TIDMALPH

RNS Number : 5962H

Alpha Pyrenees Trust Limited

19 August 2016

19 August 2016

ALPHA PYRENEES TRUST LIMITED

("ALPHA PYRENEES TRUST" OR THE "TRUST" OR THE "COMPANY")

ALPHA PYRENEES TRUST POSTS RESULTS FOR THE SIX MONTHSED 30 JUNE

2016

Alpha Pyrenees Trust Limited, the property company invested

primarily in commercial real estate in France, today posts its

results for the period from 1 January to 30 June 2016.

Contact:

Serena Tremlett

Chairman, Alpha Pyrenees Trust Limited

01481 231100

Paul Cable

Fund Manager, Alpha Real Capital LLP

020 7391 4700

For more information on the Trust please visit

www.alphapyreneestrust.com.

For more information on the Trust's Investment Manager please

visit www.alpharealcapital.com.

FORWARD-LOOKING STATEMENTS

These results contain forward-looking statements which are

inherently subject to risks and uncertainties because they relate

to events and depend upon circumstances that will occur in the

future. There are a number of factors that could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements. Forward-looking statements are

based on the Board's current view and information known to them at

the date of this statement. The Board does not make any undertaking

to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise. Nothing in

these results should be construed as a profit forecast.

About the Trust

Alpha Pyrenees Trust Limited ("the Trust", "the Company" or "the

Group") invested in higher-yielding properties in France and Spain,

focusing on commercial property in the office, industrial,

logistics and retail sectors let to tenants with strong covenants.

The Trust is pursuing an orderly realisation of its remaining

property assets and has the support of its lender in this

process.

Dividends

The Trust does not pay dividends.

Listing

The Trust is a closed-ended Guernsey registered investment

company which has been declared under the relevant legislation to

be an Authorised Closed-Ended Collective Investment Scheme. Its

shares are listed on the Official List of the UK Listing Authority

and traded on the London Stock Exchange.

Management

The Trust's Investment Manager is Alpha Real Capital LLP ("the

Investment Manager"). Control of the Trust rests with the

non-executive Guernsey-based Board of Directors.

ISA/SIPP status

The Trust's shares are eligible for Individual Savings Accounts

(ISAs) and Self Invested Personal Pensions (SIPPs).

Website

www.alphapyreneestrust.com

Chairman's Statement

The Investment Manager has been focused on achieving asset sales

to support the settlement of the bank borrowings which now mature

on 31 October 2016. The Board notes the progress achieved on this

front with the sale of a further three properties in France at

prices totalling GBP18.9 million (EUR24.3 million) with the net

proceeds being used to partially repay bank borrowings. The

Investment Manager is focused on achieving an orderly realisation

of the Trust's remaining six property assets, three of which are

located in France and three in Spain, in a consensual manner in

accordance with a formal agreement with Barclays Bank PLC

("Barclays"). To further this process the Investment Manager

continues to undertake active asset management within the remaining

portfolio with particular emphasis on the letting of vacant units

to enhance property income and the marketability of the

property.

Going concern

Given the current economic environment and the maturity of the

Group's bank borrowings on 31 October 2016 the Board will continue

to seek the support of its lender in an orderly realisation of its

remaining properties with a view to winding up the Group in due

course. The accounts are therefore not prepared on a going concern

basis. There were no adjustments required to the numbers presented

as a result of preparing the interim condensed financial statements

on a basis other than going concern.

Results and dividend

Results for the period show a consolidated loss for the six

months of GBP7.2 million (loss of 6.1 pence per share). Losses

comprise operating losses incurred on the remaining six properties,

losses on their revaluation, losses on the disposal of investment

properties and finance charges.

The Trust does not pay dividends.

Revaluation and Net Asset Value

Investment properties held for sale are included in the

consolidated balance sheet at a valuation of GBP21.9 million

(EUR26.4 million) as assessed by the independent valuers. As at 30

June 2016, the net asset value per ordinary share is negative 41.1p

primarily reflecting the loss in the period and adverse foreign

exchange effects.

Finance Commentary

It was announced on 15 April 2016 that the Trust's loan

facilities with Barclays had been extended and the maturity date of

all its borrowings is 31 October 2016.

Following net repayments in the period of GBP29.2 million

(EUR35.2 million), as at 30 June 2016 the Trust had principal

borrowings of GBP73.9 million (EUR89.1 million) under its

facilities with Barclays.

The current interest rates will continue to apply to the

facilities during the extension period and the 2% extension fees

(per annum pro-rated), charged on all borrowings from 10 February

2015, are deferred to the new maturity date and will be payable to

the extent that the Trust has sufficient cash funds at that time.

No additional fee was charged on the latest extension.

There is a cash-pooling arrangement over the Trust's cash flows

from the remaining property portfolio to provide further security

against the loan but still providing the Trust with working capital

for its operations.

Formal marketing of the Trust's remaining properties is ongoing

and the results of the marketing process to date indicate that,

although there is no certainty that any transactions will take

place, if they do, the prices achieved may be lower than the

valuation at 30 June 2016. The Trust will provide further updates

on progress in due course.

As the Board has previously stated, the sales process will not

result in any return to ordinary shareholders after repayment of

the Trust's bank borrowings, to the extent that this is possible,

has taken place.

Serena Tremlett

Chairman

18 August 2016

Property review

Portfolio overview

The Trust owns three properties in France (St Cyr L'Ecole,

Champs-sur-Marne and Ivry-sur-Seine) and three properties in Spain

(Alcalá de Guadaíra, Écija and Zaragoza) totalling approximately

33,680 square metres (approximately 362,500 square feet) of

commercial real estate. While the properties are generally well

located and offer good value accommodation to occupiers, the

properties suffer from weak tenant demand at the present time

coupled with a high level of vacancy.

The valuation of the six property portfolio as at 30 June 2016

was approximately GBP21.9 million (EUR26.4 million).

Property Sales

On 3 February 2016 the Trust sold its properties located at

Athis Mons, Aubergenville and Aubervilliers in France totalling

approximately 59,730 square metres for GBP18.9 million (EUR24.3

million).

These sales form part of the orderly realisation process

supported by the Trust's lender, Barclays, and the net proceeds

from these sales have been used in the reduction of the Trust's

bank borrowings.

The remaining properties held by the Trust are being actively

marketed and the Trust will provide further updates on the results

of the marketing process in due course.

Paul Cable

For and on behalf of the Investment Manager

18 August 2016

Principal risks and uncertainties

The principal risks and uncertainties facing the Group can be

outlined as follows:

-- The Group's existing borrowing facilities with Barclays Bank

PLC terminate on 31 October 2016. In order to enable repayment of

the bank borrowings, to the extent possible, the Group has agreed

with its lender to pursue an orderly realisation of its investment

properties, which are being actively marketed. The Board is of the

view that there will not be any value to return to ordinary

shareholders after repayment of bank borrowings.

-- Rental income and the fair value of investment properties are

affected, together with other factors, by general economic

conditions and/or by the political and economic climate of the

jurisdictions in which the Group's investment properties are

located.

-- Although the Trust has a substantial natural hedge through

the fact that its borrowings are denominated in the same currency

as the majority of its assets, the net assets of the Group are

exposed to movements in the euro exchange rate.

The Board believes that the above principal risks and

uncertainties would be equally applicable to the remaining six

month period of the current financial year.

Statement of Directors' Responsibilities

The Directors confirm that to the best of their knowledge:

-- the condensed financial statements have been prepared in

accordance with IAS 34 'Interim Financial Reporting' as adopted by

the European Union; and

-- the half year report meets the requirements of an interim

management report, and includes a fair review of the information

required by:

a) DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

six month period of the financial year; and their impact on the

interim condensed financial statements; and a description of the

principal risks and uncertainties of the remaining six months of

the year; and

b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

month period of the current financial year and that have materially

affected the financial position or performance of the Company

during the period.

The Directors of Alpha Pyrenees Trust Limited are listed

below.

At the June 2016 Board meeting, the Board has considered its

composition in terms of size and cost to manage the completion of

the sales process described above. As a result of this, David

Rowlinson, Phillip Rose and Dick Kingston have resigned from the

Board, effective 3 June 2016. David Jeffreys and Serena Tremlett,

who have been with the Company since inception, will continue as

Directors and the Board will take responsibility going forward for

matters previously dealt with by its sub-committees.

By order of the Board

Serena Tremlett

Chairman

18 August 2016

Independent review report

To Alpha Pyrenees Trust Limited

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the half year report for the six months

ended 30 June 2016 which comprises the condensed consolidated

statement of comprehensive income, condensed consolidated balance

sheet, condensed consolidated cash flow statement, condensed

consolidated statement of changes in equity and the related notes 1

to 10. We have read the other information contained in the half

year financial report and considered whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

Directors' responsibilities

The half year financial report is the responsibility of, and has

been approved by, the Directors. The Directors are responsible for

preparing the half year financial report in accordance with the

Disclosure and Transparency Rules of the United Kingdom's Financial

Conduct Authority.

As disclosed in note 2, the annual financial statements of the

Group are prepared in accordance with International Financial

Reporting Standards as adopted by the European Union. The condensed

set of financial statements included in this half year financial

report has been prepared in accordance with International

Accounting Standard 34, 'Interim Financial Reporting' as adopted by

the European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed consolidated set of financial statements in the half

year report based on our review.

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting its responsibilities in

respect of half-yearly financial reporting in accordance with the

Disclosure and Transparency Rules of the United Kingdom's Financial

Conduct Authority and for no other purpose. No person is entitled

to rely on this report unless such a person is a person entitled to

rely upon this report by virtue of and for the purpose of our terms

of engagement or has been expressly authorised to do so by our

prior written consent. Save as above, we do not accept

responsibility for this report to any other person or for any other

purpose and we hereby expressly disclaim any and all such

liability.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Information Performed by the Independent Auditor of the

Entity' issued by the Financial Reporting Council for use in the

United Kingdom. A review of interim financial information consists

of making enquiries, primarily of persons responsible for financial

and accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK and Ireland) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half year financial report for the six months to 30 June

2016 is not prepared, in all material respects, in accordance with

International Accounting Standard 34 as adopted by the European

Union and the Disclosure and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

Emphasis of matter - going concern

In forming our conclusion on the half year financial report,

which is not modified, we have considered the adequacy of the

disclosures made in note 2 and 7 to the condensed set of financial

statements which explain that the condensed set of financial

statements has not been prepared on a going concern basis. It is

the intention of the Board to effect an orderly disposal of the

Group's investment properties, seeking the continued support of its

lender whilst doing so, with a view to winding up the Group in due

course. Accordingly the directors have prepared the condensed

financial statements on the basis that the Group is no longer a

going concern.

BDO Limited

Chartered Accountants

Place du Pré

Rue du Pré

St Peter Port

Guernsey

18 August 2016

Condensed consolidated statement of comprehensive income

For the six months For the six months

ended 30 June ended 30 June

2016 (unaudited) 2015 (unaudited)

-------------------------------------- ------------------------------- -------------------------------

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Income

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Revenue 3 583 - 583 8,426 - 8,426

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Property operating

expenses (688) - (688) (2,944) - (2,944)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Net rental (expense)/income (105) - (105) 5,482 - 5,482

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Losses on disposal

of investment

properties 5 - (1,356) (1,356) - (21) (21)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Expenses

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Losses on revaluation

of investment

properties 5 - (1,985) (1,985) - (1,002) (1,002)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Investment Manager's

fee (426) - (426) (771) (331) (1,102)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Other administration

costs (487) - (487) (597) - (597)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Operating (loss)/profit (1,018) (3,341) (4,359) 4,114 (1,354) 2,760

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Finance income - - - 2 888 890

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Finance costs (2,761) (58) (2,819) (6,326) (157) (6,483)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Loss before

taxation (3,779) (3,399) (7,178) (2,210) (623) (2,833)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Taxation - - - - (11) (11)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Loss for the

period (3,779) (3,399) (7,178) (2,210) (634) (2,844)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Other comprehensive

income/(loss)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Items that may

be reclassified

to profit or

loss in subsequent

periods:

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Foreign exchange

losses on translation

of foreign operations

(translation

reserve) - (4,831) (4,831) - (53) (53)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Other comprehensive

loss for the

period - (4,831) (4,831) - (53) (53)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Total comprehensive

loss for the

period (3,779) (8,230) (12,009) (2,210) (687) (2,897)

----------------------------- ------- --------- --------- --------- --------- --------- ---------

Loss per share

- basic & diluted 4 (6.1)p (2.4)p

All items in the above statement derive from continuing

operations.

The accompanying notes are an integral part of the financial

statements.

Condensed consolidated balance sheet

Notes 30 June 31 December

2016 2015 (audited)

(unaudited) GBP'000

GBP'000

--------------------------------- ------ ------------- ----------------

Current assets

--------------------------------- ------ ------------- ----------------

Investment properties held

for sale 5 21,924 39,283

--------------------------------- ------ ------------- ----------------

Trade and other receivables 1,229 6,940

--------------------------------- ------ ------------- ----------------

Restricted cash 6 5,028 10,054

--------------------------------- ------ ------------- ----------------

Cash and cash equivalents 403 1,309

--------------------------------- ------ ------------- ----------------

28,584 57,586

--------------------------------- ------ ------------- ----------------

Current liabilities

--------------------------------- ------ ------------- ----------------

Trade and other payables (1,486) (1,955)

--------------------------------- ------ ------------- ----------------

Bank borrowings 7 (75,241) (91,311)

--------------------------------- ------ ------------- ----------------

Liabilities directly associated

with investment properties

held for sale (240) (694)

--------------------------------- ------ ------------- ----------------

(76,967) (93,960)

--------------------------------- ------ ------------- ----------------

Net liabilities (48,383) (36,374)

--------------------------------- ------ ------------- ----------------

Equity

--------------------------------- ------ ------------- ----------------

Share capital 8 - -

--------------------------------- ------ ------------- ----------------

Special reserve 113,131 113,131

--------------------------------- ------ ------------- ----------------

Translation reserve 19,403 24,234

--------------------------------- ------ ------------- ----------------

Capital reserve (169,572) (166,173)

--------------------------------- ------ ------------- ----------------

Revenue reserve (11,345) (7,566)

--------------------------------- ------ ------------- ----------------

Total equity (48,383) (36,374)

--------------------------------- ------ ------------- ----------------

Net asset value per share (41.1)p (30.9)p

The interim condensed consolidated financial statements were

approved by the Board of Directors and authorised for issue on 18

August 2016.

David Jeffreys Serena Tremlett

Director Director

The accompanying notes are an integral part of the financial

statements.

Condensed consolidated cash flow statement

For the For the

six months six months

ended 30 ended 30

June 2016 June 2015

(unaudited) (unaudited)

GBP'000 GBP'000

------------------------------------- ------------- -------------

Operating activities

------------------------------------- ------------- -------------

Loss for the period (7,178) (2,844)

------------------------------------- ------------- -------------

Adjustments for :

------------------------------------- ------------- -------------

Losses on disposal of investment

properties 1,356 21

------------------------------------- ------------- -------------

Losses on revaluation of

investment properties 1,985 1,002

------------------------------------- ------------- -------------

Deferred taxation - 11

------------------------------------- ------------- -------------

Finance income - (890)

------------------------------------- ------------- -------------

Finance costs 2,819 6,483

------------------------------------- ------------- -------------

Operating cash flows before

movements in working capital (1,018) 3,783

------------------------------------- ------------- -------------

Movements in working capital:

------------------------------------- ------------- -------------

Movement in trade and other

receivables 429 2,118

------------------------------------- ------------- -------------

Movement in trade and other

payables (1,177) (1,871)

------------------------------------- ------------- -------------

Cash flows (used in)/from

operations (1,766) 4,030

------------------------------------- ------------- -------------

Interest received - 2

------------------------------------- ------------- -------------

Cash flows (used in)/from

operating activities (1,766) 4,032

------------------------------------- ------------- -------------

Investing activities

------------------------------------- ------------- -------------

Proceeds from disposal of

investment properties 23,902 123

------------------------------------- ------------- -------------

Capital expenditure - (168)

------------------------------------- ------------- -------------

Restricted cash movement 5,903 1,213

------------------------------------- ------------- -------------

Cash flows from investing

activities 29,805 1,168

------------------------------------- ------------- -------------

Financing activities

------------------------------------- ------------- -------------

Repayment of borrowings (27,406) -

------------------------------------- ------------- -------------

Bank loan interest paid

and costs (1,189) (5,354)

------------------------------------- ------------- -------------

Cash flows used in financing

activities (28,595) (5,354)

------------------------------------- ------------- -------------

Decrease in cash and cash

equivalents (556) (154)

------------------------------------- ------------- -------------

Cash and cash equivalents

at beginning of period 1,309 4,659

------------------------------------- ------------- -------------

Exchange translation movement (350) (1,174)

------------------------------------- ------------- -------------

Cash and cash equivalents

at end of period 403 3,331

The accompanying notes are an integral part of the financial

statements.

Condensed consolidated statement of changes in equity

For the six months Share Special Translation Capital Revenue Total

ended 30 June capital reserve reserve reserve reserve reserves

2015 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------- --------- ------------ ---------- --------- ----------

At 1 January

2015 - 113,131 22,272 (129,871) (2,577) 2,955

--------------------- ---------- --------- ------------ ---------- --------- ----------

Total comprehensive

income/(loss)

for the period

--------------------- ---------- --------- ------------ ---------- --------- ----------

Loss for the

period - - - (634) (2,210) (2,844)

--------------------- ---------- --------- ------------ ---------- --------- ----------

Other comprehensive

loss - - (53) - - (53)

--------------------- ---------- --------- ------------ ---------- --------- ----------

Total comprehensive

loss for the

period - - (53) (634) (2,210) (2,897)

--------------------- ---------- --------- ------------ ---------- --------- ----------

At 30 June 2015 - 113,131 22,219 (130,505) (4,787) 58

--------------------- ---------- --------- ------------ ---------- --------- ----------

For the six months Share Special Translation Capital Revenue Total

ended 30 June capital reserve reserve reserve reserve reserves

2016 (unaudited) GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ---------- --------- ------------ ---------- --------- ----------

At 1 January

2016 - 113,131 24,234 (166,173) (7,566) (36,374)

--------------------- ---------- --------- ------------ ---------- --------- ----------

Total comprehensive

income/(loss)

for the period

--------------------- ---------- --------- ------------ ---------- --------- ----------

Loss for the

period - - - (3,399) (3,779) (7,178)

--------------------- ---------- --------- ------------ ---------- --------- ----------

Other comprehensive

loss - - (4,831) - - (4,831)

--------------------- ---------- --------- ------------ ---------- --------- ----------

Total comprehensive

loss for the

period - - (4,831) (3,399) (3,779) (12,009)

--------------------- ---------- --------- ------------ ---------- --------- ----------

At 30 June 2016 - 113,131 19,403 (169,572) (11,345) (48,383)

--------------------- ---------- --------- ------------ ---------- --------- ----------

The accompanying notes are an integral part of the financial

statements.

Notes to the condensed financial statements

1. General information

The Company is a limited liability, closed-ended investment

company incorporated in Guernsey, which has been declared under the

relevant legislation to be an Authorised Closed-Ended Collective

Investment Scheme. The Group comprises the Company and its

subsidiaries. The Group invests in commercial property in France

and Spain. The Company's functional currency is Sterling and the

subsidiaries' functional currency is Euros. The presentation

currency of the Group is Sterling. The period-end exchange rate

used is GBP1:EUR1.206 (December 2015: GBP1:EUR1.357) and the

average rate for the period used is GBP1:EUR1.284 (June 2015:

GBP1:EUR1.364).

2. Significant accounting policies

The unaudited condensed consolidated financial statements

included in the half year report for the six months ended 30 June

2016, have been prepared in accordance with the Disclosure and

Transparency Rules of the United Kingdom's Financial Conduct

Authority and International Accounting Standard (IAS) 34, 'Interim

Financial Reporting' as adopted by the European Union. The

condensed financial statements should be read in conjunction with

the Group's annual report and financial statements for the year

ended 31 December 2015, which have been prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the European Union and are available on the Company's website

(www.alphapyreneestrust.com).

The accounting policies adopted and methods of computation

followed in these condensed financial statements are consistent

with those applied in the preparation of the Group's annual

consolidated financial statements for the year ended 31 December

2015.

The rent deposits at 31 December 2015 have been re-categorised

to liabilities directly associated with investment properties held

for sale in these interim condensed consolidated financial

statements. Liabilities directly associated with investment

properties held for sale represent amounts that will be transferred

on the sale of the properties.

The Directors considered all relevant new standards, amendments

and interpretations to existing standards effective for accounting

periods beginning on 1 January 2016 and determined that they will

have no impact on the annual consolidated financial statements of

the Group or the interim condensed financial statements of the

Group.

The preparation of the interim condensed financial statements

requires Directors to make estimates and assumptions that affect

the reported amounts of revenues, expenses, assets and liabilities,

and the disclosure of contingent liabilities at the date of the

interim condensed financial statements. If in the future such

estimates and assumptions, which are based on the Directors' best

judgement at the date of the interim condensed financial

statements, deviate from actual circumstances, the original

estimates and assumptions will be modified as appropriate in the

period in which the circumstances change.

Going concern

Given the current economic environment and the maturity of the

Group's bank borrowings on 31 October 2016 the Board will continue

to seek the support of its lender in an orderly realisation of its

remaining six investment properties with a view to winding up the

Group in due course. The accounts are therefore not prepared on a

going concern basis. There were no adjustments required to the

numbers presented as a result of preparing the interim condensed

financial statements on a basis other than going concern.

3. Revenue

1 January 1 January

2016 to 2015 to

30 June 30 June

2016 2015

GBP'000 GBP'000

----------------------- ---------- ----------

Rental income 261 6,510

----------------------- ---------- ----------

Service charge income 322 1,916

----------------------- ---------- ----------

Total 583 8,426

4. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

1 January 1 January

2016 to 2015 to

30 June 30 June

2016 2015

------------------------------------- ---------- ----------

Losses after tax per statement

of comprehensive income (GBP'000) (7,178) (2,844)

------------------------------------- ---------- ----------

Basic and diluted losses per

share (6.1)p (2.4)p

------------------------------------- ---------- ----------

Weighted average number of ordinary

shares (000's) 117,627 117,627

5. Investment properties held for sale

30 June 31 December

2016 2015

GBP'000 GBP'000

--------------------------------------- --------- ------------

Fair value of investment properties

held for sale at 1 January 39,283 122,637

--------------------------------------- --------- ------------

Subsequent capital expenditure

after acquisition - 10

--------------------------------------- --------- ------------

Disposals (18,681) (109,476)

--------------------------------------- --------- ------------

Movement in rent incentives (259) (4,425)

--------------------------------------- --------- ------------

Fair value adjustment in the

period/year (1,985) 72

--------------------------------------- --------- ------------

Effect of foreign exchange 3,566 (8,818)

--------------------------------------- --------- ------------

Transfer from investment properties - 39,283

--------------------------------------- --------- ------------

Fair value of investment properties

held for sale at 30 June/31 December 21,924 39,283

The fair value of the Group's investment properties held for

sale at 31 December 2015 had been arrived at on the basis of

valuations carried out at that date by Knight Frank LLP,

independent valuers not connected to the Group, with the exception

of the three properties sold in France before signing the annual

financial statements (Aubervilliers for GBP11.5 million (EUR14.8

million), Aubergenville for GBP3.8 million (EUR4.9 million) and

Athis Mons for GBP3.6 million (EUR4.6 million)), which had been

valued by the Directors at their selling price.

The sales of these properties completed during the period ended

30 June 2016 and losses of GBP1.4 million were realised.

The fair value of the Group's remaining six investment

properties held for sale at 30 June 2016 has been arrived at on the

basis of valuations carried out at that date by Knight Frank LLP.

The portfolio has been valued on a fair value basis as defined by

the Royal Institution of Chartered Surveyors ("RICS") Appraisal and

Valuations Standards. The approved RICS definition of fair value is

"the price that would be received to sell an asset, or paid to

transfer a liability, in an orderly transaction between market

participants at the measurement date".

No provision is made for potential disposal costs as these will

be contingent upon ultimate realisation values and specific

arrangements that may be agreed.

Formal marketing of the Trust's remaining properties is ongoing

and the results of the marketing process to date indicate that,

although there is no certainty that any transactions will take

place, if they do, the prices achieved may be lower than the

valuation at 30 June 2016. The Trust will provide further updates

on progress in due course.

6. Restricted cash

The cash balance held on the cash pooling account is subject to

certain restrictions; accordingly this balance has not been

classified as cash and cash equivalents.

In November 2013, the Group entered into a cash pooling

arrangement with Barclays Bank PLC over the Group's cash-flows from

the whole property portfolio in order to provide further security

to Barclays Bank PLC but which provides the Group and the Company

with working capital for their operations. The resulting cash

pooling account is controlled by Barclays Bank PLC and a cash

release mechanism is in place whereby cash is released by Barclays

Bank PLC following review of the Group's working capital

requirements.

7. Bank borrowings

30 June 31 December

2016 2015

GBP'000 GBP'000

--------------------------- --------- ------------

Bank borrowing 73,862 90,398

--------------------------- --------- ------------

Deferred finance costs (60) (103)

--------------------------- --------- ------------

Interest payable 1,439 1,016

--------------------------- --------- ------------

Total current liabilities 75,241 91,311

In February 2016, the Group sold three properties in France at

prices totalling GBP18.9 million (EUR24.3 million) with the net

proceeds from these sales enabling the repayment of bank borrowings

totalling GBP18.1 million (EUR23.3 million).

During the period a further GBP9.3 million (EUR11.9 million) of

debt repayment was made.

The repayment date of all borrowings, originally due on 10

February 2015, was extended three times during the year 2015 (to 11

May 2015, to 15 October 2015 and to 15 April 2016) and then reset

to 31 October 2016, following agreement with Barclays Bank PLC.

The current interest rates will continue to apply to the

facilities during the extension period.

Extension fees of 2% (per annum pro-rated) are charged on all

borrowings from 10 February 2015: these are deferred to the new

maturity date and will be payable to the extent that the Group has

sufficient cash funds at that time. No additional fee was charged

on the latest extension to 31 October 2016. As at 30 June 2016, the

Board consider it probable, based on cash flow forecasts, that

there will be insufficient cash funds to settle this amount and

hence this represents a contingent liability of EUR6.3 million

(GBP5.2 million), which has not been recognised in these financial

statements.

8. Share capital

The authorised share capital is unlimited. The Company has one

class of shares which carry no right to fixed income. All ordinary

shares have a nil par value. The number of shares in issue is 117.6

million (December 2015: 117.6 million).

There have been no share cancellations during the period.

9. Related party transactions

Parties are considered to be related if one party has the

ability to control the other party or exercise significant

influence over the other party in making financial or operational

decisions. Alpha Real Capital LLP is the Investment Manager to the

Company under the terms of the Investment Manager Agreement and is

thus considered a related party of the Company.

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note.

Following the disposal of the majority of the property

portfolio, the Board has agreed, in line with the consensual sales

programme established with Barclays Bank PLC, a monthly fee

reflecting the need for the Investment Manager to maintain adequate

resources to complete the disposal of the remaining properties and

winding up of the Group. This fee is separately disclosed on the

face of the statement of comprehensive income. The consensual sales

programme requires 30% of fees earned by the Investment Manager to

be deferred and only released when sales milestones have been

achieved. The outstanding balance for Investment Manager's fees as

at 30 June 2016 is GBP473,000 (31 December 2015: GBP640,000).

The Directors of the Company received total fees as follows:

Six months Six months

ended ended

30 June 30 June

2016 2015

GBP GBP

------------------ ----------- -----------

Dick Kingston 15,000 15,000

------------------ ----------- -----------

David Jeffreys 11,500 11,500

------------------ ----------- -----------

Phillip Rose 10,000 10,000

------------------ ----------- -----------

David Rowlinson* 10,000 10,000

------------------ ----------- -----------

Serena Tremlett 10,000 10,000

------------------ ----------- -----------

Total 56,500 56,500

David Rowlinson, Phillip Rose and Dick Kingston have resigned

from the Board, effective 3 June 2016.

The Directors' interests in the shares of the Company are

detailed below:

30 June 30 June

2016 2015

shares shares

held held

------------------ ---------- ----------

Dick Kingston 710,616 710,616

------------------ ---------- ----------

David Jeffreys 250,000 250,000

------------------ ---------- ----------

Phillip Rose 1,290,079 1,290,079

------------------ ---------- ----------

David Rowlinson* - -

------------------ ---------- ----------

Serena Tremlett 121,472 121,472

* David Rowlinson is a director of Antler Investment Holdings

Limited ("Antler") and the managing director of Liberation

Management Limited, which is a trustee of the Rockmount Purpose

Trust that indirectly is a partner of Alpha Real Capital LLP. As

such he was considered to be in a position in which he was able to

exercise significant influence over the Investment Manager.

The following, being partners of the Investment Manager held the

following shares in the Company:

30 June 31 December

2016 2015

shares shares

held held

-------------------- ----------- ------------

Rockmount Ventures

Limited and ARRCO

Limited** 21,437,393 21,437,393

-------------------- ----------- ------------

Phillip Rose*** 1,290,079 1,290,079

-------------------- ----------- ------------

Bradley Bauman 544,809 544,809

-------------------- ----------- ------------

Brian Frith 229,078 229,078

-------------------- ----------- ------------

Karl Devon-Lowe 108,650 108,650

** Rockmount Ventures Limited is the parent company of ARRCO

Limited. The interest attributed to the two corporate partners

represents 21,437,393 shares held by a related party, Antler. As

such these companies are considered to be in a position in which

they are able to exercise significant influence over the Investment

Manager.

***Phillip Rose is the CEO and a partner of the Investment

Manager.

Alpha Real Capital LLP, the Investment Manager of the Company,

holds 9,390,800 (31 December 2015: 9,390,800) shares in Alpha

Pyrenees Trust Limited.

Paul Cable, being the Investment Manager's Fund Manager

responsible for the Trust's investments, holds 84,918 (31 December

2015: 84,918) shares in Alpha Pyrenees Trust Limited.

Serena Tremlett is also the Managing Director and a major

shareholder of Morgan Sharpe Administration Limited, the Company's

administrator and secretary. During the period the Company paid

Morgan Sharpe Administration Limited fees of GBP40,500 (31 December

2015: GBP81,000).

10. Events after the balance sheet date

There were no significant events after the balance sheet

date.

Directors and Trust information

Directors Administrator and Legal advisors

Serena Tremlett secretary in Guernsey

(Chairman) Morgan Sharpe Carey Olsen

David Jeffreys Administration PO Box 98

Limited Carey House

Old Bank Chambers Les Banques

La Grande Rue St Peter Port

St Martin's Guernsey GY1 4BZ

Guernsey GY4 6RT

Registered office Independent valuers Legal advisors

Old Bank Chambers Knight Frank LLP in the UK

La Grande Rue 55 Baker Street Norton Rose

St Martin's London W1U 8AN 3 More London Riverside

Guernsey GY4 6RT London SE1 2AQ

Investment Manager Independent auditor Registrar

Alpha Real Capital BDO Limited Computershare Investor

LLP Place du Pré Services (Jersey)

Level 6, 338 Euston Rue du Pré Limited

Road St Peter Port Queensway House

London NW1 3BG Guernsey GY1 3LL Hilgrove Street

St Helier

Jersey JE1 1ES

Tax advisors

BDO LLP

55 Baker Street

London W1U 7EU

Deloitte LLP

Hill House

1 Little New Street

London EC4A 3TR

Shareholder information

Share price

The Company's Ordinary Shares are listed on the London Stock

Exchange.

Change of address

Communications with shareholders are mailed to the addresses

held on the share register. In the event of a change of address or

other amendment, please notify the Company's Registrar under the

signature of the registered holder.

Investment Manager

The Company is advised by Alpha Real Capital LLP which is

authorised and regulated by the Financial Conduct Authority in the

United Kingdom.

Financial Calendar

Financial reporting Reporting/Meeting dates

---------------------------------------- ------------------------

Half year report 19 August 2016

---------------------------------------- ------------------------

Trading update statement (Q3) 11 November 2016

---------------------------------------- ------------------------

Annual report and accounts announcement 10 March 2017

---------------------------------------- ------------------------

Annual report published 31 March 2017

---------------------------------------- ------------------------

Annual General Meeting 28 April 2017

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BLGDIBGBBGLI

(END) Dow Jones Newswires

August 19, 2016 02:00 ET (06:00 GMT)

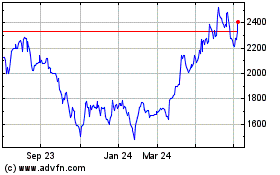

Alpha (LSE:ALPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

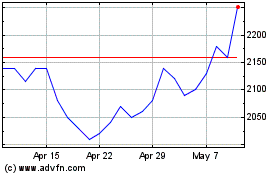

Alpha (LSE:ALPH)

Historical Stock Chart

From Apr 2023 to Apr 2024