- Revenue increased 10.4% to a third

quarter record of $551.7 million

- Gross profit increased 11.2% to $137.7

million

- Operating income increased 81.5% to

$97.1 million

- Non-GAAP operating income increased

14.7% to $98.4 million

- Diluted earnings per common share

increased 116.1% to $0.67

- Non-GAAP diluted earnings per common

share increased 21.4% to $0.68

VCA Inc. (NASDAQ: WOOF), a leading animal

healthcare company in the United States and Canada, today reported

financial results for the third quarter ended September 30, 2015,

as follows: revenue increased 10.4% to a third quarter record of

$551.7 million; gross profit increased 11.2% to $137.7 million;

operating income increased 81.5% to $97.1 million; net income

increased 99.8% to $54.9 million; diluted earnings per common share

increased 116.1% to $0.67.

Our results for the quarter included business interruption

proceeds of $4.5 million, $2.8 million net of tax, or $0.03 per

diluted common share. Our results for the 2014 quarter included a

non-cash impairment charge of $27.0 million, $17.0 million net of

tax, or $0.20 per diluted common share; debt retirement costs of

$1.7 million, $1.0 million net of tax, or $0.01 per diluted common

share. Excluding these items and acquisition-related amortization

expense, our Non-GAAP gross profit increased 11.2% to $143.4

million; Non-GAAP operating income increased 14.7% to $98.4

million; Non-GAAP net income increased 14.2% to $55.6 million; and

Non-GAAP diluted earnings per common share increased 21.4% to

$0.68.

Bob Antin, Chairman and CEO, stated, "We had another excellent

quarter. We continued to experience robust organic revenue growth

rates in our Animal Hospital and Laboratory business segments. We

remain very optimistic with respect to our results for the full

year ended December 2015.

"Animal Hospital revenue in the third quarter increased 11.6%,

to $441.9 million, driven by acquisitions made during the past 12

months and same-store revenue growth of 5.4%. Our same-store gross

profit margin was 17.3%, slightly down from 17.5% in the prior-year

quarter and our total gross margin decreased to 17.0%, from 17.3%

in the prior-year quarter. During the 2015 third quarter, we

acquired 19 independent animal hospitals which had historical

combined annual revenue of $43.6 million.

"Laboratory revenue increased 9.1%, to $100.3 million. Our

Laboratory internal revenue growth increased 6.0% to $97.4 million

from $91.9 million; laboratory gross profit margin increased 220

basis points to 51.2%, from 49.0%; and our operating margin

increased 210 basis points to 41.7%, from 39.6% in the prior-year

quarter.

"During the quarter we repurchased 1,030,000 shares of our

common stock for $58.5 million. Since the Board authorized our

repurchase programs in April 2013, through the end of the third

quarter 2015, we have acquired 10.1 million shares for $424.2

million.

"Our financial results for the nine months ended September 30,

2015 are as follows: revenue increased 11.2% to $1.6 billion; gross

profit increased 13.5% to $392.4 million; operating income

increased 35.3% to $263.4 million; net income increased 37.7% to

$147.5 million; and diluted earnings per common share increased

47.1% to $1.78. Our financial results for the nine months ended

September 30, 2015, on a Non-GAAP basis, are as follows: gross

profit increased 13.4% to $409.4 million, operating income

increased 16.4% to $276.1 million, net income increased 15.2% to

$155.2 million, and Non- GAAP diluted earnings per common share

increased 23.7% to $1.88."

2015 Guidance

We reaffirm our previously provided guidance as follows:

• Revenue from $2.12 billion to $2.13 billion;

• Net income from $172 million to $181 million;

• Diluted earnings per common share from $2.08 to $2.18; and

• Non-GAAP diluted earnings per common share of $2.25 to

$2.35

Non-GAAP Financial Measures

We believe investors’ understanding of our total performance is

enhanced by disclosing Non-GAAP financial measures including

Non-GAAP net income, Non-GAAP gross profit, Non-GAAP operating

income and Non-GAAP diluted earnings per common share. We define

these adjusted measures as the reported amounts, adjusted to

exclude certain significant items and amortization of intangibles

acquired in acquisitions.

Management believes these adjusted measures are useful to

management and investors in evaluating the Company's operational

performance and their use provides an additional tool for

evaluating the Company's operating results and trends. As a result,

these Non-GAAP financial measures help to provide meaningful

comparisons of our overall performance from one reporting period to

another and meaningful assessments of related trends.

There is a material limitation associated with the use of these

Non-GAAP financial measures: our adjusted measures exclude the

impact of these significant items, and as a result, our computation

of adjusted diluted earnings per common share does not depict

diluted earnings per common share in accordance with GAAP.

To compensate for the limitations in the Non-GAAP financial

measures discussed above, our disclosures provide a complete

understanding of all adjustments found in Non-GAAP financial

measures, and we reconcile the Non-GAAP financial measures to the

GAAP financial measures in the attached financial schedules titled

“Supplemental Operating Data.”

Conference Call

We will discuss our third quarter 2015 financial results during

a conference call today, October 28th, at 9:00 a.m. Eastern Time. A

live broadcast of the call may be accessed by visiting our website

at investor.vca.com. The call may also be accessed by dialing (877)

293-5492. Interested parties should call at least ten minutes prior

to the start of the call to register. Replay of the webcast will be

available for ninety days by visiting the company's website.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Among the forward-looking statements in this press release

are statements addressing our 2015 guidance and plans,

expectations, future financial position and results of operation.

These forward-looking statements are not historical facts and are

inherently uncertain and out of our control. Any or all of our

forward-looking statements in this press release may turn out to be

wrong. They can be affected by inaccurate assumptions we might make

or by known or unknown risks and uncertainties. Actual future

results may vary materially. Among other factors that could cause

our actual results to differ from this forward-looking information

are: the continued effects of the economic uncertainty prevailing

in regions in which we operate; our ability to execute on our

growth strategy and to manage acquired operations; changes in

demand for our products and services; fluctuations in our revenue

adversely affecting our gross profit, operating income and margins;

and the effects of the other factors discussed in our Annual Report

on Form 10-K, Reports on Form 10-Q and our other filings with the

SEC.

About VCA Inc.

We own, operate and manage the largest networks of freestanding

veterinary hospitals and veterinary-exclusive clinical laboratories

in the country, additionally we are the largest provider of online

communication, professional education and marketing solutions to

the veterinary community. We also supply diagnostic imaging

equipment to the veterinary industry.

VCA Inc. Condensed, Consolidated Income

Statements (Unaudited)

(In thousands, except per share

amounts)

Three Months EndedSeptember

30, Nine Months EndedSeptember 30, 2015

2014 2015 2014

Revenue: Animal hospital $ 441,924 $ 395,820 $ 1,270,326 $

1,134,184 Laboratory 100,309 91,903 300,503 276,392 All other

30,838 30,081 93,734 81,914 Intercompany (21,354 ) (18,227 )

(64,608 ) (53,934 ) 551,717 499,577 1,599,955

1,438,556 Direct costs 414,051 375,820 1,207,580

1,092,933 Gross profit: Animal hospital 74,941 68,537

203,810 180,673 Laboratory 51,408 45,024 156,093 137,147 All other

11,761 10,136 34,574 27,753 Intercompany (444 ) 60 (2,102 )

50 137,666 123,757 392,375 345,623

Selling, general and administrative expense: Animal

hospital 10,677 9,269 32,351 28,261 Laboratory 9,542 8,610 27,894

24,909 All other 7,660 8,023 24,088 23,782 Corporate 16,981

16,890 49,410 47,211 44,860 42,792

133,743 124,163 Impairment of goodwill

and other long-lived assets — 27,019 — 27,019 Business interruption

insurance proceeds, net (4,523 ) — (4,523 ) — Net loss (gain) on

sale or disposal of assets 250 470 (234 ) (173 )

Operating income 97,079 53,476 263,389 194,614 Interest expense,

net 5,455 4,367 15,396 12,564 Debt retirement costs — 1,709 — 1,709

Other expense 59 188 88 178 Income

before provision for income taxes 91,565 47,212 247,905 180,163

Provision for income taxes 35,097 18,261 95,961

69,389 Net income 56,468 28,951 151,944 110,774 Net

income attributable to noncontrolling interests 1,614 1,499

4,490 3,695 Net income attributable to VCA

Inc. $ 54,854 $ 27,452 $ 147,454 $ 107,079

Diluted earnings per share $ 0.67 $ 0.31

$ 1.78 $ 1.21 Weighted-average shares

outstanding for diluted earnings per share 81,795 87,360

82,744 88,665

VCA Inc.

Condensed, Consolidated Balance Sheets (Unaudited)

(In thousands)

September 30, 2015

December 31, 2014 Assets Current assets: Cash

and cash equivalents $ 74,992 $ 81,383 Trade accounts receivable,

net 74,654 60,482 Inventory 51,597 56,050 Prepaid expenses and

other 30,827 36,924 Deferred income taxes 30,329 30,331 Prepaid

income taxes — 18,277 Total current assets 262,399

283,447 Property and equipment, net 492,532 468,041 Other assets:

Goodwill 1,489,843 1,415,861 Other intangible assets, net 100,939

88,175 Notes receivable 2,345 2,807 Deferred financing costs, net

6,568 7,874 Other 76,564 65,815 Total assets $

2,431,190 $ 2,332,020

Liabilities and Equity

Current liabilities: Current portion of long-term debt $ 34,043 $

19,356 Accounts payable 45,512 46,284 Accrued payroll and related

liabilities 82,966 64,359 Income tax payable 1,827 — Other accrued

liabilities 75,179 67,219 Total current liabilities

239,527 197,218 Long-term debt, less current portion 847,112

775,412 Deferred income taxes 104,425 103,502 Other liabilities

31,969 33,190 Total liabilities 1,223,033 1,109,322

Redeemable noncontrolling interests 11,273 11,077 VCA Inc.

stockholders’ equity: Common stock 81 83 Additional paid-in capital

16,135 155,802 Retained earnings 1,211,612 1,064,158 Accumulated

other comprehensive loss (43,909 ) (19,397 ) Total VCA Inc.

stockholders’ equity 1,183,919 1,200,646 Noncontrolling interests

12,965 10,975 Total equity 1,196,884 1,211,621

Total liabilities and equity $ 2,431,190 $ 2,332,020

VCA Inc. Condensed, Consolidated Statements

of Cash Flows (Unaudited)

(In thousands)

Nine Months EndedSeptember 30,

2015 2014 Cash flows from operating

activities: Net income $ 151,944 $ 110,774 Adjustments to reconcile

net income to net cash provided by operating activities: Impairment

of goodwill and other long-lived assets — 27,019 Depreciation and

amortization 60,634 59,659 Amortization of debt issue costs 1,306

957 Provision for uncollectible accounts 6,723 4,388 Debt

retirement costs — 1,709 Net gain on sale or disposal of assets

(234 ) (173 ) Share-based compensation 12,086 12,234 Excess tax

benefit from stock based compensation (8,008 ) (3,808 ) Other (431

) 381 Changes in operating assets and liabilities: Trade accounts

receivable (20,568 ) (9,678 ) Inventory, prepaid expense and other

assets (931 ) (8,233 ) Accounts payable and other accrued

liabilities (2,451 ) 2,920 Accrued payroll and related liabilities

18,892 14,761 Income taxes 28,054 12,137 Net cash

provided by operating activities 247,016 225,047 Cash

flows from investing activities: Business acquisitions, net of cash

acquired (119,336 ) (65,415 ) Property and equipment additions

(61,470 ) (50,093 ) Proceeds from sale of assets 6,469 4,464 Other

(434 ) (202 ) Net cash used in investing activities (174,771 )

(111,246 ) Cash flows from financing activities: Repayment of debt

(20,174 ) (563,976 ) Proceeds from issuance of long-term debt —

600,000 Proceeds from revolving credit facility 97,000 — Payment of

financing costs — (7,987 ) Distributions to non-controlling

interest partners (3,810 ) (3,577 ) Purchase of non-controlling

interests (1,493 ) (326 ) Proceeds from issuance of common stock

under stock option plans 1,571 926 Excess tax benefit from stock

based compensation 8,008 3,808 Repurchase of common stock (161,117

) (139,910 ) Other 2,210 (838 ) Net cash used in financing

activities (77,805 ) (111,880 ) Effect of currency exchange rate

changes on cash and cash equivalents (831 ) (443 ) (Decrease)

increase in cash and cash equivalents (6,391 ) 1,478 Cash and cash

equivalents at beginning of period 81,383 125,029

Cash and cash equivalents at end of period $ 74,992 $

126,507

VCA Inc. Supplemental Operating

Data

(Unaudited - In thousands, except per

share amounts)

Table

#1 Reconciliation of net income attributable to Three

Months EndedSeptember 30, Nine Months

EndedSeptember 30, VCA Inc., to Non-GAAP net income

attributable to VCA Inc. (1) 2015

2014 2015 2014 Net income attributable

to VCA Inc. $ 54,854 $ 27,452 $ 147,454 $ 107,079 Impairment of

goodwill and other long-lived assets (2) — 27,019 — 27,019 Tax

benefit on impairment charge (2) — (9,978 ) — (9,978 ) Debt

retirement costs (3) — 1,709 — 1,709 Tax benefit from debt

retirement costs (3) — (669 ) — (669 ) Business interruption

proceeds (4) (4,523 ) — (4,523 ) — Tax expense on business

interruption proceeds (4) 1,771 — 1,771 — Acquisitions related

amortization (1) 5,811 5,231 17,195 15,605 Tax benefit from

acquisitions related amortization (1) (2,274 ) (2,047 ) (6,730 )

(6,108 ) Non-GAAP net income attributable to VCA Inc. $ 55,639

$ 48,717 $ 155,167 $ 134,657

Table #2 Three Months EndedSeptember 30,

Nine Months EndedSeptember 30, Reconciliation of

diluted earnings per share to Non-GAAP diluted earnings per

share (1) 2015 2014 2015

2014 Diluted earnings per share $ 0.67 $ 0.31 $ 1.78

$ 1.21 Impact of impairment charge, net of tax (2) — 0.20 — 0.19

Impact of debt retirement costs, net of tax (3) — 0.01 — 0.01

Impact of business interruption proceeds, net of tax (4) (0.03 ) —

(0.03 ) — Impact of acquisitions related amortization, net of tax

(1) 0.04 0.04 0.13 0.11 Non-GAAP

diluted earnings per share $ 0.68 $ 0.56 $ 1.88

$ 1.52 Shares used for computing diluted earnings per

share 81,795 87,360 82,744 88,665

Table #3 Three Months EndedSeptember

30, Nine Months EndedSeptember 30,

Reconciliation of consolidated gross profit to Non-GAAP

consolidated gross profit (1) 2015 2014

2015 2014 Consolidated gross profit $ 137,666

$ 123,757 $ 392,375 $ 345,623 Impact of acquisitions related

amortization (1) 5,750 5,166 17,013 15,406

Non-GAAP consolidated gross profit $ 143,416 $

128,923 $ 409,388 $ 361,029 Non-GAAP

consolidated gross profit margin 26.0% 25.8% 25.6% 25.1%

Table #4 Three Months EndedSeptember 30,

Nine Months EndedSeptember 30, Reconciliation of

consolidated operating income to Non-GAAP consolidated

operating income (1) 2015 2014 2015

2014 Consolidated operating income $ 97,079 $ 53,476

$ 263,389 $ 194,614 Impact of impairment charge (2) — 27,019 —

27,019 Impact of business interruption proceeds (4) (4,523 ) —

(4,523 ) — Impact of acquisitions related amortization (1) 5,811

5,231 17,195 15,605 Non-GAAP

consolidated operating income $ 98,367 $ 85,726 $

276,061 $ 237,238 Non-GAAP consolidated operating

margin 17.8% 17.2% 17.3% 16.5%

_________________________________________________

(1)

Management believes that investors'

understanding of our performance is enhanced by disclosing adjusted

measures as the reported amounts, adjusted to exclude certain

significant items and acquisition-related amortization. Non-GAAP

net income, Non-GAAP diluted earnings per common share, Non-GAAP

consolidated gross profit and Non-GAAP consolidated operating

income measures are not, and should not be viewed as substitutes

for U.S. generally accepted accounting principles (GAAP) net

income, its components and diluted earnings per share.

(2)

We recognized a non-cash impairment charge

of $27.0 million related to the write-down of goodwill and other

long-lived assets in our Vetstreet business.

(3)

We incurred debt retirement costs of $1.7

million related to the refinancing of our senior credit

facility.

(4)

We received insurance proceeds related to

the fire that damaged the headquarters of our Medical Technology

business resulting in a net gain of $4.5 million.

VCA Inc. Supplemental Operating Data (cont)

(Unaudited - In thousands, except per

share amounts)

As of Table #5

September 30, 2015 December

31, 2014 Selected consolidated balance sheet data

Debt: Senior term notes $ 592,500 $ 600,000 Revolving credit

232,000 135,000 Other debt and capital leases 56,655 59,768

Total debt $ 881,155 $ 794,768

Three

Months EndedSeptember 30, Nine Months

EndedSeptember 30, Table #6 Selected expense

data 2015 2014 2015 2014

Rent expense $ 19,140 $ 17,476 $ 56,761 $

51,284

Depreciation and amortization included in

direct costs:

Animal hospital $ 16,465 $ 15,044 $ 48,808 $ 44,573 Laboratory

2,701 2,650 7,852 7,709 All other 968 1,505 2,871 4,907

Intercompany (549 ) (479 ) (1,602 ) (1,417 ) $ 19,585 $ 18,720 $

57,929 $ 55,772

Depreciation and amortization included in

selling, general and administrative expense

886 1,142 2,705 3,887 Total

depreciation and amortization $ 20,471 $ 19,862 $

60,634 $ 59,659 Share-based compensation

included in direct costs: Laboratory $ 144 $ 154 $ 468 $ 437

Share-based compensation included in

selling, general and administrative expense:

Animal hospital 644 470 1,981 1,411 Laboratory 364 340 1,106 1,073

All other 226 232 626 605 Corporate 2,439 2,467 7,905

8,708 3,673 3,509 11,618 11,797

Total share-based compensation $ 3,817 $ 3,663

$ 12,086 $ 12,234

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151028005336/en/

VCA Inc.Tomas Fuller, 310-571-6505Chief Financial Officer

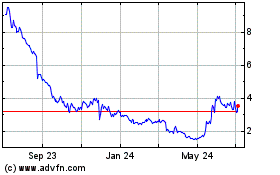

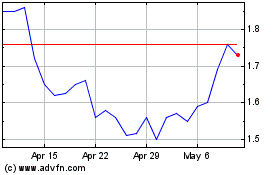

Petco Health and Wellness (NASDAQ:WOOF)

Historical Stock Chart

From Aug 2024 to Sep 2024

Petco Health and Wellness (NASDAQ:WOOF)

Historical Stock Chart

From Sep 2023 to Sep 2024