VCA Inc. Announces New $1.68 Billion Senior Credit Facility

June 29 2016 - 1:27PM

Business Wire

VCA Inc. (NASDAQ: WOOF), a leading animal healthcare

company in the United States and Canada, today announced that it

has increased its credit facility by approximately $300 million by

entering into a new $1.68 billion senior credit facility comprised

of $880 million of senior term notes and an $800 million revolving

facility. A portion of the proceeds of the new credit facility will

be used to retire the outstanding term notes and revolving facility

under the Company’s existing credit facility. The new senior term

loan and revolving facility are priced initially at LIBOR plus 175

basis points but will change depending on the Company’s ratio of

debt to EBITDA.

Bob Antin, Chairman and CEO, stated, “I am pleased that, as a

result of our consistently increasing operating results and cash

flow and the outstanding efforts of Bank of America Merrill Lynch,

J.P. Morgan Securities LLC, Barclays, SunTrust Robinson Humphrey

and Wells Fargo, we were able to increase our credit facility by

$300 million. We now have $425 million available on our revolving

facility which, along with our strong free cash flow, gives us the

financial flexibility to continue to grow our business while

optimizing our capital structure.

“Following our recently completed acquisition of an 80% interest

in Companion Animal Practices, North America (CAPNA) for $344

million and the acquisition of an additional $108 million of

hospital revenue during the first two quarters of this year, the

additional capacity under our new revolving facility enables us to

continue to focus on executing our disciplined capital deployment

strategy moving forward.”

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements are not historical facts and

are inherently uncertain and out of our control. Any or all of our

forward-looking statements in this press release may turn out to be

wrong. They can be affected by inaccurate assumptions we might make

or by known or unknown risks and uncertainties. Actual future

results may vary materially. Among other factors that could cause

our actual results to differ from this forward-looking information

are: the continued effects of the economic uncertainty prevailing

in regions in which we operate; our ability to execute on our

growth strategy and to manage acquired operations; changes in

demand for our products and services; fluctuations in our revenue

adversely affecting our gross profit, operating income and margins;

and the effects of the other factors discussed in our Annual Report

on Form 10-K, Reports on Form 10-Q and our other filings with the

SEC.

About VCA

VCA is a leading animal healthcare company with operations in

the United States and Canada. Through VCA Animal Hospitals, VCA

owns, operates and manages the largest network of free-standing

veterinary hospitals in the United States and Canada, while its

Antech Diagnostics division operates the preeminent network of

veterinary exclusive clinical laboratories in North America. VCA

also supplies diagnostic imaging equipment to the veterinary

industry through its Sound™ division, and through Camp Bow Wow

franchises a premier provider of pet services including dog day

care, overnight boarding, grooming, and other ancillary services at

specially designed pet care facilities. For further information on

VCA and its various businesses, visit its website at www.vca.com.

Source: VCA Inc.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160629006237/en/

VCA Inc.Tomas FullerChief Financial Officer(310) 571-6505

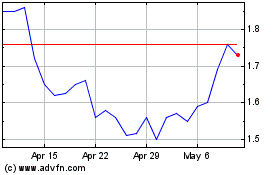

Petco Health and Wellness (NASDAQ:WOOF)

Historical Stock Chart

From Mar 2024 to Apr 2024

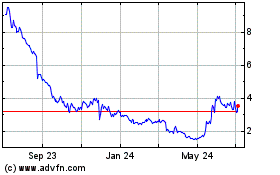

Petco Health and Wellness (NASDAQ:WOOF)

Historical Stock Chart

From Apr 2023 to Apr 2024