Alkane Energy PLC Alkane Wins National Grid Contracts (4296S)

September 24 2014 - 2:01AM

UK Regulatory

TIDMALK

RNS Number : 4296S

Alkane Energy PLC

24 September 2014

24 September 2014

Alkane Energy plc

Alkane wins National Grid demand side balancing contracts for

2014/2015

Alkane Energy plc ("Alkane") is delighted to announce that it

has been successful in winning some of the first demand side

balancing contracts for the 2014/15 winter season. These contracts

are part of National Grid's Demand Side Balancing Reserve ("DSBR")

programme which is designed to provide additional balancing

services to the UK electricity market during periods of high demand

and will provide a new income stream for Alkane.

The contracts are to supply 56MW capacity to National Grid

during periods of high system demand over the winter season running

from 1 November 2014 to 28 February 2015. They are among the very

first contract awards under interim measures introduced by National

Grid to ensure that as System Operator, it has the tools to deal

with tightening margins in the coming winters.

This award is a reflection of Alkane's cost effective, flexible

and highly reliable operating assets. The current generating fleet

provides an ideal partner to National Grid in meeting its security

of supply targets and gives Alkane confidence in bidding into the

capacity market and other balancing services in the coming

years.

The winter of 2014/15 will be the first year of operation of

this new initiative with the overall programme being designed to

cover the winter peak period from 4pm to 8pm each weekday between

November and February. Alkane will receive a two hour warning from

National Grid if it is required to generate. Alkane is not

expecting any significant additional capital expenditure or

operating costs to service this new market, which will be

accommodated by Alkane's existing power response fleet.

Neil O'Brien, Alkane's CEO, commented:

"Our power response strategy is built on being a reliable, cost

effective and flexible partner for National Grid. I am delighted to

see that this strategy is continuing to develop as planned.

Starting from a base in the STOR market in 2011 we have expanded

operations into winter running and now DSBR. All of this will be

serviced from our existing engine capacity which can be swiftly

deployed to respond to a range of market demands."

For more information please contact:

Alkane Energy plc

Neil O'Brien, Chief Executive

Officer

Steve Goalby, Finance Director 01623 827927

Liberum Capital Limited

Clayton Bush

Tim Graham 020 3100 2000

VSA Capital Limited

Andrew Raca 020 3005 5004

Hudson Sandler

Nick Lyon

Alex Brennan 020 7796 4133

Background information

Alkane is one of the UK's fastest growing independent power

generators. The Company operates mid-sized "gas to power"

electricity plants providing both base load and fast response

capacity to the grid. Following the recently announced acquisition

of three power response sites from Carron Energy Limited and Dragon

Generation Limited, Alkane has a total installed generating

capacity of 140MW and an electricity grid capacity of 160MW.

Alkane's base load operations, where power is generated 24/7,

are centred on a portfolio of coal mine methane ("CMM") sites.

Alkane has the UK's leading portfolio of CMM licences, enabling the

Company to extract gas from abandoned coal mines.

As CMM declines at any one site, Alkane retains valuable

generating capacity and a grid connection which can be redeployed

to power response. Power response sites are connected to mains gas

and produce electricity at times of high electrical demand through

peak running, or in order to balance the electricity grid through

participation in the National Grid's short term operating reserve

programme ("STOR"). Participants in STOR are paid premium rates

when called upon by the Grid to meet temporary supply shortages.

Alkane now operates 93MW of power response, one of the UK's largest

power response businesses, with contracted revenues extending out

to 2025.

The Group operates from 27 mid-size (up to 25MW) power plants

across the UK, 15 CMM only, 8 mains gas only, 3 using both fuel

sources and 1 using kerosene only. Alkane uses standard modular

reciprocating engines to generate the electricity and sells this

power through the electricity network. The engine units and other

plant are designed to be flexible and transportable allowing

additional capacity to be brought onto growing sites and

underutilised plant to be moved to new sites to maximise

efficiency.

Alkane transferred in June 2014 its shale gas interests to Egdon

Resources plc. Alkane received 40m Egdon shares making us the

largest shareholder in Egdon, a significant player within the UK

shale industry.

Alkane has a range of core skills encompassing the entire

project development cycle including planning and permitting,

sourcing plant and managing the build and commissioning stage. This

has enabled Alkane to establish a design, build and operate ("DBO")

business for third party clients in the biogas and oil & gas

industries.

The Group has circa 800km(2) of acreage under various onshore

Petroleum Exploration and Development Licences ("PEDLs").

More information is available on our website

www.alkane.co.uk

This information is provided by RNS

The company news service from the London Stock Exchange

END

CNTQKNDPABKDOCB

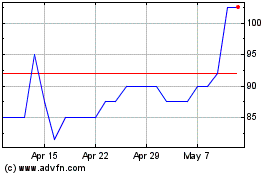

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Mar 2024 to Apr 2024

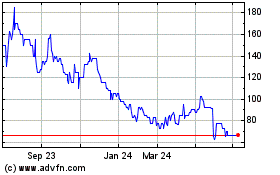

Alkemy Capital Investments (LSE:ALK)

Historical Stock Chart

From Apr 2023 to Apr 2024