Alphatec Holdings, Inc. (Nasdaq:ATEC), the parent company of

Alphatec Spine, Inc., a global provider of spinal fusion

technologies, announced today financial results for the fourth

quarter and full year ended December 31, 2015.

- Fourth quarter revenue of $47.0 million.

- Fourth quarter adjusted EBITDA of $5.2 million, 11.1% of

revenue.

- Annual total revenue of $185.3 million.

- Full year adjusted EBITDA of $20.7 million, 11.2% of

revenue.

- Continued improvement of U.S. business – up 7.6% sequentially

from Q3 2015.

- Record revenue for international business – $70.7 million, up

16.9% in constant currency, and representing 38% of full year 2015

revenue.

Recent Positive Progress Made Towards

Alphatec's Corporate Strategic Objectives

Strategic Pillar #1: "Go-to-Market" Product Portfolio and

R&D Pipeline

- Arsenal™ Degenerative system is in full launch in US and Japan,

increasing degenerative product user base by 52%.

- Arsenal CBX™ full launch underway, further expanding the

Arsenal spinal fusion platform offerings.

- Arsenal™ Deformity received 510k clearance and is ready for

launch in Q1 2016.

- Battalion™ titanium-coated PEEK interbody fusion system is now

in full launch.

- Neocore™ Osteoconductive Matrix, a synthetic scaffold for the

regeneration of bone, is now in full launch.

Strategic Pillar #2: Transform Manufacturing and

Distribution Operations

- Completed outsourcing of manufacturing to drive overall

reduction in implant unit costs and capital expense.

- Completed pilot phase of partnership with UPS for outsourcing

physical distribution of implant and instrument sets to enhance

customer service and drive set utilization improvements.

Expect outsourcing to be complete in Q3 2016.

Strategic Pillar #3: Expand Global Commercial

Participation

- Made progress in commercial expansion in large U.S.

metropolitan markets through new distributor relationships, direct

selling representatives and new surgeon customers enabled by

compelling new additions to product portfolio.

- Expanded into new international geographies, including

establishing a new distribution partner in Australia in Q1

2016.

“In 2015 we made substantial progress toward furthering our

corporate strategic initiatives within each of our three pillars,”

said Jim Corbett, President and Chief Executive Officer of Alphatec

Spine. “I am particularly pleased with the speed at which we are

bringing new products to the large spinal fusion segments of the

market; the headway we have made in efforts to outsource implant

manufacturing and physical distribution and our progress in

expanding our commercial footprint in new markets and to new

surgeon customers. We believe we have laid the foundation for

future profitable growth and will continue to focus on our

strategic objectives while finding the right capital structure to

support our business.”

Extension of MidCap Financial Credit

Facility

In conjunction with its earnings announcement, the Company

announced that on March 11, 2016, it entered into a third amendment

and waiver (the “Third Amendment”) to the Amended Credit Facility

(the “Facility”) with MidCap Financial (“MidCap”). The Third

Amendment extends the maturity date of the Facility from August 30,

2016 to December 31, 2016. In addition, the Third Amendment

contains a waiver of the Company’s failure to achieve the minimum

fixed charge coverage ratio required by the Facility for December

of 2015 and January of 2016. This constituted an event of

default under the Facility. With the Third Amendment, the

Company is not required to calculate such ratio in February of

2016. The Company’s other lender, Deerfield, which had

previously provided a waiver for December of 2015 has also provided

a waiver for January of 2016.

“The extension of the MidCap facility provides us with

additional flexibility as we work toward a long-term solution for

our capital structure,” said Jim Corbett, President and CEO of

Alphatec Spine. “We are grateful to the team at MidCap Financial

that has taken the time to understand our business, our prospects

and our capital needs.”

The Company will delay issuance of its 2016 financial guidance

as it works to reach resolution regarding its capital structure and

liquidity position.

Quarter Ended December 31, 2015

Consolidated net revenues for the fourth quarter of 2015 were

$47.0 million, down 12.4% compared to $53.6 million reported for

the fourth quarter of 2014, or down 9.4% on a constant currency

basis. Consolidated revenues were impacted by $1.6 million in

foreign currency changes in the fourth quarter due primarily to

declines in the valuation of the Japanese Yen and Euro against the

U.S. dollar. Sequentially, consolidated net revenue for the

fourth quarter was up 9.3% compared to the third quarter of

2015.

U.S. net revenues for the fourth quarter of 2015 were $29.5

million, compared to $35.7 million reported for the fourth quarter

of 2014. Sequentially, U.S. revenue for the fourth quarter was up

7.6% from the third quarter of 2015.

International net revenues for the fourth quarter of 2015 were

$17.5 million, down 2.3% compared to $17.9 million for the fourth

quarter of 2014, or up 6.3% on a constant currency basis.

Consolidated gross profit and gross margin for the fourth

quarter of 2015 were $31.1 million and 66.2%, respectively,

compared to $37.7 million and 70.3%, respectively, for the fourth

quarter of 2014.

Gross profit in the fourth quarter of 2015 declined 17% from the

fourth quarter of 2014 primarily a result of lower U.S. sales

volume, foreign currency translation effects and global geographic

mix.

Gross margin declined 4.1 percentage points compared to a strong

quarter for gross margin in the fourth quarter of 2014. The

decline over prior year is primarily attributable to unfavorable

regional mix, product mix and currency (1.4 percentage points),

increased depreciation expense related to instruments (0.4

percentage points) and non-recurring accelerated depreciation

associated with the cessation of manufacturing activities (2.1

percentage points).

Total operating expenses for the fourth quarter of 2015 were

$36.9 million, reflecting an increase of approximately 6% over the

fourth quarter of 2014. This variance is primarily

attributable to a stock-based compensation adjustment associated

with a third party consulting agreement in research and

development, as well as non-recurring restructuring expenses

related to the outsourcing of manufacturing and restructuring of

international operations.

GAAP net loss for the fourth quarter of 2015 was $9.9 million or

($0.10) per share (basic and diluted), compared to a net loss of

$273 thousand, or ($0.00) per share basic and ($0.03) per share

diluted for the fourth quarter of 2014. Please refer to the table,

"Alphatec Holdings, Inc. Reconciliation of Non-GAAP Financial

Measures" that follows for more detailed information.

Adjusted EBITDA in the fourth quarter of 2015 was $5.2 million,

or 11.1% of revenues, compared to $8.3 million, or 15.4% of

revenues reported in the fourth quarter of 2014. Fourth quarter

2015 adjusted EBITDA represents net income excluding effects of

interest and other expenses, taxes, depreciation, amortization and

stock-based compensation. Please refer to the table, "Alphatec

Holdings, Inc. Reconciliation of Non-GAAP Financial Measures" that

follows for more detailed information.

Unrestricted cash and cash equivalents were $11.2 million at

December 31, 2015, compared to $19.7 million reported at December

31, 2014. Additionally, the Company reported $2.4 million of

restricted cash, which must be used for future payment obligations

associated with the Orthotec settlement.

Current portion of long-term debt, which includes both MidCap

Financial and Deerfield, was $80.1 million at December 31,

2015.

Year Ended December 31, 2015

Consolidated net revenues for full year 2015 were $185.3

million, representing a decrease of 10.5%, compared to $207.0

million reported for full year 2014. Consolidated revenues

were adversely impacted by $11.0 million in foreign currency

changes against the U.S. dollar for the full year 2014,

predominately changes against the Japanese Yen and Euro.

U.S. net revenues for full year 2015 were $114.6 million,

representing decrease of 16.4%, compared to $137.1 million reported

for full year 2014.

International net revenues for full year 2015 were $70.7

million, representing an increase of $800 thousand on an as

reported basis compared to $69.9 million for full year 2014, or up

16.9% on a constant currency basis.

Consolidated gross profit and gross margin for full year 2015

were $120.1 million and 64.8%, respectively, compared to $143.4

million and 69.3%, respectively, for full year 2014.

Gross margin for the full year 2015 decreased 4.5 percentage

points over the prior year primarily due to unfavorable variation

in regional mix, product mix and currency (2.4 percentage points)

and one-time charges, including manufacturing restructuring

(2.4 percentage points), offset by a decrease in amortization

expense (0.3 percentage points).

Total operating expenses for full year 2015 were $292.5 million,

reflecting an increase of $151.0 million compared to full year

2014. This variance is driven primarily by non-cash, goodwill and

intangible asset impairment charges totaling $165.2 million and

restructuring expenses totaling $1.2 million.

When adjusted for non-recurring impairment and restructuring

expenses, total operating expenses for the full year of 2015 would

be $126.2 million, reflecting an improvement of 10.4%, or $14.7

million compared to the full year of 2014. This decrease is

primarily attributable to lower commission expense as a result of

lower U.S. sales volume, as well as savings in marketing and

general and administrative functions and litigation expense.

Please refer to the tables titled, "Alphatec Holdings, Inc.

Non-GAAP Condensed Consolidated Statement of Operations" that

follow for more detailed information.

GAAP net loss for full year 2015 was $178.7 million or ($1.79)

per share (basic and diluted), compared to a net loss of $12.9

million, or ($0.13) per share basic and ($0.16) per share diluted

for full year 2014. GAAP net loss for full year 2015 was

unfavorably impacted by $165.2 million of non-cash impairment

charges.

Adjusted EBITDA for full year 2015 was $20.7 million, or 11.2%

of revenues, compared to $30.8 million, or 14.9% of revenues

reported for full year 2014. Full year 2015 adjusted EBITDA

represents net income excluding effects of interest and other

expenses, taxes, depreciation, amortization, stock-based

compensation, and IPR&D. Please refer to the table, "Alphatec

Holdings, Inc. Reconciliation of Non-GAAP Financial Measures" that

follows for more detailed information.

Non-GAAP Information

Alphatec Spine reports certain non-GAAP financial measures such

as non-GAAP earnings and earnings per share, adjusted for effects

of amortization and other non-recurring or expense items, such as

impairments, loss on extinguishment of debt, and restructuring

expenses. Adjusted EBITDA included in this press release is a

non-GAAP financial measure that represents net income (loss)

excluding the effects of interest, taxes, depreciation,

amortization, stock-based compensation expenses, in process

research and development (IPR&D) expenses and other

non-recurring income or expense items, such as impairments,

restructuring expenses, severance expenses, litigation expenses,

damages associated with ongoing litigation and transaction-related

expenses. The Company believes that non-GAAP adjusted EBITDA

provides investors with an additional tool for evaluating the

Company's core performance, which management uses in its own

evaluation of continuing operating performance, and a base-line for

assessing the future earnings potential of the Company. For

completeness, management uses non-GAAP adjusted EBITDA in

conjunction with GAAP earnings and earnings per common share

measures. These non-GAPP financial measures should be

considered in addition to, and not as a substitute for, or superior

to, financial measures calculated in accordance with GAAP.

Included below are reconciliations of the non-GAAP

financial measures to the comparable GAAP financial measure.

About Alphatec Spine

Alphatec Spine, Inc., a wholly owned subsidiary of Alphatec

Holdings, Inc., is a global medical device company that designs,

develops, manufactures and markets spinal fusion technology

products and solutions for the treatment of spinal disorders

associated with disease and degeneration, congenital deformities

and trauma. The Company's mission is to improve lives by delivering

advancements in spinal fusion technologies. The Company and its

affiliates market products in the U.S. and internationally via a

direct sales force and independent distributors.

Additional information can be found at

www.alphatecspine.com.

Forward Looking Statements

This press release may contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995 that involve risks and uncertainty. Such statements

are based on management’s current expectations and are subject to a

number of risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking

statements. Alphatec Spine cautions investors that there can

be no assurance that actual results or business conditions will not

differ materially from those projected or suggested in such

forward-looking statements as a result of various factors.

Forward looking statements include the references to the success of

the Company’s initiatives to drive global sales growth and expand

its geographical sales coverage; increase margins and increase

operating efficiencies; the success of the Company in achieving its

three strategic pillars, the Company’s ability to implement a plan

that will ensure that it competes more effectively in the

marketplace, expands global participation, and improves operations

through the Company’s plan to outsource manufacturing and

distribution; the ability of the Company to remain listed on the

NASDAQ Stock Market; and the ability of the Company to restructure

its capital structure and raise additional capital in order to

continue to operate its business and service its ongoing debt

obligations; and the ability of the Company to meet the financial

covenants under its debt facilities or obtain waivers in the event

that such covenants are not met. The important factors that

could cause actual operating results to differ significantly from

those expressed or implied by such forward-looking statements

include, but are not limited to: the Company's ability to

execute its business plan in light of its cash position and its

current liabilities, which includes $80.1 million of debt; the

Company's ability to restructure its capital structure and raise

additional capital as necessary to continue to operate its business

and service its ongoing debt obligations; the uncertainty of

success in developing new products or products currently in

Alphatec Spine’s pipeline, including the products discussed in this

press release; the uncertainties in the Company’s ability to

execute upon its strategic operating plan to outsource

manufacturing and distribution; the uncertainties regarding the

ability to successfully license or acquire new products, and the

commercial success of such products; failure to achieve acceptance

of Alphatec Spine’s products by the surgeon community, including

Battalion, Neocore, Arsenal Deformity and Arsenal CBX; failure to

successfully implement outsourcing, streamlining and lean

activities to create anticipated savings; failure to obtain FDA

clearance or approval or international regulatory approvals for new

products, including the products discussed in this press release,

or unexpected or prolonged delays in the process; continuation of

favorable third party payor reimbursement for procedures performed

using the Company’s products; unanticipated expenses or liabilities

or other adverse events affecting cash flow or the Company’s

ability to successfully control its costs or achieve profitability;

uncertainty of additional funding; the Company’s ability to compete

with other competing products and with emerging new technologies;

product liability exposure; an unsuccessful outcome in any

litigation in which the Company is a defendant; patent infringement

claims; claims related to the Company’s intellectual property and

the Company’s ability to meet its financial obligations under its

credit agreements and the Orthotec settlement agreement. The

words “believe,” “will,” “should,” “expect,” “intend,” “estimate”

and “anticipate,” variations of such words and similar expressions

identify forward-looking statements, but their absence does not

mean that a statement is not a forward-looking statement.

Please refer to the risks detailed from time to time in Alphatec

Spine’s SEC reports, including its Annual Report Form 10-K for the

year ended December 31, 2015, filed on March 15, 2016 with the

Securities and Exchange Commission, as well as other filings on

Form 10-Q and periodic filings on Form 8-K. Alphatec Spine

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise, unless required by law.

| ALPHATEC HOLDINGS, INC. |

|

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

| (in thousands, except

per share amounts - unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

|

|

|

|

2015 |

|

|

|

2014 |

|

|

|

|

2015 |

|

|

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues |

$ |

47,003 |

|

|

$ |

53,627 |

|

|

|

$ |

185,279 |

|

|

$ |

206,980 |

|

|

| |

Cost of revenues |

|

15,508 |

|

|

|

15,529 |

|

|

|

|

63,742 |

|

|

|

61,834 |

|

|

| |

Amortization of

acquired intangible assets |

|

360 |

|

|

|

408 |

|

|

|

|

1,453 |

|

|

|

1,736 |

|

|

| |

Total cost of revenues |

|

15,868 |

|

|

|

15,937 |

|

|

|

|

65,195 |

|

|

|

63,570 |

|

|

| |

Gross profit |

|

31,135 |

|

|

|

37,690 |

|

|

|

|

120,084 |

|

|

|

143,410 |

|

|

| |

|

|

66.2 |

% |

|

|

70.3 |

% |

|

|

|

64.8 |

% |

|

|

69.3 |

% |

|

| |

Operating

expenses: |

|

|

|

|

|

|

|

|

| |

Research and development |

|

8,106 |

|

|

|

3,661 |

|

|

|

|

17,767 |

|

|

|

16,799 |

|

|

| |

In-process research and

development |

|

- |

|

|

|

- |

|

|

|

|

274 |

|

|

|

527 |

|

|

| |

Sales and marketing |

|

18,883 |

|

|

|

20,634 |

|

|

|

|

70,856 |

|

|

|

77,179 |

|

|

| |

General and administrative |

|

8,394 |

|

|

|

9,705 |

|

|

|

|

34,867 |

|

|

|

43,381 |

|

|

| |

Amortization of acquired intangible

assets |

|

533 |

|

|

|

717 |

|

|

|

|

2,400 |

|

|

|

2,974 |

|

|

| |

Impairment of goodwill and

intangibles |

|

- |

|

|

|

- |

|

|

|

|

165,171 |

|

|

|

- |

|

|

| |

Restructuring expenses |

|

1,025 |

|

|

|

- |

|

|

|

|

1,188 |

|

|

|

706 |

|

|

| |

Total operating expenses |

|

36,941 |

|

|

|

34,717 |

|

|

|

|

292,523 |

|

|

|

141,566 |

|

|

| |

Operating (loss)

income |

|

(5,806 |

) |

|

|

2,973 |

|

|

|

|

(172,439 |

) |

|

|

1,844 |

|

|

| |

Interest and other income

(expense), net |

|

(2,854 |

) |

|

|

(3,107 |

) |

|

|

|

(5,556 |

) |

|

|

(13,639 |

) |

|

| |

Pretax net loss |

|

(8,660 |

) |

|

|

(134 |

) |

|

|

|

(177,995 |

) |

|

|

(11,795 |

) |

|

| |

Income tax provision |

|

1,243 |

|

|

|

139 |

|

|

|

|

681 |

|

|

|

1,087 |

|

|

| |

Net loss |

$ |

(9,903 |

) |

|

$ |

(273 |

) |

|

|

$ |

(178,676 |

) |

|

$ |

(12,882 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Basic net loss per

share |

$ |

(0.10 |

) |

|

$ |

(0.00 |

) |

|

|

$ |

(1.79 |

) |

|

$ |

(0.13 |

) |

|

| |

Diluted net loss per

share |

$ |

(0.10 |

) |

|

$ |

(0.03 |

) |

|

|

$ |

(1.79 |

) |

|

$ |

(0.16 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted-average shares

- basic |

|

100,511 |

|

|

|

98,261 |

|

|

|

|

99,574 |

|

|

|

97,347 |

|

|

| |

Weighted-average shares

- diluted |

|

100,511 |

|

|

|

98,477 |

|

|

|

|

99,574 |

|

|

|

97,735 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

ALPHATEC HOLDINGS, INC. |

|

| |

CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

| |

(in thousands -

unaudited) |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

December 31, |

|

December 31, |

|

|

|

|

|

2015 |

|

|

|

2014 |

|

|

|

|

ASSETS |

|

|

|

|

| |

Current assets: |

|

|

|

|

| |

Cash and cash equivalents |

$ |

11,229 |

|

|

$ |

19,735 |

|

|

| |

Restricted

Cash |

|

2,350 |

|

|

|

4,400 |

|

|

| |

Accounts

receivable, net |

|

38,319 |

|

|

|

40,440 |

|

|

| |

Inventories,

net |

|

44,908 |

|

|

|

41,747 |

|

|

| |

Prepaid expenses

and other current assets |

|

5,052 |

|

|

|

5,466 |

|

|

| |

Deferred income

tax assets |

|

- |

|

|

|

1,324 |

|

|

| |

Total current

assets |

|

101,858 |

|

|

|

113,112 |

|

|

| |

|

|

|

|

|

| |

Property and equipment,

net |

|

21,945 |

|

|

|

26,040 |

|

|

| |

Goodwill |

|

- |

|

|

|

171,333 |

|

|

| |

Intangibles, net |

|

21,616 |

|

|

|

30,259 |

|

|

| |

Other assets |

|

1,285 |

|

|

|

4,179 |

|

|

| |

Total assets |

$ |

146,704 |

|

|

$ |

344,923 |

|

|

| |

|

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS' (DEFICIT)

EQUITY |

|

|

|

|

| |

Current

liabilities: |

|

|

|

|

| |

Accounts

payable |

$ |

14,169 |

|

|

$ |

10,130 |

|

|

| |

Accrued

expenses |

|

29,791 |

|

|

|

35,393 |

|

|

| |

Deferred

revenue |

|

648 |

|

|

|

1,300 |

|

|

| |

Common stock

warrant liabilities |

|

687 |

|

|

|

8,702 |

|

|

| |

Current portion

of long-term debt |

|

80,105 |

|

|

|

8,076 |

|

|

| |

Total current

liabilities |

|

125,400 |

|

|

|

63,601 |

|

|

| |

|

|

|

|

|

| |

Total long term

liabilities |

|

34,277 |

|

|

|

108,765 |

|

|

| |

Redeemable

preferred stock |

|

23,603 |

|

|

|

23,603 |

|

|

| |

Stockholders'

(deficit) equity |

|

(36,576 |

) |

|

|

148,954 |

|

|

| |

Total liabilities and

stockholders' (deficit) equity |

$ |

146,704 |

|

|

$ |

344,923 |

|

|

| |

|

|

|

|

|

| ALPHATEC HOLDINGS, INC. |

|

| RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES |

|

| (in thousands, except per share amounts -

unaudited) |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

|

2015 |

|

|

|

2014 |

|

|

|

|

2015 |

|

|

|

2014 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Operating income

(loss), as reported |

$ |

(5,806 |

) |

|

$ |

2,973 |

|

|

|

$ |

(172,439 |

) |

|

$ |

1,844 |

|

|

| |

Add back: |

|

|

|

|

|

|

|

|

| |

Depreciation |

|

3,907 |

|

|

|

2,913 |

|

|

|

|

12,974 |

|

|

|

12,160 |

|

|

| |

Amortization of intangible

assets |

|

132 |

|

|

|

341 |

|

|

|

|

2,204 |

|

|

|

1,515 |

|

|

| |

Amortization of acquired intangible

assets |

|

893 |

|

|

|

1,125 |

|

|

|

|

3,853 |

|

|

|

4,710 |

|

|

| |

Total EBITDA |

|

(874 |

) |

|

|

7,352 |

|

|

|

|

(153,407 |

) |

|

|

20,229 |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Add back significant

items: |

|

|

|

|

|

|

|

|

| |

Stock-based compensation |

|

203 |

|

|

|

913 |

|

|

|

|

2,643 |

|

|

|

4,554 |

|

|

| |

In-process research and

development |

|

- |

|

|

|

- |

|

|

|

|

274 |

|

|

|

527 |

|

|

| |

Goodwill and intangible

impairment |

|

- |

|

|

|

- |

|

|

|

|

165,171 |

|

|

|

- |

|

|

| |

Litigation expenses and trial

costs |

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

4,779 |

|

|

| |

Stock price guarantee |

|

4,877 |

|

|

|

- |

|

|

|

|

4,877 |

|

|

|

- |

|

|

| |

Restructuring and other

charges |

|

1,025 |

|

|

|

- |

|

|

|

|

1,188 |

|

|

|

742 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

EBITDA, as adjusted for

significant items |

$ |

5,231 |

|

|

$ |

8,265 |

|

|

|

$ |

20,745 |

|

|

$ |

30,831 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Net loss, as

reported |

$ |

(9,903 |

) |

|

$ |

(273 |

) |

|

|

$ |

(178,676 |

) |

|

$ |

(12,882 |

) |

|

| |

Add back: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Amortization of acquired intangible

assets |

|

893 |

|

|

|

1,125 |

|

|

|

|

3,853 |

|

|

|

4,710 |

|

|

| |

Amortization of intangible

assets |

|

132 |

|

|

|

341 |

|

|

|

|

2,204 |

|

|

|

1,515 |

|

|

| |

In-process research and

development |

|

- |

|

|

|

- |

|

|

|

|

274 |

|

|

|

527 |

|

|

| |

Goodwill and intangible

impairment |

|

- |

|

|

|

- |

|

|

|

|

165,171 |

|

|

|

- |

|

|

| |

Litigation settlement and trial

costs |

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

4,779 |

|

|

| |

Restructuring and other

charges |

|

1,025 |

|

|

|

- |

|

|

|

|

1,188 |

|

|

|

742 |

|

|

| |

Fair value adjustments to stock

warrants and guarantees |

|

4,877 |

|

|

|

(2,870 |

) |

|

|

|

(3,138 |

) |

|

|

(2,578 |

) |

|

| |

|

|

|

|

|

|

|

|

. |

|

|

|

| |

Net loss, as adjusted

for significant items |

$ |

(2,976 |

) |

|

$ |

(1,677 |

) |

|

|

$ |

(9,124 |

) |

|

$ |

(3,187 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

Net loss per common

share - basic |

$ |

(0.10 |

) |

|

$ |

(0.00 |

) |

|

|

$ |

(1.79 |

) |

|

$ |

(0.13 |

) |

|

| |

Add back: |

|

|

|

|

|

|

|

|

| |

Amortization of acquired intangible

assets |

|

0.01 |

|

|

|

0.01 |

|

|

|

|

0.04 |

|

|

|

0.05 |

|

|

| |

Amortization of intangible

assets |

|

0.00 |

|

|

|

0.00 |

|

|

|

|

0.02 |

|

|

|

0.02 |

|

|

| |

In-process research and

development |

|

- |

|

|

|

- |

|

|

|

|

0.00 |

|

|

|

0.01 |

|

|

| |

Goodwill and intangible

impairment |

|

- |

|

|

|

- |

|

|

|

|

1.66 |

|

|

|

- |

|

|

| |

Litigation settlement and trial

costs |

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

0.05 |

|

|

| |

Restructuring and other

charges |

|

0.01 |

|

|

|

- |

|

|

|

|

0.01 |

|

|

|

0.01 |

|

|

| |

Warrant fair value adjustment |

|

0.05 |

|

|

|

(0.03 |

) |

|

|

|

(0.03 |

) |

|

|

(0.03 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net loss per common

share - basic |

|

|

|

|

|

|

|

|

| |

as adjusted for

significant items |

$ |

(0.03 |

) |

|

$ |

(0.02 |

) |

|

|

$ |

(0.09 |

) |

|

$ |

(0.03 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

Weighted-average shares

- basic |

|

100,511 |

|

|

|

98,261 |

|

|

|

|

99,574 |

|

|

|

97,347 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ALPHATEC HOLDINGS, INC. |

|

|

|

| RECONCILIATION OF GEOGRAPHIC SEGMENT REVENUES

AND GROSS PROFIT |

|

|

| (in thousands, except percentages -

unaudited) |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

Three Months Ended |

|

|

|

|

|

% Change |

|

| |

|

December 30, |

|

% Change |

|

% Change |

|

Foreign |

|

| |

|

|

2015 |

|

|

|

2014 |

|

|

As Reported |

|

Operations |

|

Currency |

|

| |

|

|

|

|

|

| |

Revenues by geographic

segment |

|

|

|

|

| |

U.S. |

$ |

29,479 |

|

|

$ |

35,684 |

|

|

|

-17.4 |

% |

|

|

-17.4 |

% |

|

|

0.0 |

% |

|

| |

International |

|

17,524 |

|

|

|

17,943 |

|

|

|

-2.3 |

% |

|

|

6.3 |

% |

|

|

-8.6 |

% |

|

| |

Total revenues |

$ |

47,003 |

|

|

$ |

53,627 |

|

|

|

-12.4 |

% |

|

|

-9.4 |

% |

|

|

-3.0 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

Gross profit by

geographic segment |

|

|

|

|

| |

U.S. |

$ |

20,933 |

|

|

$ |

26,358 |

|

|

| |

International |

|

10,202 |

|

|

|

11,332 |

|

|

| |

Total gross profit |

$ |

31,135 |

|

|

$ |

37,690 |

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Gross profit margin by

geographic segment |

|

|

|

|

| |

U.S. |

|

71.0 |

% |

|

|

73.9 |

% |

|

| |

International |

|

58.2 |

% |

|

|

63.2 |

% |

|

| |

Total gross profit

margin |

|

66.2 |

% |

|

|

70.3 |

% |

|

|

|

|

|

| |

|

Twelve Months Ended |

|

|

|

|

|

% Change |

|

| |

|

December 30, |

|

% Change |

|

% Change |

|

Foreign |

|

| |

|

|

2015 |

|

|

|

2014 |

|

|

As Reported |

|

Operations |

|

Currency |

|

| |

|

|

|

|

|

| |

Revenues by geographic

segment |

|

|

|

|

| |

U.S. |

$ |

114,578 |

|

|

$ |

137,060 |

|

|

|

-16.4 |

% |

|

|

-16.4 |

% |

|

|

0.0 |

% |

|

| |

International |

|

70,701 |

|

|

|

69,920 |

|

|

|

1.1 |

% |

|

|

16.9 |

% |

|

|

-15.8 |

% |

|

| |

Total revenues |

$ |

185,279 |

|

|

$ |

206,980 |

|

|

|

-10.5 |

% |

|

|

-5.2 |

% |

|

|

-5.3 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

Gross profit by

geographic segment |

|

|

|

|

| |

U.S. |

$ |

77,538 |

|

|

$ |

100,568 |

|

|

| |

International |

|

42,546 |

|

|

|

42,842 |

|

|

| |

Total gross profit |

$ |

120,084 |

|

|

$ |

143,410 |

|

|

| |

|

|

|

|

|

| |

Gross profit margin by

geographic segment |

|

|

|

|

| |

U.S. |

|

67.7 |

% |

|

|

73.4 |

% |

|

| |

International |

|

60.2 |

% |

|

|

61.3 |

% |

|

| |

Total gross profit

margin |

|

64.8 |

% |

|

|

69.3 |

% |

|

|

|

| |

Footnotes: |

|

| |

1)

The impact from foreign currency represents the percentage change

in 2015 revenues due to the change in foreign |

|

| |

exchange rates for the

periods presented. |

|

| |

|

|

CONTACT: Investor/Media Contact:

Christine Zedelmayer

Investor Relations

Alphatec Spine, Inc.

(760) 494-6610

czedelmayer@alphatecspine.com

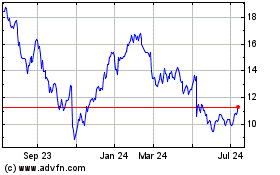

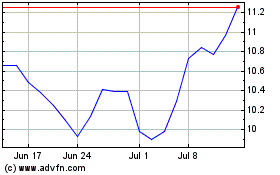

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Apr 2023 to Apr 2024