American Realty Investors, Inc. (NYSE:ARL), a Dallas-based real

estate investment company, today reported results of operations for

the third quarter ended September 30, 2014. ARL announced today

that the Company reported net loss applicable to common shares of

$1.7 million or $0.13 per diluted earnings per share, as compared

to a net loss applicable to common shares of $7.0 million or $0.62

per diluted earnings per share for the same period ended 2013.

Management’s efforts to enhance the value of our overall

portfolio has resulted in the continuing improvement in the

Company’s results of operations. We continue to see growth in the

multifamily market with increasing rents, stable operating

expenses, and an occupancy rate over 93%. We are diligent in our

mission to provide high-quality living opportunities to our

tenants.

In our commercial portfolio, we are seeing the benefit of our

efforts with new leases executed and increasing rents as first year

concessions expire. We believe that we will continue to see growth

in our commercial portfolio as the economic conditions improve and

we capitalize on the influx of attractive prospects in the

pipeline.

Our ability to take advantage of lower-interest rate mortgages

available has reduced our monthly obligations and increased cash

flow within our multifamily portfolio.

The positive results of operations has allowed the Company to

invest in mortgage receivables in various multifamily projects not

under the Company’s ownership. We will continue to invest in the

multifamily market, as conditions are optimal for achieving a high

return on our investment.

Rental and other property revenues were slightly lower for the

three months ended September 30, 2014, as compared to the same

period in the prior year. This was mainly attributable to our

commercial portfolio, which was lower in the current period related

to some prior year larger square-foot tenants downsizing or moving

out and first year lease specials for new tenants. Rental revenue

from our apartment portfolio increased in the current period as we

continue to excel with high occupancy rates and increasing rental

rates.

Property operating expenses were $10.8 million for the three

months ended September 30, 2014, representing an increase of $0.4

million as compared to the same period in the previous year.

Operating expenses have remained consistent with prior periods due

to labor efficiencies and improvements in preventative maintenance

across the portfolio, with only an increase in real estate taxes as

a result of the increase in the value of our portfolio and some

non-recurring repair projects completed in the current period.

Interest income was $5.1 million for the three months ended

September 30, 2014, representing an increase of $1.3 million as

compared to the same period in the prior year. During the current

quarter, we invested $17.3 million in mortgage receivables which

would increase the basis for our interest income.

About American Realty Investors, Inc.

American Realty Investors, Inc., a Dallas-based real estate

investment company, holds a diverse portfolio of equity real estate

located across the U.S., including office buildings, apartments,

shopping centers and developed and undeveloped land. The Company

invests in real estate through direct ownership, leases and

partnerships and invests in mortgage loans on real estate. The

Company also holds mortgage receivables. For more information,

visit the Company’s website at www.americanrealtyinvest.com.

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED STATEMENTS

OF OPERATIONS (unaudited)

For the Three Months Ended

For the Nine Months Ended

September 30, September 30, 2014 2013

2014 2013 (dollars in thousands, except per share

amounts) Revenues: Rental and other property revenues

(including $175 and $165 for the three months and $525 and $497 for

the nine months ended 2014 and 2013, respectively, from related

parties) $ 19,326 $ 19,530 $ 57,986 $ 57,810

Expenses: Property operating expenses (including $171 and

$178 for the three months and $484 and $550 for the nine months

ended 2014 and 2013, respectively, from related parties) 10,766

10,387 30,677 29,107 Depreciation and amortization 4,463 4,053

13,099 11,820 General and administrative (including $926 and $878

for the three months and $2,686 and $2,765 for the nine months

ended 2014 and 2013, respectively, from related parties) 1,590

1,867 6,770 5,911 Provision on impairment of notes receivable and

real estate assets - 1,125 - 1,926 Net income fee to related party

(186 ) 55 514 159 Advisory fee to related party 2,225

2,584 6,670 7,625 Total

operating expenses 18,858 20,071

57,730 56,548 Operating income (loss) 468 (541

) 256 1,262

Other income (expenses): Interest income

(including $4,699 and $3,718 for the three months and $14,693 and

$10,574 for the nine months ended 2014 and 2013, respectively, from

related parties) 5,106 3,778 15,264 10,831 Other income 1,332 59

1,738 2,734 Mortgage and loan interest (including $978 and $1,168

for the three months and $2,709 and $2,849 for the nine months

ended 2014 and 2013, respectively, from related parties) (9,053 )

(9,130 ) (26,573 ) (27,152 ) Deferred borrowing costs amortization

(848 ) (247 ) (2,078 ) (2,672 ) Loan charges and prepayment

penalties (1,044 ) (49 ) (2,626 ) (4,166 ) Loss on sale of

investments - (275 ) - (283 ) Earnings from unconsolidated

subsidiaries and investees 320 69 266 256 Litigation settlement

(86 ) (2,739 ) 3,666 (2,727 )

Total other expenses (4,273 ) (8,534 ) (10,343

) (23,179 ) Loss before gain on land sales, non-controlling

interest, and taxes (3,805 ) (9,075 ) (10,087 ) (21,917 ) Gain on

land sales 40 598 634

563 Net loss from continuing operations before taxes

(3,765 ) (8,477 ) (9,453 ) (21,354 ) Income tax benefit 786

402 5,030 8,561

Net loss from continuing operations (2,979 ) (8,075 ) (4,423 )

(12,793 ) Discontinued operations: Net income (loss) from

discontinued operations 477 1,021 (454 ) (970 ) Gain on sale of

real estate from discontinued operations 1,769 127 14,826 25,429

Income tax expense from discontinued operations (786 )

(402 ) (5,030 ) (8,561 ) Net income from

discontinued operations 1,460 746 9,342 15,898 Net income (loss)

(1,519 ) (7,329 ) 4,919 3,105 Net (income) loss attributable to

non-controlling interest 200 903

(1,170 ) (803 ) Net income (loss) attributable to American

Realty Investors, Inc. (1,319 ) (6,426 ) 3,749 2,302 Preferred

dividend requirement (427 ) (613 ) (1,653 )

(1,839 ) Net income (loss) applicable to common shares $

(1,746 ) $ (7,039 ) $ 2,096 $ 463

Earnings

per share - basic Net loss from continuing operations $ (0.24 )

$ (0.68 ) $ (0.59 ) $ (1.34 ) Net income from discontinued

operations 0.11 0.06 0.76

1.38 Net income (loss) applicable to common shares $

(0.13 ) $ (0.62 ) $ 0.17 $ 0.04

Earnings

per share - diluted Net loss from continuing operations $ (0.24

) $ (0.68 ) $ (0.59 ) $ (1.34 ) Net income from discontinued

operations 0.11 0.06 0.76

1.38 Net income (loss) applicable to common shares $

(0.13 ) $ (0.62 ) $ 0.17 $ 0.04 Weighted

average common shares used in computing earnings per share

13,619,647 11,525,389 12,231,146 11,525,389 Weighted average common

shares used in computing diluted earnings per share 13,619,647

11,525,389 12,231,146 11,525,389

Amounts

attributable to American Realty Investors, Inc. Net loss from

continuing operations $ (2,779 ) $ (7,172 ) $ (5,593 ) $ (13,596 )

Net income from discontinued operations 1,460

746 9,342 15,898 Net income

(loss) applicable to American Realty Investors, Inc. $ (1,319 ) $

(6,426 ) $ 3,749 $ 2,302

AMERICAN REALTY INVESTORS, INC. CONSOLIDATED

BALANCE SHEETS (unaudited) September 30,

December 31, 2014 2013 (dollars in

thousands, except share and par value amounts) Assets

Real estate, at cost $ 745,544 $ 799,698 Real estate held for sale

at cost, net of depreciation ($2,066 for 2014 and $2,390 for 2013)

44,288 16,427 Real estate subject to sales contracts at cost, net

of depreciation ($2,212 for 2014 and $1,949 for 2013) 19,594 27,598

Less accumulated depreciation (125,352 ) (143,429 )

Total real estate 684,074 700,294 Notes and interest receivable

Performing (including $147,978 in 2014 and $145,754 in 2013 from

related parties) 163,335 153,275 Non-performing 3,151 3,140 Less

allowance for doubtful accounts (including $15,537 in 2014 and

$15,809 in 2013 from related parties) (18,279 )

(19,600 ) Total notes and interest receivable 148,207 136,815 Cash

and cash equivalents 4,383 16,437 Restricted cash 28,813 32,929

Investments in unconsolidated subsidiaries and investees 4,137

3,789 Receivable from related party 22,930 14,086 Other assets

43,442 38,972 Total assets $ 935,986

$ 943,322

Liabilities and Shareholders’

Equity Liabilities: Notes and interest payable $ 597,469 $

618,930 Notes related to assets held for sale 42,883 17,100 Notes

related to subject to sales contracts 18,769 23,012 Deferred

revenue (including $74,303 in 2014 and 2013 from sales to related

parties) 76,148 76,148 Accounts payable and other liabilities

(including $10,634 in 2014 and $15,394 in 2013 to related parties)

55,917 73,271 791,186 808,461

Shareholders’ equity: Preferred stock, Series A: $2.00 par value,

authorized 15,000,000 shares, issued and outstanding 2,461,252

shares in 2014 and 3,353,954 shares in 2013 (liquidation preference

$10 per share), including 900,000 shares in 2014 and 2013 held by

ARL or subsidiaries. Series K: $2.00 par value, authorized, issued

and outstanding 0 shares in 2014 and 135,000 shares in 2013

(liquidation preference $22 per share) 3,126 4,908 Common stock,

$0.01 par value, authorized 100,000,000 shares; issued 14,443,404

shares in 2014 and 11,941,174 shares in 2013; outstanding

14,027,619 shares in 2014 and 11,525,389 shares in 2013; including

140,000 shares held by TCI (consolidated) in 2014 and 229,214

shares held by TCI (consolidated) in 2013. 141 115 Treasury stock

at cost; 415,785 shares in 2014 and 2013 (6,395 ) (6,395 ) Paid-in

capital 108,844 102,974 Retained earnings (8,046 )

(11,795 ) Total American Realty Investors, Inc. shareholders'

equity 97,670 89,807 Non-controlling interest 47,130

45,054 Total equity 144,800

134,861 Total liabilities and equity $ 935,986 $

943,322

American Realty Investors, Inc.Investor

RelationsGene Bertcher,

800-400-6407investor.relations@americanrealtyinvest.com

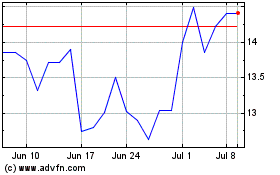

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

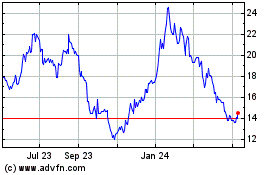

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024