ADTRAN, Inc. (NASDAQ:ADTN) reported results for the first

quarter 2016. For the quarter, sales were $142,204,000 compared to

$142,835,000 for the first quarter of 2015. Net income was

$5,014,000 compared to $3,317,000 for the first quarter of 2015.

Earnings per share, assuming dilution, were $0.10 compared to $0.06

for the first quarter of 2015. Non-GAAP earnings per share were

$0.14 compared to $0.10 for the first quarter of 2015. The

reconciliation between GAAP earnings per share, diluted, and

non-GAAP earnings per share, diluted, is in the table provided.

ADTRAN Chief Executive Officer Tom Stanton stated, “ADTRAN

delivered a solid performance this quarter resulting in earnings

coming in ahead of initial expectations. Compared to the same

period last year, Q1 domestic revenue was up over 39% with

increases in both our products and services businesses. Improved

gross margins and lower operating expenses helped us increase

operating income over 181% versus Q1 of 2015. Longer term, we

expect further improvement in the carrier environment as customers

accelerate investments in upgrading their network infrastructure to

meet customer demand.”

The Company also announced that its Board of Directors declared

a cash dividend for the first quarter of 2016. The quarterly cash

dividend is $0.09 per common share to be paid to holders of record

at the close of business on April 28, 2016. The ex-dividend date is

April 26, 2016 and the payment date is May 12, 2016.

As was previously announced, ADTRAN has changed its financial

reporting segments as of the quarter ended March 31, 2016. The

Company will now report its financial performance based on two new

reportable segments – Network Solutions and Services & Support.

ADTRAN will post supplemental information regarding revenues by

operating segment and category under its new and former reporting

structure for the fiscal quarter ended March 31, 2016, and recast

financial segment information for the four quarters and full year

for fiscal years 2014 and 2015, as if reported under the new

operating reporting structure, on the Investor Relations page of

its website at www.adtran.com.

The Company confirmed that its first quarter conference call

will be held Wednesday, April 13, 2016 at 9:30 a.m. Central Time.

This conference call will be web cast live through

StreetEvents.com. To listen, simply visit the Investor Relations

site at www.adtran.com or www.streetevents.com approximately 10

minutes prior to the start of the call and click on the conference

call link provided.

An online replay of the conference call will be available for

seven days at www.streetevents.com. In addition, an online replay

of the conference call, as well as the text of the Company's

earnings release, will be available on the Investor Relations site

at www.adtran.com for at least 12 months following the call.

ADTRAN, Inc. is a leading global provider of networking and

communications equipment. ADTRAN’s products enable voice, data,

video and Internet communications across a variety of network

infrastructures. ADTRAN solutions are currently in use by service

providers, private enterprises, government organizations, and

millions of individual users worldwide. For more information,

please visit www.adtran.com.

For more information, contact the company at 800 9ADTRAN (800

923-8726) or via email at info@adtran.com. On the Web, visit

www.adtran.com.

This press release contains forward-looking statements which

reflect management’s best judgment based on factors currently

known. However, these statements involve risks and uncertainties,

including the successful development and market acceptance of new

products, the degree of competition in the market for such

products, the product and channel mix, component costs,

manufacturing efficiencies, and other risks detailed in our annual

report on Form 10-K for the year ended December 31, 2015. These

risks and uncertainties could cause actual results to differ

materially from those in the forward-looking statements included in

this press release.

Condensed Consolidated Balance

Sheet

(Unaudited)

(In thousands)

March 31,2016

December 31,2015

Assets Cash and cash equivalents $ 91,609 $ 84,550

Short-term investments 29,303 34,396 Accounts receivable, net

67,492 71,917 Other receivables 9,199 19,321 Inventory 92,107

91,533 Prepaid expenses and other current assets 13,096 10,145

Deferred tax assets, net 17,967 18,924

Total

Current Assets 320,773 330,786 Property,

plant and equipment, net 73,511 73,233 Deferred tax assets, net

18,878 18,091 Goodwill 3,492 3,492 Other assets 9,157 9,276

Long-term investments 195,683 198,026

Total

Assets $ 621,494 $ 632,904

Liabilities and Stockholders' Equity Accounts payable $

42,635 $ 48,668 Unearned revenue 18,683 16,615 Accrued expenses

13,513 12,108 Accrued wages and benefits 11,064 12,857 Income tax

payable, net 2,739 2,395

Total Current

Liabilities 88,634 92,643 Non-current

unearned revenue 7,288 7,965 Other non-current liabilities 25,283

24,236 Bonds payable 27,900 27,900

Total

Liabilities 149,105 152,744

Stockholders' Equity 472,389

480,160 Total Liabilities and Stockholders'

Equity $ 621,494 $ 632,904

Consolidated Statements of

Income

(Unaudited)

(In thousands, except per share

data)

Three Months Ended March 31, 2016

2015 Sales Products $ 123,883 $

129,505 Services 18,321 13,330

Total sales 142,204 142,835 Cost of

sales Products 64,073 71,560 Services 12,337

5,712

Total cost of sales 76,410

77,272 Gross Profit 65,794

65,563 Selling, general and administrative expenses

30,785 31,064 Research and development expenses 29,488

32,536

Operating Income

5,521 1,963 Interest and dividend income 855

933 Interest expense (145 ) (148 ) Net realized investment gain

1,728 3,115 Other income (expense), net 119

(353 )

Income before provision for income taxes

8,078 5,510 Provision for income taxes

(3,064 ) (2,193 )

Net Income $

5,014 $ 3,317 Weighted

average shares outstanding - basic 49,220 53,399 Weighted average

shares outstanding - diluted (1) 49,389 53,634 Earnings per

common share - basic $ 0.10 $ 0.06 Earnings per common share -

diluted (1) $ 0.10 $ 0.06

(1)

Assumes exercise of dilutive stock options

calculated under the treasury stock method.

Consolidated Statements of

Comprehensive Income

(Unaudited)

(In thousands)

Three Months Ended March 31, 2016

2015 Net Income $ 5,014 $ 3,317

Other Comprehensive Income (Loss), net of tax:

Unrealized losses on available-for-sale securities (255 ) (503 )

Defined benefit plan adjustments 45 68 Foreign currency translation

1,228 (3,318 )

Other Comprehensive

Income (Loss), net of tax 1,018

(3,753 ) Comprehensive Income (Loss), net

of tax $ 6,032 $ (436

)

Consolidated Statements of Cash

Flows

(Unaudited)

(In thousands)

Three Months Ended March 31, 2016

2015 Cash flows from operating activities: Net

income

$ 5,014 $ 3,317 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 3,347 3,728 Amortization of net

premium on available-for-sale investments 220 910 Net realized gain

on long-term investments (1,728 ) (3,115 ) Net loss on disposal of

property, plant and equipment 3 8 Stock-based compensation expense

1,558 1,639 Deferred income taxes 435 (692 ) Tax benefit from stock

option exercises - 8 Excess tax benefits from stock-based

compensation arrangements - (9 ) Change in operating assets and

liabilities: Accounts receivable, net 4,752 (4,571 ) Other

receivables 10,200 511 Inventory 163 (7,261 ) Prepaid expenses and

other assets (3,083 ) (736 ) Accounts payable (6,520 ) 20,084

Accrued expenses and other liabilities 902 (282 ) Income tax

payable, net 413 (524 )

Net cash provided

by operating activities 15,676

13,015 Cash flows from investing

activities: Purchases of property, plant and equipment (3,166 )

(2,442 ) Proceeds from sales and maturities of available-for-sale

investments 60,586 58,075 Purchases of available-for-sale

investments (52,053 ) (44,584 )

Net cash provided

by investing activities 5,367

11,049 Cash flows from financing

activities: Proceeds from stock option exercises 247 280

Purchases of treasury stock (11,003 ) (3,035 ) Dividend payments

(4,453 ) (4,811 ) Excess tax benefits from stock-based compensation

arrangements - 9

Net cash used in

financing activities (15,209 )

(7,557 ) Net increase in cash and cash

equivalents 5,834 16,507 Effect of exchange rate changes 1,225

(2,937 )

Cash and cash equivalents, beginning of period

84,550 73,439

Cash and cash equivalents, end of period $

91,609 $ 87,009

Supplemental disclosure of non-cash investing activities Purchases

of property, plant and equipment included in accounts payable $ 485

$ 784

Supplemental Information

Stock-based Compensation

Expense

(Unaudited)

(In thousands)

Three Months Ended March 31, 2016

2015 Stock-based compensation expense

included in cost of sales $ 91 $

90 Selling, general and administrative expense

810 691 Research and development expense 657

858

Stock-based compensation expense included in

operating expenses 1,467

1,549 Total stock-based compensation

expense 1,558 1,639 Tax benefit for expense

associated with non-qualified options (212 ) (180 )

Total stock-based compensation expense, net of tax

$ 1,346 $ 1,459

Reconciliation of GAAP net income per

share, diluted, to

Non-GAAP net income per share,

diluted

(Unaudited)

Three Months Ended March 31, 2016

2015 GAAP earnings per common share –

diluted $ 0 .10 $ 0

.06 Amortization of acquired intangible assets 0 .01

0 .01 Stock-based compensation expense 0 .03 0 .03

Non-GAAP earnings per common share – diluted $

0 .14 $ 0 .10

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160412006882/en/

ADTRAN, Inc.Roger Shannon, 256-963-8775Senior Vice President

& CFOorGayle Ellis, 256-963-8220Investor Services

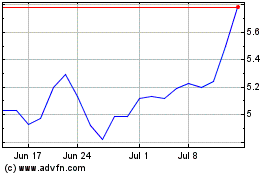

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

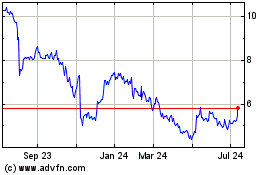

ADTRAN (NASDAQ:ADTN)

Historical Stock Chart

From Apr 2023 to Apr 2024