TIDMARGO

RNS Number : 2548J

ARGO Group Limited

08 September 2016

Argo Group Limited

("Argo" or the "Company")

Interim Results for the six months ended 30 June 2016

Argo today announces its interim results for the six months

ended 30 June 2016.

The Company will today make available its interim report for the

six month period ended 30 June 2016 on the Company's website

www.argogrouplimited.com.

Key highlights for the six month period ended 30 June 2016

This report sets out the results of Argo Group Limited (the

"Company") and its subsidiaries (collectively "the Group" or

"Argo") covering the six month period ended 30 June 2016.

- Revenues US$4.0 million (six months to 30 June 2015: US$3.1 million)

- Operating profit US$3.8 million (six months to 30 June 2015: profit US$0.2 million)

- Profit before tax US$4.9 million (six months to 30 June 2015: loss US$4.2 million)

- Net assets US$24.2 million (31 December 2015: US$22.4 million)

Commenting on the results and outlook, Kyriakos Rialas, Chief

Executive of Argo said:

"The performance of the first six months of 2016 is mainly

attributable to the monetisation of certain distressed positions,

with a sizeable contribution to profit also coming from the

resurgence in Emerging Market Debt. Moving forward we are now ready

to expand our marketing efforts with the key focus of relaunching

the flagship Argo Fund and boosting our AUM."

Enquiries

Argo Group Limited

Andreas Rialas

020 7016 7660

Panmure Gordon

Dominic Morley

020 7886 2500

CHAIRMAN'S STATEMENT

The Group and its investment objective

Argo's investment objective is to provide investors with

absolute returns in the funds that it manages by investing in,

inter alia, fixed income, special situations, local currencies and

interest rate strategies, private equity, real estate, quoted

equities, high yield corporate debt and distressed debt, although

not every fund invests in each of these asset classes.

Argo was listed on the AIM market in November 2008 and has a

performance track record dating back to 2000.

Business and operational review

For the six month period ended 30 June 2016 the Group generated

revenues of US$4.0 million (six months to 30 June 2015: US$3.1

million) with management fees accounting for US$2.0 million (six

months to 30 June 2015: US$2.8 million). The Group generated

incentive fees of US$1.7 million (six months to 30 June 2015:

US$Nil).

Total operating costs for the period, ignoring bad debt

provisions, are US$2.0 million compared to US$1.7 million for the

six months to 30 June 2015. During the period management fee

arrears of US$2.8 million were recovered from Argo Real Estate

Opportunities Fund Limited ("AREOF") against which a provision had

been raised in prior years. The Group has provided against

management fees of US$1,164,000 (EUR1,000,000) (six months to 30

June 2015: US$1,117,000 (EUR1,000,000)) due from AREOF. In the

Directors' view these amounts are fully recoverable however they

have concluded that it would not be appropriate to continue to

recognise income without provision from these investment management

services as the timing of such receipts may be outside the control

of the Company and AREOF.

Overall, the financial statements show an operating profit for

the period of US$3.8 million (six months to 30 June 2015: profit

US$0.2 million) and a profit before tax of US$4.9 million (six

months to 30 June 2015: loss US$4.2 million) reflecting the net

gain on investments of US$1.1 million (six months to 30 June 2015:

net loss US$4.5 million). The outstanding performance of The Argo

Fund Limited ("TAF") and Argo Distressed Credit Fund Limited

("ADCF") for the first six months contributed to substantial

performance fees which will be realisable at the year end provided

substantial losses do not occur in the last six months of the

year.

At the period end, the Group had net assets of US$24.2 million

(31 December 2015: US$22.4 million) and net current assets of

US$23.4 million (31 December 2015: US$15.7 million) including cash

reserves of US$9.0 million (31 December 2015: US$3.1 million).

Net assets include investments in TAF, AREOF, Argo Special

Situations Fund LP and ADCF (together referred to as "the Argo

funds") at fair values of US$9.7 million (31 December 2015: US$10.2

million), US$0.1 million (31 December 2015: US$0.1 million),

US$0.02 million (31 December 2015: US$0.02 million) and US$2.6

million (31 December 2015: US$Nil) respectively.

At the period end the Argo funds (excluding AREOF) owed the

Group total management and performance fees of US$2,172,156 (31

December 2015: US$819,451).

The Argo funds (excluding AREOF) ended the period with Assets

under Management ("AUM") at US$104.8 million, 12.2% higher than at

the beginning of the period. The current level of AUM remains below

that required to ensure sustainable profits on a recurring

management fee basis in the absence of performance fees. This has

necessitated an ongoing review of the Group's cost basis.

Nevertheless, the Group has ensured that the operational framework

remains intact and that it retains the capacity to manage

additional fund inflows as and when they arise.

The number of employees of the Group at 30 June 2016 was 24 (30

June 2015: 24).

The Group has provided AREOF with a notice of deferral in

relation to amounts due from the provision of investment management

services, under which it will not demand payment of such amounts

until the Group judges that AREOF is in a position to pay the

outstanding liability. These amounts accrued or receivable at 30

June 2016 total US$ Nil (31 December 2015: Nil) after a bad debt

provision of US$5,629,179 (EUR5,069,505) (31 December 2015:

US$7,164,702, EUR6,569,505). AREOF continues to meet part of this

obligation to the Argo Group as and when liquidity allows. During

the six month period ended 30 June 2016 AREOF settled total fees of

US$2,776,000 (EUR2,500,000). In November 2013 AREOF offered Argo

Group Limited additional security for the continued support in the

form of debentures and guarantees by underlying intermediate

companies. The AREOF management contract has a fixed term expiring

on 31 July 2018.

Fund performance

Argo Funds

30 30

June June 2015

Launch 2016 2015 year Sharpe Down

Since Annualised

Fund date 6 months 6 months total inception performance ratio months AUM

----------- ------- ---------- ---------- ------------- --------------- ------------ ------- --------- ------

% % % % CAGR US$m

%

----------- ------- ---------- ---------- ------------- --------------- ------------ ------- --------- ------

57

The Argo of

Fund Oct-00 41.90 -1.45 -17.42 183.20 7.72 0.60 89 60.0

----------- ------- ---------- ---------- ------------- --------------- ------------ ------- --------- ------

Argo

Distressed 42

Credit of

Fund Oct-08 33.36 -0.44 -9.71 99.85 10.07 0.75 93 35.8

----------- ------- ---------- ---------- ------------- --------------- ------------ ------- --------- ------

Argo

Special 47

Situations of

Fund LP Feb-12 -31.15 -16.18 -76.21 -89.86 -44.27 -0.79 53 9.0

----------- ------- ---------- ---------- ------------- --------------- ------------ ------- --------- ------

Total 104.8

-------------------- ---------- ---------- ------------- --------------- ------------ ------- --------- ------

* NAV only officially measured once a year in September.

AREOF's adjusted Net Asset Value was minus US$23.4 million

(minus EUR20.9 million) as at 30 September 2015, compared with

minus US$6.7 million (minus EUR5.3 million) a year earlier. The

adjusted Net Asset Value per share at 30 September 2015 was minus

US$0.03 (minus EUR0.03) (30 September 2014: minus US$0.01 (minus

EUR0.01)). Although AREOF's consolidated statement of financial

position indicates the AREOF group is insolvent on a consolidated

basis, the structural ring-fencing of the underlying SPV's limits

the impact on the Group of negative equity at subsidiary level. On

this basis a restatement of the Net Asset Value would be US$0.01

(EUR0.01) (30 September 2014: US$0.05 (EUR0.04)).

At the start of 2016 emerging markets were particularly affected

by low oil prices but by March the markets were enjoying a stronger

period as oil prices began to recover and the US Federal Reserve

presented a more accommodating stance. At the beginning of the

second quarter the uncertainty surrounding the "Brexit" referendum

had cast a shadow over financial markets and permeated into a

global issue but by the end of the period the outlook was more

stable as central banks in developed countries indicated their

willingness to take added measures to boost economic growth.

This backdrop has created an opportunity to reinvest in emerging

markets at lower prices and we are now in a position to take

advantage of the opportunity as a result of a liquidity event in

AREOF (see below). In response to the prevailing attitudes towards

credit funds we are relaunching TAF and ADCF as two distinct

mandates with different liquidity profiles that will make them more

attractive propositions to new investors.

During the reporting period the Argo funds generated a positive

return from trades linked to the 2015 disposal of their stake in

the Indonesian oil refinery, TPPI. In June 2016 the Argo funds

further benefited from the sale by AREOF of one of its real estate

assets in Sibiu, Romania. This also contributed to the strong

performance of TAF and ADCF and provided much needed liquidity to

the funds and allowed AREOF to repay US$2,776,000 (EUR2,500,000) of

management fee arrears.

TAF is the Group's flagship fund and has a 16 year track record.

Going forward, TAF will focus on liquid bond securities, both

sovereign and corporate, and will be the centre of the Group's

marketing efforts. Following the declines experienced by emerging

markets over the past two years, the Board believes they offer

attractive investment opportunities. Furthermore, the economic

fundamentals in emerging markets are robust. They are expected to

deliver significantly stronger economic growth than developed

markets in 2016/2017 while enjoying attractive risk profiles thanks

to low levels of government indebtedness and high foreign exchange

reserves. The results of the first half of 2016 for TAF and ADCF

show a promising future.

The two markets in which AREOF operates were mixed. Conditions

in Romania were largely favourable as the local economy continued

to expand thereby boosting the local property market. In Ukraine

the political crisis finally ended with the replacement of almost

the entire government and the economy is now on a modest recovery

path.

The majority of AREOF's debt facilities were in default at some

point during the year. This situation has been addressed through

asset disposal and renegotiation with lending banks with a view to

restructuring debt commitments to better align these to the current

level of the AREOF group's cash flow. While discussions with the

relevant banks are ongoing to find an agreeable solution for all

parties AREOF continues to enjoy the forbearance of its banks and

support of its shareholders. In view of this, the directors of

AREOF have concluded that AREOF is a going concern.

The prevailing equity price of the AREOF shares at the time of

their suspension in 2013 (see note 8 to the financial statements)

was 2.0 euro cents. The valuation of Argo Group Limited's

investment in AREOF and that of the Argo funds was 1.0 euro cent

per share as at 30 June 2016.

Dividends and share purchase programme

The Group did not pay a dividend during the current or prior

period. The Directors intend to restart dividend payments as soon

as the Group's performance provides a consistent track record of

profitability.

However during the period the Directors undertook a share

purchase programme and authorised the repurchase of 18,955,000

shares at a total cost of U$2.8 million which provided substantial

market liquidity for share trading. The Directors firmly believe

that a return of excess cash to shareholders through buy-backs will

send a positive message to investors and for this reason they

propose to undertake a further share buy-back programme over the

next 12 months.

Outlook

The Board remains optimistic about the Group's prospects

particularly in light of the significant increase in the liquidity

of the Argo funds following the asset sale in Romania. A

significant increase in AUM is still required to ensure sustainable

profits on a recurring management fee basis and the Group is well

placed with capacity to absorb such an increase in AUM with

negligible impact on operational costs.

Boosting AUM will be Argo's top priority in the next six months.

The Group's marketing efforts will continue to focus on the

re-launch of TAF which has a 16 year track record as well as

identifying acquisitions that are earnings enhancing. TAF's

prospectus was amended as of 1 March 2016 to eliminate trading in

level 3 illiquid assets and concentrate trading and investments in

emerging market bonds and other liquid assets.

Over the longer term, the Board believes there is significant

opportunity for growth in assets and profits and remains committed

to ensuring the Group's investment management capabilities and

resources are appropriate to meet its key objective of achieving a

consistent positive investment performance in the emerging markets

sector.

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2016

Six months Six months

ended ended

30 June 30 June

2016 2015

Note US$'000 US$'000

Management fees 2,042 2,771

Performance fees 1,669 -

Other income 327 318

======================================== ===== =========== ===========

Revenue 4,038 3,089

======================================== ===== =========== ===========

Legal and professional expenses (375) (162)

Management and incentive

fees payable (34) (34)

Operational expenses (481) (454)

Employee costs (1,114) (1,123)

Bad debt provision 9 1,712 (1,121)

Foreign exchange gain 39 59

Depreciation 7 (21) (23)

Operating profit 3,764 231

======================================== ===== =========== ===========

Interest income on cash and

cash equivalents 44 88

Realised and unrealised gains/(losses)

on investments 8 1,094 (4,482)

======================================== ===== =========== ===========

Profit/(loss) on ordinary

activities before taxation 4,902 (4,163)

======================================== ===== =========== ===========

Taxation 5 (97) (31)

======================================== ===== =========== ===========

Profit/(loss) for the period

after taxation attributable

to members of the Company 6 4,805 (4,194)

Other comprehensive income

Items that may be reclassified

subsequently to profit or

loss:

Exchange differences on translation

of foreign operations (215) (261)

======================================== ===== =========== ===========

Total comprehensive income

for the period 4,590 (4,455)

======================================== ===== =========== ===========

Six months Six months

Ended Ended

30 June 30 June

2016 2015

US$ US$

Earnings per share (basic) 6 0.08 -0.06

======================================== ===== =========== ============

Earnings per share (diluted) 6 0.07 -0.06

======================================== ===== =========== ============

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2016

30 June At 31

December

2016 2015

Note US$'000 US$'000

Assets

Non-current assets

Fixtures, fittings and

equipment 7 42 64

Financial assets at fair

value through profit or

loss 8 136 4,896

Loans and advances receivable 10 683 1,783

=============================== ===== ========== ==========

Total non-current assets 861 6,743

=============================== ===== ========== ==========

Current assets

Financial assets at fair

value through profit or

loss 8 12,283 11,896

Trade and other receivables 9 2,350 966

Loans and advances receivable 10 87 -

Cash and cash equivalents 8,983 3,126

Total current assets 23,703 15,988

=============================== ===== ========== ==========

Total assets 24,564 22,731

=============================== ===== ========== ==========

Equity and liabilities

Equity

Issued share capital 11 485 674

Share premium 28,277 30,878

Revenue reserve (1,434) (6,239)

Foreign currency translation

reserve (3,091) (2,876)

=============================== ===== ========== ==========

Total equity 24,237 22,437

=============================== ===== ========== ==========

Current liabilities

Trade and other payables 265 236

Taxation payable 5 62 58

=============================== ===== ========== ==========

Total current liabilities 327 294

Total equity and liabilities 24,564 22,731

=============================== ===== ========== ==========

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

FOR THE SIX MONTHSED 30 JUNE 2016

Foreign

Issued currency

share Share Revenue translation

capital premium reserve reserve Total

2015 2015 2015 2015 2015

US$'000 US$'000 US$'000 US$'000 US$'000

As at 1 January

2015 674 30,878 (3,061) (2,496) 25,995

Total comprehensive

income

Loss for the period

after taxation - - (4,194) - (4,194)

Other comprehensive

income - - - (261) (261)

As at 30 June 2015 674 30,878 (7,255) (2,757) 21,540

===================== ========== ========== ================ =============== ========

Foreign

Issued currency

share Share Revenue translation

capital premium reserve reserve Total

2016 2016 2016 2016 2016

US$'000 US$'000 US$'000 US$'000 US$'000

As at 1 January

2016 674 30,878 (6,239) (2,876) 22,437

Total comprehensive

income

Profit for the

period after taxation - - 4,805 - 4,805

Other comprehensive

income - - - (215) (215)

Transactions with

owners recorded

directly in equity

Purchase of own

shares (note 11) (189) (2,601) - - (2,790)

As at 30 June 2016 485 28,277 (1,434) (3,091) 24,237

======================== ========== ========== ========== ================ ========

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2016

Six months Six months

ended ended

30 June 30 June

2016 2015

Note US$'000 US$'000

Net cash inflow/(outflow)

from operating activities 12 3,311 (1,737)

=============================== ===== =========== ===========

Cash flows used in investing

activities

Interest received on cash

and cash equivalents 23 1

Purchase of fixtures,

fittings and equipment 7 (2) (4)

Purchase of current asset

investments 8 (2,000) -

Proceeds from disposal

of investments 8 7,467

Net cash generated from/(used

in) investing activities 5,488 (3)

=============================== ===== =========== ===========

Cash flows from financing

activities

Repurchase of own shares (2,795) -

Net cash used in financing (2,795) -

activities

=============================== ===== =========== ===========

Net increase/(decrease)

in cash and cash equivalents 6,004 (1,740)

Cash and cash equivalents

at 1 January 2016 and

1 January 2015 3,126 2,821

Foreign exchange loss

on cash and cash equivalents (147) (112)

Cash and cash equivalents

as at 30 June 2016 and

30 June 2015 8,983 969

=============================== ===== =========== ===========

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

For the six months ended 30 June 2016

1. CORPORATE INFORMATION

The Company is domiciled in the Isle of Man under the Companies

Act 2006. Its registered office is at 33-37 Athol Street, Douglas,

Isle of Man, IM1 1LB. The condensed consolidated interim financial

statements of the Group as at and for the six months ended 30 June

2016 comprise the Company and its subsidiaries (together referred

to as the "Group").

The consolidated financial statements of the Group as at and for

the year ended 31 December 2015 are available upon request from the

Company's registered office or at www.argogrouplimited.com.

The principal activity of the Company is that of a holding

company and the principal activity of the wider Group is that of an

investment management business. The functional and presentational

currency of the Group undertakings is US dollars. The Group has 24

employees.

Wholly owned subsidiaries Country of incorporation

Argo Capital Management (Cyprus) Cyprus

Limited

Argo Capital Management Limited United Kingdom

Argo Capital Management Property Cayman Islands

Limited

Argo Property Management Srl Romania

North Asset Management Sarl Luxembourg

2. ACCOUNTING POLICIES

(a) Basis of preparation

These condensed consolidated interim financial statements have

been prepared in accordance with IAS 34 Interim Financial

Reporting. They do not include all the information required for

full annual financial statements and should be read in conjunction

with the consolidated financial statements of the Group as at and

for the year ended 31 December 2015.

The accounting policies applied by the Group in these condensed

consolidated interim financial statements are the same as those

applied by the Group in its consolidated financial statements as at

and for the year ended 31 December 2015.

These condensed consolidated interim financial statements were

approved by the Board of Directors on 7 September 2016.

b) Financial instruments and fair value hierarchy

The following represents the fair value hierarchy of financial

instruments measured at fair value in the Condensed Consolidated

Statement of Financial Position. The hierarchy groups financial

assets and liabilities into three levels based on the significance

of inputs used in measuring the fair value of the financial assets

and liabilities. The fair value hierarchy has the following

levels:

Level 1: quoted prices (unadjusted) in active markets for

identical assets or liabilities;

Level 2: inputs other than quoted prices included within Level 1

that are observable for the asset or liability, either directly

(i.e. as prices) or indirectly (i.e. derived from prices); and

Level 3: inputs for the asset or liability that are not based on

observable market data (unobservable inputs).

The level within which the financial asset or liability is

classified is determined based on the lowest level of significant

input to the fair value measurement

3. SEGMENTAL ANALYSIS

The Group operates as a single asset management business.

The operating results of the companies set out in note 1 above

are regularly reviewed by the Directors of the Group for the

purposes of making decisions about resources to be allocated to

each company and to assess performance. The following summary

analyses revenues, profit or loss, assets and liabilities:

Argo Argo

Capital Argo Capital

Argo Management Capital Management Six months

Group (Cyprus) Management Property ended

Ltd Ltd Ltd Ltd 30 June

2016 2016 2016 2016 2016

US$'000 US$'000 US$'000 US$'000 US$'000

Total revenues

for reportable

segments

customers 600 786 2,497 1,425 5,308

Intersegment

revenues 600 570 100 - 1,270

Total profit/(loss)

for reportable

segments 1,470 (136) 1,063 2,622 5,019

Intersegment

profit/(loss) 600 (128) (499) - (27)

Total assets

for reportable

segments

assets 14,899 1,213 3,934 5,090 25,136

Total liabilities

for reportable

segments 40 29 691 1,069 1,829

===================== ======== ============ ============= ============= ===========

Revenues, profit or loss, assets and Six months

liabilities may be reconciled as follows:

Ended

30 June

2016

US$'000

Revenues

Total revenues for reportable segments 5,308

Elimination of intersegment revenues (1,270)

============================================ ===========

Group revenues 4,038

============================================ ===========

Profit or loss

Total profit for reportable segments 5,019

Elimination of intersegment loss 27

Other unallocated amounts (144)

============================================ ===========

Profit on ordinary activities before

taxation 4,902

============================================ ===========

Assets

Total assets for reportable segments 25,136

Elimination of intersegment receivables (572)

Group assets 24,564

============================================ ===========

Liabilities

Total liabilities for reportable segments 1,829

Elimination of intersegment payables (1,502)

============================================ ===========

Group liabilities 327

============================================ ===========

Argo Capital Argo Capital

Argo Management Argo Capital Management Six months

Group (Cyprus) Management Property ended

Ltd Ltd Ltd Ltd 30 June

2015 2015 2015 2015 2015

US$'000 US$'000 US$'000 US$'000 US$'000

Total revenues

for reportable

segments 200 883 1,211 1,435 3,729

Intersegment

revenues 200 - 440 - 640

Total profit/(loss)

for reportable

segments (4,456) 29 248 (47) (4,226)

Intersegment

profit/(loss) 200 (641) 440 - (1)

Total assets

for reportable

segments 43,874 3,162 3,025 2,689 52,750

Total liabilities

for reportable

segments 99 1,259 264 75 1,697

===================== ======== ============= =============== =============== ===========

Revenues, profit or loss, assets and liabilities Six months

may be reconciled as follows:

ended

30 June

2015

US$'000

Revenues

Total revenues for reportable segments 3,729

Elimination of intersegment revenues (640)

================================================== ===========

Group revenues 3,089

================================================== ===========

Profit or loss

Total loss for reportable segments (4,226)

Elimination of intersegment loss 1

Other unallocated amounts 62

================================================== ===========

Loss on ordinary activities before taxation (4,163)

================================================== ===========

Assets

Total assets for reportable segments 52,750

Elimination of intersegment receivables (1,180)

Elimination of Company's cost of investments (29,598)

================================================== ===========

Group assets 21,972

================================================== ===========

Liabilities

Total liabilities for reportable segments 1,697

Elimination of intersegment payables (1,265)

================================================== ===========

Group liabilities 432

================================================== ===========

4. SHARE-BASED INCENTIVE PLANS

On 14 March 2011 the Group granted options over 5,900,000 shares

to directors and employees under The Argo Group Limited Employee

Stock Option Plan. All options are exercisable in four equal

tranches over a period of four years at an exercise price of 24p

per share.

The fair value of the options granted was measured at the grant

date using a Black-Scholes model that takes into account the effect

of certain financial assumptions, including the option exercise

price, current share price and volatility, dividend yield and the

risk-free interest rate. The fair value of the options granted is

spread over the vesting period of the scheme and the value is

adjusted to reflect the actual number of shares that are expected

to vest.

The principal assumptions for valuing the options are:

Exercise price (pence) 24.0

Weighted average share

price at grant date

(pence) 12.0

Weighted average option

life (years) 10.0

Expected volatility

(% p.a.) 2.11

Dividend yield (% p.a.) 10.0

Risk-free interest rate

(% p.a.) 5.0

The fair value of options granted is recognised as an employee

expense with a corresponding increase in equity. The total charge

to employee costs in respect of this incentive plan is nil due to

the differential in exercise price and share price.

The number and weighted average exercise price of the share

options during the period is as follows:

Weighted No. of share

average options

exercise

price

Outstanding at beginning

of period 24.0p 4,090,000

Granted during the period - 750,000

Forfeited during the period 24.0p -

============================= ========== =============

Outstanding at end of

period 24.0p 4,840,000

============================= ========== =============

Exercisable at end of

period 24.0p 4,840,000

============================= ========== =============

The options outstanding at 30 June 2016 have an exercise price

of 24p and a weighted average contractual life of 10 years, with

all tranches of shares now being exercisable. Outstanding share

options are contingent upon the option holder remaining an employee

of the Group. They expire after 10 years.

No share options were issued during the period.

5. TAXATION

Taxation rates applicable to the parent company and the Cypriot,

UK, Luxembourg, Cayman and Romanian subsidiaries range from 0% to

20% (2015: 0% to 22%).

Statement of profit or loss Six months Six months

ended ended

30 June 30 June

2016 2015

US$'000 US$'000

Taxation charge for the period

on Group companies 97 31

================================ =========== ===========

The charge for the period can be reconciled to the profit/(loss)

shown on the Condensed Consolidated Statement of Comprehensive

Income as follows:

Six months Six months

ended ended

30 June 30 June

2016 2015

US$'000 US$'000

Profit/(loss) before tax 4,902 (4,163)

================================== =========== ===========

Applicable Isle of Man tax - -

rate for Argo Group Limited

of 0%

Timing differences 2 2

Non-deductible expenses 6 3

Other adjustments (171) (57)

Tax effect of different tax

rates of subsidiaries operating

in other jurisdictions 260 83

================================== =========== ===========

Tax charge 97 31

================================== =========== ===========

Statement of financial position

30 June 31 December

2016 2015

US$'000 US$'000

Corporation tax payable 62 58

================================= ======== ============

6. EARNINGS PER SHARE

Earnings per share is calculated by dividing the net

profit/(loss) for the period by the weighted average number of

shares outstanding during the period.

Six months Six months

ended ended

30 June 30 June

2016 2015

US$'000 US$'000

Net profit/(loss) for the

period after taxation attributable

to members 4,805 (4,194)

===================================== ============= =============

No. of No. of

shares shares

Weighted average number of

ordinary shares for basic

earnings per share 62,509,327 67,428,494

Effect of dilution (Note 4) 4,840,000 4,090,000

===================================== ============= =============

Weighted average number of

ordinary shares for diluted

earnings per share 67,349,327 71,518,494

===================================== ============= =============

Six months Six months

Ended ended

30 June 30 June

2016 2015

US$ US$

Earnings per share (basic) 0.08 -0.06

Earnings per share (diluted) 0.07 -0.06

============================== =========== ===========

7. FIXTURES, FITTINGS AND EQUIPMENT

Fixtures,

fittings

& equipment

US$'000

Cost

At 1 January 2015 254

Additions 8

Foreign exchange movement (17)

================================ =============

At 31 December 2015 245

Additions 2

Foreign exchange movement (13)

================================ =============

At 30 June 2016 234

================================ =============

Accumulated Depreciation

At 1 January 2015 147

Depreciation charge for period 46

Foreign exchange movement (12)

================================ =============

At 31 December 2015 181

Depreciation charge for period 21

Foreign exchange movement (10)

================================ =============

At 30 June 2016 192

================================ =============

Net book value

At 31 December 2015 64

================================ =============

At 30 June 2016 42

================================ =============

8. FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

30 June 30 June

2016 2016

Holding Investment in management Total cost Fair value

shares

US$'000 US$'000

10 The Argo Fund Ltd - -

100 Argo Distressed Credit - -

Fund Ltd

1 Argo Special Situations - -

Fund LP

- -

======== ========================= ============= =============

Holding Investment in ordinary Total cost Fair value

shares

US$'000 US$'000

33,963 The Argo Fund Ltd* 7,583 9,702

Argo Real Estate

Opportunities Fund

10,899,021 Ltd 988 119

Argo Special Situations

115 Fund LP 115 17

Argo Distressed Credit

1,291 Fund Limited* 2,000 2,581

=========== ======================== ============= =============

10,686 12,419

=========== ======================== ============= =============

31 December 31 December

2015 2015

Holding Investment in management Total cost Fair value

shares

US$'000 US$'000

10 The Argo Fund Ltd - -

100 Argo Distressed Credit - -

Fund Ltd

1 Argo Special Situations - -

Fund LP

1 Argo Local Markets - -

Fund

======== ========================= ============== ==============

- -

======== ========================= ============== ==============

Holding Investment in ordinary Total cost Fair value

shares

US$'000 US$'000

51,261 The Argo Fund Ltd* 11,583 10,230

Argo Real Estate

Opportunities Fund

10,899,021 Ltd 988 119

Argo Special Situations

115 Fund LP 115 17

Argo Local Markets

2,117 Fund Limited* 1,700 1,666

Sudan Recovery Fund

40,272 Limited 4,760 4,760

=========== ======================== ============= =============

19,146 16,792

=========== ======================== ============= =============

*Classified as current in the Statement of Financial

Position

On 3 March 2014 Argo Real Estate Opportunities Fund Limited

("AREOF") delisted from AIM as a result of default notices on its

loans creating uncertainty. The prevailing equity price of AREOF

shares at the time of the suspension in August 2013 was 2.0 euro

cents. The valuation of Argo Group Limited's investment in AREOF

and that of the Argo funds was 1.0 euro cent as at 30 June 2016.

This investment is classified as level 3 under IFRS fair value

hierarchy reflecting the non-market observable inputs to its

valuation. The audit report in respect of AREOF for the year ended

30 September 2015 was modified in respect of going concern.

During the reporting period the Group redeemed its entire

interests in Argo Local Markets Fund Limited and Sudan Recovery

Fund Limited for US$1,587,702 and US$ 1,879,262 respectively. The

Group also redeemed part of its interest in The Argo Fund Limited

for US$4,000,000 subsequently investing US$2,000,000 in the Argo

Distressed Credit Fund Limited.

9. TRADE AND OTHER RECEIVABLES

At 30 June At 31 December

2016 2015

US$ '000 US$ '000

Trade receivables 2,181 829

Other receivables 81 66

Prepayments and accrued

income 88 71

========================= ============= =================

2,350 966

========================= ============= =================

The Directors consider that the carrying amount of trade and

other receivables approximates their fair value. All trade

receivable balances are recoverable within one year from the

reporting date except as disclosed below.

The Group has provided Argo Real Estate Opportunities Fund

Limited ("AREOF") with a notice of deferral in relation to the

amounts due from the provision of investment management services,

under which it will not demand payment of such amounts until the

Group judges that AREOF is in a position to pay the outstanding

liability. These amounts accrued or receivable at 30 June 2016

total US$ Nil (31 December 2015: Nil) after a bad debt provision of

US$5,629,179 (EUR5,069,505) (31 December 2015: US$7,164,702,

EUR6,569,505). AREOF continues to meet part of this obligation to

the Argo Group as and when liquidity allows. During the six month

period ended 30 June 2016 AREOF settled total fees of US$2,776,000

(EUR2,500,000). In November 2013 AREOF offered Argo Group Limited

additional security for the continued support in the form of

debentures and guarantees by underlying intermediate companies. In

the Directors' view these amounts are fully recoverable although

they have concluded that it would not be appropriate to continue to

recognise income without provision from these investment management

services as the timing of such receipts may be outside the control

of the Company and AREOF.

At 30 June 2016 Argo Special Situations Fund LP owed the Group

total management fees of US$451,207 (31 December 2015: US$689,310).

This fund is currently facing liquidity issues due to the debt

financing arrangement put in place in 2014 however the management

continue to work to remedy this and the Directors are confident

that these fees may be recovered in the future. During the six

month period ended 30 June 2016 the Group received US$350,000 as

part settlement of these management fees.

In the audited consolidated financial statements of AREOF at 30

September 2015 a material uncertainty surrounding the refinancing

of bank debts was referred to in relation to the basis of

preparation of the financial statements. In the view of the

directors of AREOF, discussions with the banks are continuing

satisfactorily and they have therefore concluded that it is

appropriate to prepare those consolidated financial statements on a

going concern basis.

10. LOANS AND ADVANCES RECEIVABLE

At 30 At 31 December

June 2016 2015

US$'000 US$'000

Deposits on leased premises

- non-current (see below) 83 90

Other loans and advances 87 -

receivable - current

Other loans and advances

receivable - non-current

(see below) 600 1,693

============================= ============ ==========================

770 1,783

============================= ============ ==========================

The deposits on leased premises are retained by the lessor until

vacation of the premises at the end of the lease term as

follows:

At 30 June At 31 December

2016 2015

US$'000 US$'000

Non-current:

Lease expiring in second

year after reporting date 71 78

Lease expiring in fourth

year after reporting date 12 12

83 90

============================ =========== ===============

The non-current other loans and advances receivable

comprise:

At 30 June At 31 December

2016 2015

US$'000 US$'000

Loan to Bel Rom Trei (see

note (a) below) - 1,437

Loan to AREOF (see note

(b) below) 377 24

Loan to The Argo Fund Limited - 22

Loans to other AREOF Group

entities (see note (c) below) 216 208

Other loans 7 2

================================ =========== ===============

600 1,693

================================ =========== ===============

(a) In 2013 Argo Group advanced US$1,109,400 (EUR1,000,000) to

Bel Rom Trei ("Bel Rom"), an AREOF group entity based in Romania

that owns Sibiu Shopping City, in order to assist with its

operational cash requirements. The full amount of the loan and

accrued interest amounting to US$1,490,031 (EUR1,337,611) was

repaid during the six month period ended 30 June 2016.

(b) On 21 November 2013 the Argo Group provided a loan of

US$431,901 (EUR388,960) to AREOF at a rate of 10% per annum to

enable the company to service interest payments under a bank loan

agreement. A bad debt provision has been raised against the full

amount of the loan and accrued interest amounting to US$544,550

(EUR490,408).

The Argo Group has provided further loans totalling US$742,191

(EUR668,400) to AREOF to assist with its operational cash

requirements. These loans are repayable on demand and accrue

interest at 7%-10%. A bad debt provision of US$365,278 (EUR328,961)

has been raised against these debts.

(c) At 30 June 2016 the Argo Group was owed USD308,864

(EUR278,156) by various AREOF group entities being loans provided

to assist those entities with their operational cash requirements.

The loans are repayable on demand, accrue interest at 7% and remain

fully outstanding at 30 June 2016. A bad debt provision of

US$92,759 (EUR83,537) has been raised against these debts.

11. SHARE CAPITAL

The Company's authorised share capital is unlimited with a

nominal value of US$0.01.

30 June 30 June 31 December 31 December

2016 2016 2015 2015

No. US$'000 No. US$'000

Issued and fully

paid

Ordinary shares

of US$0.01 each 48,473,494 485 67,428,494 674

================== ============= ========== ============= ============

48,473,494 485 67,428,494 674

================== ============= ========== ============= ============

The Directors did not recommend the payment of a final dividend

for the year ended 31 December 2015 and do not recommend an interim

dividend in respect of the current period.

During the period the Directors authorised the repurchase of

18,955,000 shares at a total cost of US$2.8 million.

12. RECONCILIATION OF NET CASH INFLOW/(OUTFLOW) FROM OPERATING

ACTIVITIES TO PROFIT/(LOSS) ON ORDINARY ACTIVITIES BEFORE

TAXATION

Six months Six months

ended ended

30 June 30 June

2016 2015

US$'000 US$'000

Profit/(loss) on ordinary

activities before taxation 4,902 (4,163)

Interest income (44) (88)

Depreciation 21 23

Realised and unrealised

(gains)/losses on investments (1,094) 4,482

Net foreign exchange gain (39) (59)

Increase in payables 29 40

Increase in receivables,

loans and advances (371) (1,959)

Income taxes paid (93) (13)

================================ ============= =============

Net cash inflow/(outflow)

from operating activities 3,311 (1,737)

================================ ============= =============

13. FAIR VALUE HIERARCY

The table below analyses financial instruments measured at fair

value at the end of the reporting period by the level of the fair

value hierarchy (note 2b).

At 30 June 2016

Level Level Level Total

1 2 3

US$ '000 US$ '000 US$ '000 US$ '000

Financial assets

at fair value

through profit

or loss - 12,283 136 12,419

================== ========== ========= ========= =========

At 31 December 2015

Level Level Level Total

1 2 3

US$ '000 US$ '000 US$ '000 US$ '000

Financial assets

at fair value

through profit

or loss - 11,896 4,896 16,792

================== ========== ========= ========= =========

The following table shows a reconciliation from the opening

balances to the closing balances for fair value measurements in

Level 3 of the fair value hierarchy:

Unlisted Listed

closed open ended

ended investment investment

fund fund

Emerging

Markets

Real Estate Total

US$ '000 US$ '000 US$ '000

Balance as at 1 January

2016 119 4,777 4,896

Total loss recognized

in profit or loss - (2,881) (2,881)

Sales - (1,879) (1,879)

Balance as at 30

June 2016 119 17 136

========================= ==================== ============== ==========

14. RELATED PARTY TRANSACTIONS

All Group revenues derive from funds or entities in which two of

the Company's directors, Andreas Rialas and Kyriakos Rialas, have

an influence through directorships and the provision of investment

advisory services.

At the reporting date the Company holds investments in The Argo

Fund Limited, Argo Real Estate Opportunities Fund Limited

("AREOF"), Argo Special Situations Fund LP and Argo Distressed

Credit Fund Limited. These investments are reflected in the

accounts at a fair value of US$9,702,625, US$118,865, US$16,849 and

US$2,580,941 respectively.

The Group has provided AREOF with a notice of deferral in

relation to the amounts due from the provision of investment

management services, under which it will not demand payment of such

amounts until the Group judges that AREOF is in a position to pay

the outstanding liability. These amounts accrued or receivable at

30 June 2016 total US$Nil (31 December 2015:Nil) after a bad debt

provision of US$5,629,179 (EUR5,069,505) (31 December 2015:

US$7,164,702, EUR6,569,505). AREOF continues to meet part of this

obligation to the Argo Group as and when liquidity allows. During

the period AREOF settled total fees of US$2,776,000 (EUR2,500,000).

In November 2013 AREOF offered Argo Group Limited additional

security for the continued support in the form of debentures and

guarantees by underlying intermediate companies. The AREOF

management contract has a fixed term expiring on 31 July 2018.

On 21 November 2013 the Argo Group provided a loan of US$431,901

(EUR388,960) to AREOF at a rate of 10% per annum to enable the

company to service interest payments under a bank loan agreement. A

bad debt provision has been raised against the full amount of the

loan and accrued interest amounting to US$544,550 (EUR490,408).

At the period end the Argo Group was owed a further US$742,191

(EUR668,400) by AREOF comprising loans repayable on demand and

accruing interest at 7%-10%. A bad debt provision of US$365,278

(EUR328,961) has been raised against these debts.

At the period end the Argo Group was owed a total balance of

USD308,864 (EUR278,156) by other AREOF Group entities. This balance

comprises various loans that are all unsecured, repayable on demand

and accrue interest at 7%. A bad debt provision of US$92,759

(EUR83,537) has been raised against these debts.

In the audited consolidated financial statements of AREOF at 30

September 2015 a material uncertainty surrounding the refinancing

of bank debts was referred to in relation to the basis of

preparation of the consolidated financial statements. In the view

of the directors of AREOF, discussions with the banks are

continuing satisfactorily and they have therefore concluded that it

is appropriate to prepare those consolidated financial statements

on a going concern basis.

David Fisher, a non-executive director of the Company, is also a

non-executive director of AREOF.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LFFLFADIDIIR

(END) Dow Jones Newswires

September 08, 2016 02:00 ET (06:00 GMT)

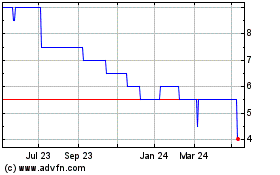

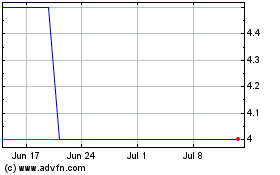

Argo (LSE:ARGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Argo (LSE:ARGO)

Historical Stock Chart

From Apr 2023 to Apr 2024