UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to

Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of

earliest event reported): April 30, 2015

|

UNITED

SECURITY BANCSHARES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

0-14549

|

63-0843362

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification Number)

|

131 West Front Street, P.O. Box 249, Thomasville, Alabama 36784

(Address

of principal executive offices, including zip code)

(334)

636-5424

(Registrant’s telephone number, including area code)

N/A

(Former

name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On April 30, 2015, United Security Bancshares, Inc. issued a press

release announcing financial results for the first quarter ended March

31, 2015. The press release is attached as Exhibit 99.1 to this

Form 8-K and is furnished to, but not filed with, the Commission.

Item

9.01 Financial Statements and Exhibits.

|

(d)

|

Exhibits.

|

|

|

|

|

|

|

|

Exhibit Number

|

Exhibit

|

|

|

99.1

|

Press Release dated April 30, 2015

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

UNITED SECURITY BANCSHARES, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Thomas S. Elley

|

|

|

|

|

Name:

|

Thomas S. Elley

|

|

|

|

|

|

Vice President, Treasurer and Assistant Secretary,

|

|

|

|

|

|

Chief Financial Officer and Principal Accounting Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

April 30, 2015

|

|

|

|

INDEX TO EXHIBITS

|

Exhibit Number

|

Exhibit

|

|

99.1

|

Press Release dated April 30, 2015*

|

*This exhibit is furnished to, but not filed with, the Commission by

inclusion herein.

Exhibit 99.1

United

Security Bancshares, Inc. Reports Improved First Quarter Results

THOMASVILLE, Ala.--(BUSINESS WIRE)--April 30, 2015--United Security

Bancshares, Inc. (Nasdaq: USBI) today reported net income rose to

$836,000, or $0.13 per diluted share, for the first quarter ended March

31, 2015, compared with net income of $774,000, or $0.13 per diluted

share, for the first quarter of 2014.

“We continued to make solid progress in the first quarter with growth in

net income and solid reduction in non-performing assets,” stated James

F. House, President and CEO of United Security Bancshares, Inc.

“Non-performing assets were down 33.6%, compared with March 31, 2014, to

$12.8 million. Our progress in reducing non-performing assets resulted

from a 17.1% reduction in other real estate owned to $8.6 million and a

66% drop in non-accrual loans to $2.5 million compared with the first

quarter of 2014. We believe that continued progress in these areas, as

well as our focus on quality loan production, will be an important part

of improving our profitability.”

“Loan demand remains soft in many of our rural service areas, especially

for quality commercial and real-estate based loans. We experienced loan

payoffs and pay downs during the first quarter at a faster rate than our

generation of new quality loans. This affected our yield on earning

assets and interest generated from loans, our largest source of income.

We are working on plans to expand into contiguous metropolitan markets

that have greater commercial loan potential, including a new branch in

Tuscaloosa, Alabama, which is expected to open later this year.”

“We are also making investments throughout the Bank to improve operating

efficiency and to provide better customer service. We are expanding our

office in Thomasville to consolidate operations staff and departments

and expect that the new facility will result in improved efficiencies

and enhanced opportunities to develop and cross-train staff. We are also

investing in new technology that will leverage our existing

infrastructure to improve services and to control costs. We are

introducing new mobile and commercial banking services, including online

check deposit, expanded internet banking and a new cash management

service for commercial customers that we expect to be very competitive

in our service areas. We also recently changed the Bank’s name to ‘First

US Bank’ as part of our rebranding program to improve our visibility in

our existing service areas, as well as potential expansion markets. We

remain very positive about the progress made in strengthening core

operations and opportunities to grow the Bank in the future,” continued

Mr. House.

First Quarter Results

Net income rose to $836,000, or $0.13 per diluted share, for the quarter

ended March 31, 2015, compared with net income of $774,000, or $0.13 per

diluted share, for the first quarter of 2014.

Interest income totaled $7.3 million in the first quarter of 2015,

compared with $7.8 million in the first quarter of 2014. The decline in

interest income was due primarily to a decrease in total loans, offset

partially by higher interest income from investment securities, compared

with the first quarter of 2014.

Interest expense declined 4.8% to $614,000 in the first quarter of 2015,

compared with $645,000 in the first quarter of 2014. The decrease

resulted primarily from a decline in interest bearing deposits and lower

interest rates paid compared with the prior period.

Net interest income was $6.7 million in the first quarter of 2015,

compared with $7.2 million in the first quarter of 2014. The decline in

net interest income was due to a decrease in loans, combined with a 38

basis point decline in net interest margin, compared with the first

quarter of 2014. Net interest margin was 5.19% in the first quarter of

2015, compared with 5.57% in the first quarter of 2014. The decline in

net interest margin was due primarily to the payoff of higher yielding

loans, the competitive loan market and a change in Acceptance Loan

Company’s (“ALC”) loan origination criteria that has focused on improved

credit quality, with a slight offset in lower interest rates charged.

Net loans declined to $239.2 million in the first quarter of 2015,

compared with $276.7 million at March 31, 2014. The decrease in net

loans was due to loan payoffs and pay downs outpacing new loan

production at the Bank. An overall sluggish economy in the geographical

areas that we serve, primarily centered in the real estate sector, has

been a significant factor in lower loan demand at the Bank during the

past year.

Provision for loan losses was a credit of $166,000 in the first quarter

of 2015, compared with a charge of $414,000 in the first quarter of

2014. The credit in the provision for loan losses was reflected as a

reduction in the reserve for loan losses. The reduction in the provision

resulted primarily from pay down of loans, recoveries of loans

previously charged off and improvement in the credit quality of several

loan relationships. Net charge-offs totaled approximately $600,000 in

the first quarter of 2015, compared with $1.2 million in the first

quarter of 2014.

Total non-interest income rose to $1.3 million in the first quarter of

2015, compared with $1.1 million in the first quarter of 2014. The

increase in non-interest income was due to growth in other income,

offset partially by lower service charges and credit life insurance

income, compared with the first quarter of 2014.

Total non-interest expense increased 1.4% to $7.0 million in the first

quarter of 2015, compared with $6.9 million in the first quarter of

2014. The increase in non-interest expense was due primarily to higher

salaries and benefits, occupancy, furniture and equipment expense and

other real estate/foreclosure expense, offset partially by lower other

expense. Total OREO related expenses increased to $220,000 in the first

quarter of 2015, compared with $100,000 in the first quarter of 2014,

primarily due to reductions in gains on sale of OREO, which are netted

in this expense category. Salaries and benefits increased $110,000 in

the first quarter of 2015 compared with the first quarter of 2014.

Effective as of the first quarter of 2015, United Security Bancshares

and First US Bank are now subject to the revised regulatory capital

standards promulgated under the Basel III Final Rule. As of March 31,

2015, both the common equity Tier 1 capital and Tier 1 risk based

capital ratios were 23.85% for the Company and 24.09% for the Bank. The

total capital ratio was 25.11% for the Company and 25.34% for the Bank.

The Tier 1 leverage ratio was 12.56% for the Company and 12.70% for the

Bank. Each of these ratios is higher than the ratios required to be

considered a “well-capitalized” institution under the revised framework.

About United Security Bancshares, Inc.

United Security Bancshares, Inc. is a bank holding company that operates

nineteen banking offices in Alabama through First US Bank. In addition,

the Company’s operations include Acceptance Loan Company, Inc., a

consumer loan company, and FUSB Reinsurance, Inc., an underwriter of

credit life and credit accident and health insurance policies sold to

the Bank’s and ALC’s consumer loan customers. The Company’s stock is

traded on the Nasdaq Capital Market under the symbol “USBI.”

Forward-Looking Statements

This press release contains forward-looking statements, as defined by

federal securities laws. Statements contained in this press release that

are not historical facts are forward-looking statements. These

statements may address issues that involve significant risks,

uncertainties, estimates and assumptions made by management. USBI

undertakes no obligation to update these statements following the date

of this press release, except as required by law. In addition,

USBI, through its senior management, may make from time to time

forward-looking public statements concerning the matters described

herein. Such forward-looking statements are necessarily estimates

reflecting the best judgment of USBI’s senior management based upon

current information and involve a number of risks and uncertainties. Certain

factors that could affect the accuracy of such forward-looking

statements are identified in the public filings made by USBI with the

Securities and Exchange Commission, and forward-looking statements

contained in this press release or in other public statements of USBI or

its senior management should be considered in light of those factors.

Specifically, with respect to statements relating to loan demand,

growth and earnings potential and the adequacy of the allowance for loan

losses for USBI, these factors include, but are not limited to, the rate

of growth (or lack thereof) in the economy, the relative strength and

weakness in the consumer and commercial credit sectors and in the real

estate markets and collateral values. There can be no assurance

that such factors or other factors will not affect the accuracy of such

forward-looking statements.

|

UNITED SECURITY BANCSHARES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(Dollars in Thousands,

Except Share and Per Share Data)

|

|

|

|

|

|

|

|

March

|

|

|

December

|

|

|

|

|

|

31,

|

|

|

31,

|

|

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

ASSETS

|

|

Cash and due from banks

|

|

|

|

$

|

8,396

|

|

|

|

$

|

9,697

|

|

|

Interest bearing deposits in banks

|

|

|

|

|

21,921

|

|

|

|

|

24,469

|

|

|

|

|

|

|

|

|

|

|

|

Total cash and cash equivalents

|

|

|

|

|

30,317

|

|

|

|

|

34,166

|

|

|

Investment securities available-for-sale, at fair value

|

|

|

|

|

209,790

|

|

|

|

|

204,966

|

|

|

Investment securities held-to-maturity, at amortized cost

|

|

|

|

|

40,074

|

|

|

|

|

29,120

|

|

|

Federal Home Loan Bank stock, at cost

|

|

|

|

|

740

|

|

|

|

|

738

|

|

|

Loans, net of allowance for loan losses of $5,401 and $6,168,

respectively

|

|

|

|

|

239,218

|

|

|

|

|

259,516

|

|

|

Premises and equipment, net

|

|

|

|

|

10,505

|

|

|

|

|

9,764

|

|

|

Cash surrender value of bank-owned life insurance

|

|

|

|

|

14,054

|

|

|

|

|

13,975

|

|

|

Accrued interest receivable

|

|

|

|

|

1,941

|

|

|

|

|

2,235

|

|

|

Other real estate owned

|

|

|

|

|

8,608

|

|

|

|

|

7,735

|

|

|

Other assets

|

|

|

|

|

9,635

|

|

|

|

|

10,394

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

|

$

|

564,882

|

|

|

|

$

|

572,609

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

Deposits

|

|

|

|

$

|

475,288

|

|

|

|

$

|

483,659

|

|

|

Accrued interest expense

|

|

|

|

|

208

|

|

|

|

|

221

|

|

|

Other liabilities

|

|

|

|

|

7,961

|

|

|

|

|

8,131

|

|

|

Short-term borrowings

|

|

|

|

|

680

|

|

|

|

|

436

|

|

|

Long-term debt

|

|

|

|

|

5,000

|

|

|

|

|

5,000

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

|

|

489,137

|

|

|

|

|

497,447

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

Common stock, par value $0.01 per share, 10,000,000 shares

authorized; 7,329,060 shares issued; 6,034,059 shares outstanding

|

|

|

|

|

73

|

|

|

|

|

73

|

|

|

Surplus

|

|

|

|

|

9,615

|

|

|

|

|

9,577

|

|

|

Accumulated other comprehensive income, net of tax

|

|

|

|

|

1,659

|

|

|

|

|

1,829

|

|

|

Retained earnings

|

|

|

|

|

85,297

|

|

|

|

|

84,582

|

|

|

Less treasury stock: 1,295,001 shares at cost

|

|

|

|

|

(20,886

|

)

|

|

|

|

(20,886

|

)

|

|

Noncontrolling interest

|

|

|

|

|

(13

|

)

|

|

|

|

(13

|

)

|

|

|

|

|

|

|

|

|

|

|

Total shareholders’ equity

|

|

|

|

|

75,745

|

|

|

|

|

75,162

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity

|

|

|

|

$

|

564,882

|

|

|

|

$

|

572,609

|

|

|

UNITED SECURITY BANCSHARES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in

Thousands, Except Per Share Data)

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

(Unaudited)

|

|

Interest income:

|

|

|

|

|

|

|

|

|

Interest and fees on loans

|

|

|

|

$

|

6,135

|

|

|

|

$

|

6,797

|

|

Interest on investment securities

|

|

|

|

|

1,186

|

|

|

|

|

1,049

|

|

|

|

|

|

|

|

|

|

|

Total interest income

|

|

|

|

|

7,321

|

|

|

|

|

7,846

|

|

|

|

|

|

|

|

|

|

|

Interest expense:

|

|

|

|

|

|

|

|

|

Interest on deposits

|

|

|

|

|

607

|

|

|

|

|

637

|

|

Interest on borrowings

|

|

|

|

|

7

|

|

|

|

|

8

|

|

|

|

|

|

|

|

|

|

|

Total interest expense

|

|

|

|

|

614

|

|

|

|

|

645

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

|

|

|

6,707

|

|

|

|

|

7,201

|

|

|

|

|

|

|

|

|

|

|

Provision (reduction in reserve) for loan losses

|

|

|

|

|

(166

|

)

|

|

|

|

414

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income after provision (reduction in reserve) for loan

losses

|

|

|

|

|

6,873

|

|

|

|

|

6,787

|

|

|

|

|

|

|

|

|

|

|

Non-interest income:

|

|

|

|

|

|

|

|

|

Service and other charges on deposit accounts

|

|

|

|

|

454

|

|

|

|

|

500

|

|

Credit insurance income

|

|

|

|

|

75

|

|

|

|

|

140

|

|

Other income

|

|

|

|

|

762

|

|

|

|

|

507

|

|

|

|

|

|

|

|

|

|

|

Total non-interest income

|

|

|

|

|

1,291

|

|

|

|

|

1,147

|

|

|

|

|

|

|

|

|

|

|

Non-interest expense:

|

|

|

|

|

|

|

|

|

Salaries and employee benefits

|

|

|

|

|

4,192

|

|

|

|

|

4,082

|

|

Net occupancy and equipment

|

|

|

|

|

823

|

|

|

|

|

815

|

|

Other real estate/foreclosure expense, net

|

|

|

|

|

220

|

|

|

|

|

100

|

|

Other expense

|

|

|

|

|

1,742

|

|

|

|

|

1,887

|

|

|

|

|

|

|

|

|

|

|

Total non-interest expense

|

|

|

|

|

6,977

|

|

|

|

|

6,884

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

|

|

1,187

|

|

|

|

|

1,050

|

|

Provision for income taxes

|

|

|

|

|

351

|

|

|

|

|

276

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

|

$

|

836

|

|

|

|

$

|

774

|

|

|

|

|

|

|

|

|

|

|

Basic net income per share

|

|

|

|

$

|

0.14

|

|

|

|

$

|

0.13

|

|

|

|

|

|

|

|

|

|

|

Diluted net income per share

|

|

|

|

$

|

0.13

|

|

|

|

$

|

0.13

|

|

|

|

|

|

|

|

|

|

|

Dividends per share

|

|

|

|

$

|

0.02

|

|

|

|

$

|

-

|

CONTACT:

United Security Bancshares, Inc.

Thomas S. Elley,

334-636-5424

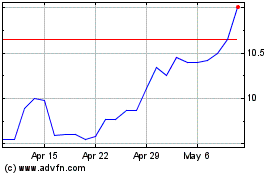

First US Bancshares (NASDAQ:FUSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

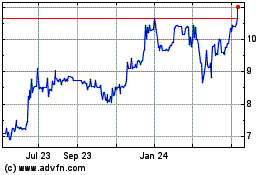

First US Bancshares (NASDAQ:FUSB)

Historical Stock Chart

From Apr 2023 to Apr 2024