Amur Minerals Corporation Operational Blueprint -2-

June 29 2015 - 2:00AM

UK Regulatory

-- Based on the existing resource inventory at Kun-Manie, the

resource is capable of supporting ore production at the nominal

annual throughput of six million tonnes of ore for 15 years. Infill

drilling of Inferred resources is required to confirm this first.

At a later date the Company has the opportunity to add additional

resources by step out drilling into highly prospective ground. Mine

production will be undertaken using both open pit and underground

mining methods. Open pit ores will be derived from four of the five

deposits, whilst underground production will be obtained from areas

lateral two of the pits. Ore will be transported by truck to the

processing plant.

The process plant and tailings impoundment areas have been

relocated to more central locations, allowing for optimised ore

transport from the four sources along the Kurumkon Trend within the

Production Licence. The upsized 6.0 million tonnes of ore per year

plant location also provides storage for the greater volume of

tailings that will be generated.

-- The process plant design has been expanded to handle six

million tonnes of ore per annum (18,000 tonnes per day). Additional

metallurgical test work indicates that metal recoveries will be

improved over previously estimated recoveries, and independent work

has confirmed that a single simple concentrate can be generated by

classic and proven flotation technology. The concentrate is also

suitable for smelting at either a toll smelter or its own captive

smelter.

-- The concentrate will be truck transported to the Baikal Amur

rail line ("BAM") where supplies and fuel will be delivered by rail

for backhaul to the mine.

-- External smelting specialists have examined the proposed

composition of the concentrate to be generated by the processing

plant and determined that it is suitable for smelting on a toll or

owner operated basis. Preliminary capital cost estimates have been

provided and a smelting cost per tonne of concentrate determined. A

trade off study indicates that the greater benefit to the Company

is generated by owning and operating its own smelter rather than

shipping to a toll smelter. The preferred smelter location is

immediately adjacent the BAM rail line where coal and limestone can

be delivered to support smelting of the concentrate. Anticipated

final products are nickel and copper cathodes, cobalt precipitate,

and refined platinum, palladium, gold and silver. Available

capacity at the smelter can be used to smelt concentrates for a fee

on a contract basis should other mining companies in the region

have suitable products that require processing.

PEA Production Basis and Projections

The Blueprint Design originates with the Company's JORC defined

resource compiled by SRK and updated at the end of Q1 2015. The

current resource ranks among the top 20 nickel sulphide projects in

the world, whilst the potential to expand the resource appears

highly prospective. The limits of four of the five drilled deposits

remain unknown as the potential is open in the dip and strike

directions. Kun-Manie is expected to move up the list in the world

ranking of sulphide deposits by simple step out drilling.

Presently, there are 650,000 tonnes of nickel and 178,000 tonnes of

copper delineated by drilling as well as additional by-product

metals including cobalt, platinum, palladium, gold and silver.

Resource Tonnage Ni Ni Cu Cu Pt Pt Pd Pd

Class

----------------- -------- ----- -------- ----- -------- ---- ------- ---- -------

Mt % t % t g/t kg g/t kg

----------------- -------- ----- -------- ----- -------- ---- ------- ---- -------

Total Measured 15.7 0.52 81,800 0.13 21,100 0.2 2,900 0.2 3,200

----------------- -------- ----- -------- ----- -------- ---- ------- ---- -------

Total Indicated 37.8 0.56 210,500 0.15 57,000 0.1 4,560 0.1 5,300

----------------- -------- ----- -------- ----- -------- ---- ------- ---- -------

Sub-total 53.5 0.55 292,300 0.15 78,100 0.1 7,460 0.2 8,500

----------------- -------- ----- -------- ----- -------- ---- ------- ---- -------

Total Inferred 67.3 0.53 358,300 0.15 100,300 0.1 9,440 0.1 9,500

----------------- -------- ----- -------- ----- -------- ---- ------- ---- -------

Grand Total 120.8 0.54 650,600 0.15 178,400 0.1 16,900 0.1 18,000

----------------- -------- ----- -------- ----- -------- ---- ------- ---- -------

With the assistance of Runge, Pincock, Minarco (RPM), pit

optimisation models were compiled for four of the drilled deposits.

Using all resource classes including Inferred, ultimate pit limits

based on Q1 2015 operating costs, metallurgical recoveries and

mining constraints for each deposit were generated. Kun-Manie's

existing resource inventory is sufficient to produce 90 million

tonnes of ore from four open pits over the anticipated 15 year

production life. It was also noted that substantial portions of

these pits required the removal of large amounts of overlying waste

that must be extracted to access the ore. In such cases,

underground mining may provide higher profit per ore tonne than

open pit production. The configuration and orientation of the

mineralised bodies was examined and it was confirmed that an

underground method such as Reverse Room and Pillar could be a

viable alternative. A trade off study was completed confirming an

optimal blend of open pit and underground production provides a

greater operating profit than open pit production alone. The

following table provides a summary reserve potential based on the

conversion of Inferred resource to Indicated resource by infill

drilling.

Production Total Total Total Strip Ni Cu Co Pt Pd

All Resource Tonnes Ore Waste Ratio (%) (%) (%) (g/t) (g/t)

Classes (Mt) (Mt) (Mt)

-------------------- -------- ------ ------- ------- ----- ----- ----- ------- -------

Open Pit /

Underground 90.0 130.5 0.56 0.15 0.01 0.13 0.15

-------------------- -------- ------ ------- ------- ----- ----- ----- ------- -------

Open Pit Component 175.5 45.0 130.5 2.9 0.59 0.15 0.01 0.13 0.16

-------------------- -------- ------ ------- ------- ----- ----- ----- ------- -------

Underground

Component 45.0 0.54 0.15 0.01 0.13 0.14

-------------------- -------- ------ ------- ------- ----- ----- ----- ------- -------

The analysis provided key information for future planning

purposes. Open pit production will be derived from Maly Kurumkon /

Flangovy, Vodorazdelny, Ikenskoe / Sobolevsky and Kubuk.

Underground production will be derived from the deposits at

Flangovy and Kubuk. Infill drilling of the conceptual reserve will

be focused on the underground portion wherein the majority of the

resource is currently classified as Inferred, while the open pit

production areas are generally Measured and Indicated. The future

infill drill programme will be given priority, allowing for the

generation of a full JORC qualified reserve to be utilised in the

assembly of a Definitive Feasibility Study. Step out drilling to

further expand the global resource will begin subsequent to

completion of the infill verification work.

The plant flowsheet consists of a classical flotation plant

suitable for sulphide mineralisation. The design and metallurgical

recovery results have been verified by SGS Minerals located in

Chita, Chichinskaya Oblast of the Russian Federation. The projected

life of mine production through the 6.0 million tonne ore per annum

plant is summarised in the tables below.

Delivered Mine Production Plant Production Smelter Deliverable

Concentrate

----------------------------------- ------------------------------- ---------------------------------

Mill Tonnes

Strip Ratio 2.9 Feed t 90,000,000 Dry Concentrate t 6,300,000

--------------------- ------------ -------------- ----------- ----------------- ----------

Open Pit Recovery Contained

Waste t 130,450,000 of Nickel % 80.4 Moisture % 8.00%

---------------- --- ------------ -------------- ----------- ----------------- ----------

Tonnes

of Recovered Concentrate

Pit Ore t 44,950,000 Ni t 411,556 Wet Tonnes t 6,804,000

---------------- --- ------------ -------------- ----------- ----------------- ----------

Underground Recovery Ni Grade

Ore 45,050,00 of Copper % 90.2 in Concentrate % 6.53%

--------------------- ------------ -------------- ----------- ----------------- ----------

Tonnes

Ni Head of Recovered Cu Grade

Grade % 0.56 Cu t 124,899 in Concentrate % 1.98%

---------------- --- ------------ -------------- ----------- ----------------- ----------

Recovery Co Grade

Ni Delivered t 512,123 of Cobalt % 66.00% in Concentrate % 0.10%

---------------- --- ------------ -------------- ----------- ----------------- ----------

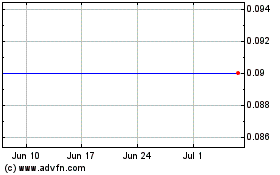

Amur Minerals (LSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

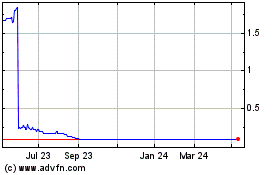

Amur Minerals (LSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024