Rental income grew by 11%

Annual growth target of +10% of EPRA

Recurring Net Income, Group share Confirmed

Regulatory News:

The transformation was materialized thanks to the fast rate

in deliveries of rented commercial properties in regional cities,

€45 million in the first half-year, and thanks to the

implementation of an action plan focused on the heritage portfolio

in Marseille. Thus, ANF Immobilier (Paris:ANF) saw its revenue

increase by 11% compared with the first half-year 2015 and confirms

its annual growth target of 10% of the EPRA Recurring Net Income,

Group share. The negative fair value change of €17 million stems

from adjustments related to the heritage portfolio in

Marseille.

"Firmly established in our strategy and armed with our

renewed identity, in this half-year we’re securing and continuing

our projects in Lyon, Marseille and Bordeaux and we are tackling

the challenges inherent to our heritage portfolio" states

Renaud Haberkorn, Chief Executive Officer of ANF Immobilier.

1) Strong performance of financial indicators

- Rental income increases of 11% from new

investments, and 3% Group share. On a like-for-like basis, the

income remained stable compared with the first half-year 2015;

- Consolidated EPRA Recurring Cash Flow:

an increase of 12% compared with the first half-year 2015 at €10.4

million. The Group share for the latter stood at €7.5 million;

- Fair value: -€17 million, mainly

resulting from the decline in the fair value of heritage retail

assets in Marseille. This variation arises from the adjustment of

rental values and is not yet offset by the outcome of our strategy

of repositioning these retail assets. This strategy is reflected by

the arrival of the chains King Jouet, Musée du Savon, Copy Top

during the first half-year 2016;

- Portfolio value of €1.1 billion, stable

compared with the end of 2015.

2) Multiple deliveries and impending launches

- Effective rotation of assets between

the disposals of heritage vacant assets and deliveries of newly let

commercial assets:

- Delivery of €45 million worth of

investments particularly with three hotels in Marseille and Bobigny

(331 rooms) and a group of shops in Rue de la République in Lyon,

occupied by Maxi Bazar and Nike (opened in March 2016);

- Volume of heritage portfolio disposed

of in Lyon of €21 million and an extra €30 million already secured

(signed agreements to sell);

- Signature of the Le Castel investment,

almost 6,000 sq.m. of new office space along the seafront in

Marseille for an amount of €19 million, for a delivery at the end

of 2018;

- Impending launch of the Quai Ilot 8.2

project in Bordeaux planned for September 2016, for a total of

almost €90 million: 29,500 sq.m. of office space and 2,000 sq.m. of

shops in the immediate vicinity of the future high-speed train

line;

3) NNNAV of €26.2 per share on June 30th 2016

negatively affected by:

i. the payment of the annual

dividend increased by its exceptional component (-€1.2 per

share) with only +€0.4 per share generated by the cash flow in the

current half-year;ii. the adjustment of the market value of

hedging instruments (-€0.5 per share);iii. reductions in the

value of Marseille retail premises (-€1.0 per share).

Income

Rental income totaled €25.8 million in the first

half-year 2016, a sharp rise of 11% compared with the first

half-year 2015 (stable like-for-like). This rise mainly comes from

the delivery of 36,000 sq.m. of office space leased to Alstom in

Lyon on June 30th 2015 and multiple deliveries of hotels in

Marseille, Bordeaux-Bègles and Bobigny. Gross rental income, Group

share, amounted to €20.9 million.

Portfolio income mainly stemmed from office leases

(55%), commercial leases (17%) and hotels (12%). The

residential sector now accounts for only 13% of rental income.

Recurring EBITDA increased 12% to €17.6 million,

resulting mainly from new acquisitions and deliveries in the

commercial real estate segment.

The EPRA Recurring Net Income, Group share, stands at

€7.9 million, i.e. a rise of 15%. Net income, Group share

(IFRS) was -€15.6 million, affected by the declines in value

in Marseille.

Recurring consolidated Cash Flow increased 12% to €10.4

million. Group share Cash Flow was €7.5 million in this half-year,

i.e. €0.4 per share.

The real estate portfolio value established by two

independent appraisers totals €1,082 million, stable compared with

end December 2015.

The Loan-To-Value ratio was 45.5% on June 30th

2016 compared with 43.0% at December 31st 2015. The cost of debt

came to 2.7% in the first half-year. During the first

half-year, the company restructured old hedging instruments in an

amount of almost €5 million. At the end of the first half-year, the

debt hedging rose to 86%, mainly through caps.

On June 30th 2016, the Triple Net Asset Value was

€26.2 per share, based on the EPRA method. Excluding payment

of the dividend of €1.24 per share and the adjustment of the fair

value of the hedging instruments, this represents a drop of

2% stemming mainly from the negative fair value change of

Marseille high street retail assets of €17 million and the impact

of the cash flow for the half-year.

Consolidated data* (H1 2016/H1 2015)

H1 2016 H1 2015 (million

€) EPRA IFRS EPRA IFRS Var. EPRA Gross rental income 25.8

25.8 23.2 23.2 11% Group Share 20.9 20.3 3% Net operating

expenses - 2.5

- 3.3 - 1.6 - 2.4

Net rental

income 23.3 22.5 21.6 20.8

8% margin 90% 87% 93% 89% Administrative expenses - 5.7

- 5.7 - 5.9 - 5.9

Recurring EBITDA

17.6 16.8 15.7 14.9 12%

margin 68% 65% 67% 64% Financial expenses - 8.3

- 8.3

- 8.3 - 8.3 Amortization -

- 0.5 - - 0.3 Change in Fair

Value -

- 17.4 - 13.0 Other items 0.2

- 3.3 - 0.2 -

0.2 Taxes 0.1

0.1 - 0.2 - 0.2 Minority interests - 2.8

- 3.1 - 2.0 - 10.5

Recurring Net Income,

Group Share 6.8 - 15.6 5.0

8.4 37% margin 26% -61% 21% 36% Adjustment non

recurring administrative expenses - - 0.6 - Adjustment financial

expenses 1.1 - 1.4 -

Recurring Net Income, Group

Share adjusted 7.9 - 15.6 6.9

8.4 15%

Recurring

EBITDA, Group Share 13.3 17.6 Cash

flow, Group Share 7.5 10.4

* The procedures for a limited examination of the half-yearly

financial statements were carried out. The limited examination

report is being issued.

A changing core

portfolio

1) Succession of deliveries

The first half-year 2016 was marked by the delivery of three

hotels with almost 331 rooms and the delivery of 2,500 sq.m. of new

high street retail premises in Rue de la République, the result of

the restructuring of the former Banque de France regional

headquarters. All of these operations represent €45 million of

investments in commercial assets generating effective yields

exceeding 7%.

Details of the hotels are as follows: one hotel in

Marseille-Vélodrome with 126 rooms under the AC By Marriott name

delivered in January 2016, a second hotel in Marseille-Euromed 2

with 88 rooms under the B&B name delivered in May 2016 and the

last hotel in Bobigny with 117 rooms under the B&B name

delivered in June 2016. These three assets were acquired through

the subsidiary ANF Immobilier Hôtels and generate an additional

income of €1.9 million, bringing the number of hotel rooms of the

specialized subsidiary to more than 1,300.

The project creating 2,500 sq.m. of commercial premises by

restructuring the former Banque de France headquarters in Lyon, was

completed and is fully leased. The property is occupied by two

major chains: Nike which opened in March 2016 and Maxi Bazar which

plans on opening before the end of the year. This Banque de France

restructuring operation is a €20 million project. It illustrates

the expertise of the ANF Immobilier teams, boasting a return on

equity of approximately 75%.

2) Anticipation and significant marketing

activity on “Ilot 34” in Marseille

Ilot 34 in Marseille, an integral part of the core commercial

portfolio of ANF Immobilier, is an asset located in the immediate

vicinity of the new European hospital within the Euromed program.

It is made up of two office buildings, 4,600 sq.m. and 8,000 sq.m.

respectively rented to the Caisse Primaire d’Assurances Maladie and

to the SNCM on January 1st 2016. The first tenant expressed its

intent to exercise an option to buy at the end of the initial

three-year period, for a price of €17 million which is in line with

the appraisal values. The second tenant's lease was partially

replaced by new leases, in particular with the company MCM for

3,500 sq.m.

3) The actual launch of the Le Castel

project and the Adecco - Adely project

At the end of May 2016, ANF Immobilier signed an agreement with

Eiffage Immobilier for the development of almost 6,000 sq.m. of

office space, not yet rented, on the Quai de la Joliette: Le

Castel. This operation will take the form of a forward purchase

agreement which should start in 2017 for a delivery at the end of

2018/early 2019. This €19 million operation shows a conservative

yield and rental value combination.

The year 2016 will be known as the year of the Adecco-Adely

project, an investment of €34 million and a development of 13,100

sq.m. of offices leased to Adecco in the Quartier du Carré de Soie,

in Lyon. The investment will be made in partnership with Crédit

Agricole Assurances and DCB International. Its delivery is planned

for the third quarter with an additional rental income of €2.5

million. As of June 30th 2016 the rate of building construction is

in line with the expectations.

4) Impending launch of the Quai 8.2

project in Bordeaux

The final deeds for the Quai 8.2 transaction in Bordeaux

(formerly Armagnac) will be signed in September 2016. As a

reminder, this project represents 29,500 sq.m. of office space and

2,000 sq.m. of retail premises in the immediate vicinity of the

future high-speed train line, for an amount of €90 million. The

offices are currently 31% leased to Orange and Allianz by means of

9-year fixed-term leases. ANF Immobilier shall retain 65% of the

investment. In parallel, ANF Immobilier, in its capacity as

developer and in partnership with Vinci, will purchase the land and

start the construction.

Re-inventing the heritage portfolio,

adapting it to the economic context

1) Anticipation of the economic context

affecting retail businesses in Marseille

During the first half-year 2016, the shops in the Rue de la

République faced an environment that was difficult for their retail

businesses. This arose from factors internal or external to the

city of Marseille. On the one hand, locally, the almost

simultaneous opening of all the retail premises and shopping malls

in the immediate vicinity (such as the Terrasses du Port, the

Centre Bourse, the Docks or the Voûtes) created oversupply,

particularly in the clothing and personal goods sectors. On the

other hand, retailers throughout France, particularly those working

on the ground floor, had a generalized drop in their income due to

the sluggish French economic climate.

Anticipating this downturn at the start of 2016, ANF Immobilier

decided to adapt its strategy through identifying two separate

segments: the first, linked to the Vieux-Port, will group together

retail premises intended specifically for the families and

tourists, and the second, linked to the Place de la Joliette, will

have an offer complementary to the expansion of the Euromed

commercial sector.

This strategy, crucial for the development of the Rue de la

République, is already bearing fruit with new establishments during

the first half-year 2016: King Jouet, a leader in the toys field,

has leased 600 sq.m., the Musée du Savon, symbolic of Marseille,

has decided to occupy 800 sq.m., Copy Top has taken more than

100 sq.m. However, this new dynamism is not enough to curb the

decline in rental values stemming from the drop in the revenues of

the retail businesses in the city center. The resulting adjustment

in the value of our Marseille retail premises is close to €15

million. Nevertheless, these new chains are signs of the resurgence

and the adaptation of the Rue de la République, with a target for

growth and pedestrian flow and a dynamism that is once again on the

move.

2) Disposal of the Lyon heritage

assets

The volume of disposals in the first half-year 2016 was mainly

composed of residential assets and shops in the Rue de la

République in Lyon. It represents €21 million bringing the

so-called "heritage" portfolio down from 46% at the end of 2015 to

44%. In mid-2016, ANF Immobilier secured the disposal of several

retail premises at 2, 3, and 4 rue de la République for an amount

of €13 million and plans on signing the final deed before the end

of the year.

Outlook

The strategy and identity of ANF Immobilier are based on three

pillars: investment in regional cities with strong potential where

the real estate compliments its development, the shift of its

portfolio to the commercial real estate sector and a recognized

capacity to operate as investor, developer and asset manager at an

early stage in all of its projects.

Right now, the company is sowing the seeds of its future

development. Accordingly, it has filed a building permit for the

Park View project (formerly known as "Future Way – Tête d’Or")

in Lyon and has cleaned out the one for the Rive Neuve project in

Marseille, strengthening and extending its pipeline beyond 2019.

These two transactions represent a supplementary amount of €63

million, i.e. almost 26,000 sq.m. of additional new office space

and ideally situated.

For the year 2016, ANF Immobilier reasserts its target and

anticipates a growth of 10% in its EPRA Recurring Net Income, Group

share.

2016 Financial Agenda Publication of revenue for the 3rd

quarter 2016 November 10, 2016 (before market opening)

About ANF Immobilier

ANF Immobilier (ISIN FR0000063091) is a

French listed real estate investment company that owns a

diversified portfolio of French office, retail, hotel and

residential property worth €1,082 million. It is currently

undergoing a major transformation to concentrate on commercial real

estate, and aims to invest in the regions and promote regional

cities. It currently has assets in Bordeaux, Lyon and Marseille.

Listed on Eurolist B of Euronext Paris and included in the EPRA

real estate index, ANF Immobilier is a company of the Eurazeo

Group.

http://www.anf-immobilier.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160727005579/en/

ANF Immobilier:Laurent Milleron, Tel: +33 1 44 15

01 11investorrelations@anf-immobilier.comorPress contact:

Renaud Large, Tel: +33 1 58 47 96

30renaud.large@havasww.com

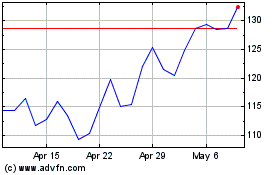

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Mar 2024 to Apr 2024

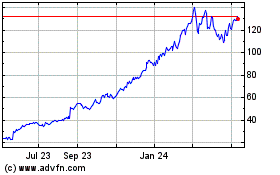

Abercrombie and Fitch (NYSE:ANF)

Historical Stock Chart

From Apr 2023 to Apr 2024