Anglesey Mining PLC Parys Mountain Project Update

September 08 2017 - 2:00AM

UK Regulatory

TIDMAYM

8th September 2017 LSE:AYM

Parys Mountain Project Update

Planning for production in 2020

Anglesey Mining plc ("Anglesey" or the "Company") is pleased to provide the

following update on the Parys Mountain project in North Wales.

On 24th July 2017, Anglesey reported on the Scoping Study completed by Micon

International Limited and Fairport Engineering Limited. The financial figures

used in the Scoping Study were based on metal prices prevailing at that time.

Since July all the metals to be produced at Parys Mountain have increased in

price with copper at $3.10/lb compared to $2.50/lb in the Scoping Study, zinc

has increased to $1.40/lb compared to $1.25/lb in the Study and lead has moved

to $1.09/lb compared to $1.00. There has also been upward movement in both

gold and silver. In contrast, the pound has strengthened somewhat against the

US dollar and is now trading around $US1.30 to GBP1.00 compared to $US1.25 in the

Study.

The overall impact of these changes would be very positive on the pre-tax NPV

and IRR.

The fundamentals underlying the recent increases in these metal prices are well

founded and are likely to continue to support upward growth through the next

several years.

Anglesey believes that it is now opportune to progress a number of steps to

move the Parys Mountain project forward with the expectation that financing can

be obtained and the project developed to production as soon as practicable.

The major steps to be taken in the short term will include:

* Commencement of an Environmental Impact Assessment

* Conversion of the Scoping Study to a Definitive Feasibility Study

* Recruitment of key corporate staff

* Discussions with potential providers of project finance, including

investment funds, metal traders, smelters and banks

It is planned to immediately commence all of these steps with the hope that a

Definitive Feasibility Study, including an Environmental Impact Assessment, can

be completed in the first half of 2018 so that meaningful project financing

discussions can take place immediately thereafter. It is the intention of the

Company to bring in new personnel into key positions to drive these matters

forward and move the project and the Company to a successful long-term future.

The Company has adequate funds to initiate these steps and continue its normal

corporate and limited site operations but will need to raise some additional

funding to complete these development targets. This will not likely involve

significant dilution for current shareholders.

Providing this timetable can be met and discussions on project financing are

well advanced by the middle of next year, it would be possible for project

construction to commence before the end of 2018 with initial production

targeted for the first half of 2020.

Parys Mountain Project

The Parys Mountain Scoping Study base case envisages a mining rate of 1,000

tonnes per day, to produce an average annual output of 12,500 tonnes of zinc

concentrate at 57% Zn, 6,400 tonnes of lead concentrate at 52% Pb and 3,500

tonnes of copper concentrate at 25% Cu, annually, over an initial mine life of

eight years.

The overall net smelter return (NSR) for the three concentrates, including the

silver and gold precious metals contributions, is expected to total more than

$270 million at the forecast metal prices used for the base case.

The base case yields a pre-tax net present value of $33.2 million, or GBP26.6

million, at a conservative 10 per cent discount rate, using metal prices of

$1.25 per pound for zinc, $1.00 per pound for lead, $2.50 per pound for copper,

$17.50 per ounce for silver and $1,275 per ounce for gold and at an exchange

rate of GBP1.00 = $US1.25. With an estimated pre-production capital cost of $53

million, or GBP42 million, this results in an indicated internal rate of return

(IRR) of 28.3%.

Using longer term metal price projections of $1.35 per pound for zinc and $3.00

per pound for copper the NPV10 would be $43.2 million, or GBP34.6 million. At an

8% discount rate, used to reflect the relatively low risks of the project given

its advanced level of development and low political risk in the UK, the NPV8

would be enhanced to $41 million, or GBP32.8 million, for the base case metal

price scenario and to $53 million, or GBP42 million, for the higher longer-term

metal prices, with an IRR of 33%.

Importantly, the Scoping Study was based on only the 2.1 million tonnes of

indicated resources reported by Micon in 2012. Micon had also reported a

further 4.1 million tonnes of inferred resources which were not incorporated

into the Scoping Study. It is expected that a high proportion of these

inferred resources will be converted to indicated probable reserves once

exploration drilling from underground takes place. These additional resources

would be processed through the same concentrator plant and would significantly

increase the projected life of the mine, to perhaps double the projected

mine-life to 15 or 18 years, and enhance the NPV.

About Anglesey Mining plc

Anglesey is carrying out development and exploration work at its 100% owned

Parys Mountain zinc-copper-lead deposit in North Wales, UK with a reported

resource of 2.1 million tonnes at 6.9% combined base metals in the indicated

category and 4.1 million tonnes at 5.0% combined base metals in the inferred

category.

Anglesey also holds a 6% interest and management rights to the Grangesberg Iron

project in Sweden, together with a right of first refusal to increase its

interest by a further 51%. Anglesey also holds 11.8% of Labrador Iron Mines

Holdings Limited which has direct shipping iron ore deposits in Labrador and

Quebec.

For further information, please contact:

Bill Hooley, Chief Executive +44 (0)7785 572517

Danesh Varma, Finance Director +44 (0)207 653 9881

Elliot Hance, Beaufort Securities +44 (0)207 382 8300

END

(END) Dow Jones Newswires

September 08, 2017 02:00 ET (06:00 GMT)

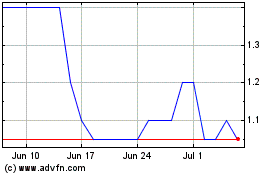

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anglesey Mining (LSE:AYM)

Historical Stock Chart

From Apr 2023 to Apr 2024