Strong Q2 FY2015 Profit Growth Driven by Cloud Momentum;

Creative ARR Tops $2 Billion

Adobe (Nasdaq:ADBE) today reported financial results for its

second quarter fiscal year 2015 ended May 29, 2015.

Quarterly Financial Highlights

- Adobe achieved record quarterly revenue

of $1.16 billion.

- Digital Media Annualized Recurring

Revenue (“ARR”) grew to $2.35 billion exiting the quarter, driven

by an increase in Creative ARR of $230 million to $2.02

billion.

- Adobe Marketing Cloud achieved revenue

of $327 million.

- Diluted earnings per share were $0.29

on a GAAP-basis, and $0.48 on a non-GAAP basis.

- Year-over-year, operating income grew

43 percent and net income grew 67 percent on a GAAP-basis;

operating income grew 28 percent and net income grew 30 percent on

a non-GAAP basis.

- Cash flow from operations was $471

million, and deferred revenue grew to an all-time high of $1.23

billion.

- The company repurchased approximately

2.6 million shares during the quarter, returning $200 million of

cash to stockholders.

A reconciliation between GAAP and non-GAAP results is provided

at the end of this press release and on Adobe’s website.

Executive Quotes

"Strong execution against our Creative Cloud, Document Cloud and

Marketing Cloud businesses drove record revenue," said Shantanu

Narayen, Adobe president and chief executive officer. "We are

accelerating the pace of innovation in our Cloud offerings and are

thrilled to be launching our best Creative Cloud release to date,

which includes Adobe Stock – our new stock content service."

“With our business model transition largely behind us, the

positive financial benefits are now reflected in our P&L,” said

Mark Garrett, Adobe executive vice president and chief financial

officer. “We are driving more profit, earnings per share, cash flow

and deferred revenue and unbilled backlog.”

Adobe to Webcast Earnings Conference Call

Adobe will webcast its second quarter fiscal year 2015 earnings

conference call today at 2:00 p.m. Pacific Time from its investor

relations website: www.adobe.com/ADBE. Earnings documents,

including Adobe management’s prepared conference call remarks with

slides, financial targets and an investor datasheet are posted to

Adobe’s investor relations website in advance of the conference

call for reference. A reconciliation between GAAP and non-GAAP

earnings results and financial targets is also provided on the

website.

Forward-Looking Statements Disclosure

This press release contains forward-looking statements,

including those related to business momentum, product innovation,

the success of our new stock image service, Adobe Stock, and

capabilities and the strength of our cloud business and growth of

our revenue, earnings, cash flow, deferred revenue and unbilled

backlog, all of which involve risks and uncertainties that could

cause actual results to differ materially. Factors that might cause

or contribute to such differences include, but are not limited to:

failure to develop, market and distribute products and services

that meet customer requirements, introduction of new products and

business models by competitors, failure to successfully manage

transitions to new business models and markets, fluctuations in

subscription renewal rates, risks associated with cyber-attacks and

information security, potential interruptions or delays in hosted

services provided by us or third parties, uncertainty in economic

conditions and the financial markets, and failure to realize the

anticipated benefits of past or future acquisitions.

For a discussion of these and other risks and uncertainties,

please refer to Adobe’s Annual Report on Form 10-K for our fiscal

year 2014 ended Nov. 28, 2014, and Adobe's Quarterly Reports on

Form 10-Q issued in fiscal year 2015.

The financial information set forth in this press release

reflects estimates based on information available at this time.

These amounts could differ from actual reported amounts stated in

Adobe’s Quarterly Report on Form 10-Q for our quarter ended May 29,

2015, which Adobe expects to file in June 2015.

Adobe assumes no obligation to, and does not currently intend

to, update these forward-looking statements.

About Adobe Systems Incorporated

Adobe is changing the world through digital experiences. For

more information, visit www.adobe.com.

© 2015 Adobe Systems Incorporated. All rights reserved. Adobe,

the Adobe logo and Creative Cloud are either registered trademarks

or trademarks of Adobe Systems Incorporated in the United States

and/or other countries. All other trademarks are the property of

their respective owners.

Condensed Consolidated Statements of

Income

(In thousands, except per share data;

unaudited)

Three Months Ended Six Months Ended May 29,

2015 May 30, 2014 May 29, 2015

May 30, 2014 Revenue: Subscription $ 773,963 $ 476,694 $

1,487,405 $ 900,257 Products 274,538 479,247 565,312 950,701

Services and support 113,657 112,267 218,622

217,370 Total revenue 1,162,158 1,068,208

2,271,339 2,068,328 Cost of revenue:

Subscription 103,694 84,147 199,221 160,879 Products 21,467 24,499

41,170 51,997 Services and support 60,012 46,258

111,580 90,537 Total cost of revenue 185,173

154,904 351,971 303,413 Gross profit

976,985 913,304 1,919,368 1,764,915 Operating expenses:

Research and development 208,047 209,092 423,556 418,617 Sales and

marketing 426,998 426,830 819,739 836,971 General and

administrative 130,208 129,138 275,289 268,122 Restructuring and

other charges 34 (366 ) 1,789 297 Amortization of purchased

intangibles 18,081 13,352 32,353 26,904

Total operating expenses 783,368 778,046 1,552,726

1,550,911 Operating income 193,617 135,258

366,642 214,004 Non-operating income (expense): Interest and

other income (expense), net 3,739 2,563 7,077 5,708 Interest

expense (16,605 ) (17,103 ) (31,150 ) (33,693 ) Investment gains

(losses), net 223 553 1,653 144 Total

non-operating income (expense), net (12,643 ) (13,987 ) (22,420 )

(27,841 ) Income before income taxes 180,974 121,271 344,222

186,163 Provision for income taxes 33,481 32,744

111,841 50,590 Net income $ 147,493 $ 88,527

$ 232,381 $ 135,573 Basic net income per share

$ 0.30 $ 0.18 $ 0.47 $ 0.27 Shares used

to compute basic net income per share 499,290 497,931

499,022 497,439 Diluted net income per share $ 0.29

$ 0.17 $ 0.46 $ 0.27 Shares used to

compute diluted net income per share 505,582 506,687

507,061 508,227

Condensed Consolidated Balance

Sheets

(In thousands, except par value;

unaudited)

May 29,

2015

November 28, 2014 ASSETS Current assets: Cash and

cash equivalents $ 956,147 $ 1,117,400 Short-term investments

2,457,101 2,622,091 Trade receivables, net of allowances for

doubtful accounts of $7,226 and $7,867, respectively 502,617

591,800 Deferred income taxes 71,218 95,279 Prepaid expenses and

other current assets 191,314 175,758 Total current

assets 4,178,397 4,602,328 Property and equipment, net

785,199 785,123 Goodwill 5,388,971 4,721,962 Purchased and other

intangibles, net 583,198 469,662 Investment in lease receivable

80,439 80,439 Other assets 149,179 126,315 Total

assets $ 11,165,383 $ 10,785,829 LIABILITIES

AND STOCKHOLDERS' EQUITY Current liabilities: Trade payables

$ 56,539 $ 68,377 Accrued expenses 647,784 683,866 Debt and capital

lease obligations — 603,229 Accrued restructuring 1,695 17,120

Income taxes payable 55,473 23,920 Deferred revenue 1,175,542

1,097,923 Total current liabilities 1,937,033

2,494,435 Long-term liabilities: Debt 1,904,376 911,086

Deferred revenue 52,613 57,401 Accrued restructuring 4,347 5,194

Income taxes payable 244,799 125,746 Deferred income taxes 326,922

342,315 Other liabilities 85,190 73,747 Total

liabilities 4,555,280 4,009,924 Stockholders' equity:

Preferred stock, $0.0001 par value; 2,000 shares authorized — —

Common stock, $0.0001 par value 61 61 Additional paid-in-capital

3,994,652 3,778,495 Retained earnings 6,879,444 6,924,294

Accumulated other comprehensive income (loss) (129,473 ) (8,094 )

Treasury stock, at cost (102,558 and 103,350 shares, respectively),

net of reissuances (4,134,581 ) (3,918,851 ) Total stockholders'

equity 6,610,103 6,775,905 Total liabilities and

stockholders' equity $ 11,165,383 $ 10,785,829

Condensed Consolidated Statements of

Cash Flows

(In thousands; unaudited)

Three Months Ended May 29, 2015 May

30, 2014 Cash flows from operating activities: Net income $

147,493 $ 88,527 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation, amortization and

accretion 85,929 77,653 Stock-based compensation expense 84,649

83,005 Unrealized investment gains, net (276 ) (352 ) Changes in

deferred revenue 44,772 47,517 Changes in other operating assets

and liabilities 108,917 71,186 Net cash provided by

operating activities 471,484 367,536 Cash

flows from investing activities: Purchases, sales and maturities of

short-term investments, net 3,541 (117,967 ) Purchases of property

and equipment (35,730 ) (27,198 ) Purchases and sales of long-term

investments, intangibles and other assets, net (1,083 ) (2,767 )

Acquisitions, net of cash (5,637 ) — Net cash used for

investing activities (38,909 ) (147,932 ) Cash flows from

financing activities: Purchases of treasury stock (200,000 )

(150,000 ) Proceeds of reissuance of treasury stock, net 2,911

12,824 Repayment of capital lease obligations — (3,626 ) Debt

issuance costs (153 ) — Excess tax benefits from stock-based

compensation 11,140 4,875 Net cash used for financing

activities (186,102 ) (135,927 ) Effect of exchange rate changes on

cash and cash equivalents (3,210 ) (573 ) Net increase in cash and

cash equivalents 243,263 83,104 Cash and cash equivalents at

beginning of period 712,884 733,916 Cash and cash

equivalents at end of period $ 956,147 $ 817,020

Non-GAAP Results

(In thousands, except per share data)

The following tables show Adobe's GAAP

results reconciled to non-GAAP results included in this

release.

Three Months Ended May 29, 2015 May

30, 2014 February 27, 2015 Operating income:

GAAP operating income $ 193,617 $ 135,258 $ 173,025

Stock-based and deferred compensation expense 85,374 83,600 86,597

Restructuring and other charges 34 (366 ) 1,755 Amortization of

purchased intangibles 40,080 31,835 33,791

Non-GAAP operating income $ 319,105 $ 250,327 $

295,168 Net income: GAAP net income $ 147,493

$ 88,527 $ 84,888 Stock-based and deferred compensation expense

85,374 83,600 86,597 Restructuring and other charges 34 (366 )

1,755 Amortization of purchased intangibles 40,080 31,835 33,791

Investment (gains) losses (223 ) (553 ) (1,430 ) Income tax

adjustments (30,829 ) (16,771 ) 18,728 Non-GAAP net income $

241,929 $ 186,272 $ 224,329 Diluted net

income per share: GAAP diluted net income per share $ 0.29 $

0.17 $ 0.17 Stock-based and deferred compensation expense 0.17 0.16

0.17 Amortization of purchased intangibles 0.08 0.06 0.07 Income

tax adjustments (0.06 ) (0.02 ) 0.03 Non-GAAP diluted net

income per share $ 0.48 $ 0.37 $ 0.44

Shares used in computing diluted net income per share 505,582

506,687 507,526

Non-GAAP Results

Three Months

Ended

May 29, 2015 Effective income tax rate: GAAP

effective income tax rate 18.5 % Resolution of income tax

examinations 6.0 Amortization of purchased intangibles, stock-based

and deferred compensation expense (2.5 ) Income tax adjustments

(1.0 ) Non-GAAP effective income tax rate 21.0 %

Use of Non-GAAP Financial Information

Adobe continues to provide all information required in

accordance with GAAP, but believes evaluating its ongoing operating

results may not be as useful if an investor is limited to reviewing

only GAAP financial measures. Adobe uses non-GAAP financial

information to evaluate its ongoing operations and for internal

planning and forecasting purposes. Adobe's management does not

itself, nor does it suggest that investors should, consider such

non-GAAP financial measures in isolation from, or as a substitute

for, financial information prepared in accordance with GAAP. Adobe

presents such non-GAAP financial measures in reporting its

financial results to provide investors with an additional tool to

evaluate Adobe's operating results. Adobe believes these non-GAAP

financial measures are useful because they allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision-making. This allows

institutional investors, the analyst community and others to better

understand and evaluate our operating results and future prospects

in the same manner as management.

Adobe's management believes it is useful for itself and

investors to review, as applicable, both GAAP information that may

include items such as stock-based and deferred compensation

expenses, restructuring and other charges, amortization of

purchased intangibles and certain activity in connection with

technology license arrangements, investment gains and losses, loss

contingencies and the related tax impact of all of these items,

income tax adjustments, the income tax effect of the non-GAAP

pre-tax adjustments from the provision for income taxes, and the

non-GAAP measures that exclude such information in order to assess

the performance of Adobe's business and for planning and

forecasting in subsequent periods. Whenever Adobe uses such a

non-GAAP financial measure, it provides a reconciliation of the

non-GAAP financial measure to the most closely applicable GAAP

financial measure. Investors are encouraged to review the related

GAAP financial measures and the reconciliation of these non-GAAP

financial measures to their most directly comparable GAAP financial

measure as detailed above.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150616006620/en/

Investor Relations ContactAdobeMike Saviage,

408-536-4416ir@adobe.comorPublic

Relations ContactAdobeEdie Kissko,

408-536-3034kissko@adobe.com

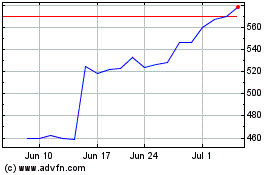

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Mar 2024 to Apr 2024

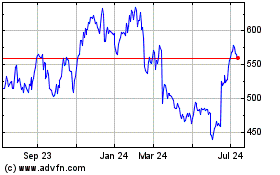

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Apr 2023 to Apr 2024