Tonnes

Cu Head of Recovered Pt Grade

Grade % 0.15 Co t 6,482 in Concentrate g 1.29

---------------- --- ------------ -------------- ----------- ----------------- ----------

Recovery Pd Grade

Cu Delivered t 138,506 of Pt % 69.00% in Concentrate g 1.547

---------------- --- ------------ -------------- ----------- ----------------- ----------

Grams

Co Head of Recovered

Grade % 0.01 Pt g 8,139,386

---------------- --- ------------ -------------- -----------

Recovery

Co Delivered t 9,821 of Pd % 75%

---------------- --- ------------ -------------- -----------

Grams

Pt Head of Recovered

Grade % 0.13 Pd g 9,266,459

---------------- --- ------------ -------------- -----------

Pt Delivered g 11,796,212

---------------- --- ------------

Pd Head

Grade % 0.14

---------------- --- ------------

Pd Delivered g 12,355,279

---------------- --- ------------

%MgO % 14.9

---------------- --- ------------

%S % 1.2

---------------- --- ------------

Total Material

Mined t 220,450,000

---------------- --- ------------

The concentrate will be transported by truck fleet from the site

to the rail siding on the Baikal Amur rail line located

approximately 320 road kilometres to the west. Supplies and fuel

will be backhauled to the site.

The most critical component to the Blueprint was the decision to

construct and operate a captive smelter located adjacent the BAM

rail line. This location provides access to coal and limestone

necessary to smelt the concentrate. It also allows the Company to

capture the revenue generated from all metals, whereas toll

smelting revenues are limited to only 70% of the nickel and 50% of

the copper and nothing from any of the by-product metals. Penalties

and transport fees are also incurred. The capital cost for the

construction of the smelter and attendant refinery are substantial,

however, the PEA results indicated that the additional revenues

more than offset the cost and ultimately provide a higher Net

Present Value for the global Kun-Manie operation.

Input Parameters and Financial Projections

The pro forma cash flow model for the Operational Blueprint

newly estimated Q1 2015 operating costs. Updated capital cost

estimates reflect the increased nominal production rate of 6.0

million tonnes per year and specific commodity pricing factors.

From first principle design considerations, the Company

estimated the cost per tonne of ore. These costs were generated

based on Q1 2015 estimates. The Operational Blueprint operating

costs are projected to be 74% higher than those estimated in

2007.

Estimated Cost Per Ore Q1 2015 2007

Tonne US$ PFS

(AMC Sourced) US$

----------------------------- -------- ------

Mining Cost Per Ore Tonne* 9.10 3.46

----------------------------- -------- ------

Processing and Tailings 10.51 6.82

----------------------------- -------- ------

G&A 1.72 1.46

----------------------------- -------- ------

Transport From Mine to

Smelter 2.26 1.93

----------------------------- -------- ------

Smelting Cost Per Ore Tonne 11.27 6.33

----------------------------- -------- ------

Total Cost Per Ore Tonne 34.86 20.00

----------------------------- -------- ------

*The cost per tonne for mining is based on the total mining cost

of open pit and underground

ore divided by the 90 million tonne life of mine production

total.

The updated capital costs for the Blueprint design were

estimated using Q1 2015 available information from public sources

and calculated by staff. A summary of the initial and sustaining

capital requirements follow:

Capital Cost Category Initial Sustaining

--------------------------- --------------- -------------

Total Capital Expenditure $1,381,473,753 $474,735,562

--------------------------- --------------- -------------

Infrastructure & Permanent Facilities

-----------------------------------------------------------

Studies $5,000,000 $-

--------------------------- --------------- -------------

Road - 320 Km Access

Road $312,000,000 $7,000,000

--------------------------- --------------- -------------

Power Generated

-6mt $117,810,000 $3,150,000

--------------------------- --------------- -------------

Site Facilities $9,865,000 $-

--------------------------- --------------- -------------

EPCM (Road, Power,

Facilities) $6,048,404 $97,745

--------------------------- --------------- -------------

Processing $133,285,000 $4,255,000

--------------------------- --------------- -------------

Tailings $13,646,349 $23,277,818

--------------------------- --------------- -------------

Electric Furnace

Smelter $126,500,000 $4,950,000

--------------------------- --------------- -------------

Converter Smelter $189,750,000 $3,300,000

--------------------------- --------------- -------------

Refinery $341,550,000 $2,750,000

--------------------------- --------------- -------------

Smelter Infrastructure $22,000,000 $-

--------------------------- --------------- -------------

Haul Roads $9,735,000 $19,911,000

--------------------------- --------------- -------------

Ikenskoe Diversion $- $2,000,000

--------------------------- --------------- -------------

Total Fixed Asset $1,287,189,753 $70,691,562

--------------------------- --------------- -------------

Mobile Equipment

-----------------------------------------------------------

Transportation

Fleet $14,989,000 $28,950,000

--------------------------- --------------- -------------

Mining Fleet $79,295,000 $375,094,000

--------------------------- --------------- -------------

Total Mobile $94,284,000 $404,044,000

--------------------------- --------------- -------------

The economic potential of the Operational Blueprint was

determined using nickel prices of US$7.50 per pound (US$16,534 per

tonne) and US$9.50 per pound (US$20,940 per tonne). The lower price

of US$7.50 was selected as the base case as this was the long term

nickel price from the 2007 SRKPFS. The second is the long term

price projection in 2017 by TD Securities, which predicts from US$

9.50 to US$10.00 per pound. The Company utilised the lower limit of

US$9.50 per pound in its economic assessment. Other commodity

prices used in the generation of the cash flow model are provided

in the table below.

Copper Per Pound $2.75 Per Tonne $6,062.65

----------- ----------- ---------- ---------- -----------

Cobalt Per Pound $13.52 Per Tonne $29,806.19

----------- ----------- ---------- ---------- -----------

Platinum Per Ounce $1,123.00 Per Gram $36.19

----------- ----------- ---------- ---------- -----------

Palladium Per Ounce $768.00 Per Gram $24.75

----------- ----------- ---------- ---------- -----------

The Operational Blueprint established by the Company is based on

external information and an extensive amount of internal work that

is to be independently audited. Also, the pro forma cash flow

models compiled by the Company are viewed as "forward looking

statements" with risks, uncertainties, and other factors which may

vary from actual results, performance or achievements of the

Company resulting in material differences. A key factor is that the

Company has already compiled a shortlist of independent mining

consultancies to undertake a comprehensive audit of the Company

PEA.

The projected financial potential of Kun-Manie based on the

Operational Blueprint covering a 15 year production period is

summarised below. Note that initial capital cost requirement for

the Blueprint is $US1.38 billion for the vertically integrated

operations.

Nickel Price Per Pound $ 7.50 $ 9.50

----------------------------- -------- --------

Nickel Price Per Tonne $16,530 $20,938

----------------------------- -------- --------

Net Present Value in

Billion $US (10% discount) 0.71 1.44

----------------------------- -------- --------

Internal Rate of Return

(post-tax) 21% 32%

----------------------------- -------- --------

Years Payback 4 4

----------------------------- -------- --------

The product of ten years of successful exploration, obtaining

the production licence, and conducting engineering works, the PEA

has permitted the Company to set a forward looking plan to direct

the project through additional engineering work, leading to a

Definitive Feasibility Study. This plan is being compiled and will

be updated based on the results of the external audit of the

PEA.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUWSRRVVANUUR

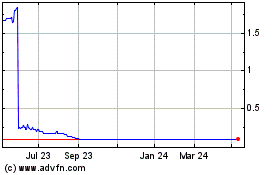

Amur Minerals (LSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amur Minerals (LSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024