TIDMALT

RNS Number : 8023Y

Altitude Group PLC

20 May 2016

Altitude Group plc

("Altitude", the "Company" or "Group")

PRELIMINARY UNAUDITED RESULTS FOR THE YEARED 31 DECEMBER

2015

Altitude Group plc (AIM: ALT), the provider of innovative

technology solutions for small to medium sized businesses,

announces its unaudited preliminary results for the year ended 31

December 2015.

Highlights:

-- Revenue increased by 2.1% to GBP4.54m (2014: GBP4.44m) and

gross margin maintained at 78.0% (2014 78.1%) during a year of

restructuring

-- Radical restructuring was undertaken in the year, removing

GBP1.8m of annualised administrative expenses

-- Adjusted operating profit* increased 164.5% to GBP0.29m

(2014: GBP0.11m after reclassification of GBP1.2m of costs as

non-recurring)

-- Operating cash inflow from activities, excluding

non-recurring and exceptional costs and expenses, GBP0.52m (2014

GBP0.50m)

-- Group remains free of bank borrowing, with net cash resources

of GBP0.37m (2014 GBP1.28m), sufficient for current

requirements

-- Strong performance at January 2016 Promotional Product Expo

("PPE") event with solid improvement in profitability. Bookings for

2017 in line with our expectations

-- Award of USA patent for the artworktool(tm) application in August 2015

-- Strong pipeline of large enterprise opportunities for technology solutions

* before amortisation of intangible assets, share-based payments and exceptional expenses and non-recurring costs relating to the restructuring exercise

Non-Executive Chairman, Peter Hallett, commented:

"The Group undertook a radical restructuring process during the

year including changes to the Board and senior management. We are

now a much leaner and focused business with clear reporting lines

and responsibilities, led by a Chief Executive with the requisite

knowledge and experience to develop our proprietary software

applications.

"Securing the patent in August 2015 for the artworktool(tm)

solution and the processes it uses to help users create artwork

online is a tremendous achievement and the result of three years of

hard work and considerable cash investment. We now have a

comprehensive suite of products to leverage using exclusive, unique

and protected proprietary applications which can be delivered on a

global scale.

"The successful restructuring and the award of the patent has

ensured that the Group is in good shape, both financially and

commercially. We have reported an adjusted operating profit, remain

free of bank borrowing and retain sufficient cash resources for our

current requirements. The Board is confident that the Group is well

placed to deliver growth in shareholder value."

Enquiries:

Altitude Group plc

Peter J Hallett (Non-Executive Tel: 07887 987469

Chairman)

WH Ireland Limited (Nominated

Adviser and Broker)

Tim Feather Tel: 0113 394 6600

Liam Gribben

Chairman's Statement

I am delighted to be reporting to you for the first time as

Chairman of Altitude, having been appointed as Chairman on 14

January 2016 after joining the Board as a non-executive director on

28 April 2015.

Restructuring

As reported in our interim results, the Group recognised early

in the year that the substantial investment in operational

management structure made during 2013 and 2014 was not producing

sufficient revenue growth to offset the corresponding increase in

overhead.

A comprehensive and urgent restructuring of the business was

required and the Group has moved quickly to "right size" the

business. As a technology company leveraging the best solutions to

help collaboration and agile development, we recognised that

duplicating resources in various locations in the USA was not only

expensive but also inefficient and unnecessary. We have therefore

now minimised the number of staff located outside our UK base.

All software maintenance and development is now controlled from

the UK, with a continued commitment to outsourcing new development

in Eastern Europe, under the day to day control of the Chief

Operating Officer, with all changes to development programmes

requiring Board sanction.

I am happy to report that the restructuring is now complete,

with day to day management being provided by the Chief Operating

Officer, leaving the Chief Executive Officer clearly focused on

establishing new enterprise relationships and markets, leveraging

the Group's proprietary software assets.

Results

Despite the significant operational disruption arising from the

restructuring, the Group has grown revenue by 2.1% to GBP4.54m

(2014 GBP4.44m), and maintained gross margins at 78.0% (2014

78.1%).

The radical restructuring undertaken during the year has removed

annualised costs of circa GBP1.8m.

Adjusted Operating profit* of GBP0.29m (2014 GBP0.11m) has

increased by 164.5%. However, as a result of the restructuring

action taken in 2015, administrative costs in 2014 of GBP1.12m have

been reclassified as non- recurring and exceptional charges, thus

increasing the 2014 adjusted operating profit* to GBP0.11m from the

originally reported loss of GBP1.05m.

Included within administrative costs are software development

costs of GBP0.83m (2014 GBP0.69m), as the Group has maintained its

support and development of its proprietary software assets. In

addition, the Group capitalised GBP0.20m of software development

costs (2014 GBP0.48m). Our new structure enabled us to remove the

US based former Chief Technology Officer, with responsibilities

being transferred to the UK under the new Chief Operating

Officer.

Operating losses amounted to GBP1.25m (2014 GBP1.66m), a

decrease of 24.4%, after inclusion of amortisation of GBP0.45m

(2014 GBP0.48m), share based payments credit of GBP0.04m (2014

charge of GBP0.17m), and non-recurring and exceptional charges of

GBP1.13m (2014 GBP1.12m).

Net cash flow from operating activities, excluding non-recurring

non-recurring and exceptional charges, was an inflow of GBP0.52m

(2014 GBP0.50m).

The Group remains free of bank borrowings, and has cash

resources of GBP0.37m (2014 GBP1.28m), which are sufficient for the

Group's current requirements.

* before amortisation of intangible assets, share-based payments and exceptional expenses and non-recurring costs relating to the restructuring exercise

Customer Focus Technology

Our fundamental technology strategy remains unchanged, as we

focus our SaaS offerings largely on SMEs under the Customer Focus

brand, both within the UK and increasingly within North

America.

During the period, as part of the reorganisation, we combined

the sales and customer service operations for our Technologo and

artworktool(tm) products under the Customer Focus brand. This

integrated offering is attracting increased interest and, whilst

the product enhances our overall technology offering, the

possibilities for the technology are applicable to a much wider

market and the opportunity is potentially very large for the

Group.

A significant achievement in this area has been the successful

application for a patent for artworktool(tm) , a solution which

enables users to easily create and share graphics and print-ready

artwork using any device with a suitable browser.

The Group balance sheet incorporates its proprietary intangible

software assets at cost, as required under the accounting

regulations where the assets are expected to deliver substantial

returns. However, the Board believe that these assets will prove to

be of significant value as the Group begins to leverage their

potential.

These assets, in particular artworktool, allow the Group to

present attractive and profitable solutions to global businesses.

This is evidenced by our relationship with Constant Contact

("CTCT"), a world leader in the provision of email marketing

solutions to more than 650,000 businesses. Under the terms of the

agreement, CTCT have embedded artworktool(tm) functionality into

the user accounts of all customers allowing them easily to create

engaging graphics to use in email campaigns without the need to

purchase expensive specialist software applications.

It is therefore in this area that the Group, and in particular

the efforts of the Chief Executive Officer, are focused.

Trade Only Exhibitions & Publications

Our Exhibition and Publications business continues to perform

well. The January 2016 event showed another strong performance with

increased profitability. Bookings for the 2017 show are in line

with our expectations and we expect another good performance from

this business in 2017 based on booked orders.

With over 4,000 delegates attending the main event in January

each year all being involved in the print, promotional and

personalised gift sectors, the potential to drive additional sales

of our SaaS products in the UK remains strong and adds further

value to the Group from the ability to engage so many customers

with other products and services.

On 15 April 2016, following an increase in the Company's share

price, the Group was obliged to disclose the existence of early

stage discussions for the disposal of the Exhibitions and

Publications business. The discussions are ongoing, and there is no

guarantee at this stage that they will lead to a successful

conclusion. If the transaction is agreed, the Directors expect that

it would be classified as a fundamental change of business under

the AIM Rules for Companies and require the prior approval of

shareholders.

Board Changes

As previously reported, the changes made to the board on 28

April 2015 were the catalyst for the comprehensive restructuring of

the Group detailed above.

This process saw the appointment of Vicky Robinson as Group

Managing Director, myself as Non-Executive Director and Richard

Sowerby moving to Executive Chairman, following the departure of

the former Executive Chairman.

On 28 January, I agreed to become Non-Executive Chairman, with

Richard Sowerby becoming Non-Executive Director, and Martin Varley

appointed as Chief Executive Officer. Martin has an unrivalled

knowledge of the business and in particular the potential of its

proprietary software assets and the target markets for their

application. The Board has no doubt that he is the best person for

this role.

On 28 January we also appointed Shaun Parker to the Board as

Chief Operating Officerand Vicky Robinson left the Group, wishing

to take time out with her family after ten years of service. Shaun

brings wide and relevant experience of the technology sector gained

through senior management positions in Redstone plc, Hewlett

Packard and Compaq amongst others.

The Board now comprises two executive and two non-executive

directors.

Outlook

We continue to drive forward with a leaner and more focused

structure, centred in the UK, with clear and concise reporting

lines and objectives

We are fortunate to have a portfolio of proprietary software and

technology assets which the Board is confident has the potential

yto generate increasing shareholder value in 2016 and beyond. In

addition, we have a successful Exhibitions and Publications

business which provides synergies to our technology business and

which we would be very happy to retain should the discussions

regarding its potential sale not result in a transaction.

The successful restructuring and the award of the patent for

artworktool(tm) has ensured that the Group is in good shape, both

financially and commercially. We have reported an adjusted

operating profit*, remain free of bank borrowing and retain

adequate cash resources for our current requirements. The Board is

confident that the Group is well placed to deliver growth in

shareholder value.

Peter J Hallett

Non-Executive Chairman

* before amortisation of intangible assets, share-based payments and exceptional expenses and non-recurring costs relating to the restructuring exercise

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2015

2015 2014

Note GBP'000 GBP'000

Unaudited Audited

Revenue 4,535 4,440

Cost of sales (998) (971)

--------------------- ----------------------

Gross Profit 3,537 3,469

-------------------------------- ------------ --------------------- ----------------------

Administrative costs before

share based payment charges,

amortisation, exceptional

charges and non-recurring

costs (3,246) (3,359)

Operating profit before

share based payment charges,

amortisation, exceptional

charges and non-recurring

costs 291 110

Share based payment charges 38 (168)

Amortisation (448) (478)

Exceptional charges 3 (404) -

Non recurring costs 4 (729) (1,119)

-------------------------------- ------------ --------------------- ----------------------

Operating loss (1,252) (1,655)

Finance income 3 89

--------------------- ----------------------

Loss before taxation (1,249) (1,566)

Taxation - -

--------------------- ----------------------

Loss attributable to the

equity shareholders of

the Company (1,249) (1,566)

Other comprehensive income:

Foreign exchange differences (1) -

--------------------- ----------------------

Total comprehensive loss

for the year (1,250) (1,566)

Loss per ordinary share

attributable to the equity

shareholders of the Company

Basic (pence) 5 (2.91) (3.68)

Diluted (pence) 5 (2.91) (3.68)

Consolidated Balance Sheet

as at 31 December 2015

2015 2014

GBP'000 GBP'000

Unaudited Audited

Non-current assets

Property, plant & equipment 42 105

Intangible assets 937 1,184

Goodwill 564 564

Deferred tax 426 426

----------------- ----------

1,969 2,279

Current assets

Trade and other receivables 696 787

Cash and cash equivalents 366 1,280

----------------- ----------

1,062 2,067

----------------- ----------

Total assets 3,031 4,346

----------------- ----------

Current liabilities

Trade and other payables (2,038) (2,065)

----------------- ----------

Total liabilities (2,038) (2,065)

----------------- ----------

Net assets 993 2,281

----------------- ----------

Equity attributable to equity

holders of the Company

Called up share capital 172 172

Share premium account 6,254 6,254

Retained earnings (5,433) (4,145)

----------------- ----------

Total equity 993 2,281

----------------- ----------

Consolidated Cash Flow Statement

for the year ended 31 December 2015

2015 2014

GBP'000 GBP'000

Unaudited Audited

Operating activities

Loss for the period (1,249) (1,566)

Amortisation of intangible

assets 448 478

Depreciation 78 102

Net nance credit (3) (89)

Share based payment charges (38) 168

---------- ----------

Operating cash outflow before

changes in working capital (764) (907)

Movement in trade and other

receivables 91 222

Movement in trade and other

payables (28) (52)

---------- ----------

Operating cash outflow from

operations (701) (737)

Interest received 3 89

---------- ----------

Net cash ow from operating

activities (698) (648)

Investing activities

Purchase of tangible assets (15) (48)

Purchase of intangible assets (201) (474)

---------- ----------

Net cash ow from investing

activities (216) (522)

---------- ----------

Financing activities

Loan note repayment received - 2,000

---------- ----------

Net cash ow from nancing activities - 2,000

---------- ----------

Net increase in cash and cash

equivalents (914) 830

Cash and cash equivalents at

the beginning of the year 1,280 450

---------- ----------

Cash and cash equivalents at

the end of the year 366 1,280

---------- ----------

Consolidated Statement of Changes in Equity

Equity attributable to equity holders of the Company

Share Share Retained

Capital Premium Earnings

GBP000 GBP000 GBP000

As at 1 January 2014 172 6,254 (2,747)

Total comprehensive

loss for the year - - (1,566)

Transactions with owners

recorded directly in

equity:

Share based payment

charges - - 168

--------- --------- ----------

At 31 December 2014 172 6,254 (4,145)

Total comprehensive

loss for the year - - (1,250)

Transactions with owners

recorded directly in

equity:

Share based payment

charges - - (38)

--------- --------- ----------

At 31 December 2015 172 6,254 (5,433)

--------- --------- ----------

Notes

1 Financial information

The financial information set out herein does not constitute the

Group's statutory accounts for the year ended 31 December 2015 or

the year ended 31 December 2014 within the meaning of section 435

of the Companies Act 2006. The 2015 statutory accounts have not

been finalised but this preliminary announcement has been prepared

by the Directors based on the results and position which they

expect will be reflected in the statutory accounts. The comparative

information in respect of the year ended 31 December 2014 has been

derived from the audited statutory accounts for the year ended on

that date upon which an unmodified audit opinion was expressed and

which did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006. The audited accounts will be posted to all

shareholders in due course and will be available on the Company's

website. A further announcement will be made at that time.

2 Basis of preparation

The Group financial statements have been prepared and approved

by the Directors in accordance with International Financial

Reporting Standards as adopted by the European Union on the basis

of the accounting policies adopted for the year ended 31 December

2015, that will be set out in the Company's Annual Report and

Accounts, and as previously disclosed in the Company's Annual

Report and Accounts for the year ended 31 December 2014.

The preparation of financial statements in conformity with IFRS

requires management to make judgments, estimates and assumptions

that affect the application of policies and reported amounts of

assets and liabilities, income and expenses. The estimates and

associated assumptions are consistent with those made in the

financial statements for the year ended 31 December 2014 and are

based on historical experience and various other factors that are

believed to be reasonable under the circumstances, the results of

which form the basis of making the judgments about carrying values

of assets and liabilities that are not readily apparent from other

sources. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period, or in the period of the revision and future

periods if the revision affects both current and future

periods.

3 Exceptional expenses

2015 2014

GBP'000 GBP'000

Exceptional expenses incurred 404 -

in redundancies and terminations

404 -

4 Non-recurring administrative expenses

2015 2014

GBP'000 GBP'000

Non-recurring employment

expenses following the restructuring 511 701

Non-recurring costs of locations

closed in the year 218 418

729 1,119

The non recurring expenses include specific payroll and office

costs that were incurred to the point that they were terminated as

part of the restructuring exercise. These have been identified and

separated to show the impact of the restructuring in the year. As

part of this process we have restated the prior year figures to

separate these costs and provide information on a like-for-like

basis.

5 Basic and diluted earnings per share

2015 2014

Earnings GBP'000 (1,249) (1,566)

Weighted average number of

shares (number '000) 42,908 42,908

Fully diluted average number

of shares (number '000) 42,908 42,908

Basic loss per ordinary share

(pence) (2.91) (3.68)

Diluted loss per ordinary

share (pence) (2.91) (3.68)

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UKOKRNUAVAAR

(END) Dow Jones Newswires

May 20, 2016 02:00 ET (06:00 GMT)

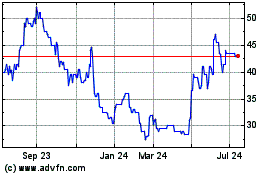

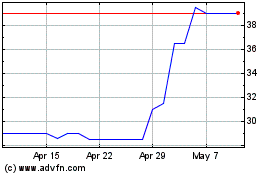

Altitude (LSE:ALT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Altitude (LSE:ALT)

Historical Stock Chart

From Apr 2023 to Apr 2024