TIDMAAIF

RNS Number : 3609I

Aberdeen Asian Income Fund Limited

25 March 2015

ABERDEEN ASIAN INCOME FUND LIMITED

ANNUAL FINANCIAL REPORT FOR THE YEAR ENDED 31 DECEMBER 2014

STRATEGIC REPORT - COMPANY SUMMARY AND FINANCIAL HIGHLIGHTS

The Company

Aberdeen Asian Income Fund Limited (the "Company") is a

Jersey-incorporated, closed-end investment company and its Ordinary

shares of No Par Value ("Ordinary Shares") are listed on the London

Stock Exchange. The Company is a member of the Association of

Investment Companies.

Investment Objective

The investment objective of the Company is to provide investors

with a total return primarily through investing in Asian Pacific

securities, including those with an above average yield. Within its

overall investment objective, the Company aims to grow its

dividends over time.

Portfolio Management

The investment management of the Company has been delegated by

Aberdeen Private Wealth Management Limited (the "Manager", the

"Alternative Investment Fund Manager" or "AIFM") to Aberdeen Asset

Management Asia Limited ("AAM Asia" or the "Investment Manager").

AAM Asia is based in Singapore and is a wholly-owned subsidiary,

and the Asia Pacific headquarters, of Aberdeen Asset Management PLC

(the "Aberdeen Group"), a publicly-quoted company on the London

Stock Exchange.

Website

Up-to-date information can be found on the Company's website

www.asian-income.co.uk.

Financial Highlights

2014 2013

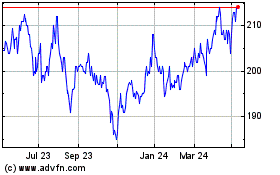

Ordinary share price total return{A} +6.7% -9.2%

Net asset value total return{A} +7.6% -2.6%

MSCI AC Asia Pacific ex Japan Index

(currency adjusted){A} +9.5% +1.7%

Earnings per Ordinary share - basic

(revenue) 8.24p 8.23p

Dividends per Ordinary share 8.00p 7.90p

Premium to net asset value per Ordinary

share 1.0% 1.8%

Ongoing charges 1.25% 1.24%

{A} 1 year return

STRATEGIC REPORT - OVERVIEW OF STRATEGY

Introduction

The Company aims to attract long term private and institutional

investors wanting to benefit from the growth prospects of Asian

companies including those with above average yields.

The business of the Company is that of an investment company and

the Directors do not envisage any change in this activity in the

foreseeable future. The Company's investment objective and key

results are shown under Financial Highlights below. A review of the

Company's activities is given in the Chairman's Statement and the

Investment Manager's Review. This includes a review of the business

of the Company and its principal activities, likely future

developments of the business and details of any changes in the

issued Ordinary Share capital.

Duration

The Company does not have a fixed life.

MSCI AC Asia Pacific (ex Japan) Index

The Company compares its performance against the

currency-adjusted MSCI AC Asia Pacific (ex Japan) Index. The

Company's portfolio is constructed without reference to any

stockmarket index. It is likely, therefore, that there will be

periods when the Company's performance will be quite unlike that of

any index and there can be no assurance that such divergence will

be wholly or even primarily to the Company's advantage.

Key Performance Indicators (KPIs)

At each Board meeting, the Directors consider a number of

performance measures to assess the Company's success in achieving

its objectives. Below are the main KPIs which have been identified

by the Board for determining the progress of the Company and a

record of these measures is also disclosed under Financial

Highlights below:

-- Net Asset Value Per Ordinary Share

-- Share Price Ordinary Share (mid market)

-- Discount/Premium to NAV per Ordinary Share

-- Dividend Payments per Ordinary Share

-- Ongoing Charges Ratio

Business Model - Investment Policy

The Company primarily invests in the Asia Pacific region through

investment in:

-- companies listed on stock exchanges in the Asia Pacific region;

-- Asia Pacific securities, such as global depositary receipts (GDRs), listed on other international stock

exchanges;

-- companies listed on other international exchanges that derive significant revenues or profits from the

Asia Pacific region; and

-- debt issued by governments or companies in the Asia Pacific region or denominated in Asian Pacific

currencies.

The Company's investment policy is flexible, enabling it to

invest in all types of securities, including equity shares,

preference shares, debt, convertible securities, warrants and other

equity-related securities.

The Company is free to invest in any particular market segments

or any particular countries in the Asia Pacific region.

The Company invests in small, mid and large capitalisation

companies. The Company's policy is not to acquire securities that

are unquoted or unlisted at the time of investment (with the

exception of securities which are about to be listed or traded on a

stock exchange). However, the Company may continue to hold

securities that cease to be quoted or listed if the Investment

Manager considers this to be appropriate.

Typically, the portfolio will comprise 30 to 50 holdings (but

without restricting the Company from holding a more or less

concentrated portfolio in the future). At 31 December 2014 there

were 58 holdings in the portfolio.

The Company will not invest more than 10%, in aggregate, of the

value of its Total Assets in other investment trusts or investment

companies admitted to the Official List, provided that this

restriction does not apply to investments in any such investment

trusts or investment companies which themselves have stated

investment policies to invest no more than 15% of their Total

Assets in other investment trusts or investment companies admitted

to the Official List. In any event, the Company will not invest

more than 15%

of its Total Assets in other investment trusts or investment

companies admitted to the Official List.

In addition, the Company will not:

-- invest, either directly or indirectly, or lend more than 20% of its Total Assets to any single underlying

issuer (including the underlying issuer's subsidiaries or affiliates), provided that this restriction does

not apply to cash deposits awaiting investment;

-- invest more than 20% of its Total Assets in other collective investment undertakings (open-ended or

closed- ended);

-- expose more than 20% of its Total Assets to the creditworthiness or solvency of any one counterparty

(including the counterparty's subsidiaries or affiliates);

-- invest in physical commodities;

-- enter into derivative transactions for speculative purposes;

-- take legal or management control of any of its investee companies; or

-- conduct any significant trading activity.

The Company may invest in derivatives, financial instruments,

money market instruments and currencies solely for the purpose of

efficient portfolio management (i.e. solely for the purpose of

reducing, transferring or eliminating investment risk in the

Company's investments, including any technique or instrument used

to provide protection against exchange and credit risks).

The Investment Manager expects the Company's assets will

normally be fully invested. However, during periods in which

changes in economic conditions or other factors so warrant, the

Company may reduce its exposure to securities and increase its

position in cash and money market instruments.

The Board is responsible for determining the gearing strategy

for the Company. The Board has restricted the maximum level of

gearing to 25% of net assets although, in normal market conditions,

the Company is unlikely to take out gearing in excess of 15% of net

assets. Gearing is used selectively to leverage the Company's

portfolio in order to enhance returns where and to the extent this

is considered appropriate to do so. Borrowings are generally short

term, but the Board may from time to time determine to incur longer

term borrowings where it is believed to be in the Company's best

interests to do so. Particular care is taken to ensure that any

bank covenants permit maximum flexibility of investment policy.

The percentage investment and gearing limits set out under this

sub-heading "Investment Policy" are only applied at the time of the

relevant investment is made or borrowing is incurred.

In the event of any breach of the Company's investment policy,

shareholders will be informed of the actions to be taken by the

Investment Manager by an announcement issued through a Regulatory

Information Service or a notice sent to shareholders at their

registered addresses in accordance with the Articles.

The Company may only make material changes to its investment

policy (including the level of gearing set by the Board) with the

approval of shareholders (in the form of an ordinary resolution).

In addition, any changes to the Company's investment objective or

policy will require the prior consent of the Jersey Financial

Services Commission ("JFSC") to the extent that they materially

affect the import of the information previously supplied in

connection with its approval under Jersey Funds Law or are contrary

to the terms of the Jersey Collective Investment Funds laws.

Principal Risks and Uncertainties

An investment in the Ordinary Shares is only suitable for

investors capable of evaluating the risks (including the potential

risk of capital loss) and merits of such investment and who have

sufficient resources to bear any loss which may result from such

investment. Furthermore, an investment in the Ordinary Shares

should constitute part of a diversified investment portfolio.

The risks described below are those risks that the Directors

considered at the date of this Annual Report to be material but are

not the only risks relating to the Company or its Ordinary Shares.

If any of the adverse events described below actually occur, the

Company's financial condition, performance and prospects and the

price of its Ordinary Shares could be materially adversely affected

and shareholders may lose all or part of their investment.

Additional risks which were not known to the Directors at the date

of this Annual Report, or that the Directors considered at the date

of this Annual Report to be immaterial, may also have an effect on

the Company's financial condition, performance and prospects and

the price of the Ordinary Shares.

-- Investment risk

The Company's investment strategy requires investment in Asia

Pacific equity and bond markets, which involves a greater degree of

risk than that associated with investment in more developed markets

which may lead to a loss of capital. Separately, inappropriate

asset allocation or level of gearing, as part of the investment

strategy adopted by the Company, may result in underperformance

against either the Company's comparative index and/or its peer

group, which may in turn lead to a widening of the discount at

which the Company's shares trade.

Stockmarket movements and changes in economic conditions

(including, for example, interest rates, foreign exchange rates and

rates of inflation), changes in industry conditions, competition,

political and diplomatic events, natural disasters, changes in laws

(including taxation and regulation), investors' perceptions and

other factors beyond the control of either the Company or the

Investment Manager can substantially (either adversely or

favourably) affect the value of the securities in which the Company

invests and, therefore, the Company's financial condition,

performance and prospects.

The Board seeks to manage these risks by diversifying its

investments, as set out in the investment restrictions and

guidelines agreed with the Manager, and on which the Company

receives regular monitoring reports from the Manager. At each Board

meeting, the Directors review the effectiveness of the investment

process with the Manager by assessing relevant management

information including revenue forecasts, absolute/relative

performance data, attribution analysis and liquidity/risk

reports.

Income and dividend risk

There is a risk that the Company fails to generate sufficient

income from its investment portfolio, particularly in periods of

weak equity and bond markets, to meet its operational expenses

which results in it drawing upon, rather than replenishing, its

revenue reserves. This might hamper the Board's capacity to

maintain dividends to shareholders. The Board monitors this risk

through the review of income forecasts, provided by the Manager, at

each Board meeting.

-- Discount volatility

Investment company shares can trade at discounts to their

underlying net asset values, although they can also trade at

premia. Discounts and premia can fluctuate considerably. In order

to seek to minimise the impact of such fluctuations, where the

shares are trading at a significant discount, the Company has

operated a share buy-back programme for a number of years. If the

shares trade at a premium, the Company has the authority to issue

new shares or re-issue shares from treasury. Whilst these measures

seek to minimise volatility, it cannot be guaranteed that they will

do so.

-- Foreign exchange risk

The Company accounts for its activities, reports it NAV and

declares dividends in sterling whilst its investments may be made

and realised in other currencies. The value of the Company's

investments and the income derived from them can, therefore, be

affected by movements in foreign exchange rates. In addition, the

earnings of the Company's investments may also be affected by

currency movements which, indirectly, could have an impact on the

Company's performance. The Company does not currently hedge its

foreign currency exposure.

-- Operational risk

In common with most other investment companies, the Company has

no employees. The Company therefore relies on services provided by

third parties, particularly the Manager, to whom responsibility for

the management of the Company has been delegated under a management

agreement (the "Agreement") (further details of which are set out

in the Directors' Report). The terms of the Agreement cover the

necessary duties and responsibilities expected of the Manager. The

Board reviews the overall performance of the Manager on a regular

basis and their compliance with the Agreement is reviewed formally

on an annual basis.

Contracts with other third party providers, including share

registrar and custodial services, are entered into after

appropriate due diligence. Thereafter, each contract, and the

performance of the provider, is subject to regular formal review.

The security of the Company's assets is the responsibility of the

custodian, BNP Paribas. The effectiveness of the internal controls

at the custodian is subject to review and regular reporting to the

Audit Committee.

-- Regulatory risk

The Company operates in a complex regulatory environment and

faces a number of related risks. A breach of applicable laws and

regulations, such as the UKLA Listing Rules, Jersey Company law or

Accounting Standards, could lead to suspension from the London

Stock Exchange and reputational damage. The Board receives frequent

compliance reports from the Manager to monitor compliance with

regulations.

An explanation of other risks relating to the Company's

investment activities, specifically market price, liquidity and

credit risk, and a note of how these risks are managed, are

contained in note 16 to the Financial Statements.

Alternative Investment Fund Managers Directive ("AIFMD")

In accordance with the Alternative Investment Funds (Jersey)

Regulations 2012, the Jersey Financial Services Commission ("JFSC")

has granted its permission for the Company to be marketed within

any EU Member State or other EU State to which the Directive

applies. The Company's registration certificate with the JFSC is

now conditioned such that the Company "must comply with the

applicable sections of the Codes of Practice for Alternative

Investment Funds and AIF Services Business".

Aberdeen Private Wealth Management Limited ("APWM"), as the

Company's non-EEA alternative investment fund manager, has notified

the UK Financial Conduct Authority in accordance with the

requirements of the UK National Private Placement Regime of its

intention to market the Company (as a non-EEA AIF under the

Directive) in the UK.

In addition, in accordance with Article 23 of the AIFMD and Rule

3.2.2 of the Financial Conduct Authority ("FCA") Fund Sourcebook,

APWM is required to make available certain disclosures for

potential investors in the Company. These disclosures, in the form

of a Pre-Investment Disclosure Document ("PIDD"), are available on

the Company's website: www.asian-income.co.uk.

Foreign Account Tax Compliance Act ("FATCA")

The States of Jersey signed an Intergovernmental Agreement

("IGA") with the United States on 13 December 2013 in a bid to

improve tax compliance and implement FATCA. Jersey also signed an

IGA with the UK on 22 October 2013. Companies that are classified

as Financial Institutions will have an obligation to report on any

UK or US Specified persons identified during their due diligence.

As a result of the IGAs, Jersey companies must report to the

Comptroller of Taxes at the Jersey Taxes Office, and not directly

to the IRS. Jersey companies have to report relevant information

for the previous calendar year to the Comptroller by 30 June. The

Comptroller has until September 2015 to forward information

relating to the 2014 calendar year to the competent authority in

the US. Under US FATCA, Companies may suffer a withholding tax at

an effective rate of 30% as a result of non-compliance.

Board Diversity

The Board recognises the importance of having a range of

skilled, experienced individuals with the right knowledge in order

to allow the Board to fulfill its obligations. At 31 December 2014,

in respect of gender diversity specifically there were five male

Directors and one female Director. The Company has no employees.

The Board's statement on diversity more generally is set out in the

Annual Report.

Environmental, Social and Human Rights Issues

The Company has no employees as it is managed by Aberdeen

Private Wealth Management Limited. There are therefore no

disclosures to be made in respect of employees. The Company's

socially responsible investment policy is outlined in the Statement

of Corporate Governance contained in the Annual Report.

Global Greenhouse Gas Emissions

The Company has no greenhouse gas emissions to report from the

operations of its business, nor does it have direct responsibility

for any other emissions producing sources.

Peter Arthur

Chairman

24 March 2015

STRATEGIC REPORT - CHAIRMAN'S STATEMENT

Background and Overview

Your Company's net asset value total return was 7.6% for the

year ended 31 December 2014, trailing the 9.5% gain in the MSCI All

Country Asia Pacific ex-Japan Index. On a total return basis the

share price rose by 6.7% to 199.9p. Despite this relatively

disappointing recent performance, the longer term track record

remains highly creditable, with the NAV total return being 76.6%

compared to 36.0% for the Index for the five years to 31 December

2014. The premium over net asset value contracted marginally from

1.8% to 1.0% at year end, whereas at the time of writing they are

trading at a discount of 3.1% Total dividends for the year amounted

to 8.0p (2013: 7.9p) representing a slight increase of 1.2% over

2013.

Last year was eventful for higher-yielding stocks, which

returned to favour after their poor performance in 2013. Continued

low interest rates, together with uncertainty surrounding an

increasingly divergent policy landscape among key central banks,

drove demand for dividend-paying stocks. While the US Federal

Reserve terminated its asset purchase programme, pressure mounted

on Europe, China and Japan to turn on their stimulus taps. At the

time of writing, the European Central Bank has now started to

implement the purchase of EUR60 billion in bonds every month until

September 2016. Japan, too, has expanded its monetary base in an

attempt to ward off the spectre of deflation.

Although falling shy of the double-digit returns of the US,

Asian equities outperformed most of their emerging and developed

market counterparts. Headlines were dominated by landmark political

developments, notably in India, Indonesia and Thailand. In India

and Indonesia, the prospect of sweeping policy change after the

elections led both indices to gain over 30% in sterling terms,

although your Company has little direct exposure to their equity

markets due to the generally low yields on offer. Conversely, the

exposure to Thailand added to performance: the stockmarket rallied

after the military seized power following months of political

unrest. Investors were cheered by the prospect of relative

stability and the resumption of stalled infrastructure

investments.

In the second half of the year, plummeting oil prices threw

markets into disarray. Amid lacklustre demand and OPEC's decision

to maintain production levels, crude prices ended the year at half

their summer levels. While oil exporters such as Malaysia have been

pressured by the prospect of lower government revenues, the rest of

Asia, which is a net importer, seems likely to benefit. Cheaper oil

has also given greater policy flexibility to lawmakers, some of

whom have taken the opportunity to dismantle expensive fuel

subsidies, freeing up resources for more productive uses, such as

investment in infrastructure and healthcare.

Your Company's small exposure to China hampered returns in the

fourth quarter. The market far outstripped its regional peers

towards the end of the year, despite recurring concerns over a

potential property bubble and disappointing growth figures. Stocks

were buoyed by the central bank's move to reduce interest rates and

inject liquidity into the banking system. Hong Kong posted

comparatively subdued returns, as pro-democracy protests towards

the year-end weighed on sentiment.

Dividends

Four quarterly dividends were declared over 2014. The first

three were paid at the rate of 1.8p totalling 5.4p which, when

added to the fourth dividend of 2.6p, represented an overall

increase of 1.2% for the year to stand at 8.0p. In the year to 31

December 2014, after deducting the payment of the fourth interim

dividend, approximately GBP0.45 million has been transferred to the

Company's revenue reserves which now amount to GBP7.25 million

(approximately 3.7p per share).

Looking ahead, your Investment Manager does not anticipate a

substantial increase in absolute dividends in the current year.

While the balance sheets of your Company's holdings remain

resilient, your Investment Manager expects market volatility to

persist well into 2015. Given the challenging operating

environment, earnings growth is likely to remain muted.

Ordinary Share Issuance and Gearing

During the year, there was further demand for your Company's

Ordinary shares and 800,000 new Ordinary Shares were issued at a

premium to the prevailing NAV. Such issues enhance the NAV (albeit

marginally) for existing shareholders.

Your Company entered into a new unsecured three year GBP30

million multi currency facility with Scotiabank (Ireland) Limited

which replaced a GBP15 million secured facility that matured in

April 2014. At the period end approximately GBP29.7 million was

drawn down under the facility (USD11.0 million, HKD252.8 million

and GBP1.7 million) representing a gearing level of 6.8% of net

assets which overall has been beneficial to the net asset value

performance over the period under review. Subsequent to the period

end the Company has agreed an extra facility with Scotiabank Europe

PLC in the form of a GBP10.0 million term loan facility. On 4 March

2015 GBP10 million was drawn down under the new facility for a

fixed three year period at an all-in interest rate of 2.2175%. At

the time of writing the equivalent of GBP39.4 million has been

drawn down in sterling, Hong Kong and US dollars under the

facilities, representing a gearing level of 9.7% of net assets.

Directorate

As part of the Board's succession planning, Dr Armstrong has

indicated her intention to retire at the forthcoming Annual General

Meeting and not to seek re-election to the Board. I would like to

take this opportunity to thank Ana for her considerable

contribution to the Company since its launch in 2005 and to wish

her well for the future.

The Directors, through the Nomination Committee, have initiated

a search for a new Director by preparing a specification of the

skills and experience required and a detailed search has been

undertaken using the services of an independent external

recruitment company. The process is well advanced and the Board

expects to be able to update shareholders in due course.

Outlook

Asian stock markets will be steered by some of the same issues

that drove sentiment last year. The evolving expectations

surrounding the timing of a US interest rate hike will continue to

foment volatility. At the time of writing, most signs point to an

environment of looser monetary policy in the near term, given

falling oil prices and still-anaemic levels of growth in most

developed markets apart from the US. Even with the relatively

upbeat backdrop, economic data from the US has been patchy, while

still-low inflation could ease pressure on the Fed to raise its

benchmark rate within the first half of the year. A looser policy

environment might prove positive for most asset classes, including

equities, but one feels that this only delays the crucial

realignment between company fundamentals and share price

performance. Meanwhile, risk appetite continues to be vulnerable to

further shocks in both the oil and currency markets.

We expect Asia to be the fastest growing region of the world in

2015 albeit muted by its own high historic standards. Notably,

while Chinese authorities will undoubtedly cushion the impact of a

slowdown with targeted easing measures, its growth forecasts this

year are still hovering at the decade-low level of 7%. The rest of

the region, previously buoyed by China's insatiable appetite for

their exports, will similarly have to adjust to lower levels of

expansion.

That said, the investment case for Asia remains attractive for

an investor with a long-term horizon. Young populations with rising

wealth, coupled with relatively stable political environments and

proactive central banks, will continue to underpin growth in the

decades ahead. On the corporate front, investment flows into

high-yielding stocks are likely to be dictated in the near term by

the vacillating expectations regarding US interest rates. But your

Company's holdings continue to warrant confidence. Selected for

their defensiveness and solid fundamentals, they are

well-positioned to produce healthy dividend growth in the

longer-term despite the challenging macroeconomic environment.

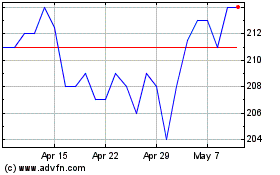

Annual General Meeting

Your Company's Annual General Meeting ("AGM") will be held at

10.30 a.m. on Thursday 7 May 2015 at the Company's registered

office, 1st Floor, Sir Walter Raleigh House, 48 - 50 Esplanade, St

Helier JE2 3QB. Your Board looks forward to meeting as many

shareholders as possible. If you are unable to attend the AGM, I

would encourage you to vote by returning your proxy (or letter of

directions if you invest via the Aberdeen Savings Plans) which is

enclosed with the Annual Report and financial statements. If you

intend to attend the AGM, I would also be grateful if you would

tick the relevant box when voting.

I look forward to reporting to you again with the Half Yearly

Report to 30 June 2015, which will be issued to shareholders around

the end of August 2015. Those shareholders who wish to keep up to

date with developments between formal reports may wish to view the

monthly factsheet and other useful information relating to the

Company at www.asian-income.co.uk.

Peter Arthur

Chairman

24 March 2015

STRATEGIC REPORT - INVESTMENT MANAGER'S REVIEW

Overview

Asian equities rose in 2014, a year marked by political change

and the start of monetary policy divergence. Asia outperformed most

peers in emerging markets and advanced counterparts in Europe but

lagged the double-digit gains in the US. Sentiment was influenced

by major central banks' policy decisions, including the Bank of

Japan's plan to expand its monetary base to stave off deflation and

the state pension fund's reallocation towards equities. In China,

the government continued to announce targeted easing measures and

the central bank cut interest rates to boost growth. Juxtaposed

against this was the US Federal Reserve's decision to end

quantitative easing. Expectations of a rate hike some time in 2015

strengthened the US dollar and pared market gains in Asia. This was

exacerbated by the plunge in global oil prices, which heightened

risk aversion. On a positive note, inflation eased because of

cheaper oil, allowing various authorities to cut fuel subsidies

that were a significant strain on budgets.

Performance Review

During the review period, the Company's net asset value rose by

7.6% and the share price rose by 6.7%, compared to the MSCI AC Asia

Pacific ex Japan Index's gain of 9.5% (on a total return basis).

Volatility was heightened in 2014, with a refocus on the search for

yield, as expectations of a US rate hike were pushed out, and

long-term interest rates continued to decline on weakening

inflation. Overall, your Company's underlying portfolio provided

steady dividends, backed by decent earnings growth and cash

generation. Furthermore, balance sheets remained robust.

The Company's outperformance, which lasted until the end of

September, was eroded in the fourth quarter, primarily by the small

exposure to China and the Company's holdings in Hong Kong. Its

portfolio does not hold Chinese banks, a large part of the

comparative index, and they rebounded on the back of looser

monetary policy to help boost economic growth. Among these policy

moves were a cut in interest rates, lower bank loan-to-deposit

ratios and a liquidity injection, all of which helped to mask

concerns over local banks' asset quality and potential losses.

However, unless there are substantial market reforms that inspire

greater confidence in the banks' ability to operate commercially,

it is unlikely that we would change our stance on introducing them

to the portfolio. Similarly, this goes for Chinese insurance firms,

even though they benefited from the stimulus measures.

Over the full year, your Company's banking sector holdings were

a considerable drag on performance. In particular, HSBC in Hong

Kong detracted. Weak economic sentiment in the bank's core markets

continued to weigh on earnings. Its profits were also hampered by

higher compliance costs and provisions for various fines. The bank

has a big global retail presence, with over US$1 trillion in

deposits. As it restructures, earnings could face more near-term

pressure, but looking ahead, it should benefit from the

normalisation of interest rates and an economic recovery in its

core markets. Meanwhile, Standard Chartered, also a holding,

continued to face headwinds. The lender warned that profits would

be hurt by unexpected commodities-related provisions, and there is

the possibility of fresh probes by US regulators into alleged

sanction violations. Some of its problems are cyclical and should

be resolved in the medium term. More structural ones will require

management to reprioritise investments, divest non-core businesses

and streamline riskier portfolios. We think Standard Chartered's

advantage lies in its peerless focus on emerging markets, replete

with banking licences and long-term customer relationships,

something that cannot be easily replicated, and it is still an

exciting franchise. In recent top management changes Bill Winters

will replace Peter Sands as CEO in June. Meanwhile, group executive

director Jaspal Bindra will step down this year and chairman John

Peace will follow suit in 2016. New independent directors will also

be appointed. These changes are no surprise and we believe they are

important steps in strengthening the bank and positioning it for an

emerging markets recovery.

Elsewhere in Hong Kong, Giordano suffered from a difficult

operating environment, particularly in China. However, the clothing

retailer is revamping its cost base and closing unprofitable shops.

Notably, it still has a very strong balance sheet. The dividend was

cut but the yield still remains attractive. Retail sales in the US

were also subdued, and this weighed on Li & Fung. However, we

are positive about the firm's renewed focus on global supply-chain

management, after it spun off its brands management business in the

form of Global Brands Group.

India and Indonesia were among the top performing markets as

they rode on a wave of elections euphoria. Pro-reform candidates in

both countries were elected into power and made some headway in

keeping their promises to cut corruption and bureaucracy, while

boosting infrastructure spending. However, the portfolio does not

have exposure to India, as companies there generally do not pay out

much of their earnings in dividends, preferring to reinvest cash.

The Indonesian holding in coal producer, Indo Tambangraya Mega, was

weighed down by falling coal prices owing to slower demand from

China. However, the firm is still cash generative and profitable

due to its low cost base.

The Malaysian stockmarket fell mainly owing to the sharp fall in

oil prices, as the country is a net oil exporter. The stock price

of our holding in brewer Guinness Anchor was affected by fears of a

weaker outlook for consumer spending and by speculation of a hike

in excise duties on alcohol to help the government compensate for

the growing budget deficit. We think that the firm's robust cash

generation and strong balance sheet will continue to support its

attractive dividend payments over the longer term. Management has

also embarked on cost cutting and improving productivity.

On a positive note, the portfolio's significant exposure to

Thailand benefited performance as investors reacted positively to

the military coup, which, outwardly at least, restored the

semblance of stability and allowed the resumption of government

spending on infrastructure. Our holdings of local utility,

Electricity Generating, and Hana Microelectronics posted solid

results and the share price of our investment in Advanced Info

Service rose on hopes that the new government would restart the

auction process for 3G spectrum licenses. The firm's results were

underpinned by robust non-voice revenues and stable margins. It

also maintained its 100% dividend payout policy.

Conversely, the lack of exposure to Korea aided performance as

growth slowed and export demand weakened. Consumer sentiment was

also subdued. The portfolio does not hold Korean stocks as dividend

yields tend to be low.

Singapore rose in line with the benchmark and Singapore Post was

a key contributor. The firm continues to invest in regional

e-commerce capabilities and Chinese industry giant Alibaba bought a

strategic stake. We welcome this development and think that

Singapore Post should be well-positioned to benefit from the

fast-growing e-commerce opportunities in the region.

We also invest in bonds when we know the underlying issuer well,

and see attractive yields. The exposure to fixed income benefited

performance, in particular the bond issued by Sri Lankan DFCC Bank.

The bond was priced with a good yield, and rallied in line with the

local stockmarket on improved growth sentiment.

Portfolio Activity

Over the year, we sold Singapore Press Holdings, Takeda

Pharmaceutical and Global Brands Group. Singapore Press Holdings'

core newspaper business has been in gradual decline. In addition,

the hidden value in the property business was largely realised

after it was spun off and cash was returned to shareholders in the

form of a special dividend. For Takeda Pharmaceutical, we were

concerned over its ongoing lawsuits involving its diabetes drug

Actos and threats to its current portfolio from generic drug

manufacturers. With Global Brands Group, we had received our shares

through the holding in Li & Fung, but found its dividend yield

not sufficiently attractive.

Against this, we introduced Indonesia-based coal miner Indo

Tambangraya Megah, mining giant Rio Tinto and emerging

markets-focused lender Standard Chartered. Indo Tambangraya Megah

has a robust balance sheet to support its dividend policy, and its

largest shareholder Thai-listed Banpu would welcome the dividend

income. With Rio Tinto, we remain confident that management will

improve capital management, while Standard Chartered was also

trading at attractive valuations at the time. Furthermore, we

subscribed to OCBC's rights issue, as the core holding has a solid

track record of being conservatively managed, plus the Wing Hang

acquisition in Hong Kong will enable the bank to extend its

business in North Asia effectively.

In fixed income, we subscribed to Green Dragon Gas' bond issue

in view of its attractive yield. We have followed the Chinese gas

producer for some time and hence understand the business and

underlying risks.

Outlook

We expect the overall business environment in Asia to remain

challenging as global growth remains sluggish. Earnings growth for

2015 will likely be in the single-digits, amid continued volatility

spurred by central bank action. At the time of writing a series of

interest rate cuts and stimulus measures by central banks,

including, Australia, Canada, China and Europe, are likely to

intensify the search for yield. This should favour companies that

continue to pay out attractive dividends. In terms of the

portfolio, valuations look reasonable versus regional benchmarks

and developed markets, with a price-to-earnings ratio of 14.4 times

for 2014, and a forecast of 14 times for 2015. Overall, the

Company's holdings are relatively defensive with robust cash

generation and solid balance sheets to support dividend

payments.

Aberdeen Asset Management Asia Limited

24 March 2015

STRATEGIC REPORT - RESULTS

Financial Highlights

31 December 31 December % change

2014 2013

Total assets GBP414,538,000 GBP384,136,000 +7.9

Total equity shareholders'

funds (net assets) GBP384,868,000 GBP371,117,000 +3.7

Market capitalisation GBP388,824,000 GBP377,780,000

Share price Ordinary share

(mid market) 199.88p 195.00p +2.5

Net asset value per Ordinary

share 197.84p 191.56p +3.3

Premium to net asset value

per Ordinary share 1.0% 1.8%

MSCI AC Asia Pacific ex Japan

Index (currency adjusted, capital

gains basis) 560.65 528.87 +6.0

Net gearing{A} 6.8% 2.6%

Dividend and earnings

Total return per Ordinary share{B} 14.17p (6.69p)

Revenue return per Ordinary

share{B} 8.24p 8.23p +0.1

Dividends per Ordinary share{C} 8.00p 7.90p +1.3

Dividend cover per Ordinary

share 1.03 1.04

Revenue reserves{D} GBP7.25m GBP6.81m

Ongoing charges{E}

Ongoing charges ratio 1.25% 1.24%

{A} Calculated in accordance with AIC guidance

"Gearing Disclosures post RDR"

{B} Measures the relevant earnings for the year

divided by the weighted average number of Ordinary

shares in issue (see Statement of Comprehensive

Income).

{C} The figure for dividends reflects the years

in which they were earned (see note 8 to the financial

statements).

{D} The revenue reserves figure takes account of

the fourth interim dividend amounting to GBP5,058,000

(2013 - fourth interim amounting to GBP4,843,000).

{E} Ongoing charges have been calculated in accordance

with guidance issued by the AIC as the total of

investment management fees (excluding performance

fees) and administrative expenses divided by the

average cum income net asset value throughout the

year.

Performance (total return)

Since

1 year 3 year 5 year launch{A}

% return % return % return % return

Share price (Ordinary) +6.7 +33.0 +78.6 +175.8

Net asset value (diluted) +7.6 +34.7 +76.6 +178.7

MSCI AC Asia Pacific ex

Japan Index (currency adjusted) +9.5 +30.6 +36.0 +127.5

All figures are for total return and assume re-investment

of net dividends.

{A} Launch being 20 December 2005.

Dividends per Ordinary Share

Rate xd date Record date Payment date

First interim 1.80p 30 April 2 May 2014 16 May 2014

2014 2014

Second interim 1.80p 16 July 18 July 2014 22 August

2014 2014 2014

Third interim 1.80p 23 October 24 October 17 November

2014 2014 2014 2014

Fourth interim 2.60p 22 January 23 January 18 February

2014 2015 2015 2015

______

2014 8.00p

______

First interim 1.80p 24 April 26 April 17 May 2013

2013 2013 2013

Second interim 1.80p 17 July 19 July 2013 23 August

2013 2013 2013

Third interim 1.80p 23 October 25 October 15 November

2013 2013 2013 2013

Fourth interim 2.50p 15 January 17 January 18 February

2013 2014 2014 2014

______

2013 7.90p

______

DIRECTORS' REPORT

Introduction

The Directors present their Report and the audited financial

statements for the year ended 31 December 2014.

The current Directors, Messrs Peter Arthur, Duncan Baxter,

Andrey Berzins, Charles Clarke, Hugh Young and Dr Ana Armstrong

held office throughout the year and were the only Directors in

office during the year.

The Company and its Investment Policy

The business of the Company is that of an investment company

investing in the Asia Pacific region. The investment policy and

objective of the Company is set out in the Strategic Report. The

primary aim of the Company is to provide investors with a total

return primarily through investing in Asian Pacific securities,

including those with an above average yield. Within its overall

investment objective, the Company aims to grow its dividends over

time.

A review of the Company's activities is given in the Strategic

Report. This includes the overall strategy of the Company and its

principal activities, main risks faced by the Company, likely

future developments of the business and the details of any issues

of Ordinary Shares for cash by the Company.

Status

The Company is registered with limited liability in Jersey as a

closed-end investment company under the Companies (Jersey) Law 1991

with registered number 91671. In addition, the Company constitutes

and is regulated as a collective investment fund under the

Collective Investment Funds (Jersey) Law 1988 and is an Alternative

Investment Fund (within the meaning of Regulation 3 of the

Alternative Investment Fund Regulations). The Company has no

employees and the Company makes no political donations. The

Ordinary Shares are admitted to the Official List in the premium

segment and are traded on the London Stock Exchange's Main

Market.

The Company is a member of the Association of Investment

Companies ("AIC").

The Company intends to manage its affairs so as to be a

qualifying investment for inclusion in the stocks and shares

component of an Individual Savings Account ('ISA') and it is the

Directors' intention that the Company should continue to be

equivalent to a qualifying trust.

Results and Dividends

Details of the Company's results and dividends are shown under

Financial Highlights above and in note 8 to the Financial

Statements. Interim dividends were paid on a quarterly basis in

May, August, November 2014 and February 2015. The Board believes

that it is preferable for shareholders to receive regular interim

dividend payments on a quarterly basis and accordingly no final

dividend is declared and shareholders are not required to wait

until approval is given at the AGM for any payments. Dividends are

paid to the extent that they are covered by the Company's revenue

reserves. As at 31 December 2014 the Company's revenue reserves

(adjusted for the payment of the fourth interim dividend) amounted

to GBP7.25 million (approximately 3.7p per Ordinary Share).

Management Arrangements

The Company has an agreement with Aberdeen Private Wealth

Management Limited, subject to six months' notice, for the

provision of management services, details of which are shown in

note 5 to the financial statements. The Directors review the terms

of the Management Agreement on a regular basis and have confirmed

that, due to the investment skills, experience and commitment of

the Investment Manager, in their opinion the continuing appointment

of Aberdeen Private Wealth Management Limited, on the terms agreed,

is in the interests of shareholders as a whole.

Ordinary Share Capital

As at 31 December 2014 there were 194,533,389 Ordinary Shares in

issue. During the year the Company issued a total of 800,000 new

Ordinary Shares for cash at a premium to the prevailing NAV at the

time of issue.

Directors

The Directors' beneficial holdings are disclosed in the

Directors' Remuneration Report. No Director has a service contract

with the Company. The Directors' interests in contractual

arrangements with the Company are as shown in note 18 to the

financial statements. No other Directors were interested in

contracts with the Company. Details of the Directors retiring by

rotation at the Annual General Meeting are disclosed in the

Statement of Corporate Governance.

Directors' Authority to Allot Relevant Securities

There are no provisions under Jersey law which confer rights of

pre-emption upon the issue or sale of any class of shares in the

Company. However, the Company has a premium listing on the London

Stock Exchange and is required to offer pre-emption rights to its

shareholders. Accordingly, the Articles of Association contain

pre-emption provisions similar to those found under UK law in

satisfaction of the Listing Rules requirements. Ordinary Shares

will only be issued at a premium to the prevailing net asset value

per Ordinary Share and, therefore, will not be disadvantageous to

existing shareholders. Any future issues of Ordinary Shares will be

carried out in accordance with the Listing Rules.

Unless previously disapplied by special resolution, in

accordance with the Listing Rules, the Company is required to first

offer any new Ordinary Shares or securities (or rights to subscribe

for, or to convert or exchange into, Ordinary Shares) proposed to

be issued for cash to shareholders in proportion to their holdings

in the Company. In order to continue with such Ordinary Share

issues, as in previous years, your Board is also proposing that its

annual disapplication of the pre-emption rights is renewed so that

the Company may continue to issue Ordinary Shares as and when

appropriate. Accordingly, Resolution 10, a Special Resolution,

proposes a disapplication of the pre-emption rights in respect of

10% of the Ordinary Shares in issue, set to expire on the earlier

of eighteen months from the date of the resolution or at the

conclusion of the Annual General Meeting to be held in 2016.

Purchase of the Company's Securities

The Directors aim to operate an active discount management

policy through the use of Ordinary Share buy backs, should the

Company's shares trade at a significant discount. The objective

being to maintain the price at which the Ordinary Shares trade

relative to their underlying net asset value at a discount of no

more than 5%. Purchases of Ordinary Shares will only be made

through the market for cash at prices below the prevailing net

asset value per Ordinary Share (which, subject to shareholder

approval at the AGM will be the latest estimated net asset value

per Ordinary Share) where the Directors believe such purchases will

enhance shareholder value and are likely to assist in narrowing any

discount to net asset value at which the Ordinary Shares may

trade.

Resolution 9, a Special Resolution, will be proposed to renew

the Directors' authority to make market purchases of the Company's

Ordinary Shares in accordance with the provisions of the Listing

Rules of the Financial Conduct Authority. Accordingly, the Company

will seek authority to purchase up to a maximum of 29,160,555

Ordinary Shares (representing 14.99% of the current issued Ordinary

Share capital). The authority being sought will expire at the

conclusion of the Annual General Meeting in 2016 unless such

authority is renewed prior to such time. Any Ordinary Shares

purchased in this way will be cancelled and the number of Ordinary

Shares will be reduced accordingly, or the Ordinary Shares will be

held in treasury. During the year and subsequent to the period end

no Ordinary Shares have been purchased in the market for

cancellation or treasury.

Under Jersey company law, Jersey companies can either cancel

shares or hold them in treasury following a buy-back of shares.

Repurchased shares will only be held in treasury if the Board

considers that it will be in the interest of the Company and for

the benefit of all shareholders. Any future sales of Ordinary

Shares from treasury will only be undertaken at a premium to the

prevailing net asset value per Ordinary Shares.

Amendment to Articles Re: Offshore Board Meetings

Following a recent relaxation in approach by the UK government

to the holding of board meetings in the UK by non-UK incorporated

alternative investment funds for the purpose of determining tax

residency, your Board is seeking to remove current restrictions on

the location of its Board meetings contained in the Company's

articles of association. Previously, holding a Board meeting in the

UK gave rise to the risk that the Company would be regarded as tax

resident in the UK. However, changes introduced in the UK during

2014 mean that this is no longer the case. Whilst the Directors

have no current plans to change their practice of holding their

Board meetings offshore, the Board believes it is in shareholders'

best interests for the Board to have maximum flexibility regarding

the location of its Board meetings. As a consequence, the Directors

are proposing that all restrictions on the location of Board

meetings, and the non-validity of Board resolutions passed at

meetings held in the UK or Ireland, are removed from the articles

of association. Accordingly, Resolution 11, a Special Resolution to

adopt new articles of association containing such amendments, is

being proposed at the AGM. No other changes are being proposed to

the articles of association at this time and therefore the new

articles of association proposed to be adopted are the same as the

existing articles of association in all other respects.

A copy of the new articles of association, together with a

blacklined version showing the proposed changes, will be available

for inspection at the offices of Aberdeen Asset Management PLC, Bow

Bells House, 1 Bread Street, London EC 4M 9HH from the date of the

Annual Report until the close of the AGM.

Recommendation

Your Board considers Resolutions 9 to 11 to be in the best

interests of the Company and its members as a whole. Accordingly,

your Board recommends that shareholders should vote in favour of

Resolutions 9 to 11 to be proposed at the Annual General Meeting,

as they intend to do in respect of their own beneficial

shareholdings which amount to 217,837 Ordinary Shares.

Directors' & Officers' Liability Insurance

The Company maintains insurance in respect of Directors' &

Officers' liabilities in relation to their acts on behalf of the

Company. Furthermore, each Director of the Company shall be

entitled to be indemnified out of the assets of the Company to the

extent permitted by law against all costs, charges, losses,

expenses and liabilities incurred by him or her in the actual or

purported execution and/or discharge of his or her duties and/or

the exercise or purported exercise of his or her powers and/or

otherwise in relation to or in connection with his or her duties,

powers or office. These rights are included in the Articles of

Association of the Company and the Company has granted indemnities

to the Directors on this basis.

Additional Information

There are no restrictions on the transfer of Ordinary Shares in

the Company other than certain restrictions which may from time to

time be imposed by law (for example, insider trading and market

abuse restrictions).

The Company is not aware of any agreements between shareholders

that may result in restriction on the transfer of securities and/or

voting rights.

The rules governing the appointment of Directors are set out in

the Statement of Corporate Governance. The Company's Articles of

Association may only be amended by a special resolution at a

general meeting of shareholders.

The Company is not aware of any significant agreements to which

it is a party that take effect, alter or terminate upon a change of

control of the Company following a takeover.

Other than the management and administration contracts with the

Investment Manager, set out earlier in the report, the Company is

not aware of any contractual or other agreements which are

essential to its business which ought to be disclosed in the

Directors' Report.

Corporate Governance

The Statement of Corporate Governance forms part of this

Directors' Report and covers the Company's compliance with the UK

Corporate Governance Code.

Going Concern

The Directors have undertaken a rigorous review of the Company's

ability to continue as a going concern. The Company's assets

consist primarily of a diverse portfolio of listed equity shares

which in most circumstances are realisable within a very short

timescale.

The Directors are mindful of the principal risks and

uncertainties disclosed in the strategic Report and have reviewed

forecasts detailing revenue and liabilities and the Directors

believe that the Company has adequate financial resources to

continue its operational existence for the foreseeable future and

at least 12 months from the date of this Annual Report.

Accordingly, the Directors continue to adopt the going concern

basis in preparing these financial statements.

Accountability and Audit

The respective responsibilities of the Directors and the Auditor

in connection with the financial statements are set out in the

Annual Report.

Each Director confirms that, so far as he or she is aware, there

is no relevant audit information of which the Company's Auditor is

unaware, and he or she has taken all reasonable steps that they

ought to have taken as a Director in order to make themselves aware

of any relevant audit information and to establish that the

Company's Auditor is aware of that information. Additionally there

are no important events since the year end other than as disclosed

in the notes to the financial statements.

Independent Auditor

Our Auditor, Ernst & Young LLP, has indicated its

willingness to remain in office. The Directors will place a

Resolution before the Annual General Meeting to re-appoint them as

independent Auditor for the ensuing year, and to authorise the

Directors to determine their remuneration.

Peter Arthur

Chairman

24 March 2015

1(st) Floor, Sir Walter Raleigh House

48 - 50 Esplanade, Jersey JE2 3QB

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulations.

Jersey Company law requires the Directors to prepare financial

statements for each financial period in accordance with any

generally accepted accounting principles. The financial statements

of the Company are required by law to give a true and fair view of

the state of affairs of the Company and of the profit or loss of

the Company for that period. In preparing these financial

statements, the Directors should:

- select suitable accounting policies and then apply them consistently;

- make judgments and estimates that are reasonable and prudent;

- specify which generally accepted accounting principles have

been adopted in their preparation;

- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Company will

continue in business. and,

- assess whether the Annual Report and financial statements,

taken as a whole, is 'fair, balanced and understandable'.

The Directors are responsible for keeping accounting records

which are sufficient to show and explain its transactions and are

such as to disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements prepared by the Company comply with the

requirements of the Companies (Jersey) Law 1991. They are also

responsible for safeguarding the assets of the Company and hence

for taking reasonable steps for the prevention and detection of

fraud and other irregularities.

The Directors listed in the Annual Report, being the persons

responsible, hereby confirm to the best of their knowledge:

- that the financial statements have been prepared in accordance

with International Financial Reporting Standards ("IFRS"), as

adopted by the International Accounting Standards Board

("IASB"),and give a true and fair view of the assets, liabilities,

financial position and profit or loss of the Company;

- that in the opinion of the Directors, the Annual Report and

financial statements taken as a whole, is fair, balanced and

understandable and it provides the information necessary to assess

the Company's performance, business model and strategy; and

- the Strategic Report, including the Chairman's Statement and

the Investment Manager's Review, include a fair review of the

development and performance of the business and the position of the

Company together with a description of the principal risks and

uncertainties that the Company faces.

For and on behalf of the Board

Peter Arthur

Chairman

24 March 2015

1(st) Floor, Sir Walter Raleigh House

48 - 50 Esplanade

Jersey JE2 3QB

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

company's website. Legislation in Jersey governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions

STATEMENT OF COMPREHENSIVE INCOME

Year ended Year ended

31 December 2014 31 December 2013

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment income 4

Dividend income 17,254 - 17,254 17,544 - 17,544

Interest income 2,079 - 2,079 1,192 - 1,192

_______ _______ _______ _______ _______ ______

Total revenue 19,333 - 19,333 18,736 - 18,736

Gains/(losses) on

investments designated

at fair value through

profit or loss 10 - 15,582 15,582 - (23,927) (23,927)

Net currency (losses)/gains - (1,631) (1,631) - 98 98

_______ _______ _______ _______ _______ ______

19,333 13,951 33,284 18,736 (23,829) (5,093)

_______ _______ _______ _______ _______ ______

Expenses

Investment management

fee 5 (1,506) (2,259) (3,765) (1,578) (2,368) (3,946)

Other operating expenses 6 (994) - (994) (995) - (995)

_______ _______ _______ _______ _______ ______

Profit/(loss) before

finance costs and

tax 16,833 11,692 28,525 16,163 (26,197) (10,034)

_______ _______ _______ _______ _______ ______

Finance costs 7 (112) (169) (281) (88) (133) (221)

_______ _______ _______ _______ _______ ______

Profit/(loss) before

tax 16,721 11,523 28,244 16,075 (26,330) (10,255)

Tax expense 2(d) (737) (17) (754) (805) (2) (807)

_______ _______ _______ _______ _______ ______

Profit/(loss) for

the year 15,984 11,506 27,490 15,270 (26,332) (11,062)

_______ _______ _______ _______ _______ ______

Profit/(loss) for

the year analysed

as follows:

Attributable to equity

shareholders 15,984 11,506 27,490 15,270 (27,696) (12,426)

Attributable to C

shares - - - - 1,364 1,364

_______ _______ _______ _______ _______ ______

Total 15,984 11,506 27,490 15,270 (26,332) (11,062)

_______ _______ _______ _______ _______ ______

Earnings per Ordinary

share (pence): 9

Basic 8.24 5.93 14.17 8.23 (14.92) (6.69)

_______ _______ _______ _______ _______ ______

Earnings per C share

(pence): 9

Basic and diluted n/a n/a n/a n/a 2.27 2.27

_______ _______ _______ _______ _______ ______

The Company does not have any income or expense that

is not included in profit/(loss) for the year, and therefore

the "Profit/(loss) for the year" is also the "Total

comprehensive income for the year", as defined in IAS

1 (revised).

All of the profit/(loss) and total comprehensive income

is attributable to the equity holders of Aberdeen Asian

Income Fund Limited. There are no non-controlling interests.

The total column of this statement represents the Statement

of Comprehensive Income of the Company, prepared in

accordance with IFRS. The revenue and capital columns

are supplementary to this and are prepared under guidance

published by the Association of Investment Companies.

All items in the above statement derive from continuing

operations.

The accompanying notes are an integral part of the financial

statements.

BALANCE SHEET

As at As at

31 December 31 December

2014 2013

Notes GBP'000 GBP'000

Non-current assets

Investments designated at

fair value through profit

or loss 10 410,259 380,554

Current assets

Cash and cash equivalents 3,671 3,463

Other receivables 11 1,196 983

_________ _________

4,867 4,446

_________ _________

Current liabilities

Bank loans 12 (29,670) (13,019)

Other payables 12 (588) (864)

_________ _________

(30,258) (13,883)

_________ _________

Net current liabilities (25,391) (9,437)

_________ _________

Net assets 384,868 371,117

_________ _________

Stated capital and reserves

Stated capital 13 194,533 193,733

Capital redemption reserve 1,560 1,560

Capital reserve 14 176,463 164,176

Revenue reserve 14 12,312 11,648

_________ _________

Equity shareholders' funds 384,868 371,117

_________ _________

Net asset value per Ordinary

share (pence): 15 197.84 191.56

_________ _________

STATEMENT OF CHANGES IN EQUITY

For the year ended

31 December 2014

Capital

Stated redemption Capital Revenue Retained

capital reserve reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Opening balance 193,733 1,560 164,176 11,648 - 371,117

Issue of Ordinary

shares 800 - 781 - - 1,581

Profit for the

year - - - - 27,490 27,490

Transferred from

retained earnings

to capital reserve{A} - - 11,506 - (11,506) -

Transferred from

retained earnings

to revenue reserve - - - 15,984 (15,984) -

Dividends paid - - - (15,320) - (15,320)

______ ______ ______ _______ ______ ______

Balance at 31 December

2014 194,533 1,560 176,463 12,312 - 384,868

______ ______ ______ _______ ______ ______

For the year ended

31 December 2013

Capital

Stated Warrant redemption Capital Revenue Retained

capital reserve reserve reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Opening balance 151,182 357 1,560 147,830 10,358 - 311,287

Issue of Ordinary

shares via conversion

of C shares 30,552 - - 32,453 - - 63,005

Issue of Ordinary

shares 8,425 - - 10,517 - - 18,942

Exercise of warrants 3,574 (357) - 1,072 - - 4,289

Loss for the year - - - - - (12,426) (12,426)

Transferred from

retained earnings

to capital reserve{A} - - - (27,696) - 27,696 -

Transferred from

retained earnings

to revenue reserve - - - - 15,270 (15,270) -

Dividends paid - - - - (13,980) - (13,980)

______ ______ ______ _______ ______ ______ ______

Balance at 31 December

2013 193,733 - 1,560 164,176 11,648 - 371,117

______ ______ ______ _______ ______ ______ ______

{A} Represents the capital profit attributable to equity

shareholders per the Statement of Comprehensive Income.

The revenue reserve represents the amount of the Company's

reserves distributable by way of dividend.

The accompanying notes are an integral part of the financial

statements.

The stated capital in accordance with Companies (Jersey)

Law 1991 Article 39A is GBP259,877,000 (2013 - GBP258,296,000).

CASH FLOW STATEMENT

Year ended Year ended

31 December 31 December

2014 2013

Notes GBP'000 GBP'000 GBP'000 GBP'000

Profit/(loss) for the year 27,490 (11,062)

Add back finance costs 7 281 221

Add back taxation suffered 754 807

Non cash stock dividends (1,643) -

(Gains)/losses on investments

held at fair value through

profit or loss 10 (15,582) 23,927

Net currency losses/(gains) 14 1,631 (98)

Increase in other receivables (228) (84)

(Decrease)/increase in other

payables (263) 303

_______ _______

Net cash inflow from operating

activities before finance

costs and tax 12,440 14,014

Bank and loan interest paid (294) (220)

Overseas taxation suffered (739) (822)

_______ _______

Net cash inflow from operating

activities 11,407 12,972

Investing activities

Purchases of investments (56,266) (41,544)

Sales of investments 43,786 18,404

_______ _______

Net cash outflow from investing

activities (12,480) (23,140)

_______ _______

Financing activities

Proceeds from issue of Ordinary

shares 13 1,581 18,942

Proceeds from exercise of

warrants 13 - 4,289

Dividends paid 8 (15,320) (13,980)

Loans drawn down 14,927 -

_______ _______

Net cash inflow from financing

activities 1,188 9,251

_______ _______

Net increase/(decrease) in

cash and cash equivalents 115 (917)

Cash and cash equivalents

of the start of the year 3,463 4,532

Effect of foreign exchange

rate changes 93 (152)

_______ _______

Cash and cash equivalents

at the end of the year 2,16 3,671 3,463

_______ _______

NOTES TO THE FINANCIAL STATEMENTS

For the year ended 31 December 2014

1. Principal activity

The Company is a closed-end investment company incorporated

in Jersey, with its Ordinary shares being listed

on the London Stock Exchange.

2. Accounting policies

(a) Basis of preparation

The financial statements have been prepared in

accordance with International Financial Reporting

Standards ("IFRS"), as adopted by the International

Accounting Standards Board ("IASB"), and interpretations

issued by the International Reporting Interpretations

Committee of the IASB ("IFRIC"). All of the IFRS

which took effect during the year were adopted

by the Company and did not have a material impact

on the financial results.

The Company's assets consist substantially of

equity shares in companies listed on recognised

stock exchanges and in most circumstances are

realisable within a short timescale. The Board

has set limits for borrowing and regularly reviews

actual exposures, cash flow projections and compliance

with banking covenants. The Directors believe

that the Company has adequate resources to continue

in operational existence for the foreseeable

future and, for the above reasons, they continue

to adopt the going concern basis in preparing

the financial statements.

The preparation of financial statements in conformity

with IFRS requires the use of certain critical

accounting estimates which requires management

to exercise its judgement in the process of applying

the accounting policies. These judgements and

estimates include but are not limited to the

assessment of the Company's ability to continue

as a going concern, the measurement of fair value

of financial instruments and the corresponding

classification in the fair value hierarchy as

well as the impairment of assets and the recognition

and measurement of provisions and contingent

liabilities under IAS 37. Actual results may

differ from these estimates.

The financial statements are prepared on a historical

cost basis, except for investments that have

been measured at fair value through profit or

loss and financial liabilities that have been

measured at amortised cost.

The accounting policies which follow set out

those policies which apply in preparing the financial

statements for the year ended 31 December 2014.

The financial statements are presented in sterling

and all values are rounded to the nearest thousand

(GBP'000) except when otherwise indicated.

Where guidance set out in the Statement of Recommended

Practice ("SORP") for investment trusts issued

by the Association of Investment Companies ("AIC")

is consistent with the requirement of IFRS, the

Directors have sought to prepare the financial

statements on a basis compliant with the recommendations

of the SORP.

Changes in accounting policy and disclosures

At the date of authorisation of these financial

statements, the following Standards and Interpretations

were in issue but not yet effective:

- IFRS 9 - Financial Instruments (revised, early

adoption permitted) (effective for annual periods

beginning on or after 1 January 2018).

The following amendments to Standards are all

effective for annual periods beginning on or

after 1 January 2016.

- IFRS 10 and IAS 28 - Sale or Contribution of

Assets between an Investor and its Associate

or Joint Venture

- IFRS 15 - Revenue from Contracts with Customers

- IAS 1 - Disclosure Initiative

- IAS 16 and IAS 38 - Clarification of Acceptable

Methods of Depreciation and Amortisation

- IAS 27 - Investment Entities: Applying the

Consolidation Exception

In addition, under the Annual Improvements to

IFRSs 2010 -2012 and 2011 - 2013 Cycles, a number

of Standards are included for annual periods

beginning on or after 1 July 2014.

Under the Annual Improvements to IFRSs 2012 -

2014 Cycle, a number of Standards are included

for annual periods beginning on or after 1 January

2016.

The Directors do not anticipate that the adoption

of these Standards and Interpretations in future

periods will materially impact the Company's

financial results in the period of initial application

although there will be revised presentations

to the Financial Statements and additional disclosures.

The Company intends to adopt the Standards in

the reporting period when they become effective.

(b) Income

Dividends receivable on equity shares are brought

into account on the ex-dividend date. Dividends

receivable on equity shares where no ex-dividend

date is quoted are brought into account when

the Company's right to receive payment is established.

Where the Company has elected to receive dividends

in the form of additional shares rather than

in cash, the amount of the cash dividend foregone

is recognised as income. Special dividends are

credited to capital or revenue according to their

circumstances. Dividend revenue is presented

gross of any non-recoverable withholding taxes,

which are disclosed separately in the Statement

of Comprehensive Income.

The fixed returns on debt securities and non-equity

shares are recognised using the effective interest

rate method.

Interest receivable from cash and short-term

deposits is recognised on an accruals basis.

(c) Expenses

All expenses, with the exception of interest

expenses, which are recognised using the effective

interest method, are accounted for on an accruals

basis. Expenses are charged through the revenue

column of the Statement of Comprehensive Income

except as follows:

- expenses which are incidental to the acquisition

or disposal of an investment are treated as

capital and separately identified and disclosed

in note 10;

- expenses (including share issue costs) are

treated as capital where a connection with

the maintenance or enhancement of the value

of the investments can be demonstrated; and

- the Company charges 60% of investment management

fees and finance costs to capital, in accordance

with the Board's expected long term return

in the form of capital gains and income respectively

from the investment portfolio of the Company.

(d) Taxation

Profits arising in the Company for the year ended

31 December 2014 will be subject to Jersey income

tax at the rate of 0% (2013 - 0%).

However, in some jurisdictions, investment income

and capital gains are subject to withholding

tax deducted at the source of the income. The

Company presents the withholding tax separately

from the gross investment income in the Statement

of Comprehensive Income. For the purpose of the