TIDMALPH

RNS Number : 5912F

Alpha Pyrenees Trust Limited

13 November 2015

13 November 2015

Alpha Pyrenees Trust Limited (the "Trust" or the "Company")

Trading Update

Alpha Pyrenees Trust Limited today publishes its trading update

statement for the quarter ending 30 September 2015 and the period

up until the date of this announcement. The information contained

herein has not been audited.

KEY POINTS

-- MATURITY OF BORROWINGS EXTENDED TO 15 APRIL 2016

-- TRUST HAS THE SUPPORT OF ITS LENDER FOR AN ORDERLY REALISATION OF ITS INVESTMENT PROPERTY

-- SALES PROCESS IS UNLIKELY TO RESULT IN ANY RETURN TO ORDINARY SHAREHOLDERS

-- ADJUSTED NAV* 0.0 PENCE PER SHARE AS AT 30 SEPTEMBER 2015 (30

JUNE 2015: 2.4 PENCE PER SHARE)

VALUATION AND NET ASSET VALUE ("NAV")

The Trust's current investment portfolio, excluding the Cordoba

property which was sold in July, was last valued on 30 June 2015 at

EUR254.1m (GBP188.4m at 30 September 2015 exchange rate) giving an

average valuation yield across the portfolio of 8.3% (French

portfolio 8.2% and Spanish portfolio 9.0% respectively).The next

independent revaluation will take place as at 31 December 2015.

As at 30 September 2015 the adjusted NAV* is 0.0 pence per

share. The decrease in adjusted NAV from 31 December 2014 (6.0

pence per share) is due to the combined effect of the loss incurred

in the period, property revaluation, adverse foreign exchange

effects and the contingent liability for deferred arrangement fees,

described below.

*Adjusted NAV - unaudited, after adjustments for the interest

rate swap derivatives (only relevant for the 31 December 2014

comparative), 50% of the deferred tax provisions and part of the

contingent liability for deferred arrangement fees.

FINANCING

It was announced on 15 October 2015 that the Trust's loan

facilities with Barclays Bank PLC ("Barclays") have been extended

and the maturity date of all its borrowings (EUR257.3m) has been

extended to 15 April 2016.

The current interest rates will continue to apply to the

facilities during the extension period. Arrangement fees (charged

at 2% per annum pro-rated) on the initial and new extensions will

all be deferred to the new maturity date and will be payable to the

extent that the Trust has sufficient cash funds at that time. The

Trust is currently compliant with its borrowing covenants.

SALES PROCESS

As reported in the half year report, in July the Trust sold the

Connecta retail park at Cordoba for EUR15.3m which represented its

valuation as at 30 June 2015 and the sales proceeds were used to

reduce the Trust's bank borrowings.

The Trust has the support of its lender for an orderly

realisation of its investment property. The Investment Manager is

focussed on this process and formal marketing of the majority of

the Trust's properties is progressing with the aim of realising

sales proceeds to support the settlement of the bank borrowings as

they mature. The results of the marketing process to date indicate

that although there is no certainty that any transactions will take

place, if they do, the Board does not expect that there will be any

value to return to ordinary shareholders after repayment of its

bank borrowings has taken place.

The Trust will provide further updates in due course.

DIVIDEND

The Trust does not propose to pay dividends.

PROPERTY UPDATE

The Trust's Investment Manager has continued to concentrate on

active asset management and property management initiatives. Since

30 June 2015, new leases and lease extensions covering

approximately 1,685 square metres (0.7% of the Trust's current

portfolio by area) have been achieved as detailed below.

FRANCE

-- Goussainville - A new 6/9/12 year lease from November 2015

was signed with Leonor Greyl, a hair care products and treatments

company, on 1,280 square metres of warehouse space.

-- Mulhouse - A new 6/9/12 year lease from January 2016 was

signed with Allen System Group, a computer software company, on 190

square metres of office space

SPAIN

-- Alcala - A new 5/8/12 year lease was signed from October 2015

with restaurant operator, Pomodoro, on a 215 square metre retail

unit.

GENERAL

The Investment Manager remains focussed on ensuring service

charges are controlled; the annual level of property costs is

closely monitored and additional sources of income are

identified.

The Trust's portfolio has an overall level of average occupancy

of 79% (80% at 30 June 2015), measured by rental income as a

percentage of potential total income. The weighted average lease

length as at 30 June 2015 was 9.1 years to expiry and 6.4 years to

next break with 90% of the current portfolio income coming from

Grade A tenants. By value, 98% of the Trust's portfolio is in

France and 89% is in the Paris region.

RENTAL INDEXATION

The INSEE Construction Cost Index ("ICC"), applicable to the

Trust's leases in France, showed an annualised decrease of 0.4% for

the latest published quarter, Q2 2015, following an annualised

decrease of 1.0% for Q1 2015.

The Spanish Consumer Price Index, applicable to the Trust's

leases in Spain, was running at an annualised rate of decrease of

0.7% as at the end of October 2015.

For further information:

Dick Kingston, Chairman, Alpha Pyrenees Trust Limited 01481 231100

Paul Cable, Fund Manager, Alpha Real Capital LLP 020 7391 4700

For more information on the Company, please visit

www.alphapyreneestrust.com.

FORWARD-LOOKING STATEMENTS

This interim management statement contains forward-looking

statements which are inherently subject

to risks and uncertainties because they relate to events and

depend upon circumstances that will

occur in the future. There are a number of factors that could

cause actual results to differ materially

from those expressed or implied by such forward-looking

statements. Forward-looking statements are

based on the Board's current view and information known to them

at the date of this statement. The

Board does not make any undertaking to update or revise any

forward-looking statements, whether as

a result of new information, future events or otherwise. Nothing

in this interim management statement

should be construed as a profit forecast.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFSALDLFLIE

(END) Dow Jones Newswires

November 13, 2015 02:00 ET (07:00 GMT)

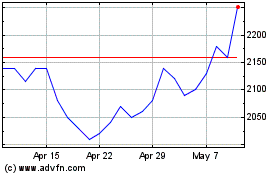

Alpha (LSE:ALPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

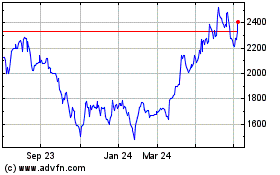

Alpha (LSE:ALPH)

Historical Stock Chart

From Apr 2023 to Apr 2024