Air Liquide Launches EUR3.3 Billion Capital Increase to Part Finance Airgas Deal

September 13 2016 - 2:48AM

Dow Jones News

By Inti Landauro

PARIS--French industrial gas supplier Air Liquide SA (AI.FR)

said Monday it plans to raise 3.3 billion euros ($3.71 billion)

through the sale of new shares to help finance its acquisition of

U.S. rival Airgas.

The sale will run from Sept. 14 to Sept. 28 and existing

shareholders will have priority, with the right to buy one new

share for every eight already held.

Shares are being sold at EUR76 each, 21% below Air Liquide's

closing share price on Friday.

The capital increase represent 12.5% of the company's existing

shares. The transaction is being underwritten by a syndicate of

banks.

Overall Air Liquide plans to finance the $13 billion acquisition

with the sale of EUR3 billion worth of bonds in Europe already

carried out and plans to raise a further $4.5 billion in bonds in

the U.S.

Air Liquide's acquisition of Airgas Inc. in May enabled the

French company to reclaim the No. 1 spot among makers of gases used

in manufacturing, food production, and health care, with annual

revenue of more than $23 billion. Following that merger, two other

rivals, Germany's Linde AG (LIN.XE) and Praxair Inc. (PX) launched

merger talks that collapsed earlier this week.

-Write to Inti Landauro at inti.landauro@wsj.com

(END) Dow Jones Newswires

September 13, 2016 02:33 ET (06:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

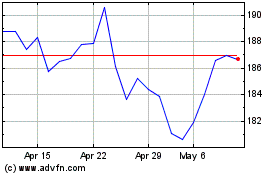

Air Liquide (EU:AI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air Liquide (EU:AI)

Historical Stock Chart

From Apr 2023 to Apr 2024