SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

January 8, 2016 (December 16, 2015)

Avangrid,

Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| New York |

|

001-37660 |

|

14-1798693 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| Durham Hall, 52 Farm View Drive,

New Gloucester, Maine |

|

04260 |

| (Address of principal executive offices) |

|

(Zip Code) |

(207) 688-6363

(Registrant’s telephone number, including area code)

N.A.

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.01 |

Completion of Acquisition or Disposition of Assets. |

As previously disclosed, on

December 16, 2015, UIL Holdings Corporation, a Connecticut corporation (“UIL”), became a wholly-owned subsidiary of Avangrid, Inc., a New York corporation (formerly Iberdrola USA, Inc. and referred to herein as the

“Company”), as a result of the merger of Green Merger Sub, Inc., a Connecticut corporation and a wholly-owned subsidiary of the Company (“Merger Sub”), with UIL, with Merger Sub surviving as a wholly-owned subsidiary of the

Company (the “Merger”). The Merger was effected pursuant to the Agreement and Plan of Merger, dated as of February 25, 2015, by and among the Company, Merger Sub, and UIL. Following the completion of the Merger, Merger Sub was renamed

“UIL Holdings Corporation.” On December 18, 2015, the Company filed a Current Report on Form 8-K (the “Original Report”) to report the completion of the Merger.

This amendment to the Original Report is being filed to provide the financial statements and pro forma financial information required by Items

9.01(a) and 9.01(b), respectively, of Form 8-K. This amendment makes no other amendments to the Original Report.

| Item 9.01 |

Financial Statements and Exhibits. |

| |

(a) |

Financial Statements of Business Acquired |

The audited consolidated financial statements

of UIL as of December 31, 2014 and 2013, and for each of the three years in the period ended December 31, 2014, as well as the accompanying notes thereto and the related Report of Independent Registered Public Accounting Firm, were filed

by UIL with the Securities and Exchange Commission on Form 10-K on February 26, 2015 and are incorporated herein by reference as Exhibit 99.1.

The unaudited consolidated financial statements of UIL as of September 30, 2015 and for the three and nine months ended

September 30, 2015 and September 30, 2014, as well as the accompanying notes thereto, were filed by UIL with the Securities and Exchange Commission on Form 10-Q on November 2, 2015 and are incorporated herein by reference as Exhibit 99.2.

| |

(b) |

Pro Forma Financial Information |

The unaudited pro forma combined financial statements

for the nine months ended September 30, 2015 and for the year ended December 31, 2014, and the unaudited pro forma combined balance sheet as of September 30, 2015, giving effect to the Merger, are filed as Exhibit 99.3 and

incorporated herein by reference.

|

|

|

| Exhibit

No. |

|

Document |

|

|

| 23.1 |

|

Consent of PricewaterhouseCoopers LLP |

|

|

| 99.1 |

|

Audited financial statements of UIL Holdings Corporation as of December 31, 2014 and 2013, and for each of the three years in the period ended December 31, 2014 (incorporated by reference to UIL’s Annual Report on

Form 10-K, filed on February 26, 2015) |

|

|

| 99.2 |

|

Unaudited consolidated financial statements of UIL Holdings Corporation as of September 30, 2015 and for the three and nine months ended September 30, 2015 and September 30, 2014 (incorporated by reference to UIL’s Quarterly

Report on Form 10-Q, filed on November 2, 2015) |

|

|

| 99.3 |

|

Unaudited pro forma combined financial statements |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Dated: January 8, 2016 |

|

|

|

AVANGRID, INC. |

|

|

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

|

/s/ R. Scott Mahoney |

|

|

|

|

Name: |

|

R. Scott Mahoney |

|

|

|

|

Title: |

|

General Counsel |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Document |

|

|

| 23.1 |

|

Consent of PricewaterhouseCoopers LLP |

|

|

| 99.1 |

|

Audited financial statements of UIL Holdings Corporation as of December 31, 2014 and 2013, and for each of the three years in the period ended December 31, 2014 (incorporated by reference to UIL’s Annual Report on

Form 10-K, filed on February 26, 2015) |

|

|

| 99.2 |

|

Unaudited consolidated financial statements of UIL Holdings Corporation as of September 30, 2015 and for the three and nine months ended September 30, 2015 and September 30, 2014 (incorporated by reference to UIL’s Quarterly

Report on Form 10-Q, filed on November 2, 2015) |

|

|

| 99.3 |

|

Unaudited pro forma combined financial statements |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in the Registration Statements on Form S-8 (No. 333-208571) and Form S-4 (No. 333-205727) of Avangrid, Inc. (formerly Iberdrola USA, Inc.) of our report dated February 26, 2015 relating to the financial statements, financial statement schedules and the effectiveness of internal

control over financial reporting which appears in UIL Holdings Corporation’s Annual Report on Form 10-K for the year ended December 31, 2014, which is incorporated by reference in this Current Report on Form 8-K/A of Avangrid, Inc.

/s/ PricewaterhouseCoopers LLP

Boston, MA

January 8, 2016

Exhibit 99.3

UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

The following unaudited pro forma combined financial information sets forth the unaudited pro forma combined statement of income of the

combined company for the nine months ended September 30, 2015 and for the year ended December 31, 2014, and the unaudited pro forma combined balance sheet as of September 30, 2015 to give effect to the transaction described in Note 1,

or the transaction, as if such transaction was completed on January 1, 2014 and September 30, 2015, respectively.

The following

unaudited pro forma combined financial information is based on the historical financial statements of Avangrid, Inc., or Avangrid, formerly Iberdrola USA, Inc., and UIL Holdings Corporation, or UIL, and is intended to illustrate how the transaction

might have affected the historical financial statements of Avangrid if it had been consummated at the dates indicated above. The unaudited pro forma combined financial information reflects preliminary estimates and assumptions based on information

available at the time of preparation, including fair value estimates of assets and liabilities. The unaudited pro forma combined financial information is provided for illustrative purposes only and does not necessarily reflect the financial position

or results of operations that would have actually resulted had the transaction occurred as of the dates indicated, nor should it be taken as necessarily indicative of the future financial position or results of operations of the combined company.

Future results may vary significantly from the results reflected because of various factors, including those discussed in the section entitled “Risk Factors” beginning on page 37 of Avangrid’s Registration Statement on Form S-4 (File

No. 333-205727), filed with the Securities and Exchange Commission, or the SEC, which was declared effective on November 12, 2015, or the S-4.

The unaudited pro forma combined financial information should be read together with:

| |

• |

|

the accompanying notes to the unaudited pro forma combined financial information; |

| |

• |

|

the unaudited consolidated financial statements of Avangrid as of September 30, 2015 and for the three and nine months ended September 30, 2015 and 2014 contained in its Quarterly Report on Form 10-Q filed

with the SEC on December 16, 2015; |

| |

• |

|

the audited combined and consolidated financial statements of Avangrid as of December 31, 2014 and 2013 and for the three years ended December 31, 2014 included in the S-4; |

| |

• |

|

the unaudited consolidated financial statements of UIL as of September 30, 2015 and for the three and nine months ended September 30, 2015 and 2014 contained in its Quarterly Report on Form 10-Q filed with the

SEC on November 2, 2015, which are incorporated by reference into this document; |

| |

• |

|

the audited consolidated financial statements of UIL as of December 31, 2014 and 2013 and for the three years ended December 31, 2014 contained in its Annual Report on Form 10-K filed with the SEC on

February 26, 2015, which are incorporated by reference into this document. |

The unaudited pro forma combined financial

information does not reflect any cost savings, operating synergies or revenue enhancements that the combined company may achieve as a result of the transaction, the costs to integrate the operations of UIL and Avangrid or the costs necessary to

achieve these cost savings, operating synergies and revenue enhancements. The unaudited pro forma combined financial information also does not reflect regulatory actions that impact the combined company.

1

Unaudited Pro Forma Combined Balance Sheet as of September 30, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of September 30, 2015 |

|

| |

|

Historical

Avangrid |

|

|

Historical

UIL |

|

|

Reporting

Reclassifications

(K) |

|

|

Transaction

Adjustments |

|

|

|

|

Pro Forma

Avangrid |

|

| |

|

(in millions) |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,050 |

|

|

$ |

84 |

|

|

$ |

— |

|

|

$ |

(662 |

) |

|

A |

|

$ |

472 |

|

| Restricted cash |

|

|

— |

|

|

|

1 |

|

|

|

(1 |

) |

|

|

— |

|

|

|

|

|

— |

|

| Accounts receivable and unbilled revenues, net |

|

|

792 |

|

|

|

— |

|

|

|

272 |

|

|

|

— |

|

|

|

|

|

1,064 |

|

| Accounts receivable, less allowance |

|

|

— |

|

|

|

216 |

|

|

|

(216 |

) |

|

|

— |

|

|

|

|

|

— |

|

| Unbilled revenue |

|

|

|

|

|

|

55 |

|

|

|

(55 |

) |

|

|

— |

|

|

|

|

|

— |

|

| Notes receivable from affiliates |

|

|

8 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

8 |

|

| Derivative assets |

|

|

120 |

|

|

|

10 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

130 |

|

| Fuel and gas in storage |

|

|

190 |

|

|

|

62 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

252 |

|

| Materials and supplies |

|

|

97 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

97 |

|

| Deferred income taxes |

|

|

61 |

|

|

|

— |

|

|

|

— |

|

|

|

17 |

|

|

B |

|

|

78 |

|

| Refundable taxes |

|

|

— |

|

|

|

14 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

14 |

|

| Prepayments and other current assets |

|

|

267 |

|

|

|

— |

|

|

|

39 |

|

|

|

— |

|

|

|

|

|

306 |

|

| Prepayments |

|

|

— |

|

|

|

25 |

|

|

|

(25 |

) |

|

|

— |

|

|

|

|

|

— |

|

| Other |

|

|

— |

|

|

|

14 |

|

|

|

(14 |

) |

|

|

— |

|

|

|

|

|

— |

|

| Regulatory assets |

|

|

114 |

|

|

|

82 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

196 |

|

| Deferred income taxes regulatory |

|

|

7 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Current Assets |

|

|

2,706 |

|

|

|

563 |

|

|

|

— |

|

|

|

(645 |

) |

|

|

|

|

2,624 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity investment in GenConn |

|

|

— |

|

|

|

110 |

|

|

|

(110 |

) |

|

|

— |

|

|

|

|

|

— |

|

| Other |

|

|

— |

|

|

|

28 |

|

|

|

(28 |

) |

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Other Investments |

|

|

— |

|

|

|

138 |

|

|

|

(138 |

) |

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property, plant and equipment, at cost |

|

|

22,286 |

|

|

|

4,284 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

26,570 |

|

| Less: accumulated depreciation |

|

|

(6,289 |

) |

|

|

(1,071 |

) |

|

|

— |

|

|

|

— |

|

|

|

|

|

(7,360 |

) |

| Net Property, Plant and Equipment in Service |

|

|

15,997 |

|

|

|

3,213 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

19,210 |

|

| Construction work in progress |

|

|

1,032 |

|

|

|

272 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

1,304 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Property, Plant and Equipment |

|

|

17,029 |

|

|

|

3,485 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

20,514 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity method investments |

|

|

271 |

|

|

|

— |

|

|

|

110 |

|

|

|

— |

|

|

|

|

|

381 |

|

|

|

|

|

|

|

|

| Other investments |

|

|

40 |

|

|

|

— |

|

|

|

28 |

|

|

|

25 |

|

|

C |

|

|

93 |

|

| Regulatory assets |

|

|

2,269 |

|

|

|

683 |

|

|

|

— |

|

|

|

130 |

|

|

E |

|

|

3,082 |

|

| Other Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Goodwill |

|

|

1,361 |

|

|

|

266 |

|

|

|

— |

|

|

|

1,510 |

|

|

D |

|

|

3,137 |

|

| Intangible assets |

|

|

541 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

541 |

|

| Derivative assets |

|

|

120 |

|

|

|

21 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

141 |

|

| Unamortized debt issuance expenses |

|

|

— |

|

|

|

13 |

|

|

|

(13 |

) |

|

|

— |

|

|

|

|

|

— |

|

| Other long-term receivable |

|

|

— |

|

|

|

2 |

|

|

|

(2 |

) |

|

|

— |

|

|

|

|

|

— |

|

| Other |

|

|

60 |

|

|

|

1 |

|

|

|

15 |

|

|

|

17 |

|

|

F |

|

|

93 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Other Assets |

|

|

2,082 |

|

|

|

303 |

|

|

|

— |

|

|

|

1,527 |

|

|

|

|

|

3,912 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

24,397 |

|

|

$ |

5,172 |

|

|

$ |

— |

|

|

$ |

1,037 |

|

|

|

|

$ |

30,606 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of September 30, 2015 |

|

| |

|

Historical

Avangrid |

|

|

Historical

UIL |

|

|

Reporting

Reclassifications

(K) |

|

|

Transaction

Adjustments |

|

|

|

|

Pro Forma

Avangrid |

|

| |

|

(in millions) |

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Line of credit borrowings |

|

$ |

— |

|

|

$ |

85 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

$ |

85 |

|

| Current portion of debt |

|

|

173 |

|

|

|

7 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

180 |

|

| Tax equity financing arrangements |

|

|

112 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

112 |

|

| Interest accrued |

|

|

37 |

|

|

|

26 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

63 |

|

| Accounts payable |

|

|

659 |

|

|

|

142 |

|

|

|

68 |

|

|

|

— |

|

|

|

|

|

869 |

|

| Dividends payable |

|

|

— |

|

|

|

24 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

24 |

|

| Accrued liabilities |

|

|

— |

|

|

|

68 |

|

|

|

(68 |

) |

|

|

— |

|

|

|

|

|

— |

|

| Taxes accrued |

|

|

45 |

|

|

|

20 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

65 |

|

| Derivative liability |

|

|

86 |

|

|

|

28 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

114 |

|

| Deferred income taxes |

|

|

— |

|

|

|

13 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

13 |

|

| Other current liabilities |

|

|

257 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

257 |

|

| Regulatory liabilities |

|

|

130 |

|

|

|

22 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

152 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Current Liabilities |

|

|

1,499 |

|

|

|

435 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

1,934 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Regulatory Liabilities |

|

|

1,354 |

|

|

|

524 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

1,878 |

|

| Deferred income taxes regulatory |

|

|

347 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

347 |

|

| Other Non-current Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deferred income taxes |

|

|

2,409 |

|

|

|

620 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

3,029 |

|

| Deferred income |

|

|

1,571 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

1,571 |

|

| Pension and other post-retirement |

|

|

755 |

|

|

|

— |

|

|

|

351 |

|

|

|

— |

|

|

|

|

|

1,106 |

|

| Pension accrued |

|

|

— |

|

|

|

264 |

|

|

|

(264 |

) |

|

|

— |

|

|

|

|

|

— |

|

| Other post-retirement benefits accrued |

|

|

— |

|

|

|

87 |

|

|

|

(87 |

) |

|

|

— |

|

|

|

|

|

— |

|

| Tax equity financing arrangements |

|

|

205 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

205 |

|

| Derivative liability |

|

|

49 |

|

|

|

75 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

124 |

|

| Asset retirement obligation |

|

|

245 |

|

|

|

— |

|

|

|

19 |

|

|

|

— |

|

|

|

|

|

264 |

|

| Environmental remediation costs |

|

|

275 |

|

|

|

— |

|

|

|

4 |

|

|

|

— |

|

|

|

|

|

279 |

|

| Other |

|

|

247 |

|

|

|

49 |

|

|

|

(23 |

) |

|

|

— |

|

|

|

|

|

273 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Other Non-current Liabilities |

|

|

5,756 |

|

|

|

1,095 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

6,851 |

|

| Non-current debt |

|

|

2,794 |

|

|

|

1,730 |

|

|

|

— |

|

|

|

172 |

|

|

E |

|

|

4,696 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Non-current Liabilities |

|

|

10,251 |

|

|

|

3,349 |

|

|

|

— |

|

|

|

172 |

|

|

|

|

|

13,772 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

11,750 |

|

|

|

3,784 |

|

|

|

— |

|

|

|

172 |

|

|

|

|

|

15,706 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ Equity |

|

|

12,631 |

|

|

|

1,388 |

|

|

|

— |

|

|

|

865 |

|

|

G |

|

|

14,884 |

|

| Noncontrolling Interests |

|

|

16 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Equity |

|

|

12,647 |

|

|

|

1,388 |

|

|

|

— |

|

|

|

865 |

|

|

|

|

|

14,900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Equity |

|

$ |

24,397 |

|

|

$ |

5,172 |

|

|

$ |

— |

|

|

$ |

1,037 |

|

|

|

|

$ |

30,606 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the unaudited pro forma combined financial information.

3

Unaudited Pro Forma Combined Statement of Income for the nine months ended

September 30, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the nine months ended September 30, 2015 |

|

| |

|

Historical

Avangrid |

|

|

Historical

UIL |

|

|

Reporting

Reclassifications

(K) |

|

|

Transaction

Adjustments |

|

|

|

|

|

Pro Forma

Avangrid |

|

| |

|

(in millions, except per share data) |

|

| Operating Revenues |

|

$ |

3,214 |

|

|

$ |

1,226 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

4,440 |

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased power, natural gas and fuel used |

|

|

754 |

|

|

|

422 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

1,176 |

|

| Transmission wholesale |

|

|

— |

|

|

|

68 |

|

|

|

(68 |

) |

|

|

— |

|

|

|

|

|

|

|

— |

|

| Operations and maintenance |

|

|

1,235 |

|

|

|

316 |

|

|

|

75 |

|

|

|

(26 |

) |

|

|

H |

|

|

|

1,600 |

|

| Impairment of non-current assets |

|

|

10 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

10 |

|

| Depreciation and amortization |

|

|

525 |

|

|

|

123 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

648 |

|

| Taxes other than income taxes |

|

|

260 |

|

|

|

108 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

368 |

|

| Merger and acquisition related expenses |

|

|

— |

|

|

|

7 |

|

|

|

(7 |

) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Operating Expenses |

|

|

2,784 |

|

|

|

1,044 |

|

|

|

— |

|

|

|

(26 |

) |

|

|

|

|

|

|

3,802 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income |

|

|

430 |

|

|

|

182 |

|

|

|

— |

|

|

|

26 |

|

|

|

|

|

|

|

638 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income and (Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

|

|

38 |

|

|

|

13 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

51 |

|

| Earnings from equity method investments |

|

|

(3 |

) |

|

|

10 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

7 |

|

| Interest expense/charges, net |

|

|

(191 |

) |

|

|

(73 |

) |

|

|

— |

|

|

|

6 |

|

|

|

E |

|

|

|

(258 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Before Income Tax |

|

|

274 |

|

|

|

132 |

|

|

|

— |

|

|

|

32 |

|

|

|

|

|

|

|

438 |

|

| Income tax expense |

|

|

103 |

|

|

|

43 |

|

|

|

— |

|

|

|

13 |

|

|

|

I |

|

|

|

159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

171 |

|

|

$ |

89 |

|

|

$ |

— |

|

|

$ |

19 |

|

|

|

|

|

|

$ |

279 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share (basic) |

|

$ |

705,110 |

|

|

$ |

1.56 |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

|

|

|

$ |

0.90 |

|

| Earnings per share (diluted) |

|

$ |

705,110 |

|

|

$ |

1.55 |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

|

|

|

$ |

0.90 |

|

| Cash dividends per share |

|

|

— |

|

|

$ |

1.296 |

(2) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

(1) |

| (1) |

Avangrid will initially set its dividend at $0.432 per share, and will target a dividend based on a 65% to 75% payout ratio long-term. |

| (2) |

The cash dividends declared per share amount disclosed in UIL’s Quarterly Report on Form 10-Q for the nine months ended September 30, 2015 erroneously reflected only two quarters of dividends declared

($0.864). This amount has been corrected to reflect three quarters of dividends declared ($1.296). UIL has concluded that this error is immaterial to its prior period financial statements. |

See accompanying notes to the unaudited pro forma combined financial information.

4

Unaudited Pro Forma Combined Statement of Income for the year ended December 31, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the year ended December 31, 2014 |

|

| |

|

Historical

Avangrid |

|

|

Historical

UIL |

|

|

Reporting

Reclassifications

(K) |

|

|

Transaction

Adjustments |

|

|

|

|

|

Pro Forma

Avangrid |

|

| |

|

(in millions, except per share data) |

|

| Operating Revenues |

|

$ |

4,594 |

|

|

$ |

1,632 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

6,226 |

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased power, natural gas and fuel used |

|

|

1,181 |

|

|

|

600 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

1,781 |

|

| Transmission wholesale |

|

|

— |

|

|

|

88 |

|

|

|

(88 |

) |

|

|

— |

|

|

|

|

|

|

|

— |

|

| Operation and maintenance |

|

|

1,552 |

|

|

|

400 |

|

|

|

95 |

|

|

|

— |

|

|

|

|

|

|

|

2,047 |

|

| Impairment of non-current assets |

|

|

25 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

25 |

|

| Depreciation and amortization |

|

|

629 |

|

|

|

152 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

781 |

|

| Taxes other than income taxes |

|

|

322 |

|

|

|

138 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

460 |

|

| Acquisition related expenses |

|

|

— |

|

|

|

7 |

|

|

|

(7 |

) |

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Operating Expenses |

|

|

3,709 |

|

|

|

1,385 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

5,094 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income |

|

|

885 |

|

|

|

247 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

1,132 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income and (Expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

|

|

52 |

|

|

|

18 |

|

|

|

(16 |

) |

|

|

— |

|

|

|

|

|

|

|

54 |

|

| Earnings from equity method investments |

|

|

12 |

|

|

|

14 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

26 |

|

| Interest expense/charges, net |

|

|

(243 |

) |

|

|

(96 |

) |

|

|

— |

|

|

|

8 |

|

|

|

E |

|

|

|

(331 |

) |

| Acquisition related bridge facility fees |

|

|

— |

|

|

|

(16 |

) |

|

|

16 |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Before Income Tax |

|

|

706 |

|

|

|

167 |

|

|

|

— |

|

|

|

8 |

|

|

|

|

|

|

|

881 |

|

| Income tax expense |

|

|

282 |

|

|

|

57 |

|

|

|

— |

|

|

|

3 |

|

|

|

J |

|

|

|

342 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

424 |

|

|

$ |

110 |

|

|

$ |

— |

|

|

$ |

5 |

|

|

|

|

|

|

$ |

539 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share (basic) |

|

$ |

1,743,940 |

|

|

$ |

1.93 |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

|

|

|

$ |

1.74 |

|

| Earnings per share (diluted) |

|

$ |

1,743,940 |

|

|

$ |

1.92 |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

|

|

|

$ |

1.74 |

|

| Cash dividends per share |

|

|

— |

|

|

$ |

1.728 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

(1) |

| (1) |

Avangrid will initially set its dividend at $0.432 per share, and will target a dividend based on a 65% to 75% payout ratio long-term. |

See accompanying notes to the unaudited pro forma combined financial information.

5

NOTES TO THE UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

| 1. |

Description of the Transaction |

On February 25, 2015, an agreement was reached

between Avangrid, a wholly-owned subsidiary of Iberdrola, S.A., Green Merger Sub, Inc., or merger sub, a wholly-owned subsidiary of Avangrid, and UIL, under which UIL agreed to merge with and into merger sub, with merger sub surviving the merger as

a wholly-owned subsidiary of Avangrid. The merger was completed on December 16, 2015, or the Acquisition Date, and in connection with the merger, 57,255,850 shares of common stock of Avangrid were issued to UIL shareowners in addition to

payment of $10.50 in cash per each share of the common stock of UIL issued and outstanding at the Acquisition Date. Immediately following the completion of the merger, former UIL shareowners owned 18.5% of the outstanding shares of common stock of

Avangrid and Iberdrola, S.A. owned the remaining shares. The transaction described above is referred to as the transaction in these notes to the unaudited pro forma combined financial information.

The historical consolidated financial statements of Avangrid and

UIL have been adjusted in the unaudited pro forma combined financial information to give effect to pro forma events that are (1) directly attributable to the transaction, (2) factually supportable, and (3) with respect to the

statements of income, expected to have a continuing impact on the combined results. The unaudited pro forma combined financial information excludes the impacts of the settlement entered into with intervenors in the joint application of Iberdrola,

S.A. et al. and UIL Holdings Corporation for Approval of a Change of Control before the Connecticut Public Utilities Regulatory Authority, or PURA, and the Massachusetts Department of Public Utilities, or DPU, which is discussed in the sections

entitled “The Merger—Regulatory Approvals Required for the Merger—PURA Approval” and “The Merger—Regulatory Approvals Required for the Merger—DPU Approval” beginning on pages 107 and 109, respectively, of the

S-4, on the basis that these three criteria are not met.

The unaudited pro forma combined financial information has been prepared in

accordance with Article 11 of the SEC’s Regulation S-X.

The unaudited pro forma combined financial information gives effect

to the transaction accounted for as a business combination in accordance with ASC 805 Business Combinations, with Avangrid treated as the accounting acquirer, as if the transaction with UIL had been completed on January 1, 2014, for

statements of income purposes, and on September 30, 2015 for balance sheet purposes.

UIL’s assets acquired and

liabilities assumed will be recorded at their fair value at the Acquisition Date using the preliminary estimates, which are subject to change during the measurement period (up to one year from the Acquisition Date) as the valuations of the assets

acquired and liabilities assumed are finalized. ASC 805 establishes that the consideration transferred shall be measured at the closing date of the transaction at the then-current market price. The purchase consideration for UIL under the

acquisition method is based on the stock price of UIL on the Acquisition Date multiplied by the number of shares issued by Avangrid to the UIL shareowners after applying an equity exchange factor to the shares of vested restricted common stock of

UIL, performance awards and other UIL shares. The “equity exchange factor” is the sum of one plus a fraction, (i) the numerator of which is the cash consideration and (ii) the denominator of which is the average of the volume

weighted averages of the trading prices of UIL common stock on each of the ten consecutive trading days ending on (and including) the trading day that immediately precedes the closing date of the merger minus $10.50. The preliminary

determination of the purchase price is based on a UIL stock price of $50.10 per share being the closing stock price on the Acquisition Date.

6

Transaction costs (i.e., advisory, legal and other professional fees) are not included as a

component of the consideration transferred but are accounted for as expenses in the periods in which the costs are incurred. Total transaction costs still expected to be incurred are estimated to be approximately $42 million, which are reflected in

the unaudited pro forma combined balance sheet as of September 30, 2015 as a reduction to equity, net of the estimated tax effect of $17 million at a statutory tax rate of 40% applied to deductible amounts. Transaction costs of Avangrid and UIL

of $26 million recorded in the historical income statement are non-recurring expenses and have therefore been removed, net of taxes, from the unaudited pro forma combined income statement for the nine months ended September 30, 2015.

Transaction Adjustments

For the purpose of preparing the accompanying unaudited pro forma combined balance sheet as of September 30, 2015, management made the

following assumptions and estimates, including assumptions relating to the consideration paid and the allocation thereof to the assets acquired and liabilities assumed from UIL based on preliminary estimates of fair value:

| |

• |

|

UIL’s shareowners exchanged their shares of UIL common stock for the equivalent of 18.5% of Avangrid’s common stock issued and outstanding; |

| |

• |

|

the estimated fair value of Avangrid common stock issued to UIL shareowners was determined based on the closing market price of the UIL common stock on December 16, 2015, with the $10.50 cash portion of the merger

consideration included in this closing market price, and the number of shares of Avangrid common stock issued to UIL shareowners was based on the number of shares of UIL common stock outstanding on December 16, 2015 plus the number of shares of

vested restricted common stock of UIL, performance awards and other UIL shares on December 16, 2015 after applying an equity exchange factor. |

Avangrid was a private company up until the Acquisition Date and the fair value of its common shares was not readily available. ASC 805

addresses a business combination scenario where the transaction-date fair value of the acquiree’s equity interests may be more reliably measurable than the transaction-date fair value of the acquirer’s equity interests. In such cases, ASC

805 requires the acquirer to use the transaction-date fair value of the acquiree’s equity interests instead of the transaction-date fair value of acquirer’s equity interests transferred.

7

As UIL’s common stock was publicly traded in an active market up until the Acquisition Date,

Avangrid determined that UIL’s common stock is more reliably measurable than the common stock of Avangrid to determine the fair value of the consideration transferred in the transaction. The quoted price of UIL shares has been determined to be

the most factually supportable measure available to support the determination of the fair value of the consideration transferred, given the market participant element of a widely held stock in an actively traded market. Under this approach, a

preliminary estimate of fair value of Avangrid common stock issued to the UIL shareowners in the business combination represents the purchase consideration in the business combination, which was computed as follows:

|

|

|

|

|

| |

|

(in millions, except

share data) |

|

| Common shares(1) |

|

|

56,629,377 |

|

| Price per share of UIL common stock as of the Acquisition Date(6) |

|

$ |

50.10 |

|

| Estimated subtotal value of common shares |

|

$ |

2,837 |

|

| Restricted stock units(2) |

|

|

476,198 |

|

| Other shares(3) |

|

|

12,999 |

|

| Equity exchange factor |

|

|

1.2806 |

|

| Total restricted and other shares after applying an equity exchange factor |

|

|

626,473 |

|

| Price per share used(5) |

|

$ |

39.60 |

|

| Estimated subtotal value of restricted and other shares |

|

$ |

25 |

|

| Total shares of Avangrid common stock issued to UIL shareowners |

|

|

57,255,850 |

|

| Performance shares(4) |

|

|

211,904 |

|

| Equity exchange factor |

|

|

1.2806 |

|

| Total performance shares after applying an equity exchange factor |

|

|

271,368 |

|

| Price per share used(5) |

|

$ |

39.60 |

|

| Estimated subtotal value of performance shares |

|

$ |

11 |

|

| Total estimated consideration |

|

$ |

2,873 |

|

| (1) |

Based on UIL’s common shares outstanding on December 16, 2015. |

| (2) |

Based on UIL’s shares of vested restricted stock. |

| (3) |

Based on UIL’s restricted shares vested upon the change in control. |

| (4) |

Based on UIL’s vested performance shares award. |

| (5) |

Based on the closing share price of UIL common stock on December 16, 2015 less the cash component of $10.50, which is not applicable to restricted, performance and other shares. |

| (6) |

The $50.10 share price used in calculating the estimated purchase consideration represents the closing share price of UIL common stock on December 16, 2015, the Acquisition Date. UIL share price was used because,

as a privately held company, Avangrid did not have a readily observable market price at the Acquisition Date. When evaluating the trading value of UIL common stock as an estimate of the fair value of the estimated consideration exchanged, management

determined that the trading value of UIL already reflects the cash consideration of $10.50 per share. Upon announcement of the merger on February 25, 2015, the UIL stock price increased from $42.33, the stock price at the close on the day

immediately preceding the announcement, to $52.07. This increase is likely attributable to the announcement of the total consideration payable to the holders of UIL common stock in the merger, which includes both the equity and the cash component.

The following is a summary of the components of the estimated consideration transferred to UIL’s shareowners: |

|

|

|

|

|

| |

|

(in millions,

except share

data) |

|

| Cash ($10.50 x number of UIL common shares outstanding at the Acquisition Date - 56,629,377) |

|

$ |

595 |

|

| Equity |

|

|

2,278 |

|

|

|

|

|

|

| Total estimated consideration |

|

$ |

2,873 |

|

|

|

|

|

|

The final purchase accounting to be determined in accordance with ASC 805 is dependent upon certain valuations

that have yet to progress to a stage where there is sufficient information for a definitive measurement. Accordingly, the pro forma adjustments are preliminary and have been made solely for the purpose of providing unaudited pro forma combined

financial information. With the transaction completed, final valuations will be performed and management anticipates that the values assigned to the assets acquired and liabilities assumed will be finalized during the measurement period following

the Acquisition Date. Differences between these preliminary estimates and the final purchase accounting will occur and these differences could have a material impact on the accompanying unaudited pro forma combined financial information and the

combined company’s future results of operations and financial position.

8

The following is a summary of the preliminary allocation of the purchase price as reflected in

the unaudited pro forma combined balance sheet as of September 30, 2015:

|

|

|

|

|

| |

|

(in millions) |

|

| Current assets |

|

$ |

563 |

|

| Other investments |

|

|

138 |

|

| Property, plant and equipment, net |

|

|

3,485 |

|

| Regulatory assets |

|

|

814 |

|

| Other assets |

|

|

53 |

|

| Current liabilities |

|

|

(435 |

) |

| Regulatory liabilities |

|

|

(524 |

) |

| Non-current debt |

|

|

(1,902 |

) |

| Other liabilities |

|

|

(1,095 |

) |

|

|

|

|

|

| Total net assets acquired at fair value |

|

|

1,097 |

|

|

|

|

|

|

| Goodwill – consideration transferred in excess of fair value assigned |

|

|

1,776 |

|

|

|

|

|

|

| Total estimated consideration (see note 6 above) |

|

$ |

2,873 |

|

|

|

|

|

|

For the majority of UIL’s assets and liabilities, primarily property, plant and equipment, fair value was

determined to be the respective carrying amounts. UIL’s operations are conducted in a regulated environment where the regulatory authority allows a reasonable rate of return on the carrying amount of the regulated asset base. In addition, the

fair value adjustment to non-current debt has been reflected on the pro forma balance sheet with an offsetting regulatory asset based upon the expectation that if these fair value adjustments are realized, a portion of such amounts would be

reflected in the future customer rates.

Based on the above, the pro forma adjustments related to the purchase accounting included in the

unaudited pro forma combined financial information are explained below:

| (A) |

This adjustment is to record cash consideration paid to UIL’s shareowners of $595 million based on the $10.50 cash payment per share multiplied by the number of UIL common shares outstanding at the Acquisition

Date. It also includes the funding obligation of approximately $25 million related to certain contractual change in control obligations of UIL (refer to note C below) and $42 million of estimated transaction costs not reflected in the historical

financial statements and expected to be incurred in the future. |

| (B) |

This adjustment is to record the tax effect of the estimated transaction costs mentioned in note A above. Because the tax rate used for these pro forma financial statements is an estimate, it may vary from the actual

effective rate in periods subsequent to the transaction. |

| (C) |

This adjustment is to record approximately $25 million related to certain contractual change in control funding obligations of UIL existing deferred compensation plans. |

| (D) |

This adjustment reflects the write-off of the historical UIL’s goodwill of $266 million and to record pro forma goodwill of $1,776 million resulting from purchase accounting. |

| (E) |

This adjustment is to record non-current debt at its estimated fair value resulting from purchase accounting. Also includes an adjustment of $130 million to regulatory assets to offset the fair value adjustment to the

regulatory component of the non-current debt. The fair value amortization impact to the income statement was to decrease interest expense by approximately $6 million and $8 million for the nine months ended September 30, 2015 and for the year

ended December 31, 2014, respectively. |

9

| (F) |

This adjustment is to record the tax effect of the corresponding fair value adjustment to the non-current debt resulting from purchase accounting. The tax rate used for these pro forma financial statements is an

estimate and it may vary from the actual effective rate in periods subsequent to the transaction. |

| (G) |

This adjustment is to record the following affecting equity: (1) a negative impact of $1,388 million to remove the book value of the net assets acquired from UIL as part of the business combination, (2) a

positive impact of $2,278 million to equity representing the issuance of Avangrid common stock to UIL shareowners as part of the business combination and (3) a negative impact of $25 million representing estimated transaction costs, net of

taxes, not reflected in the historical financial statements and expected to be incurred in the future. |

| (H) |

This adjustment is to eliminate accrued transaction costs of $26 million representing non-recurring expenses directly related to the transaction and accrued by Avangrid and UIL. |

| (I) |

This adjustment is to record the tax effect of $11 million associated with the accrued transaction costs mentioned in note H above and the tax effect of $2 million associated with the interest expense relating to

recording the non-current debt at its estimate fair value mentioned in note E above. The tax rate used for these pro forma financial statements is an estimate and it may vary from the actual effective rate in periods subsequent to the transaction.

|

| (J) |

This adjustment is to record the tax effect of $3 million associated with the interest expense relating to recording the non-current debt at its estimated fair value mentioned in note E above. The tax rate used for

these pro forma financial statements is an estimate and it may vary from the actual effective rate in periods subsequent to the transaction. |

Reporting Reclassifications

| (K) |

These reclassifications have been made to the historical balance sheet and historical income statements of UIL to conform to the presentation and classification used in the historical financial statements of Avangrid.

|

| 4. |

Pro Forma Earnings Per Share |

The pro forma earnings per share calculation reflects the

shares of Avangrid issued to Iberdrola, S.A. and to UIL shareowners, after giving effect to the transaction, as follows:

|

|

|

|

|

| Total shares held by Iberdrola, S.A. |

|

|

243 |

|

| Total shares issued to Iberdrola, S.A. (1) |

|

|

252,234,989 |

|

| Total shares issued to UIL shareowners (2) |

|

|

57,255,850 |

|

|

|

|

|

|

| Pro forma weighted-average shares used in computing earnings per share – basic and diluted |

|

|

309,491,082 |

|

| (1) |

Together with the 243 shares of Avangrid common stock held by Iberdrola, S.A., represents 81.5% of the total aggregate number of shares of common stock of the combined company. |

| (2) |

Represents 18.5% of the total aggregate number of shares of common stock of the combined company. |

Pro forma earnings per share for the nine months ended September 30, 2015

|

|

|

|

|

| |

|

(in millions except

per share data) |

|

| Pro forma net income for the nine months ended September 30, 2015 |

|

$ |

279 |

|

| Pro forma weighted-average shares used in computing earnings per share – basic and diluted |

|

|

309 |

|

| Pro forma earnings per share for the nine months ended September 30, 2015 – basic and diluted |

|

$ |

0.90 |

|

10

Pro forma earnings per share for the year ended December 31, 2014

|

|

|

|

|

| |

|

(in millions except per

share data) |

|

| Pro forma net income for the year ended December 31, 2014 |

|

$ |

539 |

|

| Pro forma weighted-average shares used in computing earnings per share – basic and diluted |

|

|

309 |

|

| Pro forma earnings per share for the year ended December 31, 2014 – basic and diluted |

|

$ |

1.74 |

|

The pro forma earnings per share presented in this unaudited combined pro forma financial information vary

significantly from the actual earnings per share of Avangrid included in the historical financial statements of Avangrid given that the pro forma earnings per share calculation takes into consideration the issuance of 309,490,839 shares by Avangrid

as a consequence of its merger with UIL. Avangrid’s number of shares outstanding was 243 during all prior periods, all of which shares were owned by Iberdrola, S.A.

11

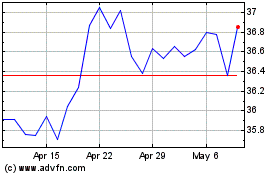

Avangrid (NYSE:AGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avangrid (NYSE:AGR)

Historical Stock Chart

From Apr 2023 to Apr 2024