TIDMAMC

RNS Number : 1701S

Amur Minerals Corporation

29 September 2017

29 September 2017

AMUR MINERALS CORPORATION

(AIM: AMC)

Interim Results 2017

Chairman's Statement

Dear Shareholder,

It is with pleasure that I take this opportunity to update

shareholders of Amur Minerals Corporation (the "Company") on the

Company's successful performance during the first six months of

2017.

We began the year with the appointment of Mr. Lou Naumovski to

the Board as a Non-Executive Director. His three decades of

experience working in Russia strengthens the Board as we continue

to develop into and through our pre-production phase of the

Kun-Manie nickel copper sulphide project located in the Far East of

Russia.

Timeline of Key Highlights:

-- In January, Mr Lou Naumovski joined the Board as a

Non-Executive director, and the Gipronickel Institute ("GI")

completed metallurgical test work on a half-tonne bulk sample for

our largest of four deposits, Maly Kurumkon / Flangovy.

-- In February, RPMGlobal Asia ("RPM") completed a comprehensive

resource update resulting in a resource of 101 million ore tonnes

with a nickel equivalent grade of 1.03% containing over one million

nickel equivalent tonnes.

-- In March and April the ice road resupply was undertaken

comprising 9 convoys delivering over 500 tonnes of fuel, supplies

and equipment.

-- Also in March, the 2017 field season plan comprising of a

15,000 drill metre program at the Ikenskoe / Sobolevsky and Kubuk

deposits was finalised, with an optional additional 5,000 metres

planned should time and weather permit.

-- The Company engaged Medea Capital Partners Ltd ("Medea") to

undertake a survey of global debt markets.

-- In May the drill season commenced nearly four weeks ahead of

schedule, and the Company initiated a review of operating cost

estimates by RPM.

-- During June, the first of the Company's 2017 drill results

were provided and a large high grade extension having an average

grade of 0.98% nickel had been identified at our Ikenskoe /

Sobolevsky deposit.

-- Post 30 June 2017, Medea presented their report of the global

debt markets and RPM their review of operating costs in July.

Mineral Resource Estimate Update

RPM issued a project wide JORC Mineral Resource Estimate ("MRE")

update in February. The newly derived MRE reported resource for

each of the four deposits fully located within our Detailed

Exploration and Production Licence. The new MRE also utilised a

higher nickel cutoff grade of 0.4%. In total, 101.3 million tonnes

of mineralisation is present and it averages 0.76% nickel and 0.20%

copper, by-product cobalt, platinum and palladium were also

estimated. The nickel equivalent grade at Kun-Manie is projected to

be 1.03% nickel. The RPM update included all drill results

completed through 2016 and expanded the total contained tonnes of

nickel by 38%. More than 80% of the mineral resource is classified

as Measured and Indicated which is suitable for use in the

determination of Mining Ore Reserves.

JORC Mineral Resource Estimates

Februay 2017

0.4% Nickel Cutoff Grade

Classification Mt Ni Cu Co Pt Pd Contained Metal

% % % g/t g/t

---------------- ------- ----- ----- ------ ----- ----- ---------------------------------------------

Ni Cu Co Pt Pd

t t t kg kg

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Maly Kurumkon / Flangovy (MKF)

------------------------------------------------------------------------------------------------------------

Measured

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Indicated 57.5 0.77 0.22 0.02 0.15 0.16 445,000 124,000 8,900 8,800 9,300

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

M+I 57.5 0.77 0.22 0.02 0.15 0.16 445,000 124,000 8,900 8,800 9,300

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Inferred 3.4 0.80 0.22 0.02 0.16 0.15 27,000 7,000 600 500 500

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

MKF TOTAL 60.9 0.78 0.22 0.02 0.15 0.16 473,000 131,000 9,400 9,300 9,800

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Ikenskoe / Sobolevsky (IKEN)

------------------------------------------------------------------------------------------------------------

Measured 10.1 0.66 0.18 0.011 0.21 0.25 67,000 18,000 1,100 2,100 2,500

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Indicated 6.3 0.61 0.14 0.011 0.20 0.25 39,000 9,000 700 1,200 1,600

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

M+I 16.4 0.65 0.17 0.01 0.20 0.25 106,000 27,000 1,800 3,300 4,100

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Inferred 4.7 0.84 0.20 0.02 0.19 0.23 40,000 9,000 800 900 1,100

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

IKEN

TOTAL 21.1 0.69 0.17 0.01 0.20 0.25 145,000 36,000 2,500 4,200 5,200

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Kubuk (KUB)

------------------------------------------------------------------------------------------------------------

Measured

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Indicated 3.6 0.87 0.21 0.02 0.18 0.19 31,000 8,000 600 600 700

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

M+I 3.6 0.87 0.23 0.02 0.17 0.20 31,000 8,000 600 600 700

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Inferred 10.9 0.74 0.20 0.02 0.16 0.14 81,000 22,000 1,700 1,700 1,500

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

KUB TOTAL 14.5 0.77 0.20 0.02 0.16 0.15 111,000 29,000 2,300 2,300 2,200

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Vodorazdelny (VOD)

------------------------------------------------------------------------------------------------------------

Measured 0.6 0.74 0.22 0.01 0.29 0.32 5,000 1,000 100 200 200

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Indicated 3.2 0.85 0.21 0.02 0.16 0.16 27,000 7,000 500 500 500

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

M+I 3.8 0.85 0.21 0.02 0.19 0.19 32,000 8,000 600 700 700

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Inferred 1.0 0.81 0.22 0.02 0.17 0.16 8,000 2,000 200 200 200

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

VOD TOTAL 4.8 0.83 0.21 0.02 0.18 0.18 40,000 10,000 800 900 900

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Global Resource

------------------------------------------------------------------------------------------------------------

Measured 10.7 0.67 0.18 0.01 0.21 0.25 72,000 19,000 1,200 2,300 2,700

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Indicated 70.5 0.77 0.21 0.02 0.16 0.17 542,000 148,000 10,700 11,100 12,100

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

M+I 81.2 0.76 0.21 0.01 0.17 0.18 614,000 167,000 11,900 13,400 14,800

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

Inferred 20.1 0.77 0.20 0.02 0.17 0.16 156,000 40,000 3,300 3,300 3,300

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

TOTAL 101.31 0.76 0.20 0.01 0.17 0.18 769,000 206,000 15,000 16,700 18,100

---------------- ------- ----- ----- ------ ----- ----- -------- -------- ------- ------- -------

In Situ Value ($US) and Nickel Equivalent Tonnage

1 February 2017 Metal Pricing

Pricing Nickel Copper Cobalt Platinum Palladium Total Ni

US$ Eq

Value Tonnes

----------- ----------

Imperial $4.54 $2.69 $16.90 $996.00 $760.00

/ lb / lb /lb / oz /oz

---------- ---------- -------- --------- ---------- ----------- ----------

Metric $10,006 $5,929 $37,248 $32,026 $24,437

/t / t / t / kg / kg

----------- ---------- ---------- -------- --------- ---------- ----------- ----------

Measured 720.44M 112.65M 44.70M 73.66M 65.98M 1,017.43M 101,680

----------- ---------- ---------- -------- --------- ---------- ----------- ----------

Indicated 5,423.34M 877.46M 398.55M 355.49M 295.69M 7,350.52M 734,600

----------- ---------- ---------- -------- --------- ---------- ----------- ----------

M+I 6,143.78M 990.10M 443.25M 429.14M 361.67M 8,367.95M 836,280

----------- ---------- ---------- -------- --------- ---------- ----------- ----------

Inferred 1,560.96M 237.15M 122.92M 105.68M 80.64M 2,107.36M 210,606

----------- ---------- ---------- -------- --------- ---------- ----------- ----------

TOTAL 7,694.74M 1,221.32M 558.71M 534.83M 442.32M 10,451.92M 1,044,549

----------- ---------- ---------- -------- --------- ---------- ----------- ----------

% Value

Content 73.6% 11.7% 5.3% 5.1% 4.2% 100.0%

----------- ---------- ---------- -------- --------- ---------- ----------- ----------

Gipronickel Metallurgical Test Work

The GI test results derived from a 443 kilogram bulk sample

consisting of half core from three holes located in the Maly

Kurumkon / Flangovy ("MKF") deposit. GI confirmed that higher

metallurgical recoveries can be obtained by the implementation of a

two stage grinding process, which had not been previously

considered in detail. GI was able to determine that recoveries are

80.63% for nickel, 83.78% for copper, 61.4% for cobalt, 59.6% for

platinum, 82.3% for palladium, 63.7% for gold and 70.5% for

silver.

Additionally GI identified and improved mass pull which could

lead to potential savings in capital expenditure for the

construction of the concentrate treatment facility and a reduction

in the concentrate transport fleet.

Medea Global Survey

The Company engaged Medea in March 2017 to undertake a survey of

the global debt markets and potential strategic partners to

determine the potential availability of project financing for

construction of the Kun-Maine project. Medea's subsequent findings

reported to the Board in early July concluded that there is

available market capacity for investment by a strategic partner and

that Export Credit Agency ("ECA") covered debt financing could be

available for the development of the project. Medea also concluded

that the Company would be better positioned in the near term by

updating the Pre-feasibility Study ("PFS"), and therefore the

economics of the project, as part of its development of a road map

to full project funding.

Review of Operating Costs

An independent review of operating cost was completed by RPM in

July. The review encompassed open pit mining, underground mining,

on site processing, all other site related costs and transport of

concentrate to the Ulak rail. From these costs the Company was able

to derive an average projected operating cost of $1.78 per pound of

contained nickel in concentrate delivered to the Ulak rail station

located on the Baikal Amur ("BAM") rail line. This figure does not

include consideration of smelter terms or royalties.

Additionally, using these costs and $4.00 per pound nickel

price, our projected open pit and underground mining cutoff grades

range from 0.29% and 0.39% nickel, meaning nearly all of our

resource as reported in Feburary 2017 using a cutoff grade of 0.40%

is available in the determination of mining tonnages and grades.

The mining cutoff grade being less than the minimum grade to model

the resource provides a highly robust model for project

evaluation.

2017 Field Season

After a very successful 2016 field season at Maly Kurumkon /

Flangovy ("MKF") deposit, the Company focused on the undrilled

potential at and between the Ikenskoe ("IKEN") and Kubuk ("KUB")

deposits in 2017 as indicated in the map below.

http://www.rns-pdf.londonstockexchange.com/rns/1701S_1-2017-9-28.pdf

A 15,000 metre drill programme of resource conversion and

resource expansion at IKEN and KUB was planned but with sufficient

supplies to drill an additional 5,000 metres should time and

weather permit. Drilling was allocated to resource conversion

(Inferred to Indicated), resource expansion via step out drill from

the known limits of mineralisation at IKEN and KUB and the

acquisition of metallurgical sample.

Mild weather meant the Company was able to start the drilling

programme on 5 May 2017, well ahead of the planned 1 June 2017

start date. Of the two Company owned drill rigs, the LF70 was

assigned to the IKEN deposit and the LF90 to the KUB deposit. As

with the 2016 field season a high drill rate averaging 135 metres

per day meant the drill programme progressed ahead of schedule.

As of the time of writing, over 23,000 metres of drilling has

been completed, with approximately 18,500 metres completed along

2,400 metres of the 3 kilometre geochemical and geophysical anomaly

linking the IKEN and KUB deposits. All but 500 to 600 metres of

this target has been drilled as part of the IKEN / KUB step out

drilling programmes, and the drill results confirm that there is

indeed potential for the IKEN and KUB deposits to both be part of a

single 4.5 kilometre long deposit.

Globally, this year's drilling has nearly doubled the size of

both the IKEN and KUB deposits as reported in the MRE of February

2017 which contained approximately a quarter million tonnes of

nickel. Not only is the expansion of IKEN and KUB likely, an 800

metre long segment has been drilled and additional resource within

this area will further expand our MRE during the next update.

Infill drilling has also likely converted 10.9 million tonnes of

Inferred resource to that of Indicated making it available for use

in the determination of Mining Ore Reserves.

Financial Overview

The Company remained debt free throughout the period with cash

reserves of US$5.4 million as at 30 June 2017, down from US$8.2

million at the start of 2017. The Company continues to work closely

with its financial advisors developing the near and long-term

financing opportunities, and the Directors are confident that they

will be able to raise funds in the near future to progress the

planned exploration programme. Should there be any delay in raising

such funds the Directors consider that they would be able to manage

on-going expenditures through cutting exploration expenditure,

other discretionary costs and reducing key management salaries that

would allow the present cash resources to cover its financial

liabilities and commitments for the period up to 31 December

2018.

In January 2017 Jett Capital Advisors LLC exercised 1m warrants

at an exercise price of 4.68p providing a cash inflow for the

Company of US$57,000.

During the period Crede CG III Ltd converted 14.5 million

warrants of tranche 3 leaving 48 million warrants still outstanding

as at 30 June 2017. The fair valuation of these remaining warrants

as at 30 June 2017 is US$763,000 (31 December 2016: US$3 million)

which is shown as a financial liability at fair value through the

profit and loss on the statement of financial position. A

significant gain on fair value therefore of US$2.3 million has been

recognised in the profit and loss for the period ended 30 June

2017. The remaining 48 million warrants where converted on 18

September 2017, resulting in Crede having no outstanding warrants

as at that date completing the Crede agreement.

In total the Company has spent US$258,000 on capital equipment

during the period (US$1.4 million for the same period in 2016) and

US$1.7 million on exploration costs (US$1.3 million in the same

period in 2016).

Although the administration expenses for the period have

significantly reduced compared to the same period last year, the

difference is mostly non-cash items in 2016. The Statement of Cash

Flows shows that the Company actually incurred comparable

administrative expenses to last year.

Outlook

The Company will continue to be very busy throughout the

remainder of 2017, aiming to complete and extend the drilling

programme which will have a material impact on the economic

potential of Kun-Manie, and to complete an updated PFS. The hard

work and dedication of our staff has been instrumental in the

success of the project.

We will also continue to work closely with Medea as we develop

the near and long-term financing opportunities for the Company. We

are also working in conjunction with Medea and our PR

representative, Yellow Jersey on improving our knowledge of the

battery metals market and the nickel/copper end user market in

general.

Lastly, the Company extends its appreciation and thanks to

long-term shareholders that have supported the Company to this

point and into the future. There was a good turn-out at the General

Meeting in July with a very productive Q&A session which we

look forward to repeating in the near future.

Mr. Robert W. Schafer

Non Executive Chairman

28 September 2017

Independent Review Report

To the shareholders of Amur Minerals Corporation

Introduction

We have been engaged by the company to review the consolidated

interim financial information in the interim financial report for

the six months ended 30 June 2017 which comprises Consolidated

Statement of Financial Position, Consolidated Statement of

Comprehensive Income, Consolidated Statement of Cash Flows,

Consolidated Statement of Changes in Equity, and related notes.

We have read the other information contained in the interim

report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the set of financial statements.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of and has been approved

by the directors. The directors are responsible for preparing the

interim report in accordance with the rules of the London Stock

Exchange for companies trading securities on AIM which require that

the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the company's annual

accounts having regard to the accounting standards applicable to

such annual accounts.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the interim financial

report based on our review.

Our report has been prepared in accordance with the terms of our

engagement to assist the company in meeting the requirements of the

rules of the London Stock Exchange for companies trading securities

on AIM and for no other purpose. No person is entitled to rely on

this report unless such a person is a person entitled to rely upon

this report by virtue of and for the purpose of our terms of

engagement or has been expressly authorised to do so by our prior

written consent. Save as above, we do not accept responsibility for

this report to any other person or for any other purpose and we

hereby expressly disclaim any and all such liability

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity", issued by the Financial Reporting Council for use

in the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the consolidated interim financial

information in the interim report for the six months ended 30 June

2017 is not prepared, in all material respects, in accordance with

the rules of the London Stock Exchange for companies trading

securities on AIM.

BDO LLP

Chartered Accountants and Registered Auditors

London,

United Kingdom

28 September 2018

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

AMUR MINERALS CORPORATION AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT of COMPREHENSIVE INCOME

FOR THE six monthsED 30 June 2017

(Amounts in thousands of US Dollars)

Unaudited Unaudited Audited

30 June 30 June 31 December

Note 2017 2016 2016

Non-current assets

Exploration and evaluation

assets 5 19,896 14,049 17,167

Property, plant and

equipment 3,204 3,108 2,736

23,100 17,157 19,903

------------ ------------ -------------

Current assets

Inventories 830 874 756

Other receivables 231 483 768

Cash and cash equivalents 5,438 11,495 8,199

------------ -------------

6,499 12,852 9,723

------------ ------------ -------------

Total assets 29,599 30,009 29,626

------------ ------------ -------------

Current liabilities

Trade and other payables 645 243 416

Derivative financial

liability 7 763 1,200 3,295

1,408 1,443 3,711

------------ ------------ -------------

Net current assets 5,091 11,409 6,012

------------ ------------ -------------

Non-Current Liabilities

Rehabilitation provision 172 159 166

Total non-current

liabilities 172 159 166

------------ ------------ -------------

Net assets 28,019 28,407 25,749

============ ============ =============

Equity

Share capital 8 60,548 60,278 60,293

Share premium 4,904 4,904 4,904

Foreign currency

translation reserve (11,802) (13,226) (12,427)

Share options reserve 9 3,480 3,538 3,575

Accumulated deficit (29,111) (27,087) (30,596)

Total equity 28,019 28,407 25,749

============ ============ =============

Approved on behalf of the Board on 28 September 2017

Robin Young Brian C Savage

AMUR MINERALS CORPORATION AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT of COMPREHENSIVE INCOME

FOR THE six monthsED 30 June 2017

(Amounts in thousands of US Dollars)

Unaudited Unaudited

6 Months 6 Months Audited

ended ended Year ended

30 June 30 June 31 December

Note 2017 2016 2016

Administrative expenses (946) (2,336) (3,768)

Operating loss (946) (2,336) (3,768)

Finance income 2 - 4

Fair value movements

on derivative financial

instruments 7 2,334 88 (2,007)

Profit / (loss) before

tax 1,390 (2,248) (5,771)

Income tax expense 6 - - -

Profit / (loss) for the

period / year attributable

to owners of the parent 1,390 (2,248) (5,771)

=========== =========== ============

Other Comprehensive income:

Items that could be reclassified

to profit or loss

Exchange differences

on translation of foreign

operations 625 2,084 2,883

Total comprehensive income

/ (loss) for the period

/ year attributable to

owners of the parent 2,015 (164) (2,888)

=========== =========== ============

Earnings / (loss) per 4 US$ 0.002 US$ (0.004) US$ (0.011)

share: basic & diluted

AMUR MINERALS CORPORATION AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT OF cash flowS

FOR THE SIX MONTHSED 30 JUNE 2017

(Amounts in thousands of US Dollars)

Unaudited Unaudited Audited

6 Months 6 Months Year ended

ended ended 31 December

30 June 2017 30 June 2016 2016

Cash flows used in operating

activities:

Payments to suppliers

and employees (835) (1,083) (2,210)

Net cash outflow from

operating activities (835) (1,083) (2,210)

-------------- -------------- -------------

Cash flow used in investing

activities:

Payments for exploration

expenditure (1,773) (1,320) (2,863)

Payment for property,

plant and equipment (258) (1,427) (1,670)

Interest received - 4

Net cash used in investing

activities (2,031) (2,747) (4,529)

-------------- -------------- -------------

Cash flow from financing

activities:

Proceeds from issue of

shares (net of issue costs) 57 6,574 6,589

Net cash generated from

financing activities 57 6,574 6,589

-------------- -------------- -------------

Net (decrease)/increase

in cash and cash equivalents (2,809) 2,744 (150)

Cash and cash equivalents

at beginning of period

/ year 8,199 9,613 9,613

Effect of foreign exchange

rates 48 (862) (1,264)

Cash and cash equivalents

at end of period / year 5,438 11,495 8,199

============== ============== =============

Foreign currency

Share translation reserve Share

Share capital premium options reserve Accumulated deficit Total

------------- -------- -------------------- ----------------- -------------------- -------

At 1 January 2017 60,293 4,904 (12,427) 3,575 (30,596) 25,749

Profit of the period - - - - 1,390 1,390

Other comprehensive

income for the

period - - 625 - - 625

------------- -------- -------------------- ----------------- -------------------- -------

Total comprehensive

income for the

period - - 625 - 1,390 2,015

Issue of share - - - - - -

capital

Exercise of warrants 255 - - (57) 57 255

Options expired - - - (38) 38 -

At 30 June 2017

(unaudited) 60,548 4,904 (11,802) 3,480 (29,111) 28,019

============= ======== ==================== ================= ==================== =======

At 1 January 2016 54,093 5,648 (15,310) 3,907 (25,869) 22,469

Profit of the period - - - - (2,248) (2,248)

Other comprehensive

income for the

period - - 2,084 - - 2,084

------------- -------- -------------------- ----------------- -------------------- -------

Total comprehensive

income for the

period - - 2,084 - (2,248) (164)

Issue of share

capital 6,185 - - - - 6,185

Equity settled share

based payments - - - 661 - 661

Options expired - - - (1,030) 1,030 -

Costs associated with

issue of share

capital - (744) - - - (744)

At 30 June 2016

(unaudited) 60,278 4,904 (13,226) 3,538 (27,087) 28,407

============= ======== ==================== ================= ==================== =======

At 1 January 2016 54,093 5,648 (15,310) 3,907 (25,869) 22,469

Loss for the year - - - - (5,771) (5,771)

Other comprehensive

income for the year - - 2,883 - - 2,883

------------- -------- -------------------- ----------------- -------------------- -------

Total comprehensive

income for the

period - - 2,883 - (5,771) (2,888)

Issue of share

capital 6,185 - - - - 6,185

Equity settled share

based payments - - - 712 - 712

Exercise of options 15 - - (14) 14 15

Options expired - - - (1,030) 1,030 -

Costs associated with

issue of share

capital - (744) - - - (744)

At 31 December 2016

(audited) 60,293 4,904 (12,427) 3,575 (30,596) 25,749

============= ======== ==================== ================= ==================== =======

1. Reporting Entity

Amur Minerals Corporation (the "Company") is a company domiciled

in the British Virgin Islands. The consolidated interim financial

information as at and for the six months ended 30 June 2017

comprise the Company and its subsidiaries (together referred to as

the "Group").

The consolidated financial statements of the Group as at and for

the year ended 31 December 2016 are available upon request from the

Company's registered office at Kingston Chambers, P.O. Box 173,

Road Town, Tortola, British Virgin Islands, from offices of RBC

Europe Limited, Riverbank House, 2 Swan Lane London EC4R 3BF or at

www.amurminerals.com.

2. BASIS OF PREPARATION

The financial information set out in this report is based on the

consolidated financial information of Amur Minerals Corporation and

its subsidiary companies. The financial information of the Group

for the 6 months ended 30 June 2017 was approved and authorised for

issue by the Board on 28 September 2017. The interim results have

not been audited, but were the subject to an independent review

carried out by the Company's auditors, BDO LLP. This financial

information has been prepared in accordance with the accounting

policies that are expected to be applied in the Report and Accounts

of Amur Minerals Corporation for the year ended 31 December 2017

and are consistent with the recognition and measurement

requirements of IFRS as adopted by the European Union. The

auditors' report on the group accounts to 31 December 2016 was

unqualified. The comparative information for the full year ended 31

December 2016 is not the Group's full annual accounts for that

period but has been derived from the annual financial statements

for that period.

The consolidated financial information incorporates the results

of Amur Minerals Corporation and its subsidiaries undertakings as

at 30 June 2017. The corresponding amounts are for the year ended

31 December 2016 and for the 6 month period ended 30 June 2016.

The Group financial information is presented in US Dollars

('US$') and values are rounded to the nearest thousand Dollars.

3. GOING CONCERN

The Group operates as a natural resources exploration and

development company. To date, the Group has not earned significant

revenues and is considered to be in the exploration stage. In May

2015 the 20 year 'Detailed Exploration and Production Licence' was

issued to the Company's wholly owned subsidiary, ZAO Kun-Manie. The

production licence expires on 1 July 2035.

The Directors continue to work closely with Medea and other

financial advisors to develop the near and long-term financing

opportunities for the Company to progress with the ongoing

development of its projects. The Directors are confident that they

will be able to raise funds in the near future to be able to

progress with their planned exploration programme. However should

such funds not be raised the Directors consider that they would be

able to reduce expenditure through cutting exploration expenditure,

other discretionary costs and reducing key management salaries that

would allow the present cash resources to cover its financial

liabilities and commitments for the period up to 31 December 2018.

As such, the financial information has been prepared on a going

concern basis.

4. EARNINGS / (LOSS) PER SHARE

Basic and diluted profit or loss per share are calculated and

set out below.

Unaudited Unaudited

6 Months 6 Months Audited

ended ended Year ended

30 June 30 June 31 December

2017 2016 2016

------------ ------------ -------------

Net profit/(loss)

for the period / year 1,390 (2,248) (5,771)

Average number of

shares for the period 601,452,853 501,389,574 547,940,724

Basic profit/(loss)

per share US$ 0.002 US$ (0.004) US$ (0.011)

Diluted profit/(loss)

per share US$ 0.002 US$ (0.004) US$ (0.011)

Basic weighted average

number of ordinary

shares 601,452,853 501,389,574 547,940,724

Dilutive effect 32,964,403 - -

of weighted average

share options

Diluted weighted

average number of

ordinary shares 634,417,256 501,389,574 547,940,724

As of 30 June there where 31,428,387 share options and

48,076,924 warrants in issue which could have a potential dilutive

effect on the base profit per share in the future.

5. capitalised expenditures

Unaudited Unaudited Audited

6 Months 6 Months Year ended

ended ended 31 December

30 June 30 June 2016

2017 2016

At start of the

period / year 17,167 11,513 11,513

Additions 2,264 1,320 3,487

Foreign exchange

differences 465 1,216 2,167

At end of the

period / year 19,896 14,049 17,167

========== ========== =============

The Group did not recognise any impairment of capitalised

expenditure during the period (1H 2016: nil).

6. TaXATION

No tax charge has arisen in the period and no deferred tax asset

has been recognised for past taxable losses as the recoverability

of any such assets is uncertain in the foreseeable future.

7. Derivative financial LIABILITY

During the period the Company granted no new warrants (1H 2016:

72,586,729) to Crede CG III Limited as part of an equity

subscription agreement entered into on 14 December 2015.

Under the terms of the subscription agreement 3 warrants were

issued for every 4 subscription shares with a 5 year exercise

period. Each warrant gives the warrant holder the right to

subscribe to either:

-- One ordinary share, for each warrant, at a price per ordinary

share equal to subscription price; or

-- If the share price is below the subscription price, a number

of ordinary shares calculated by dividing the aggregate

Black-Scholes value of the warrants by the closing share price, at

a price of 1 pence.

The company has the right to call the warrants at any time the

share price is trading at a 25% premium to the subscription price

of the warrants.

The movement in warrants during the year has been as

follows:

Derivative Financial Liability

Unaudited Unaudited Audited

30 June 30 June 31 December

2017 2016 2016

Number Number Number

At start of period

/ year 62,586,729 17,045,455 17,045,455

New issue - 72,586,729 72,586,729

Exercise of warrants (14,509,805) (27,045,455) (27,045,455)

At end of period

/ year 48,076,924 62,586,729 62,586,729

============= ============= =============

The movement in their fair values is shown in the table

below:

Derivative Financial Liability

Unaudited Unaudited Audited

30 June 30 June 31 December

2017 2016 2016

US$'000 US$'000 US$'000

At start of period

/ year 3,295 370 370

New warrants - 1,630 1,630

Exercise of warrants (198) (712) (712)

Fair value movement (2,334) (88) 2,007

At end of period

/ year 763 1,200 3,295

========== ========== =============

As the warrants are exchangeable into variable number of shares,

their fair values on the grant date and the reporting date were

determined using a Monte-Carlo simulation. For each iteration of

the simulation, the simulated share price was analysed to determine

the warrants value. The fair value was based on the following

assumptions:

Tranche

3

--------------------- --------

Share Price 6.29

--------------------- --------

Expected volatility 111.2%

--------------------- --------

Option life 2 years

--------------------- --------

Expected dividends 0

--------------------- --------

Risk free rate 0.31

--------------------- --------

8. share Capital

Unaudited Unaudited Audited

30 June 30 June 31 December

2017 2016 2016

-------------- -------------- --------------

Number of Shares

(no par value):

Authorised 1,000,000,000 1,000,000,000 1,000,000,000

============== ============== ==============

Total issued 611,552,748 594,433,617 594,683,617

============== ============== ==============

On 12 January 2017, the Company issued 500,000 new Ordinary

Shares to Jett Capital Advisors LLC, following the exercise of

warrants at an exercise price of 4.68 pence per share.

On 30 January 2017, the Company issued 500,000 new Ordinary

Shares to Jett Capital Advisors LLC, following the exercise of

warrants at an exercise price of 4.68 pence per share.

On 28 April 2017, the Company, pursuant to the subscription

agreement entered into with Crede CG III Ltd on 14 December 2015,

converted all 14,509,805 warrants held by Crede using the

Black-Scholes valuation method applicable to the agreement, for

15,869,131 new Ordinary Shares.

All of these shares have been admitted to trading on the AIM

market of London Stock Exchange plc.

9. options

During the period ended 30 June 2017 233,000 options expired (1H

2016: 9,570,000) with a write back to the Options Reserve of

US$38,000 (1H 2016: US$1,030,000). During this period no new

options were granted to key management and personnel (1H 2016:

nil).

At 30 June 2017 the following options were outstanding at the

beginning and end of the period:

Outstanding at

1 January 2017 32,661,387

Granted -

Exercised (1,000,000)

Expired (233,000)

Outstanding at

30 June 2017 31,428,387

The fair value of the options is estimated at the grant date

using a Black-Scholes model, taking into account the terms and

conditions on which the options were granted. This uses inputs for

share price, exercise price, expected volatility, option life,

expected dividends and risk free rate.

The share price is the price at which the shares can be sold in

an arm's length transaction between knowledgeable, willing parties

and is based on the mid-market price on the grant date. The

expected volatility is based on the historic performance of Amur

Minerals shares on the Alternative Investment Market of the London

Stock Exchange. The option life represents the period over which

the options granted are expected to be outstanding and is equal to

the contractual life of the options. The risk-free interest rate

used is equal to the yield available on the principal portion of UK

government issued Gilt Strips with a life similar to the expected

term of the options at the date of measurement.

There are no market conditions associated with the share option

grants. There was no charge arising from outstanding options for

the period (H1 2016: US$444,000; December 2016 US$712,000), out of

which (H1 2016: US$123,000; December 2016:US$137,000) has been

capitalized within the E&E assets.

10. related parties

Key management personnel and directors were paid a total

compensation of US$551,000 for the six months ended 30 June 2017

(1H 2016: US$477,000). No new options were granted to directors in

the six months ended 30 June 2017 (1H 2016: nil).

11. EVENTS AFTER THE BALANCE SHEET DATE

On 18 September 2017 the Company issued 22,877,041 new ordinary

shares to Crede CG III Ltd following the exercise of their

remaining 48,076,924 warrants.

12. INTERIM REPORT

Copies of this interim report for the six months ended 30 June

2017 will be available from the Company's website

www.amurminerals.com.

http://amurminerals.com/content/wp-content/uploads/AMC-H1-2017-v3.mp3

Enquiries:

Company Nomad and Broker Public Relations

Amur Minerals S.P. Angel Yellow Jersey

Corp. Corporate Finance

LLP

Robin Young Ewan Leggat Dominic Barretto

CEO +44 (0) 20 +44 (0) 77

+7 4212 755 3470 0470 6853 7739

615

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFFAATITFID

(END) Dow Jones Newswires

September 29, 2017 02:01 ET (06:01 GMT)

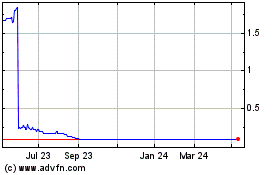

Amur Minerals (LSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amur Minerals (LSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024