Air France Seeks Cost Cuts Despite Higher Profit

October 29 2015 - 4:30AM

Dow Jones News

PARIS—Air France-KLM's management on Thursday called for drastic

cost-cutting despite the airline posting its largest quarterly net

profit in five years as a result of lower fuel prices.

Air France-KLM reported a sharp rise in third-quarter net profit

to €480 million ($533 million), compared with a revised €86 million

profit in the same period last year. The airline's bottom line was

boosted by some €500 million in cost savings from lower jet-fuel

prices as well as a weak comparative quarter, which was hit by a

costly pilots strike, Chief Financial Officer Pierre Francois

Riolacci said.

However, strong profit growth is likely to complicate the

company's effort to convince restive unions in France that the

carrier needs to undertake sharp cost cuts. Management says the

cuts are necessary for it to compete with short-haul budget

carriers and Gulf airlines on the more expensive long-haul

flights.

Talks between Air France's management and unions turned sour

early this month when a group of company employees accosted two

company executives and tore off their shirts. Workers turned

against the company's negotiators when they announced a plan to cut

2,900 jobs.

The profit also thrusts Air France-KLM into the unusual position

of arguing that its results are actually weaker than they

appear.

"Since the gain is mostly due to favorable fuel prices, our

competitors also improved their results," Mr. Riolacci said on a

conference call with reporters. "We still have a competitiveness

gap that we must close."

Air France-KLM argues it needs to adjust its cost structure the

same way rival legacy airline British Airways did a few years ago,

a move that led to double-digit profitability. With sales at €7.42

billion during the quarter, Air France-KLM's profit margin is still

much too low to be sustainable in the long-run, Mr. Riolacci

said.

Even low fuel prices themselves are a threat, the company

argues: Competitors will take advantage of their own boosted profit

to increase capacity in coming months, adding new pressure to

prices, and jeopardizing Air France-KLM's apparent turnaround

during the third quarter, Mr. Riolacci added.

After years of losses, Air France-KLM may even post a net profit

this year, Mr. Riolacci said, though he insisted the company

doesn't give guidance for net profit. Like in 2013, the company

will post an operating profit, after posting operating losses in

2012 and 2014, he said.

Air France has managed to improve its competitiveness since 2013

by reducing its payroll size without firing workers; some

employees, such as technicians, have accepted working more days and

have taken pay cuts.

Still, its expenses are much higher than many rivals. Air

France's unit costs, measured by costs per available seat

kilometer, were 13% higher than KLM's last year and their combined

costs are 12% higher than at International Consolidated Airlines

Group SA, the parent company of British Airways, according to the

CAPA Center for Aviation.

Write to Inti Landauro at inti.landauro@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 04:15 ET (08:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

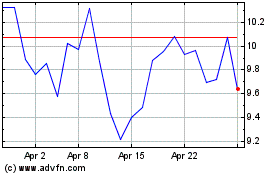

Air FranceKLM (EU:AF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air FranceKLM (EU:AF)

Historical Stock Chart

From Apr 2023 to Apr 2024