By Robb M.Stewart

MELBOURNE, Australia -- Activist investor Elliott Management

Corp. has mounted pressure on BHP Billiton Ltd. to defend not only

its corporate structure, but also whether it takes advantage of a

peculiarity of Australian investing: franking credits.

Elliott, an aggressive investor that manages almost $33 billion,

has been trying for months to convince BHP executives of the

shareholder value that could be unlocked by spinning off its U.S.

petroleum assets and collapsing a dual Australia-U.K. structure. It

has now taken the idea public to try to convince other investors,

though BHP is fighting back.

Investors in Australia welcomed the debate stirred by the

proposal, particularly if it encourages greater returns from BHP,

although some questioned the lift in value projected by Elliott and

how easy it would be to achieve.

Much of the value that Elliott expects comes through unifying

BHP as a single entity with its headquarters and tax residency in

Australia, then leveraging local tax benefits -- the franking

credits -- to buy back shares at a discount. In its letter, Elliott

argued the dual-listed structure had "far outlived its original

utility" and prevents the company from passing on the Australian

tax credits to all shareholders.

The dual-listing structure was used to ease the way for the 2001

tie-up of Australia's BHP Ltd. and London-listed Billiton PLC

without either acquiring the other in a legal sense.

BHP says the proposal makes no mention of hefty costs that would

outweigh the benefits of concentrating on a single structure.

The plan could also run up against the government. A spokeswoman

for the treasurer said any significant changes to BHP would need to

be consistent with Australia's national-interest test and would be

carefully considered.

In 2015, the Treasury recommended the merger of BHP and Billiton

but on the conditions that BHP Ltd. remain the ultimate holding

company and retain an Australian listing, the global headquarters

be in Australia, and the chief executive and chief financial

officer have their principal residence in Australia.

Australia and New Zealand are the last two countries with a

franking, or imputation, system after countries including the U.K.,

Germany, Singapore and Malaysia abandoned their systems over the

past 15 or so years.

Franking was introduced in 1987 to stop dividends from being

taxed twice. The credits allow companies to pass along as a benefit

taxes paid on Australian operations, reducing or eliminating the

tax investors pay on dividends.

By last year, BHP had amassed a balance of franking credits

worth $9.7 billion, or about 10% of its total market value.

Unifying BHP as an Australian tax resident would allow it to buy

its Australian shares at a discount and release far more franking

credits, according to Elliott.

Elliott argues for using the credits when buying back Australian

shares at a discount, making use of an Australian Taxation Office

allowance to buy back shares off market at an up to 14% discount.

The hedge fund estimated a new structure would enable BHP to return

about $33 billion to shareholders through off-market buybacks over

five years, through mid-2022, lifting earnings per share by about a

third.

Shareholders in Australia would welcome a faster release of

franking credits but acknowledge that BHP has reviewed its

structure and failed to find a solution. Some noted that nothing

prevents BHP from buying back its U.K. shares whenever they trade

at a discount to the Sydney shares, which would offer a similar

boost to earnings per share.

Some also argued that the nature of BHP's business raises

questions about big buybacks. Big mining companies haven't had the

balance-sheet strength to consider buying back shares until a

recent recovery in prices for iron ore, coal and other commodities

and after cutting costs and debt.

In a presentation to investors Wednesday, BHP said that unifying

its structure would cost $1.3 billion in taxes, plus $3 billion in

lost value. In addition, as a single entity, some $7.3 billion in

franking credits would have been paid since 2001 to investors not

holding the Australian shares who mainly couldn't use them. BHP has

taken advantage of the existing structure previously to maintain

equal dividends to both sides of the company, using its franking

credits to fund the U.K. PLC entity in 2015.

BHP insiders estimate that collapsing the dual structure could

cost billions of dollars in taxes alone. And BHP has taken

advantage of the structure previously to maintain equal dividends

to both sides of the company, using its franking credits to fund

the U.K. PLC entity in 2015.

Elliott's proposal calls for the new BHP to be incorporated in

England and Wales, to help with the stock's inclusion in major FTSE

indexes, with shares also listed on the Australian Securities

Exchange.

Investors in Australia said that could encourage selling by

Australians, particularly index investors that hold BHP because of

its weighting in the ASX.

Of the more than a dozen major dual-listed companies that have

been set up, Elliott noted, most collapsed the structure. In 2005,

Royal Dutch Shell PLC ended a nearly century-old dual structure,

and its Hague- and London-based parent companies began trading as a

single stock, albeit with two classes of shares. However, mining

company Rio Tinto PLC has operated a dual Australia-U.K. structure

since late 1995.

Citigroup said in a research report that it doesn't expect

collapsing the dual structure to unlock value. It expects that

returning capital to shareholders is a timing issue and would

happen anyway.

Write to Robb M.Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

April 12, 2017 12:42 ET (16:42 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

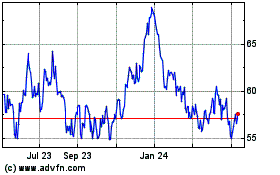

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

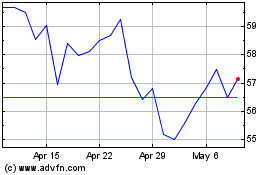

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024