American Realty Investors, Inc. (NYSE:ARL), a Dallas-based real

estate investment company, reported results of operations for the

third quarter ended September 30, 2015. ARL announced today that

the Company reported a net loss applicable to common shares of

($5.4) million, including $2.0 million in gains on the sale of land

and $0.7 million in gains on sale of income producing properties,

or ($0.35) per diluted earnings per share, as compared to a net

loss applicable to common shares of ($1.7) million, or ($0.13) per

diluted earnings per share for the same period ended 2014.

For the nine months ended September 30, 2015, we reported a net

loss applicable to common shares of ($1.6) million or ($0.11) per

diluted earnings per share, as compared to net income applicable to

common shares of $2.1 million or $0.17 per diluted earnings per

share for the same period ended 2014.

During the three months ended September 30, 2015, we acquired

two income-producing properties. “The Company remains highly

focused on expanding our multifamily portfolio and enhancing the

underlying value of our commercial assets. At the same time, we

continue to seek out unique opportunities to secure strategic sales

and/or the development of various parcels of land. We also strive

aggressively in obtaining improvements associated with operating

performance in terms of revenue growth and expense control. We

remain significantly focused by paying close attention to all

details of our business throughout our organization,” said Daniel

J. Moos, the Company’s President and CEO. “Most assuredly, we will

continue to be very aware as to the overall economic climate and

remain vigilant in our ability to rapidly adjust our business

strategies accordingly.”

Rental and other property revenues were $27.8 million for the

three months ended September 30, 2015. This represents an increase

of $8.5 million, as compared to the prior period revenues of $19.3

million. This change, by segment, is an increase in the apartment

portfolio of $5.0 million and an increase in the commercial

portfolio of $3.5 million. Within the apartment portfolio there was

an increase of $4.8 million in the acquired property portfolio and

an increase of $0.2 million in the same property portfolio. Our

apartment portfolio continues to thrive in the current economic

conditions with occupancies averaging approximately 95%. We have

been able to surpass expectations due to the high-quality product

offered, the strength of our management team and our commitment to

our tenants. This increase in apartment portfolio is also due to

the acquisition of new properties. Within the commercial portfolio,

there was an increase of $1.8 million in the acquired property

portfolio and an increase of $1.7 million in the same store

properties. We are continuing to market our properties aggressively

to attract new tenants and strive for continuous improvement of our

properties to maintain our existing tenants.

Property operating expenses were $14.5 million for the three

months ended September 30, 2015. This represents an increase of

$3.7 million, as compared to the prior period operating expenses of

$10.8 million. This change, by segment, is an increase in the

apartment portfolio of $2.1 million and an increase in the

commercial portfolio of $1.6 million. Within the apartment

portfolio there was an increase of $2.0 million in the acquired

properties portfolio and an increase of $0.1 million in the same

property portfolio. Within the commercial portfolio, there was an

increase of $1.5 million in the acquired properties portfolio and

an increase of $0.1 million in the same store properties.

Depreciation and amortization expense was $6.6 million for the

three months ended September 30, 2015. This represents an increase

of $2.1 million, as compared to the prior period expense of $4.5

million. The majority of this change is in the apartment portfolio

related to an increase in the acquired properties portfolio.

Mortgage and loan interest expense was $15.0 million for the

three months ended September 30, 2015. This represents an increase

of $4.1 million, as compared to the prior period expense of $10.9

million. The majority of this increase is in the other portfolio

and is related to the securing of a new loan in 2015.

Interest income was $3.95 million for the three months ended

September 30, 2015. This represents a decrease of $1.2 million, as

compared to the prior year income of $5.1 million.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

shopping centers and developed and undeveloped land. The Company

invests in real estate through direct ownership, leases and

partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables. For more information,

visit the Company’s website at www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED STATEMENTS

OF OPERATIONS (unaudited) For the Three Months

Ended For the Nine Months Ended September 30,

September 30, 2015 2014 2015

2014 (dollars in thousands, except per share amounts)

Revenues: Rental and other property revenues (including $211

and $175 for the three months and $591 and $526 for the nine months

ended 2015 and 2014, respectively, from related parties) $ 27,826 $

19,326 $ 75,223 $ 57,986

Expenses: Property operating

expenses (including $202 and $172 for the three months and $551 and

$511 for the nine months ended 2015 and 2014, respectively, from

related parties) 14,499 10,766 37,467 30,677 Depreciation and

amortization 6,569 4,463 16,410 13,099 General and administrative

(including $634 and $926 for the three months and $2,554 and $2,686

for the nine months ended 2015 and 2014, respectively, from related

parties) 1,417 1,590 5,215 6,770 Net income fee to related party

232 (186 ) 567 514 Advisory fee to related party 3,024

2,225 7,625 6,670

Total operating expenses 25,741 18,858

67,284 57,730 Net operating income

(loss) 2,085 468 7,939 256

Other income (expenses): Interest

income (including $3,886 and $4,699 for the three months and

$13,190 and $14,692 for the nine months ended 2015 and 2014,

respectively, from related parties) 3,950 5,106 13,722 15,264 Other

income (72 ) 1,332 4,040 1,738 Mortgage and loan interest

(including $982 and $978 for the three months and $2,797 and $2,709

for the nine months ended 2015 and 2014, respectively, from related

parties) (13,481 ) (9,901 ) (34,203 ) (28,651 ) Loan charges and

prepayment penalties (1,545 ) (1,044 ) (2,260 ) (2,626 ) Earnings

from unconsolidated subsidiaries and investees 81 320 276 266

Litigation settlement (expense) (85 ) (86 )

(203 ) 3,666 Total other expenses (11,152 )

(4,273 ) (18,628 ) (10,343 ) Loss before gain

on land sales, non-controlling interest, and taxes (9,067 ) (3,805

) (10,689 ) (10,087 ) Gain on sale of income producing properties

735 - 735 - Gain on land sales 1,958 40

7,861 634 Net income (loss) from

continuing operations before taxes (6,374 ) (3,765 ) (2,093 )

(9,453 ) Income tax benefit (expense) 16 786

107 5,030 Net income (loss) from

continuing operations (6,358 ) (2,979 ) (1,986 ) (4,423 )

Discontinued operations: Net income (loss) from discontinued

operations 47 477 306 (454 ) Gain on sale of real estate from

discontinued operations - 1,770 - 14,826 Income tax benefit

(expense) from discontinued operations (16 ) (786 )

(107 ) (5,030 ) Net income (loss) from discontinued

operations 31 1,461 199

9,342 Net income (loss) (6,327 ) (1,518 )

(1,787 ) 4,919 Net income (loss) attributable to non-controlling

interest 1,164 200 1,132

(1,170 ) Net income attributable to American Realty

Investors, Inc. (5,163 ) (1,318 ) (655 ) 3,749 Preferred dividend

requirement (275 ) (428 ) (941 ) (1,653

) Net income applicable to common shares $ (5,438 ) $ (1,746 ) $

(1,596 ) $ 2,096

Earnings per share - basic Net

income (loss) from continuing operations $ (0.35 ) $ (0.24 ) $

(0.12 ) $ (0.59 ) Net income from discontinued operations -

0.11 0.01 0.76 Net

income applicable to common shares $ (0.35 ) $ (0.13 ) $ (0.11 ) $

0.17

Earnings per share - diluted Net income

(loss) from continuing operations $ (0.35 ) $ (0.24 ) $ (0.12 ) $

(0.59 ) Net income (loss) from discontinued operations -

0.11 0.01 0.76 Net

income applicable to common shares $ (0.35 ) $ (0.13 ) $ (0.11 ) $

0.17 Weighted average common shares used in computing

earnings per share 15,514,360 13,619,647 14,975,212 12,231,146

Weighted average common shares used in computing diluted earnings

per share 15,514,360 13,619,646 14,975,212 12,231,146

Amounts attributable to American Realty Investors, Inc. Net

income (loss) from continuing operations $ (5,194 ) $ (2,779 ) $

(854 ) $ (5,593 ) Net income (loss) from discontinued operations

31 1,461 199 9,342

Net income applicable to American Realty Investors, Inc. $

(5,163 ) $ (1,318 ) $ (655 ) $ 3,749

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED BALANCE

SHEETS (unaudited) September

30, December 31, 2015 2014

(dollars in thousands, except share and par value amounts)

Assets

Real estate, at cost $ 961,099 $ 810,214 Real estate subject to

sales contracts at cost, net of depreciation ($194 for 2015 and

$2,300 for 2014) 9,213 19,026 Less accumulated depreciation

(145,101 ) (129,477 )

Total real estate

825,211 699,763 Notes and interest receivable Performing (including

$121,099 in 2015 and $139,466 in 2014 from related parties) 132,452

149,484 Non-performing - 3,161 Less allowance for doubtful accounts

(including $15,537 in 2015 and 2014 from related parties)

(17,037 ) (18,279 )

Total notes and interest receivable

115,415 134,366 Cash and cash equivalents 11,989 12,299 Restricted

cash 42,214 49,266 Investments in unconsolidated subsidiaries and

investees 5,152 4,279 Receivable from related party 43,301 21,414

Other assets 43,829 44,111

Total assets

$ 1,087,111 $ 965,498

Liabilities and Shareholders’

Equity

Liabilities: Notes and interest payable $ 782,570 $ 638,891 Notes

related to subject to sales contracts 7,793 20,168 Deferred revenue

(including $71,603 in 2015 and $72,564 in 2014 from sales to

related parties) 71,672 74,409 Accounts payable and other

liabilities (including $7,001 in 2015 and $11,024 in 2014 to

related parties) 46,412 52,442 908,447

785,910 Shareholders’ equity: Preferred stock, Series A:

$2.00 par value, authorized 15,000,000 shares, issued and

outstanding 2,000,614 and 2,461,252 shares in 2015 and 2014

(liquidation preference $10 per share), including 900,000 shares in

2015 and 2014 held by ARL or subsidiaries. 2,205 3,126 Common

stock, $0.01 par value, authorized 100,000,000 shares; issued

15,930,145 and 14,443,404 shares; outstanding 15,514,360 and

14,027,619 shares in 2015 and 2014, respectively; including 140,000

shares held by TCI (consolidated) in 2015 and 2014. 156 141

Treasury stock at cost; 415,785 shares (6,395 ) (6,395 ) Paid-in

capital 110,136 108,378 Retained earnings 18,435

19,090

Total American Realty Investors, Inc.

shareholders' equity

124,537 124,340

Non-controlling interest

54,127 55,248

Total shareholders' equity

178,664 179,588

Total liabilities and shareholders'

equity

$ 1,087,111 $ 965,498

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151113005762/en/

American Realty Investors, Inc.Investor

RelationsGene Bertcher,

800-400-6407investor.relations@americanrealtyinvest.com

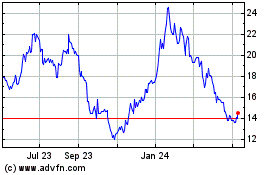

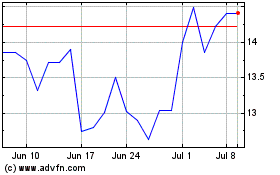

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024