 is

likely to cause moisture stress in palm trees. Furthermore, the

region was blanketed by haze reducing the sunlight required for

photosynthesis process in palms and will likely result in reduced

crop production in 2016. A lower production will most likely lead

to a gradual increase in CPO price. The successful efforts of

Indonesia and Malaysia to introduce higher mandatory blending of

biodiesel for industrial and commercial purposes likewise could

provide some price support.

Rubber prices averaged $1,269/mt for 2015 (2014: $1,616/mt). Our

small area of 502ha of mature rubber contributed a revenue of $1.1

million in 2015 (2014: $1.8 million).

Corporate Development

In 2015, the Group opened up new land and planted 1,826ha of oil

palm mainly in Kalimantan, boosting planted area including Plasma

by 3% to 65,100ha (2014: 63,500ha). This excludes the replanting of

1,423ha of oil palm in North Sumatera. Another 166ha of ageing

rubber trees were replanted with oil palm. New plantings remain

behind schedule due to delays in finalising settlement of land

compensation with villagers in Bengkulu, Bangka and Kalimantan. The

villagers seek compensation beyond what the Group considered fair

and reasonable resulting in protracted negotiations. The progress

of new planting in Kalimantan was interrupted by prolonged dry

weather during a four month period.

The mill construction in Central Kalimantan was completed in the

second quarter of 2015. It began commercial operation in the third

quarter with an initial capacity to process FFB at a rate of

45mt/hr. There is sufficient space to add a new processing line in

the mill to expand the processing capacity to 90mt/hr when the need

arises.

Negotiation to sell the surplus power estimated at 5.75 million

kwh per year to the Indonesian National Electricity Company from

its new biogas plant in North Sumatera is pending approval from

authority after completion of a feasibility study. Upon approval,

the Company will install electric cables, transformer and

switchgears estimated to cost $300,000 to link the biogas plant to

the national grid.

The Group has started construction of a second biogas plant in

Kalimantan which is expected to be completed by end of next year.

This project would contribute to the Group's reduction of carbon

footprint.

Corporate Social Responsibility

Corporate Social Responsibility ("CSR") is an integral part of

corporate self-regulation incorporated into our business model. Our

Group embraces responsibility for the impact of its activities on

the environment, consumers, employees, communities, stakeholders

and all other members of the public sphere. In engaging the social

dimension of CSR, the Group's business has taken cognizance of the

contribution and further enrichment of its employees while

continuing to make contributions to improve the well-being of the

surrounding community.

The majority of employees and their dependents in the

plantations and mills are housed in self-contained communities

built by the Group. The employees and their dependents are provided

with free housing, clean water and electricity. The Group also

builds, provides and repairs places of worship for workers of

different religious faiths as well as schools and sports facilities

in these communities. Over the years, the Group has built a total

of 71 mosques and 16 churches in all its estates. In 2015, the

Group spent $399,500 to build additional facilities and to maintain

these amenities. This includes construction of a new classroom in a

school in Bengkulu while a new elementary school in Labuhan Bilik

was built and handed over to the local government.

Staff and selected employees are given the opportunity to be

trained and to attend seminars to enhance their working skills and

capability. In 2015 the Group's Head Agronomist completed his PhD

in Soil Science with summa cum laude from the University of North

Sumatera. The Group provides free education for all employees'

children in the local plantations and communities where they work.

In 2015, scholarships amounting to $32,300 were provided to

children in surrounding villages and selected employees' children

to further their tertiary education in collaboration with

universities in Riau and Bengkulu. In total 95 scholarships were

given out. Selected under graduates were given opportunities for

industrial training during semester breaks. In addition the Group

provides funding to construct educational facilities including

laboratories, libraries, and computers. The salaries of teachers in

the estates and the cost of school buses to transport employees'

children to the schools are provided by the Group. Over the years a

total of 34 schools have been built with 121 teachers currently

employed within our Group estates. In 2015, the Group spent some

$552,500 on running the schools. The Group bought a new school bus

in Kalimantan taking the tally of school buses operated by the

Group in 2015 to 32 vehicles.

The Group continues to provide free comprehensive health care

for all its workers as we believe that every employee and their

dependents should have easy access to health services. We have

established 22 clinics operated by qualified doctors, nurses and

hospital assistants in the estates. In addition, the Group

organised fogging to prevent spread of dengue mosquitoes. In

isolated locations, the Group drill tube wells to provide clean

water. Related healthcare expenses for 2015 were $550,800.

A strong commitment to CSR has a positive impact on employees'

attitudes and boosts employee recruitment. The Group realizes that

employees are valuable assets in order to run an efficient,

effective, profitable and sustainable business and operations.

The Group also recognises its obligations to the wider farming

communities in which it operates. The Indonesian authorities have

established that not less than 20% of the new planted areas

acquired from 2007 onwards are to be reserved for the benefit of

smallholder cooperative scheme, known as Plasma, and the Group is

integrating such smallholder developments alongside its estates. In

order to aid the development of Plasma scheme, a subsidiary

provided a corporate guarantee to a local bank in excess of $16

million to cover loans raised by the cooperative. The plasma

development has commenced in stages for its estates in Sumatera and

Kalimantan.

The Board supported Kas Desa smallholder village development

programme to supplement the livelihood of the villages. The Group

has to-date financed, developed and managed 22 smallholder village

schemes across four companies.

In addition to education and healthcare which includes the

construction of schools, provision of scholarships, books, the

Group also develops infrastructure such as construction and repair

of 3 bridges and maintain 680km of external roads in 2015. The

Group also provides initial aid and seed capital to villagers such

as fruit seedlings, fish fries, cattle and ducks to start community

sustainable programs.

Indonesian Sustainable Palm Oil

The ISPO certification is legally mandatory for all plantations

in Indonesia. In March 2012, ISPO, which is fundamentally aligned

to RSPO (Roundtable on Sustainable Palm Oil) principles, has become

the mandatory standard for Indonesian planters.

(MORE TO FOLLOW) Dow Jones Newswires

April 26, 2016 11:00 ET (15:00 GMT)

A Steering Committee was established to work out a roadmap to

support the ISPO implementation at mills and estates. Workshops and

training sessions on occupational safety and healthcare were

carried out to inculcate a safety culture in workplaces at the

estates and mills in North Sumatera, Riau, Bengkulu and Kalimantan.

During the year the Group continued to upgrade its agricultural

chemical stores and diesel fuel storage tanks in various

plantations and mills to meet safety and environmental standards.

Standard operating procedures were refined and documented based on

sustainable oil palm best practices. The Group also conducts

internal audits using an audit checklist adopted from the above

practices to determine the level of compliance. The Group worked

closely with appointed certification consultants in the

implementation of ISPO standard. In addition to three subsidiaries

which were ISPO certified, another subsidiary has been approved for

ISPO certification in December 2015. Six companies are at the

second stage of ISPO audit while one company is at first stage of

certification.

Care For The Environment and Sustainable Practices

As a Group, we highlight the importance of creating awareness

and implementation of good environmental management practices

throughout the organisation. The Group has been consistently

practising good agricultural practices such as zero burning,

integrated pest management, land terracing and recycling of

biomass. When it comes to replanting, old palms felled are chipped

and left to decompose at site. This mitigates the greenhouse gas

emissions commonly associated with open burning when land is

cleared through the traditional method of slash-and-burn. It also

enriches the organic matter in the soil. Where the land is

undulating, we build terraces for planting which helps to prevent

landslides, conserve the water and nutrients effectively and

provide better accessibility for employees. Legume cover crops are

planted to minimise soil erosion and preserve the soil moisture. In

mature areas, fronds and EFB are placed inter-rows to allow the

slow release of organic nutrients while minimising soil erosion and

degradation.

Effluent discharged from some mills is initially treated in

lagoons before being applied to trenches located between rows of

palm trees. Once the effluent dries up, it becomes organic

fertilizer for the oil palm and reduces the application and buying

of inorganic fertilizers. In some estates, EFB are applied to land

where it biodegrades to fertilizers. Through the application of a

combination of EFB, organic fertilisers from mill by-products and

inorganic fertilisers, the Group is able to raise the fertility of

sandy soil in Kalimantan plantations.

The Group's first biogas and biomass project in North Sumatera

completed last year will enhance the waste management treatment in

the mill and at the same time mitigate greenhouse biogas emissions.

The methane gas trapped will be used to generate and supply power

to its biomass plant without dependency on fossil fuel. Another

biogas plant is being constructed at the new mill in Kalimantan.

Further similar undertakings for the Group's mills are planned and

shall be implemented in stages. The Group intends to sell surplus

power generated to the National Grid.

The Group is committed to implementing good agricultural

practices as spelled out in its standard operating procedures for

the planting of oil palm. Integrated Pest Management has been

adopted to control pests and to improve biological balance.

Barn Owls were introduced to control rats. Beneficial plants of

Turnerasp, Cassia cobannesis and Antigononleptosus were planted to

attract natural predators for biological control of bagworms and

leaf-eating caterpillars. Weeds are controlled selectively by using

more environmental friendly herbicide such as Glyphosate.

The usage of Paraquat herbicide and chemicals has been reduced

and minimized to control weeds and vermins. The sprayers are also

trained in safety and spraying techniques. The chemicals are kept

in designated storage and examined at regular intervals. Employees

who handled the use of chemicals undergo medical examination.

Natural vegetation on uncultivable land such as deep peat, very

steep areas and riparian zones along watercourses are maintained to

preserve biodiversity and wildlife corridors.

Two mills in the Bengkulu region have been installed with

Extended Aeration to enhance the treatment of the mill effluent by

mechanical aeration.

All our mills utilize the waste mesocarp fibre from the oil palm

fruits as fuel to generate steam from boilers to eventually produce

power from steam turbines. The power generated drives all of the

processing equipment in mills and estate housing. This helps to

reduce reliance on fossil fuel such as diesel in our milling

operations.

The Group continues to comply and preserve the High Conservative

Value ("HCV") areas recognised by the Department of Forestry.

Principal risks and uncertainties

The Group's business involves risks and uncertainties of which

the Directors currently consider the following to be material.

There are or may be other risks and uncertainties faced by the

Group that the Directors currently deem immaterial, or of which

they are unaware, that may have a material adverse impact on the

Group. The Board carries out a robust assessment of the principal

risks facing the Group on an annual basis.

Nature of the The likelihood Mitigating or

risk and its origin and impact of other relevant

the risk and considerations

the circumstances

under which the

risk might be

most relevant

to the Company

----------------------------- -------------------------- -------------------------------

Country and regulatory

----------------------------- -------------------------- -------------------------------

The Group's operations Political upheaval The country has

are located substantially and deterioration recently benefited

in Indonesia and in security situation from a period

therefore significantly may cause disruption of relative political

rely on economic on operation stability, steady

and political and consequently economic growth

stability in Indonesia. financial loss. and stable financial

system. But during

the Asian financial

crisis in late

1990 there were

civil unrest

attributed to

ethnic tensions

in some parts

of Indonesia.

But the Group

operations were

not interrupted

by the regional

security problems.

----------------------------- -------------------------- -------------------------------

Introduction of Transfer of profit The Board is

measures to rein from Indonesia not aware of

in the country's to UK will be any attempt by

fiscal deficits. restricted affecting the government

This included servicing of to impose exchange

the exchange controls UK obligations controls that

and restriction and payment of would restrict

on repatriation dividends to the transfer

of profit through shareholders. of profits from

payment of dividend. Indonesia to

the UK. The Board

perceives that

the Group will

be able to continue

to extract profits

from its subsidiaries

in Indonesia

for the foreseeable

future.

----------------------------- -------------------------- -------------------------------

The Group acquires Any changes in There are several

the land exploitation law and regulations more years before

rights ("HGU") relating to land the first HGU

after paying land tenure could is due for renewal

acquisition and have negative in 2023. There

HGU processing impact on the are no reasons

costs. These costs Group's activities. for the Directors

are capitalized to believe that

(MORE TO FOLLOW) Dow Jones Newswires

April 26, 2016 11:00 ET (15:00 GMT)

as land asset the HGU will

costs since the not be renewed

asset characteristics upon expiration

fulfill the recognition by complying

criteria. The with existing

Group holds its law and regulations.

land under 25

or 35 year renewable

leases.

----------------------------- -------------------------- -------------------------------

Changes in land Mandatory reduction The Group realize

legislation. Based of foreign ownership that there is

on National Land in Indonesian a possibility

Agency Law 2 / plantations. that foreign

1999, mandatory Forced divestment owners may be

restriction to of interests required over

land ownership in Indonesia time to partially

by non-state plantation at below market divest ownership

companies and values. of Indonesia

companies not oil palm operations

listed in Indonesia but has no reason

to 20,000ha per to believe that

province and a such divestment

total of 100,000ha would be anything

in Indonesia. other than at

market value.

----------------------------- -------------------------- -------------------------------

Group failure Reputational The Group continues

to meet the standards damage and criminal to maintain strong

expected in relation sanctions. controls in this

to bribery and area as Indonesia

corruption. has been classified

as relatively

high risk by

the International

Transparency

Corruption Perceptions

index.

----------------------------- -------------------------- -------------------------------

Exchange rates

----------------------------- -------------------------- -------------------------------

CPO is a US Dollar Adverse movements The Board has

denominated commodity of Rupiah against taken the view

and a significant US Dollar can that these risks

proportion of have a negative are inherent

revenue costs effect on the in the business

in Indonesia (such operating costs and feels that

as fertiliser and raise funding adopting hedging

and fuel) and cost. mechanisms to

development costs counter the negative

(such as heavy effects of foreign

machinery and exchange volatility

mills equipment) are both difficult

are imported and to achieve and

are US Dollar would not be

related. cost effective.

----------------------------- -------------------------- -------------------------------

Weather and natural

disasters

----------------------------- -------------------------- -------------------------------

Oil palms rely Dry periods, Where appropriate,

on regular sunshine in particular, bunding is built

and rainfall but will affect yields around flood

these weather in the short prone areas and

patterns can vary and medium terms. canals/drainage

and extremes such Drought induces constructed and

as unusual dry moisture stress adapted either

periods or, conversely, in palm trees. to evacuate surplus

heavy rainfall High levels of water or to maintain

leading to flooding rainfall can water levels

in some locations disrupt estate in areas quick

can occur. operations and to dry out. Where

result in harvesting practical, natural

delays with loss disasters are

of oil palm fruits covered by insurance

or deterioration policy. Certain

in fruit quality. risks (including

Any delay in the risk of crop

collection of loss through

harvested FFB fire, earthquake,

during the rainy flood and other

season could perils potentially

raise the level affecting the

of free fatty planted areas

acid ("FFA") on the Group's

in the CPO. CPO estates) if they

with higher level materialise could

of FFA will be dent the potential

sold at a discount revenues, for

to market prices. which insurance

Low level of cover is either

sunshine could not available

result in delay or would in the

in formation opinion of the

of FFB resulting Directors be

in potential disproportionately

loss of revenue. expensive, are

not insured.

These risks of

floods or haze

are mitigated

by the geographical

spread of the

plantations but

an occurrence

of an adverse

uninsured event

could result

in the Group

sustaining material

losses.

----------------------------- -------------------------- -------------------------------

Cultivation risks

----------------------------- -------------------------- -------------------------------

The Group's plantations Loss of crops Agricultural

may be affected or reduction best practice

by pests and diseases in the quality and husbandry

like ganoderma of harvest resulting can to some extent

fungus and white in loss of potential mitigate these

rot. Crop damages revenue. risks but they

by oryctes beetles, cannot be entirely

nettie caterpillar, eliminated. The

termites, vermins, spread of majority

elephants and of the plantations

wild boars are over Sumatera

common. and Kalimantan

mitigates the

risks affecting

the entire Group.

----------------------------- -------------------------- -------------------------------

Other operational

factors

----------------------------- -------------------------- -------------------------------

The Group's plantation With the removal Whilst the Directors

(MORE TO FOLLOW) Dow Jones Newswires

April 26, 2016 11:00 ET (15:00 GMT)

productivity is of fuel subsidy have no reason

dependent upon by the Indonesian to anticipate

necessary inputs, government in shortages of

including, in January 2015, such inputs,

particular fertiliser, diesel will be the Group's investment

spare-parts, chemicals priced in accordance in biogas plants

and fuel. to global oil will reduce reliance

prices. When on fossil fuel

global oil prices for the mill

rise, it will operations.

put pressure

on production

inputs which

include cost

of electricity

to the mills

and the transportation

of FFB. Group's

operations could

be materially

disrupted should

such shortages

occur over an

extended period.

Increase in prices

would significantly

increase production

costs.

----------------------------- -------------------------- -------------------------------

The Group has This would likely The Group bulk

bulk storage facilities force a temporary storage facilities

located within halt in FFB processing have substantial

its mills which resulting in capacity. Furthermore

are adequate to loss of crop these facilities

meet the Group's and revenue. have always being

requirements for adequate for

CPO storage. Nevertheless, the mills production

delays in collection storage in the

of CPO sold could past.

result in CPO

production exceeding

the available

CPO storage capacity.

----------------------------- -------------------------- -------------------------------

Substantial increases Regional hikes The Group endeavours

in governmental in minimum wages to improve productivity

directed minimum for 2016 averaged of field workers

wage levels in 10.4%. The Group to justify the

Indonesia. pays no less increase in wages.

than the minimum Field workers

wage and the are employed

increase will on part-time

result in a significant basis.

rise in Group's

employment costs.

Higher wages

will erode the

profitability

as it forms a

substantial part

of the production

costs.

----------------------------- -------------------------- -------------------------------

Produce prices

----------------------------- -------------------------- -------------------------------

CPO is a primary This may lead Directors believe

commodity and to significant that such swings

is affected by price swings. should be moderated

the world economy, The profitability by continuous

levels of inflation, and cash flow demand in economies

availability of of the plantation like China, India

alternative soft operations depend and Indonesia.

oils such as soya upon world prices Larger export

oils. CPO price of CPO and upon would lead to

also moves in the Group's ability lower inventory

tandem with crude to sell CPO at of CPO which

oil prices which price levels augurs well for

determines the comparable with future produce

competitiveness world prices. price.

of CPO as a source

of biodiesel.

----------------------------- -------------------------- -------------------------------

Imposition of Reduced revenue The Indonesian

import controls and reduction government allows

or taxes in consuming in cash flow free export of

and exporting and profit. When CPO but applies

countries. The CPO price is a sliding scale

Indonesian government below $750/mt, of duties on

in July 2015 imposes the export tax exports which

a $50/mt export levy will impact allows producers

levy to fund biodiesel upon the Group's economic margins.

subsidies. It profit. When The export levy

also introduced CPO price recovers may be regarded

a simpler export to above $750/mt, as a measure

tax system expressed the effective to support CPO

in US dollar instead tax rate will producers through

of a percentage be lower providing increase in biodiesel

of CPO price. some relief to consumption.

planters.

----------------------------- -------------------------- -------------------------------

Environmental and governance practices

------------------------------------------------------------------------------------------

The ISPO which Environment pollutions The Directors

fundamentally and criticism take seriously

aligns with RSPO by environmental their environmental

principles became activists resulting and social responsibilities.

the mandatory in reputational Management follows

standard for all and financial industry best-practice

Indonesian planters damage. guidelines and

in March 2012. abides by Indonesian

law with regard

to such matters

as health and

safety. The Group

uses EFB for

mulching in the

estates which

is a form of

fertiliser and

reduces the consumption

of inorganic

fertilisers.

The liquid effluent

from the mills

after treatment

is applied to

trenches in the

estates as a

form of fertiliser.

The biogas plant

in North Sumatera

will mitigate

emissions of

biogas. Environmental

impact assessment

is undertaken

by an independent

consultant for

its new project.

----------------------------- -------------------------- -------------------------------

Expansion

----------------------------- -------------------------- -------------------------------

The Group is planning The Group compensates It is rather

to plant more the settlers difficult to

(MORE TO FOLLOW) Dow Jones Newswires

April 26, 2016 11:00 ET (15:00 GMT)

oil palm. In areas and land owners foresee with

where the Group in a transparent reliable accuracy

holds the land and fair way. what area will

compensation rights The negotiation be available

(or Izin lokasi), for compensation for planting

the settlers and can, however out of the total

land owners are involve a considerable area covered

compensated before number of local by land rights.

land is cleared individuals with Much depends

for planting. similar ownership upon the success

claims and this of negotiations

can cause difficulties with settlers

in reaching agreement and land owners

with all affected and satisfactory

parties. Such resolution of

disruptions have land title issue.

in the past caused The Group has

delays to the to-date mixed

planting programmes success in managing

and consequently such periodic

financial loss. delays and disruptions

especially in

South Sumatera,

Bengkulu, Bangka

and Kalimantan.

----------------------------- -------------------------- -------------------------------

The Directors Should land or The Group has

believe that when cash availability fair amount of

the land becomes fall short of cash holding

available for expectations to fund planting

planting, the and the Group exercise. The

development programmes is unable to Group aims to

can be funded secure alternative manage its finances

from available land or funding, conservatively

Group cash resources the Group's continued to ensure that

and future operational growth may be it is able to

cash flows, supplemented delayed or curtailed. fund the planned

with external This may lead planting programme.

debt funding. to reduction

Profitability of reported profit

of new sizable and adverse market

plantations requires perceptions as

a period of between to the value

six and seven of the Company's

years before cash shares.

flow turns positive.

Because oil palms

do not begin yielding

significantly

until four years

after planting,

this development

period and the

cash requirement

is affected by

changes in commodity

prices.

----------------------------- -------------------------- -------------------------------

Hedging risk

------------------------------------------------------------------------------------------

The Group's subsidiaries The Group could Risk is partially

have borrowing face significant mitigated by

in US Dollar. exchange losses US Dollar denominated

in the event cash balances.

of depreciation It also considers

of their local the average interest

currency (i.e. rate on Rupiah

Strengthening deposits which

of US Dollar) is 7.47% higher

- and vice versa. than on US Dollar

deposits whereas

interest rate

for Rupiah borrowing

is about 6.65%

higher as compared

to US Dollar

borrowing.

----------------------------- -------------------------- -------------------------------

Social, community and human rights issues

------------------------------------------------------------------------------------------

Any material breakdown Communication The Group endeavours

in relations between breakdown would to mitigate this

the Group and cause disruption risk by liaising

the host population on operation regularly with

in the vicinity and consequently representatives

of the operations financial loss. of surrounding

could disrupt villages and

the Group's operations. by seeking to

The plantations improve local

hire large numbers living standards

of people and through mutually

have significant beneficial economic

economic importance and social interaction

for local communities with the local

in the areas of villages. In

the Group's operations. particular, the

Group, when possible,

gives priority

to applications

for employment

from members

of the local

population and

supports specific

initiatives to

encourage local

farmers and tradesmen

to act as suppliers

to the Group,

its employees

and their dependents.

The Group spends

considerable

sums of money

constructing

new roads and

bridges and maintaining

existing roads

used by villagers.

The Group also

provides technical

and management

expertise to

villagers to

develop oil palm

plots or Kebun

Kas Desa (village's

scheme) and plasma

schemes surrounding

the operating

estates. The

returns from

these plots are

used to improve

villages' community

welfare.

----------------------------- -------------------------- -------------------------------

Interest rate risk

------------------------------------------------------------------------------------------

The Group's surplus The Group had There is no policy

cash and its borrowings net cash throughout to hedge interest

(MORE TO FOLLOW) Dow Jones Newswires

April 26, 2016 11:00 ET (15:00 GMT)

are subject to 2015, so the rates, partly

variable interest effect of variations because of the

rates. in borrowing net cash position

rates is more and because the

than offset. net interest

A 1% change in is relatively

the borrowing small proportion

or deposit interest of the Group

rate would not profits.

have a significant

impact on the

Group's reported

results.

----------------------------- -------------------------- -------------------------------

Gender diversity

The AEP Plc Board is composed of three men and one woman with

extensive knowledge in their respective fields of experience. The

Board has taken note of the recent legislative initiatives with

regard to the representation of women on the boards of Directors of

listed companies and will make every effort to conform to its

composition based on legislative requirement.

2015 average employed

during the year

Group Headcount Women Men Total

Board 2 14 16

Senior Management

(GM and Above) - 8 8

Managers & Executives 30 369 399

Full Time 314 5,095 5,409

Part-time Field Workers 4,745 6,235 10,980

Total 5,091 11,721 16,812

% 30% 70% 100%

2014 average employed

during the year

Group Headcount Women Men Total

Board 2 14 16

Senior Management

(GM and Above) - 8 8

Managers & Executives 23 363 386

Full Time 168 4,944 5,112

Part-time Field Workers 3,005 6,682 9,687

Total 3,198 12,011 15,209

% 21% 79% 100%

Although the Group provides equal opportunities for female

workers in the plantations, the male workers make up a majority of

the field workers due to the nature of work and the remote location

of plantations from the towns and cities. Nevertheless the

percentage of women workforce within the Group increased from 21%

in 2014 to 30% in 2015.

Employees

In 2015, the number of full time workforce averaged 5,832 (2014:

5,522) while the part-time labour averaged 10,980 (2014:

9,687).

The Group has formal processes for recruitment particularly key

managerial positions, where psychometric testing is conducted to

support the selection and hiring decisions. Exit interviews are

also conducted with departing employees to ensure that management

can address any significant issues.

The Group has a programme for recruiting graduates from

Indonesian universities to join existing employees selected on

regular basis to training programmes organised by the Group's

training centre that provides grounding and refresher courses in

technical aspects of oil palm estate and mill management. The

training centre also conducts regular programmes for all levels of

employees to raise the competency and quality of employees in

general. These programmes are often supplemented by external

management development courses including attending industry

conferences for technical updates. A wide variety of topics are

covered including work ethics, motivation, self-improvement,

company values, health and safety.

A large workforce and their families are housed in the Group's

housing across the Group's plantations. The Group further provides

at its own cost water and electricity and a host of other amenities

including places of worship, schools and clinics. On top of

competitive salaries and bonuses, extensive benefits and privileges

help the Group to retain and motivate its employees.

The Group promotes a policy for creation of equal and ethnically

diverse employment opportunities including with respect to

gender.

The Group has in place key performance linked indicators to

determine increment and bonus entitlements for its employees.

The Group promotes and encourages employee involvement in every

aspect wherever practical as it recognises employees as a valuable

asset and is one of the key contributions to the Group's success.

The employees contribute their ideas, feedback and voice out their

concerns through formal and informal meetings, discussions and

annual performance appraisal. In addition, various work related and

personal training programmes are carried out annually for employees

to promote employee engagement and interaction.

Although the Group does not have a specific policy on employment

of disabled persons, it however employs disabled persons as part of

its workforce. The Group welcomes disabled persons joining the

Group based on their suitability.

Outlook

FFB production for three months to March 2016 was 9% higher

against the same period in 2015 mainly due to the increase in

production from Kalimantan region. It is too early to forecast

whether the production will be better for the rest of the year.

The CPO CIF (Cost, Insurance, Freight) Rotterdam price opened

the year 2016 at $570/mt and prices are expected to be in the range

of $500/mt to $750/mt for the first half of 2016. CPO price is

likely to recover if a significant drop in crop production

materialises due to the effects of El Nino in 2015.

It was reported that the US Dollar appreciated by approximately

11% (2014: +2%) against the Indonesian Rupiah in 2015 in

anticipation of an interest rate hike in the United States and the

weak emerging economies. The Rupiah has since strengthened by 4% in

2016 which makes palm oil more expensive for importers.

The continuing rise in income levels and population growth in

China, India and Indonesia would expect to drive the consumption of

CPO and likely lead to a gradual recovery in CPO prices. The

Indonesian and Malaysian government efforts to rein in fiscal

deficits by introducing higher mandatory blending of biodiesel

could provide some price support.

The rising material costs and wages in Indonesia are expected to

increase the overall production cost in 2016. Indonesia's minimum

wage has increased at an average rate of between 8% and 15% per

annum over the last few years. The Indonesian government recently

announced regional hikes in 2016 minimum wage ranging from 7% in

Bengkulu to 12% in South Sumatera. These wage hikes will raise

overall estate costs and erode profit margins. A depreciating

Rupiah would also mean that imports of fertilisers and equipment

for the mills and estates will be more costly.

Nevertheless barring any unforeseen circumstances, the Group is

confident that CPO demand will be sustainable in the long term on

the backdrop of global economic recovery and we can expect a

satisfactory profit level and cash flow for 2016.

On behalf of the Board

Dato' John Lim Ewe Chuan

Executive Director, Corporate Finance and Corporate Affairs

26 April 2016

Consolidated Income Statement

For the year ended 31 December 2015

2015 2014

Result Result

Continuing before BA before BA

operations Note BA adjustment adjustment Total BA adjustment adjustment Total

$000 $000 $000 $000 $000 $000

------------------ ------- --------------- -------------- ----------- --------------- -------------- ----------

Revenue 2 196,451 - 196,451 251,258 - 251,258

Cost of sales (145,897) - (145,897) (164,666) - (164,666)

------------------ ------- --------------- -------------- ----------- --------------- -------------- ----------

Gross profit 50,554 - 50,554 86,592 - 86,592

Biological asset

revaluation

movement - (64,121) (64,121) - (33,718) (33,718)

Administration

expenses (7,826) - (7,826) (7,747) - (7,747)

------------------ ------- --------------- -------------- ----------- --------------- -------------- ----------

Operating profit

/ (loss) 42,728 (64,121) (21,393) 78,845 (33,718) 45,127

Exchange (losses)

/ gains (2,354) - (2,354) 852 - 852

Finance income 3 6,683 - 6,683 7,276 - 7,276

Finance expense 3 (2,010) - (2,010) (2,019) - (2,019)

------------------ ------- --------------- -------------- ----------- --------------- -------------- ----------

Profit / (Loss)

before tax 4 45,047 (64,121) (19,074) 84,954 (33,718) 51,236

Tax expense (10,385) 16,030 5,645 (20,967) 8,429 (12,538)

(MORE TO FOLLOW) Dow Jones Newswires

April 26, 2016 11:00 ET (15:00 GMT)

------------------ ------- --------------- -------------- ----------- --------------- -------------- ----------

Profit / (Loss)

for the year 34,662 (48,091) (13,429) 63,987 (25,289) 38,698

------------------ ------- --------------- -------------- ----------- --------------- -------------- ----------

Attributable to:

- Owners of the

parent 27,505 (42,402) (14,897) 52,422 (21,660) 30,762

-

Non-controlling

interests 7,157 (5,689) 1,468 11,565 (3,629) 7,936

------------------ ------- --------------- -------------- ----------- --------------- -------------- ----------

34,662 (48,091) (13,429) 63,987 (25,289) 38,698

------------------ ------- --------------- -------------- ----------- --------------- -------------- ----------

Earnings per

share

for profit /

(loss)

attributable to

the owners of

the parent

during

the year

7 (37.58)cts 77.61cts

* basic

7 (37.58)cts 77.53cts

* diluted

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2015

2015 2014

$000 $000

-------------------------------------------- ------------ --- ------------

Profit / (Loss) for the year (13,429) 38,698

-------------------------------------------- ------------ --- ------------

Other comprehensive income / (expense):

Items may be reclassified to profit

or loss:

Loss on exchange translation

of foreign operations (54,595) (12,019)

Net other comprehensive expense

may be reclassified to profit

or loss (54,595) (12,019)

-------------------------------------------- ------------ --- ------------

Items not to be reclassified to

profit or loss:

Unrealised gain on revaluation

of leasehold land 4,902 386

Deferred tax on revaluation of

leasehold land (1,226) (96)

Remeasurement of retirement benefits

plan 445 (680)

Deferred tax on retirement benefits (111) 170

Net other comprehensive income

/ (expense) not being reclassified

to profit or loss 4,010 (220)

-------------------------------------------- ------------ --- ------------

Total other comprehensive expenses

for the year, net of tax (50,585) (12,239)

Total comprehensive (expense)

/ income for the year (64,014) 26,459

Attributable to:

- Owners of the parent (56,016) 21,188

- Non-controlling interests (7,998) 5,271

-------------------------------------------- ------------ --- ------------

(64,014) 26,459

-------------------------------------------- ------------ --- ------------

Consolidated Statement of Financial Position

As at 31 December 2015

2015 2014

Note $000 $000

-------------------------------- ------ ----------- -----------

Non-current assets

Biological assets 9 179,010 251,374

Property, plant and equipment 9 219,990 227,380

Receivables 3,655 3,007

Deferred tax assets 8,021 3,982

410,676 485,743

-------------------------------- ------ ----------- -----------

Current assets

Inventories 6,693 7,846

Tax receivables 16,679 9,231

Trade and other receivables 4,704 8,807

Cash and cash equivalents 104,614 125,937

132,690 151,821

-------------------------------- ------ ----------- -----------

Current liabilities

Loans and borrowings (1,750) (313)

Trade and other payables (17,406) (21,010)

Tax liabilities (5,917) (10,752)

Dividend payables - (20)

(25,073) (32,095)

-------------------------------- ------ ----------- -----------

Net current assets 107,617 119,726

-------------------------------- ------ ----------- -----------

Non- current liabilities

Loans and borrowings (32,875) (34,625)

Deferred tax liabilities (28,932) (48,350)

Retirement benefits - net

liabilities (4,528) (4,445)

-------------------------------- ------ ----------- -----------

(66,335) (87,420)

-------------------------------- ------ ----------- -----------

Net assets 451,958 518,049

-------------------------------- ------ ----------- -----------

Issued capital and reserves

attributable to owners of

the parent

Share capital 15,504 15,504

Treasury shares (1,171) (1,171)

Share premium 23,935 23,935

Capital redemption reserve 1,087 1,087

Revaluation reserves 59,594 57,029

Exchange reserves (234,490) (190,503)

Retained earnings 504,892 521,355

-------------------------------- ------ ----------- -----------

369,351 427,236

Non-controlling interests 82,607 90,813

-------------------------------- ------ ----------- -----------

Total equity 451,958 518,049

-------------------------------- ------ ----------- -----------

Consolidated Statement of Changes in Equity

For the year ended 31 December 2015

Capital Foreign

Share Treasury Share redemption Revaluation exchange Retained Non-controlling Total

capital shares premium reserve reserve reserve earnings Total interests equity

$000 $000 $000 $000 $000 $000 $000 $000 $000 $000

Balance at 31 December

2013 15,504 (1,171) 23,935 1,087 56,767 (181,107) 493,031 408,046 85,964 494,010

Items of other comprehensive

income

-Unrealised gain on revaluation

of leasehold land, net

of tax - - - - 262 - - 262 28 290

-Remeasurement of retirement

benefit plan, net of tax - - - - - - (440) (440) (70) (510)

-Loss on exchange translation

of foreign operations - - - - - (9,396) - (9,396) (2,623) (12,019)

--------------------------------------------------------- -------- --------- -------- ----------- ------------ ---------- --------- --------- ---------------- ---------

Total other comprehensive

income / (expenses) - - - - 262 (9,396) (440) (9,574) (2,665) (12,239)

Profit for the year - - - - - - 30,762 30,762 7,936 38,698

--------------------------------------------------------- -------- --------- -------- ----------- ------------ ---------- --------- --------- ---------------- ---------

Total comprehensive income

and expenses for the year - - - - 262 (9,396) 30,322 21,188 5,271 26,459

Dividends paid - - - - - - (1,998) (1,998) (422) (2,420)

--------------------------------------------------------- -------- --------- -------- ----------- ------------ ---------- --------- --------- ---------------- ---------

Balance at 31 December

(MORE TO FOLLOW) Dow Jones Newswires

April 26, 2016 11:00 ET (15:00 GMT)

2014 15,504 (1,171) 23,935 1,087 57,029 (190,503) 521,355 427,236 90,813 518,049

--------------------------------------------------------- -------- --------- -------- ----------- ------------ ---------- --------- --------- ---------------- ---------

Items of other comprehensive

income

* Unrealised gain on revaluation of leasehold land,

net

of tax - - - - 2,565 - - 2,565 1,111 3,676

-Remeasurement of retirement

benefit plan, net of tax - - - - - - 303 303 31 334

-Loss on exchange translation

of foreign operations - - - - - (43,987) - (43,987) (10,608) (54,595)

--------------------------------------------------------- -------- --------- -------- ----------- ------------ ---------- --------- --------- ---------------- ---------

Total other comprehensive

income / (expenses) - - - - 2,565 (43,987) 303 (41,119) (9,466) (50,585)

(Loss) / Profit for the

year - - - - - - (14,897) (14,897) 1,468 (13,429)

--------------------------------------------------------- -------- --------- -------- ----------- ------------ ---------- --------- --------- ---------------- ---------

Total comprehensive income

and expenses for the year - - - - 2,565 (43,987) (14,594) (56,016) (7,998) (64,014)

Dividends paid - - - - - - (1,869) (1,869) (208) (2,077)

--------------------------------------------------------- -------- --------- -------- ----------- ------------ ---------- --------- --------- ---------------- ---------

Balance at 31 December

2015 15,504 (1,171) 23,935 1,087 59,594 (234,490) 504,892 369,351 82,607 451,958

--------------------------------------------------------- -------- --------- -------- ----------- ------------ ---------- --------- --------- ---------------- ---------

Consolidated Statement of Cash Flows

For the year ended 31 December 2015

2015 2014

$000 $000

------------------------------------------- --------- ---------

Cash flows from operating activities

(Loss) / Profit before tax (19,074) 51,236

Adjustments for:

BA adjustment 64,121 33,718

(Profit) / Loss on disposal

of tangible fixed assets (111) 36

Depreciation 6,768 6,833

Retirement benefit provisions 973 951

Net finance income (4,673) (5,257)

Unrealised loss / (gain) in

foreign exchange 2,354 (852)

Property, plant and equipment

written off 1,708 135

Operating cash flow before changes

in working capital 52,066 86,800

Decrease in inventories 341 451

Decrease in non-current, trade

and other receivables 4,425 664

(Decrease) / Increase in trade

and other payables (1,623) 5,929

------------------------------------------- --------- ---------

Cash inflow from operations 55,209 93,844

Interest paid (2,010) (2,019)

Retirement benefit paid (103) (61)

Overseas tax paid (27,856) (17,756)

------------------------------------------- --------- ---------

Net cash flow from operations 25,240 74,008

------------------------------------------- --------- ---------

Investing activities

Property, plant and equipment

* purchase (38,555) (49,754)

* sale 979 156

Interest received 6,683 7,276

------------------------------------------- --------- ---------

Net cash used in investing activities (30,893) (42,322)

------------------------------------------- --------- ---------

Financing activities

Dividends paid by Company (1,869) (1,998)

Finance lease repayment - (20)

Dividends paid to minority shareholders (228) (402)

Repayment of existing long term

loans (313) (63)

------------------------------------------- --------- ---------

Net cash (used in) / from financing

activities (2,410) (2,483)

------------------------------------------- --------- ---------

(Decrease) / Increase in cash

and cash equivalents (8,063) 29,203

Cash and cash equivalents

At beginning of year 125,937 98,738

Foreign exchange (13,260) (2,004)

------------------------------------------- --------- ---------

At end of year 104,614 125,937

------------------------------------------- --------- ---------

Comprising:

Cash at end of year 104,614 125,937

------------------------------------------- --------- ---------

Notes

1 Accounting policies

Anglo-Eastern Plantations Plc ("AEP") is a company incorporated

in the United Kingdom under the Companies Act 2006 and is listed on

the London Stock Exchange. The registered office of AEP is located

at Quadrant House, 6(th) Floor, 4 Thomas More Square, London E1W

1YW, United Kingdom. The principal activity of the Group is

plantation agriculture.

The financial information set out below does not constitute the

company's statutory accounts for 2015 or 2014. Statutory accounts

for the years ended 31 December 2015 and 31 December 2014 have been

reported on by the Independent Auditors. The Independent Auditors'

Reports on the Annual Report and Financial Statements for the years

ended 31 December 2015 and 31 December 2014 were unqualified, did

not draw attention to any matters by way of emphasis, and did not

contain a statement under 498(2) or 498(3) of the Companies Act

2006.