TIDMAEC

RNS Number : 5622A

AEC Education plc

29 September 2015

AEC Education PLC

("AEC" or the "Company" and together with its subsidiaries, the"

Group")

Half year results for the six months ended 30 June 2015

Key Points

-- Revenues on continuing activities of GBP3.58m (2014: GBP4.33m)

-- Operating loss of GBP0.57m (2014: loss of GBP0.07m)

-- Loss before tax of GBP0.52m (2014: loss of GBP0.10m)

-- Loss after tax from continuing activities of GBP0.52m (2014: loss of GBP0.11m)

-- Loss per share of 0.86p (2014: 0.15p)

-- Ireland, Malaysia and our Cyprus JV continue to contribute

profits but the London market is still in decline with losses

reported for the first half.

-- New initiatives have been implemented in London to assist

recovery starting from the second half of 2015.

Liam Swords, Chairman, stated,

"The Group's results for the six months ended 30 June 2015 were

disappointing with London and, to a lesser extent, Singapore,

offsetting the total gains generated by all the other operating

units. We have initiated and implemented a number of strategic

plans for these two units to gain traction in student acquisition.

These positive measures will start to take effect from the latter

months of 2015 and continue into 2016 and beyond. Nevertheless, we

are also very encouraged by the improvement generated in Dublin and

Malaysia. We are also initiating a licensing model for

non-traditional markets to expand our revenue base beyond the

current sources. These measures are expected to positively drive

the Group forward."

Enquiries:

AEC Education PLC Tel: +44 (0) 7725 836 811

Liam Swords

WH Ireland Limited (NOMAD) Tel: +44 (0)117 945 3470

Mike Coe

CHAIRMAN'S STATEMENT

Introduction

The Group's results for the six months ended 30 June 2015 were

disappointing with London and, to a lesser extent, Singapore,

offsetting the total gains generated by all the other operating

units. We have initiated and implemented a number of strategic

plans for these two units to gain traction in student acquisition.

These positive measures will start to take effect from the latter

months of 2015 and continue into 2016 and beyond. Nevertheless, we

are also very encouraged by the improvement generated in Dublin and

Malaysia. The strategic decision to build an operation in Ireland

to offset the expected decline in London is beginning to work but

visa and work restrictions in the UK have driven the market down

much quicker and with much greater impact than expected London. We

are introducing a licensing model for non-traditional markets to

expand our revenue base beyond the current sources.

Financial Results

Revenues on continuing activities for the six months reduced to

GBP3.58m. (2014: GBP4.33.m). The loss before tax was GBP0.52m

compared to a loss of GBP0.10m in the same period last year. London

and Singapore continue to struggle, a result of the previously

reported visa work ban (non-EU) and loss of the EduTrust

accreditation. Malaysia is showing a small profit and Dublin

continues to show positive numbers. The loss after tax was GBP0.52m

(2014: GBP0.11m). The loss per share was 0.86p (2014: 0.15p). Cash

balances as at 30 June 2015 stood at GBP0.36m (2014: GBP0.65m).

Operational Review

In Europe, the London revenue has been impacted greatly by the

change of policy to the working capability of non-EU students and

the continuing tightening of student visa controls. An initial

upside in the first half of 2014 was not sustained as the market

declined further. With this in mind, Management have taken the

initiative to introduce some robust programs that would force the

widening of the revenue base to cater for students outside the

visa-working requirements. This program kicked off in September

this year and we hope to see some positive outcomes over the coming

months. Ireland continues to grow strongly and to show improved

results but not sufficient to offset the very rapid decline in

London. Cyprus revenue has been affected by the decline in the

Russian market because of the current political tensions with

Europe but has grown its local adult market strongly which has

largely offset the decline in its Summer School seasonal numbers.

Cyprus had already started to focus on Europe and achieved some

success during this first period which also helped to offset some

of the decline in the Summer School numbers.

The Asian units are also experiencing mixed results. Singapore

has the same underlying revenue issues as London. The loss of

EduTrust reduced the Singapore revenue opportunities dramatically

and it has taken time to shift the focus and re-design a new

product base. A number of new programmes have been introduced which

are expected to provide increasing revenue in the coming

months.

Malaysia remains, the most diversified of all the business

units. Moreover, market conditions, especially with the weak

Ringgit should give the Malaysia a stronger position in the Asia

market and assist in its drive to increase student numbers in the

next period and continue to make a contribution.

Outlook

We look forward positively as we restructure the revenue

generation models of all our operating units to include a wider

range of products. We have also begun discussions with various

parties on the development of online teaching platforms as a

supplement to the traditional teaching methods. Further, we have

started to re-introduce licensing models to offer our educational

content and brand to non-traditional markets in Asia and the Middle

East. We strongly believe that by early 2016, all our new

initiatives and programs will begin to show an overall Group

return.

Liam Swords

Chairman

UNAUDITED CONSOLIDATED INCOME STATEMENT

Note Six months Six months Twelve months

to 30 June to 30 June to 31 December

2015 2014 2014

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Revenues

Sales of services and other

revenue 4 3,579 4,333 8,978

Cost of services sold &

operating

expenses (4,148) (4,403) (10,092)

Operating (loss) / profit (569) (70) (1,114)

(Loss) / profit from

operations (569) (70) (1,114)

Share of results of

associated

companies and joint venture 85 (6) 54

Finance costs (33) (20) (41)

(Loss) / profit before

taxation (517) (96) (1,101)

Income tax credit / (charge) - (9) (29)

(Loss) / profit for the

period

/ year from continuing

activities (517) (105) (1,130)

(Loss) / profit for the

period

/ year from discontinued

activities - - 282

(Loss) / profit for the

period

/ year (517) (105) (848)

Minority interests (24) 13 (34)

-------------------------- ------------------------- ------------------------

(Loss) / profit attributable

to

equity holders (541) (92) (882)

(Loss) / earnings per share

on

continuing activities Pence Pence Pence

Basic (0.86) (0.15) (1.85)

Diluted (0.86) (0.15) (1.85)

(Loss) / earnings per share

on

discontinued activities Pence Pence Pence

Basic - - 0.45

Diluted - - 0.45

(MORE TO FOLLOW) Dow Jones Newswires

September 29, 2015 07:53 ET (11:53 GMT)

UNAUDITED STATEMENT OF FINANCIAL POSITION

As at 30 June As at 30 June As at 31

2015 2014 December

2014

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Fixed assets

Intangible assets 3,240 3,951 3,524

Tangible assets 411 650 450

Investment in joint venture 182 17 98

3,833 4,618 4,072

-------------------------- ----------------------------- ---------------------

Current assets

Inventory 7 9 7

Debtors 1,391 1,848 1,221

Cash at bank and in hand 364 645 361

-------------------------- ----------------------------- ---------------------

1,762 2,502 1,589

Total assets 5,595 7,120 5,661

========================== ============================= =====================

Creditors

Amounts falling due within

one year (3,936) (4,375) (3,563)

Net current liabilities (2,174) (1,873) (1,974)

-------------------------- ----------------------------- ---------------------

Non-current liabilities

Finance lease (27) (48) (38)

Deferred taxation (13) (22) (13)

-------------------------- ----------------------------- ---------------------

(40) (70) (51)

Total liabilities (3,976) (4,445) (3,614)

-------------------------- ----------------------------- ---------------------

Equity attributable to equity

holders of the Company

Share capital 5,362 5,362 5,362

Share premium 896 896 896

Reserves (4,564) (3,403) (4,080)

-------------------------- ----------------------------- ---------------------

1,694 2,855 2,178

Minority interest in equity (75) (180) (130)

1,619 2,675 2,048

-------------------------- ----------------------------- ---------------------

Total equity and liabilities 5,595 7,120 5,662

========================== ============================= =====================

UNAUDITED CONSOLIDATED STATEMENT OF CASH FLOWS

Six months Six months Twelve months

to 30 June to 30 June to 31 December

2015 2014 2014

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Cash Flows from operating

activities

(Loss) / profit before income

tax from continuing activities (517) (96) (1,101)

(Loss) / profit before income

tax from discontinued activities - - 282

Adjustments for:

Depreciation & amortisation 153 176 370

Loss on disposal of plant and

equipment - (11) 170

Loss/(profit) on disposal of

an associate - (279) (52)

Impairment of intangible assets - - 350

Interest paid (20) (20) 41

Share of results of associated

companies and joint venture (85) 6 (54)

(469) (224) 6

------------------------- -------------------------- ----------------------

Changes in working capital

(Increase) / decrease in debtors (151) 172 725

(Increase) / decrease in creditors 200 (769) (2,087)

(Increase) / decrease in inventories - - 2

(Increase) / decrease in related

parties 235 ( 209) 232

Cash flows from operating activities (185) (1,030) (1,122)

------------------------- -------------------------- ----------------------

Taxation

Taxes recovered / (paid) (14) (20) (5)

Net cash used in operating

activities (199) (1,050) (1,127)

------------------------- -------------------------- ----------------------

Cash flows from investing

activities

Purchase of property, plant

and equipment (39) (21) (68)

Purchase of intangible fixed

assets - (7) (14)

Acquisition of joint venture - - 40

Disposal of property, plant

and equipment - 27 -

Disposal of an associate - 293 -

(39) 292 (42)

------------------------- -------------------------- ----------------------

Cash flows from financing

activities

Dividend paid to minority

shareholders - - (41)

(Decrease) / increase in finance

lease liabilities (21) (31) -

Repayment of term loan (37) (62) (97)

(58) (93) (138)

------------------------- -------------------------- ----------------------

Effect of foreign exchange

rate changes on consolidation 299 21 193

------------------------- -------------------------- ----------------------

Net increase in cash and cash

equivalents 3 (830) (1,114)

Cash and cash equivalents at

beginning of period / year 361 1,475 1,475

Cash and cash equivalents at

end of period / year 364 645 361

------------------------- -------------------------- ----------------------

NOTES TO ACCOUNTS

1. Publication of non-statutory accounts and basis of preparation.

(MORE TO FOLLOW) Dow Jones Newswires

September 29, 2015 07:53 ET (11:53 GMT)

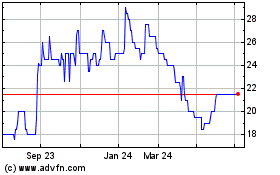

Malvern (LSE:MLVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

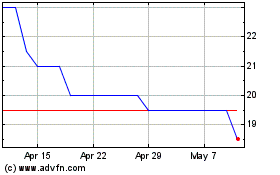

Malvern (LSE:MLVN)

Historical Stock Chart

From Apr 2023 to Apr 2024