UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to

Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of

earliest event reported): January 28, 2016

|

UNITED SECURITY BANCSHARES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

0-14549

|

63-0843362

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification Number)

|

131 West Front Street, P.O. Box 249, Thomasville, Alabama 36784

(Address

of principal executive offices, including zip code)

(334)

636-5424

(Registrant’s telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On January 28, 2016, United Security Bancshares, Inc. issued a press

release announcing financial results for the fourth quarter and year

ended December 31, 2015. The press release is attached as Exhibit 99.1

to this Form 8-K and is furnished to, but not filed with, the

Commission.

Item 9.01 Financial Statements and Exhibits.

|

(d)

|

Exhibits.

|

|

|

|

|

|

|

|

Exhibit Number

|

Exhibit

|

|

|

99.1

|

Press Release dated January 28, 2016

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

UNITED SECURITY BANCSHARES, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas S. Elley

|

|

|

|

|

|

Name:

|

Thomas S. Elley

|

|

|

|

|

|

|

Vice President, Treasurer and Assistant Secretary,

Chief

Financial Officer and Principal Accounting Officer

|

Dated: January 28, 2016

INDEX TO EXHIBITS

|

Exhibit Number

|

Exhibit

|

|

99.1

|

Press Release dated January 28, 2016*

|

*This exhibit is furnished to, but not filed with, the Commission by

inclusion herein.

Exhibit 99.1

United

Security Bancshares, Inc. Reports Fourth Quarter and Year-End Results

Reports

Fourth Quarter Loan Growth and Continued Reductions in Non-Performing

Assets

THOMASVILLE, Ala.--(BUSINESS WIRE)--January 28, 2016--United Security

Bancshares, Inc. (Nasdaq: USBI) today reported net income of $2.6

million, or $0.41 per diluted share, for the year ended December 31,

2015, compared to net income of $3.5 million, or $0.57 per diluted

share, for the year ended December 31, 2014. Net income for the fourth

quarter of 2015 totaled $441,000, or $0.07 per diluted share, compared

to $720,000, or $0.12 per diluted share, for the fourth quarter of 2014.

Fourth Quarter Highlights

-

Net loans increased during the fourth quarter by $17.7 million, or

29.8% on an annualized basis. For the year ended December 31, 2015,

net loans declined by $4.1 million, or 1.6%.

-

Non-performing assets decreased by $1.7 million during the fourth

quarter and by $5.2 million for the year ended December 31, 2015.

Non-performing assets as a percentage of total assets were reduced to

1.59% as of December 31, 2015, compared to 1.98% as of September 30,

2015 and 2.50% as of December 31, 2014.

-

During the fourth quarter, First US Bank’s new branch in downtown

Tuscaloosa, Alabama became operational, and renovations to the Bank’s

main office in Thomasville, Alabama were completed.

“We are pleased to report significant loan growth in the fourth quarter,

as well as continued improvement in asset quality,” said James F. House,

President and Chief Executive Officer of United Security Bancshares,

Inc. “Our efforts to resolve problem assets over the past several years

have resulted in reductions in non-performing assets at a faster pace

than we originally expected. As a result, we have now begun to focus

more effort on generating quality loans. We expect that continued

progress in reducing non-performing assets, combined with focused

efforts on quality commercial loan generation, will contribute to future

growth in earnings.”

“Earnings in 2015 were below last year’s results due primarily to

decreased loan volume at First US Bank. Although we had substantial

growth in the Bank’s loan portfolio during the fourth quarter, we

experienced decreases during the first three quarters of the year. A

portion of these decreases resulted from the continued resolution of

problem assets and the migration of loans off of the balance sheet that

did not meet the Bank’s current credit standards. At this point, we

believe that the Bank is well-positioned to expand its commercial loan

production capabilities. We are already beginning to see increased

opportunity from the Bank’s new location in downtown Tuscaloosa, and we

continue to look for opportunities to expand in other markets as well.

We also remain optimistic about opportunities for expanding our consumer

loan portfolio through our subsidiary, Acceptance Loan Company, Inc.

(“ALC”). ALC experienced consistent loan growth through 2015, ending the

year with net loans of $81.7 million, an increase of 13% over December

31, 2014,” continued Mr. House.

Results of Operations

-

Pre-provision net interest income totaled $7.0 million for the fourth

quarter of 2015, compared to $6.8 million for the prior quarter and

$7.1 million for the fourth quarter of 2014. The increase compared to

the prior quarter was attributable to loan growth in the fourth

quarter. However, average loan volumes remained below levels

experienced in the fourth quarter of 2014.

-

Net interest income after the provision for loan losses totaled $6.5

million for the fourth quarter of 2015, compared to $6.8 million in

the prior quarter and $7.2 million in the fourth quarter of 2014. The

reduction compared to both prior quarters resulted primarily from

increased loan loss provisioning. The provision for loan losses

totaled $415,000 for the fourth quarter of 2015, compared to

reductions in reserves during the prior quarter and fourth quarter of

2014 totaling $78,000 and $169,000, respectively. For the year ended

December 31, 2015, the provision for loan losses totaled $216,000,

compared to reductions in reserves of $74,000 for the year ended

December 31, 2014.

-

Non-interest income totaled $1.2 million for the fourth quarter of

2015, compared to $1.0 million in the prior quarter and $1.3 million

in the fourth quarter of 2014. For the year ended December 31, 2015,

non-interest income totaled $4.5 million, compared to $5.1 million for

the year ended December 31, 2014. The reduction in 2015 resulted

primarily from reduced revenues from service charges on deposit

accounts and credit insurance income.

-

Non-interest expense totaled $7.2 million in the fourth quarter of

2015, compared to $7.1 million in the prior quarter and $7.2 million

in the fourth quarter of 2014. For the year ended December 31, 2015,

non-interest expense totaled $28.4 million, compared to $28.6 million

for the year ended December 31, 2014.

-

The provision for income taxes totaled $1.0 million for the year ended

December 31, 2015, compared to $1.8 million in the prior year. The

Company’s effective tax rate was 26.8% in 2015, compared to 34.0% in

2014. The reduction in effective rate resulted primarily from

increases in favorable permanent tax items (primarily tax-exempt

interest) as a percentage of pre-tax income.

-

Return on average assets was 0.46% for 2015, compared to 0.63% for

2014.

Balance Sheet Management

-

The Bank maintained capital ratios at a higher level than ratios

required to be considered a “well-capitalized” institution under the

applicable regulatory framework. As of December 31, 2015, both the

Bank’s common equity Tier 1 capital and Tier 1 risk-based capital

ratios were 22.19%, while the Bank’s total capital ratio was 23.35%

and Tier 1 leverage ratio was 13.02%.

-

Deposit levels declined slightly year over year, totaling $479.3

million as of December 31, 2015, compared to $483.7 million as of

December 31, 2014, a decrease of 0.9%. In addition to deposits, the

Bank maintains significant external sources of liquidity, including

access to funding through federal funds lines, Federal Home Loan Bank

advances and brokered deposits.

-

Investment securities were maintained at consistent levels throughout

2015, totaling $231.2 million as of December 31, 2015, compared to

$234.1 million as of December 31, 2014. The investment securities

portfolio both enhances interest income and serves as an additional

source of liquidity.

-

Shareholders’ equity increased to $76.3 million, or $12.65 per share,

at December 31, 2015, compared to $75.2 million, or $12.45 per share,

at December 31, 2014. The increase in shareholders’ equity resulted

from continued growth in retained earnings, offset partially by a $1.3

million decrease in other comprehensive income that resulted from a

decrease in the market value of investment securities

available-for-sale.

-

The Company declared a cash dividend of $0.02 per share on its common

stock in each quarter of 2015. Dividends declared for the year ended

December 31, 2015 totaled $0.08, compared to $0.03 for the year ended

December 31, 2014.

About United Security Bancshares, Inc.

United Security Bancshares, Inc. is a bank holding company that operates

twenty banking offices in Alabama through First US Bank. In addition,

the Company’s operations include Acceptance Loan Company, Inc., a

consumer loan company, and FUSB Reinsurance, Inc., an underwriter of

credit life and credit accident and health insurance policies sold to

the Bank’s and ALC’s consumer loan customers. The Company’s stock is

traded on the Nasdaq Capital Market under the symbol “USBI.”

Forward-Looking Statements

This press release contains forward-looking statements, as defined by

federal securities laws. Statements contained in this press release that

are not historical facts are forward-looking statements. These

statements may address issues that involve significant risks,

uncertainties, estimates and assumptions made by management. The

Company undertakes no obligation to update these statements following

the date of this press release, except as required by law. In

addition, the Company, through its senior management, may make from time

to time forward-looking public statements concerning the matters

described herein. Such forward-looking statements are necessarily

estimates reflecting the best judgment of the Company’s senior

management based upon current information and involve a number of risks

and uncertainties. Certain factors that could affect the accuracy

of such forward-looking statements are identified in the public filings

made by the Company with the Securities and Exchange Commission, and

forward-looking statements contained in this press release or in other

public statements of the Company or its senior management should be

considered in light of those factors. Specifically, with respect

to statements relating to loan demand, growth and earnings potential,

geographic expansion and the adequacy of the allowance for loan losses

for the Company, these factors include, but are not limited to, the rate

of growth (or lack thereof) in the economy generally and in the Bank’s

and ALC’s service areas, the availability of quality loans in the Bank’s

and ALC’s service areas, the relative strength and weakness in the

consumer and commercial credit sectors and in the real estate markets

and collateral values. There can be no assurance that such

factors or other factors will not affect the accuracy of such

forward-looking statements.

|

|

|

|

|

|

UNITED SECURITY BANCSHARES, INC. AND SUBSIDIARIES

SELECTED FINANCIAL DATA – LINKED QUARTERS

(Dollars in Thousands, Except Per Share Data)

|

|

|

|

|

|

|

|

|

|

Quarter Ended

|

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

December 31,

|

|

|

September 30,

|

|

|

June 30,

|

|

|

March 31,

|

|

|

December 31,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

Results of Operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

$

|

7,513

|

|

|

|

$

|

7,328

|

|

|

|

$

|

7,735

|

|

|

|

$

|

7,321

|

|

|

|

$

|

7,686

|

|

|

Interest expense

|

|

|

|

549

|

|

|

|

|

561

|

|

|

|

|

565

|

|

|

|

|

614

|

|

|

|

|

636

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

|

|

6,964

|

|

|

|

|

6,767

|

|

|

|

|

7,170

|

|

|

|

|

6,707

|

|

|

|

|

7,050

|

|

|

Provision (reduction in reserve) for loan losses

|

|

|

|

415

|

|

|

|

|

(78

|

)

|

|

|

|

45

|

|

|

|

|

(166

|

)

|

|

|

|

(169

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income after provision (reduction in reserve) for loan

losses

|

|

|

|

6,549

|

|

|

|

|

6,845

|

|

|

|

|

7,125

|

|

|

|

|

6,873

|

|

|

|

|

7,219

|

|

|

Non-interest income

|

|

|

|

1,176

|

|

|

|

|

996

|

|

|

|

|

1,068

|

|

|

|

|

1,291

|

|

|

|

|

1,279

|

|

|

Non-interest expense

|

|

|

|

7,203

|

|

|

|

|

7,090

|

|

|

|

|

7,107

|

|

|

|

|

6,977

|

|

|

|

|

7,246

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

|

522

|

|

|

|

|

751

|

|

|

|

|

1,086

|

|

|

|

|

1,187

|

|

|

|

|

1,252

|

|

|

Provision for income taxes

|

|

|

|

81

|

|

|

|

|

207

|

|

|

|

|

312

|

|

|

|

|

351

|

|

|

|

|

532

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

$

|

441

|

|

|

|

$

|

544

|

|

|

|

$

|

774

|

|

|

|

$

|

836

|

|

|

|

$

|

720

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per share

|

|

|

$

|

0.07

|

|

|

|

$

|

0.09

|

|

|

|

$

|

0.13

|

|

|

|

$

|

0.14

|

|

|

|

$

|

0.12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted net income per share

|

|

|

$

|

0.07

|

|

|

|

$

|

0.09

|

|

|

|

$

|

0.12

|

|

|

|

$

|

0.13

|

|

|

|

$

|

0.12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared

|

|

|

$

|

0.02

|

|

|

|

$

|

0.02

|

|

|

|

$

|

0.02

|

|

|

|

$

|

0.02

|

|

|

|

$

|

0.02

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period-End Balance Sheet:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

$

|

575,782

|

|

|

|

$

|

548,537

|

|

|

|

$

|

560,650

|

|

|

|

$

|

564,882

|

|

|

|

$

|

572,609

|

|

|

Loans, net of allowance for loan losses

|

|

|

|

255,432

|

|

|

|

|

237,715

|

|

|

|

|

244,993

|

|

|

|

|

239,218

|

|

|

|

|

259,516

|

|

|

Allowance for loan losses

|

|

|

|

3,781

|

|

|

|

|

4,345

|

|

|

|

|

5,008

|

|

|

|

|

5,401

|

|

|

|

|

6,168

|

|

|

Investment securities, net

|

|

|

|

231,202

|

|

|

|

|

239,009

|

|

|

|

|

246,176

|

|

|

|

|

249,864

|

|

|

|

|

234,086

|

|

|

Total deposits

|

|

|

|

479,258

|

|

|

|

|

463,266

|

|

|

|

|

471,141

|

|

|

|

|

475,288

|

|

|

|

|

483,659

|

|

|

Long-term debt

|

|

|

|

5,000

|

|

|

|

|

-

|

|

|

|

|

5,000

|

|

|

|

|

5,000

|

|

|

|

|

5,000

|

|

|

Total shareholders’ equity

|

|

|

|

76,316

|

|

|

|

|

76,283

|

|

|

|

|

75,783

|

|

|

|

|

75,745

|

|

|

|

|

75,162

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Performance Ratios:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (annualized)

|

|

|

|

0.31

|

%

|

|

|

|

0.39

|

%

|

|

|

|

0.55

|

%

|

|

|

|

0.59

|

%

|

|

|

|

0.50

|

%

|

|

Return on average equity (annualized)

|

|

|

|

2.28

|

%

|

|

|

|

2.84

|

%

|

|

|

|

4.09

|

%

|

|

|

|

4.47

|

%

|

|

|

|

3.83

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses as % of loans

|

|

|

|

1.46

|

%

|

|

|

|

1.80

|

%

|

|

|

|

2.00

|

%

|

|

|

|

2.21

|

%

|

|

|

|

2.32

|

%

|

|

Nonperforming assets as % of total assets

|

|

|

|

1.59

|

%

|

|

|

|

1.98

|

%

|

|

|

|

1.96

|

%

|

|

|

|

2.27

|

%

|

|

|

|

2.50

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED SECURITY BANCSHARES, INC. AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollars in Thousands, Except Share and Per Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

(Unaudited)

|

|

|

|

|

ASSETS

|

|

Cash and due from banks

|

|

|

$

|

7,088

|

|

|

|

$

|

9,697

|

|

|

Interest-bearing deposits in banks

|

|

|

|

36,984

|

|

|

|

|

24,469

|

|

|

Total cash and cash equivalents

|

|

|

|

44,072

|

|

|

|

|

34,166

|

|

|

Investment securities available-for-sale, at fair value

|

|

|

|

198,843

|

|

|

|

|

204,966

|

|

|

Investment securities held-to-maturity, at amortized cost

|

|

|

|

32,359

|

|

|

|

|

29,120

|

|

|

Federal Home Loan Bank stock, at cost

|

|

|

|

1,025

|

|

|

|

|

738

|

|

|

Loans, net of allowance for loan losses of $3,781 and $6,168,

respectively

|

|

|

|

255,432

|

|

|

|

|

259,516

|

|

|

Premises and equipment, net

|

|

|

|

12,084

|

|

|

|

|

9,764

|

|

|

Cash surrender value of bank-owned life insurance

|

|

|

|

14,292

|

|

|

|

|

13,975

|

|

|

Accrued interest receivable

|

|

|

|

1,833

|

|

|

|

|

2,235

|

|

|

Other real estate owned

|

|

|

|

6,038

|

|

|

|

|

7,735

|

|

|

Other assets

|

|

|

|

9,804

|

|

|

|

|

10,394

|

|

|

Total assets

|

|

|

$

|

575,782

|

|

|

|

$

|

572,609

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

Deposits

|

|

|

$

|

479,258

|

|

|

|

$

|

483,659

|

|

|

Accrued interest expense

|

|

|

|

180

|

|

|

|

|

221

|

|

|

Other liabilities

|

|

|

|

7,674

|

|

|

|

|

8,131

|

|

|

Short-term borrowings

|

|

|

|

7,354

|

|

|

|

|

436

|

|

|

Long-term debt

|

|

|

|

5,000

|

|

|

|

|

5,000

|

|

|

Total liabilities

|

|

|

|

499,466

|

|

|

|

|

497,447

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

Common stock, par value $0.01 per share, 10,000,000 shares

authorized; 7,329,060 shares issued; 6,038,554 and 6,034,059

shares outstanding, respectively

|

|

|

|

73

|

|

|

|

|

73

|

|

|

Surplus

|

|

|

|

9,844

|

|

|

|

|

9,577

|

|

|

Accumulated other comprehensive income, net of tax

|

|

|

|

536

|

|

|

|

|

1,829

|

|

|

Retained earnings

|

|

|

|

86,693

|

|

|

|

|

84,582

|

|

|

Less treasury stock: 1,290,506 and 1,295,001 shares at cost,

respectively

|

|

|

|

(20,817

|

)

|

|

|

|

(20,886

|

)

|

|

Noncontrolling interest

|

|

|

|

(13

|

)

|

|

|

|

(13

|

)

|

|

|

|

|

|

|

|

|

|

Total shareholders’ equity

|

|

|

|

76,316

|

|

|

|

|

75,162

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity

|

|

|

$

|

575,782

|

|

|

|

$

|

572,609

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED SECURITY BANCSHARES, INC. AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in Thousands, Except Per Share Data)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

Twelve Months Ended

|

|

|

|

|

December 31,

|

|

|

December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2015

|

|

|

2014

|

|

|

|

|

(Unaudited)

|

|

|

(Unaudited)

|

|

|

|

|

Interest income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans

|

|

|

$

|

6,362

|

|

|

$

|

6,501

|

|

|

|

$

|

25,177

|

|

|

$

|

26,929

|

|

|

Interest on investment securities

|

|

|

|

1,151

|

|

|

|

1,185

|

|

|

|

|

4,720

|

|

|

|

4,432

|

|

|

Total interest income

|

|

|

|

7,513

|

|

|

|

7,686

|

|

|

|

|

29,897

|

|

|

|

31,361

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on deposits

|

|

|

|

541

|

|

|

|

628

|

|

|

|

|

2,262

|

|

|

|

2,522

|

|

|

Interest on borrowings

|

|

|

|

8

|

|

|

|

8

|

|

|

|

|

27

|

|

|

|

31

|

|

|

Total interest expense

|

|

|

|

549

|

|

|

|

636

|

|

|

|

|

2,289

|

|

|

|

2,553

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

|

|

6,964

|

|

|

|

7,050

|

|

|

|

|

27,608

|

|

|

|

28,808

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision (reduction in reserve) for loan losses

|

|

|

|

415

|

|

|

|

(169

|

)

|

|

|

|

216

|

|

|

|

(74

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income after provision (reduction in reserve) for

loan losses

|

|

|

|

6,549

|

|

|

|

7,219

|

|

|

|

|

27,392

|

|

|

|

28,882

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service and other charges on deposit accounts

|

|

|

|

453

|

|

|

|

524

|

|

|

|

|

1,844

|

|

|

|

2,096

|

|

|

Credit insurance income

|

|

|

|

162

|

|

|

|

271

|

|

|

|

|

501

|

|

|

|

694

|

|

|

Other income

|

|

|

|

561

|

|

|

|

484

|

|

|

|

|

2,186

|

|

|

|

2,301

|

|

|

Total non-interest income

|

|

|

|

1,176

|

|

|

|

1,279

|

|

|

|

|

4,531

|

|

|

|

5,091

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits

|

|

|

|

4,151

|

|

|

|

4,108

|

|

|

|

|

16,664

|

|

|

|

16,690

|

|

|

Net occupancy and equipment

|

|

|

|

769

|

|

|

|

810

|

|

|

|

|

3,116

|

|

|

|

3,226

|

|

|

Other real estate/foreclosure expense, net

|

|

|

|

213

|

|

|

|

428

|

|

|

|

|

1,027

|

|

|

|

1,077

|

|

|

Other expense

|

|

|

|

2,070

|

|

|

|

1,900

|

|

|

|

|

7,570

|

|

|

|

7,602

|

|

|

Total non-interest expense

|

|

|

|

7,203

|

|

|

|

7,246

|

|

|

|

|

28,377

|

|

|

|

28,595

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

|

522

|

|

|

|

1,252

|

|

|

|

|

3,546

|

|

|

|

5,378

|

|

|

Provision for income taxes

|

|

|

|

81

|

|

|

|

532

|

|

|

|

|

951

|

|

|

|

1,829

|

|

|

Net income

|

|

|

$

|

441

|

|

|

$

|

720

|

|

|

|

$

|

2,595

|

|

|

$

|

3,549

|

|

|

Basic net income per share

|

|

|

$

|

0.07

|

|

|

$

|

0.12

|

|

|

|

$

|

0.42

|

|

|

$

|

0.58

|

|

|

Diluted net income per share

|

|

|

$

|

0.07

|

|

|

$

|

0.12

|

|

|

|

$

|

0.41

|

|

|

$

|

0.57

|

|

|

Dividends per share

|

|

|

$

|

0.02

|

|

|

$

|

0.02

|

|

|

|

$

|

0.08

|

|

|

$

|

0.03

|

|

CONTACT:

United Security Bancshares, Inc.

Thomas S. Elley,

334-636-5424

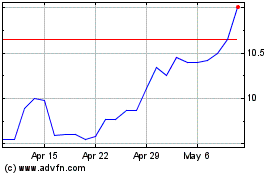

First US Bancshares (NASDAQ:FUSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

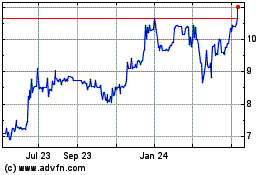

First US Bancshares (NASDAQ:FUSB)

Historical Stock Chart

From Apr 2023 to Apr 2024