AB Foods 16-Week Group Revenue -2%; Backs 2015 Guidance

January 14 2016 - 3:16AM

Dow Jones News

By Ian Walker

LONDON--Associated British Foods PLC (ABF.LN) said Thursday

group revenue for the 16 weeks ended Jan. 2 fell 2% at actual

exchange rates, and backed its guidance for the year ahead.

The international food and ingredients firm, and owner of the

Primark budget clothing chain, added that investment in expansion

opportunities will continue, most notably for Primark, and there is

increasing evidence that stability in sugar profit ahead the

European Union quota removal in 2017 will be realized.

AB Foods, which houses Twinings, Ovaltine and Silver Spoon sugar

among its brands, said at the time of its fiscal 2015 earnings in

November, and again reiterated at the annual shareholder meeting in

December that it expects currency pressures to lead to a "modest"

decline in adjusted operating profit and adjusted earnings for the

group for the full year.

AB Foods reiterated this again Thursday.

Primark sales for the 16 weeks rose 7% on a constant currency

basis, but were only 3% higher at actual exchange rates due to the

weakening of the euro against sterling. While comparable sales in

the first seven weeks of the period were strong, the subsequent

nine weeks suffered from the warmer weather. This echoes comments

from both Next and Marks and Spencer.

In the year ended Dec. 12, 2015 adjusted operating profit, which

strips out exceptional and other one-off items, was 1.92 billion

pounds ($2.86 billion) and adjusted EPS were 102.0 pence.

Shares closed Wednesday at 3041 pence.

-Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

January 14, 2016 03:01 ET (08:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

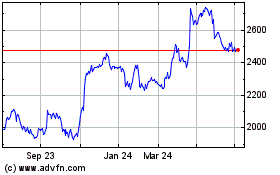

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Apr 2023 to Apr 2024