TIDMIII

RNS Number : 1424V

3i Group PLC

26 January 2017

26 January 2017

3i Group plc

FY2017 Q3 performance update

A robust performance from our portfolio companies and

continued investment momentum

* NAV per share of 558 pence and total return of 24.1%

at 31 December 2016

* Cash realisations of GBP917 million in the nine

months to 31 December 2016 from our Private Equity

business

* Continued momentum in investment activity taking year

to date Private Equity cash investment to GBP356

million

* Infrastructure announced the launch of a new GBP700

million fund, managed by 3i, to acquire a portfolio

of European infrastructure assets

==============================================================

Simon Borrows, Chief Executive, commented:

"Q3 was an active quarter for our investment teams. We announced

two significant Private Equity investments as well as the launch of

a new fund managing a portfolio of infrastructure assets.

Realisation activity continues apace and we received proceeds from

Action's recent refinancing and our shareholdings in Loxam and Go

Outdoors.

Overall our portfolio remains well positioned, with our key

assets continuing to deliver consistently robust performance. 3i is

set for a strong close to the current financial year."

Private Equity

Portfolio performance

The Private Equity portfolio continued to perform well in the

quarter. In particular, Action delivered another excellent

performance. Its rapid store expansion programme, strong earnings,

like-for-like sales growth and cash generation allowed it to secure

a EUR1.675 billion refinancing. As a result, 3i received GBP187

million of proceeds.

There was a mixed performance from other retailers in our

portfolio with Hobbs trading well through Christmas but Agent

Provocateur and our German investment, Christ, experienced more

subdued December trading.

We continue to see good earnings growth across the portfolio

more generally, with assets such as ATESTEO, Aspen Pumps and

Euro-Diesel performing well and strong cash flow generation from

Scandlines.

Private Equity investments

In December 2016, we made a GBP62 million further investment in

Q Holding to support its transformative acquisition of Degania

Silicone Ltd ("Degania") to create one of the largest medical

silicone and systems manufacturers globally. Our GBP122 million

investment in Ponroy Santé, a manufacturer of natural healthcare

and cosmetics products, completed on 24 January 2017.

Private Equity realisations

We generated total cash proceeds in the quarter to 31 December

2016 of GBP263 million, taking total cash proceeds received in the

nine months to 31 December 2016 to GBP917 million. In addition, we

announced the disposal of Lekolar in January 2017 for proceeds of

c.GBP33 million.

Realisation proceeds

GBPm

============================================= ======================

Full realisations

Go Outdoors 21

Loxam 40

Other 4

Partial realisations

Refresco 11

Refinancings

Action 187

============================================ ======================

Total Q3 2017 cash proceeds 263

============================================= ======================

H1 2017 cash proceeds 654

Total cash proceeds as at 31 December 2016 917

============================================= ======================

In October 2016, we announced an implementation agreement to

sell ACR to two Shenzhen-government sponsored investment companies.

The transaction is subject to a number of regulatory approvals

including the National Development and Reform Commission ("NDRC")

authorisation to remit renminbi outside of China. The recent

tightening of NDRC policy means that inevitably the approval

process will take longer than previously anticipated. As a result,

we have not valued the investment on an imminent sales basis at 31

December 2016.

Top 10 investments by value at 31 December 2016

Valuation Valuation

Valuation Valuation Sep-16 Dec-16

basis currency GBPm GBPm Activity in the quarter

======================= =========== =========== ========== ========== ===========================================

Action Earnings EUR 1,549 1,369 Refinancing returned GBP187m of proceeds

to 3i

======================= =========== =========== ========== ========== ===========================================

3i Infrastructure plc Quoted GBP 673 648

======================= =========== =========== ========== ========== ===========================================

Scandlines DCF EUR 434 443

======================= =========== =========== ========== ========== ===========================================

Q Holding Earnings USD 134 209 Further investment of GBP62m to support

Q Holding's acquisition of Degania in

December 2016

======================= =========== =========== ========== ========== ===========================================

Weener Plastic Earnings EUR 187 189

======================= =========== =========== ========== ========== ===========================================

Basic-Fit Quoted EUR 195 182

======================= =========== =========== ========== ========== ===========================================

Audley Travel Earnings GBP 162 168

======================= =========== =========== ========== ========== ===========================================

Schlemmer Earnings EUR 157 156

======================= =========== =========== ========== ========== ===========================================

BoConcept Earnings DKK 133 138

======================= =========== =========== ========== ========== ===========================================

ATESTEO Earnings EUR 115 136

======================= =========== =========== ========== ========== ===========================================

The top 10 investments in this table comprise 74% (30 September

2016: 74%) of the total Proprietary Capital portfolio by value.

This table does not include ACR, which has been excluded for

commercial reasons.

Total return and NAV position

The foreign exchange impact was flat in the quarter despite

intra-period volatility. Based on the balance sheet at 31 December

2016, a 1% movement in the euro and US dollar would result in a

total return movement of GBP28 million and GBP8 million

respectively.

Altogether the diluted NAV per share increased to 558 pence (30

September 2016: 551 pence) and 550 pence ex-dividend.

Balance sheet and dividend

The Group's balance sheet remains well funded. Net cash

increased to GBP348 million, following good levels of realised

proceeds in the quarter. Liquidity remained strong at GBP1,517

million. The 8 pence FY2017 interim dividend (GBP77 million) was

paid on 4 January 2017 and our EUR310 million bond, due in March

2017, will be repaid out of cash resources.

-S -

Notes

1. Balance sheet values are stated net of foreign exchange translation. Where applicable, the

GBP equivalents at 31 December 2016 in this update have been calculated at a currency exchange

rate of EUR1.1690:GBP1 and $1.2338:GBP1 respectively. At 31 December 2016, 56% of the Group's

net assets were in euro and 15% were in US dollar.

2. At 31 December 2016, 3i had 966.5 million diluted shares.

3. Valuations based on earnings use the 12 months to 30 September 2016 financials, unless forecast

data provides a more reliable picture of maintainable earnings.

4. Action was valued using a post discount run-rate EBITDA multiple of 15.8x based on its 30

September 2016 run rate earnings.

For further information, please contact:

Silvia Santoro

Investor Relations Director

Tel: 020 7975 3258

Kathryn van der Kroft

Communications Director

Tel: 020 7975 3021

About 3i Group

3i is a leading international investment manager focused on

mid-market Private Equity and Infrastructure. Our core investment

markets are northern Europe and North America. For further

information, please visit: www.3i.com.

All statements in this performance update relate to the three

month period ended 31 December 2016 unless otherwise stated. The

financial information is unaudited and is presented on 3i's

non-GAAP Investment basis in order to provide users with the most

appropriate description of the drivers of 3i's performance. Net

asset value ("NAV") and total return are the same on the Investment

basis and on an IFRS basis. Details of the differences between 3i's

consolidated financial statements prepared on an IFRS basis and

under the Investment basis are provided in the 2016 Annual report

and accounts. There have been no material changes to the financial

position of 3i from the end of this quarter to the date of this

announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSEIFWIFWSEIF

(END) Dow Jones Newswires

January 26, 2017 02:00 ET (07:00 GMT)

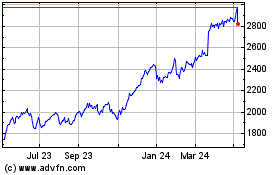

3i (LSE:III)

Historical Stock Chart

From Mar 2024 to Apr 2024

3i (LSE:III)

Historical Stock Chart

From Apr 2023 to Apr 2024