As filed with the U.S. Securities and Exchange

Commission on August 26, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

| SEACOAST BANKING CORPORATION OF FLORIDA |

| (Exact name of registrant |

| as specified in its charter) |

| Florida |

|

59-2260678 |

| |

|

|

| (State or other jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification Number) |

815 Colorado Avenue

Stuart, Florida 34994

(772) 287-4000

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Amended and Restated Seacoast Banking

Corporation of Florida

2013 Long-Term Incentive Plan

(Full Title of the

Plan)

Dennis S. Hudson, III

Chief Executive Officer

Seacoast Banking Corporation of Florida

815 Colorado Avenue

Stuart, Florida 34994

(772) 287-4000

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Randolph A. Moore III

Alston & Bird LLP

One Atlantic Center

1201 W. Peachtree Street

Atlanta, Georgia 30309

Telephone: (404) 881-7794

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer x |

Non-accelerated filer ¨ |

Smaller reporting company ¨ |

| (Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

Title of Securities to be Registered | |

Amount to

be Registered | | |

Proposed

Maximum

Offering Price

Per Share | | |

Proposed

Maximum

Aggregate

Offering Price | | |

Amount of

Registration Fee | |

| Common Stock, $0.01 par value | |

| 1,700,000 | (1) | |

$ | 14.465 | (2) | |

$ | 24,590,500 | (2) | |

$ | 2,857.42 | |

| (1) | Amount to be registered consists of 1,700,000 shares of common stock of Seacoast Banking Corporation of Florida (the “Company”)

that may be issued under the Amended and Restated Seacoast Banking Corporation of Florida 2013 Incentive Plan (the “Plan”).

The amount of common stock registered hereunder shall be deemed to include any additional shares issuable as a result of any stock

split, stock dividend or other change in the capitalization of the Company. The Company previously registered 6,500,000 shares

(adjusted to 1,300,000 shares upon the Company’s one-for-five reverse stock split on December 13, 2013) on a Form S-8 filed

on August 9, 2013 (Reg. No. 333-190507) for issuance under the Plan. |

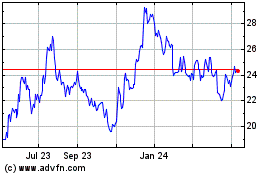

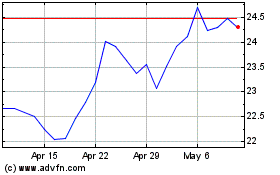

| (2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(h), based on the average of the

high and low prices of the Company’s common stock reported on the NASDAQ Global Select Market on August 24, 2015. |

| PART I |

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS |

(a) The

documents constituting Part I of this Registration Statement on Form S-8 under the Securities Act of 1933, as amended (the “Registration

Statement”) will be sent or given to participants in the Plan as specified by Rule 428(b)(1) under the Securities Act.

These documents and the documents incorporated by reference in this registration statement pursuant

to Item 3 of Part II of this form, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the

Securities Act.

(b) Upon

written or oral request, the Company will provide, without charge, the documents incorporated by reference in Item 3 of Part II

of this Registration Statement. The documents are incorporated by reference in the Section 10(a) prospectus. The Company will also

provide, without charge, upon written or oral request, other documents required to be delivered to employees pursuant to Rule 428(b).

Requests for any of the above-mentioned information should be directed to the Company’s Corporate Secretary at the address

and telephone number on the cover of this Registration Statement.

| PART II |

INFORMATION REQUIRED IN REGISTRATION STATEMENT |

| Item 3. | Incorporation of Documents by Reference. |

The following documents

filed with the Securities and Exchange Commission (the “Commission”) pursuant to the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), are hereby incorporated by reference into this Registration Statement and deemed to

be a part hereof:

(1) The

Company’s Annual Report on Form 10-K for the year ended December 31, 2014, filed on March 16, 2015, including

the portions of our Definitive Proxy Statement on Schedule 14A filed on April 7, 2015, and incorporated by reference into Part

III of our Annual Report on Form 10-K;

(2)

The Company’s Quarterly Report on Form 10-Q for the quarter ended

March 31, 2015, filed on May 11, 2015 and quarter ended June 30, 2015, filed on August 10, 2015;

(3) The

Company’s Current Reports on Form 8-K or Form 8-K/A, as applicable, filed February 24, 2015, March 2, 2015, March 31, 2015,

May 18, 2015, May 27, 2015, July 20, 2015, and August 7, 2015;

(4) The

description of our common stock contained in our Registration Statement filed with the SEC pursuant to Section 12 of the Exchange

Act, including any amendment or report filed for purposes of updating such description; and

(5) All

other documents subsequently filed by the Company pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the

filing of a post-effective amendment to this Registration Statement that indicates that all securities offered have been sold or

that deregisters all securities that remain unsold (except for information furnished to the Commission that is not deemed to be

“filed” for purposes of the Exchange Act).

Any statement contained

in a document incorporated or deemed incorporated herein by reference shall be deemed to be modified or superseded for the purpose

of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document which also

is, or is deemed to be, incorporated herein by reference modifies or supersedes such statement. Any such statement so modified

or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

| Item 4. |

Description of Securities. |

Not Applicable.

| Item 5. | Interests of Named Experts and Counsel. |

Not Applicable.

| Item 6. |

Indemnification of Directors and Officers. |

The Florida Business

Corporation Act, as amended (the “FBCA”) permits, under certain circumstances, the indemnification of officers, directors,

employees and agents of a corporation with respect to any threatened, pending or completed action, suit or proceeding, whether

civil, criminal, administrative or investigative, to which such person was or is a party or is threatened to be made a party, by

reason of his or her being an officer, director, employee or agent of the corporation, or is or was serving at the request of,

such corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise,

against liability incurred in connection with such proceeding, including appeals thereof; provided, however, that the officer,

director, employee or agent acted in good faith and in a manner that he or she reasonably believed to be in, or not opposed to,

the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe

his or her conduct was unlawful. The termination of any such third-party action by judgment, order, settlement, or conviction or

upon a plea of nolo contendere or its equivalent does not, of itself, create a presumption that the person (i) did not act in good

faith and in a manner which he or she reasonably believed to be in, or not opposed to, the best interests of the corporation or

(ii) with respect to any criminal action or proceeding, had reasonable cause to believe that his or her conduct was unlawful.

In the case of proceedings

by or in the right of the corporation, the FBCA permits for indemnification of any person by reason of the fact that such person

is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of, such corporation as

a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against liability

incurred in connection with such proceeding, including appeals thereof; provided, however, that the officer, director, employee

or agent acted in good faith and in a manner that he or she reasonably believed to be in, or not opposed to, the best interests

of the corporation, except that no indemnification is made where such person is adjudged liable, unless a court of competent jurisdiction

determines that, despite the adjudication of liability but in view of all circumstances of the case, such person is fairly and

reasonably entitled to indemnity for such expenses which such court shall deem proper.

To the extent that

such person is successful on the merits or otherwise in defending against any such proceeding, Florida law provides that he or

she shall be indemnified against expenses actually and reasonably incurred by him or her in connection therewith.

The Company’s

Bylaws contain indemnification provisions similar to the FBCA, and further provide that the Company may purchase and maintain insurance

on behalf of directors, officers, employees and agents in their capacities as such, or serving at the request of the corporation,

against any liabilities asserted against such persons whether or not the Company would have the power to indemnify such persons

against such liability under its Bylaws.

Insofar as indemnification

for liabilities arising under the Securities Act of 1933, as amended, may be permitted to the Company’s directors, officers

and controlling persons pursuant to the foregoing provisions, or otherwise, the Company has been advised that, in the opinion of

the Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

| Item 7. |

Exemption from Registration Claimed. |

Not Applicable.

Item 8. Exhibits.

See Exhibit Index,

which is incorporated here by this reference.

Item 9. Undertakings.

(a) The

undersigned Company hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in this Registration Statement.

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement

or any material change to such information in this Registration Statement;

provided, however,

that paragraphs (a)(1)(i) and (a)(1)(ii) of this section do not apply if the registration statement is on Form S-8 and the information

required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the

Commission by the Company pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated

by reference in this Registration Statement.

(2) That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(b) The

undersigned Company hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing

of the Company’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where

applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange

Act of 1934) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(c) Insofar

as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the Company pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of

the Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event

that a claim for indemnification against such liabilities (other than the payment by the Company of expenses incurred or paid by

a director, officer or controlling person of the Company in the successful defense of any action, suit or proceeding) is asserted

by such director, officer or controlling person in connection with the securities being registered, the Company will, unless in

the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final

adjudication of such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused these Post-Effective Amendments to the Registration Statements to

be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Stuart, state of Florida, on this 26th day

of August, 2015.

| |

SEACOAST BANKING CORPORATION OF FLORIDA |

| |

|

|

| |

By: |

/s/ Dennis S. Hudson, III |

| |

|

Dennis S. Hudson, III |

| |

|

Chief Executive Officer |

POWER OF ATTORNEY

Each person whose signature

appears below hereby constitutes and appoints Dennis S. Hudson, III his or her true and lawful attorney-in-fact and agents, with

full power of substitution and resubstitution for him or her, in any and all capacities, to sign this Registration Statement for

the registration of certain securities of the Company Corporation, any or all amendments to the Registration Statement (including,

but not limited to, post-effective amendments), which amendments may make such changes in and additions to the Registration Statement

as such attorney-in-fact may deem necessary or appropriate, and to file the same, with exhibits thereto and other documents in

connection therewith, with the Commission, granting unto such attorney-in-fact and agent full power and authority to do and perform

each and every act and thing requisite and necessary in connection with such matters, as fully to all intents and purposes as he

or she might or could do in person, hereby ratifying and confirming all that such attorney-in-fact and agent or his substitute

or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities

and on the date indicated.

| Signatures |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Dennis S. Hudson, III |

|

Chairman of the Board, Chief |

|

August 26, 2015 |

| Dennis S. Hudson, III |

|

Executive Officer and Director

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Stephen A. Fowle |

|

Executive Vice President and Chief |

|

August 26, 2015 |

| Stephen A. Fowle |

|

Financial Officer

(Principal Financial Officer and Principal Accounting Officer) |

|

|

| /s/ Dennis J. Arczynski |

|

Director |

|

August 26, 2015 |

| Dennis J. Arczynski |

|

|

|

|

| |

|

|

|

|

| /s/ Stephen E. Bohner |

|

Director |

|

August 26, 2015 |

| Stephen E. Bohner |

|

|

|

|

| |

|

|

|

|

| /s/ Jacqueline L. Bradley |

|

Director |

|

August 26, 2015 |

| Jacqueline L. Bradley |

|

|

|

|

| |

|

|

|

|

| /s/ T. Michael Crook |

|

Director |

|

August 26, 2015 |

| T. Michael Crook |

|

|

|

|

| |

|

|

|

|

| /s/ H. Gilbert Culbreth, Jr. |

|

Director |

|

August 26, 2015 |

| H. Gilbert Culbreth, Jr. |

|

|

|

|

| /s/ Julie H.

Daum |

|

Director |

|

August 26, 2015 |

| Julie H. Daum |

|

|

|

|

| |

|

|

|

|

| /s/ Christopher E. Fogal |

|

Director |

|

August 26, 2015 |

| Christopher E. Fogal |

|

|

|

|

| |

|

|

|

|

| /s/ Maryann

Goebel |

|

Director |

|

August 26, 2015 |

| Maryann Goebel |

|

|

|

|

| |

|

|

|

|

| /s/ Roger O. Goldman |

|

Director |

|

August 26, 2015 |

| Roger O. Goldman |

|

|

|

|

| |

|

|

|

|

| /s/ Robert B. Goldstein |

|

Director |

|

August 26, 2015 |

| Robert B. Goldstein |

|

|

|

|

| |

|

|

|

|

| /s/ Dennis S. Hudson, Jr. |

|

Director |

|

August 26, 2015 |

| Dennis S. Hudson, Jr. |

|

|

|

|

| |

|

|

|

|

| /s/ Thomas E. Rossin |

|

Director |

|

August 26, 2015 |

| Thomas E. Rossin |

|

|

|

|

| |

|

|

|

|

| /s/ Edwin E. Walpole, III |

|

Director |

|

August 26, 2015 |

| Edwin E. Walpole, III |

|

|

|

|

EXHIBIT INDEX

TO

REGISTRATION STATEMENT ON FORM S-8

| Exhibit |

|

|

| Number |

|

Description |

| |

|

|

| 4.1.1 |

|

Amended and Restated Articles of Incorporation of the Company, incorporated herein by reference from Exhibit 3.1 to the Company’s Quarterly Report on Form 10-Q, filed May 10, 2006. |

| |

|

|

| 4.1.2 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8-K, filed December 23, 2008. |

| |

|

|

| 4.1.3 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.4 to the Company’s Form S-1, filed June 22, 2009. |

| |

|

|

| 4.1.4 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8-K, filed July 20, 2009. |

| |

|

|

| 4.1.5 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8-K, filed December 3, 2009. |

| |

|

|

| 4.1.6 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8-K/A, filed July 14, 2010. |

| |

|

|

| 4.1.7 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8-K, filed June 25, 2010. |

| |

|

|

| 4.1.8 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8-K, filed June 1, 2011. |

| |

|

|

| 4.1.9 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation, incorporated herein by reference from Exhibit 3.1 to the Company’s Form 8-K, filed December 13, 2013. |

| |

|

|

| 4.2 |

|

Amended and Restated By-laws of the Company, incorporated herein by reference from Exhibit 3.2 to the Company’s Form 8-K, filed December 21, 2007. |

| |

|

|

| 5.1 |

|

Opinion of Alston & Bird LLP. |

| |

|

|

| 23.1 |

|

Consent of Alston & Bird LLP (included in Exhibit 5.1). |

| |

|

|

| 23.2 |

|

Consent of KPMG LLP. |

| |

|

|

| 23.3 |

|

Consent of Crowe Horwath LLP. |

| |

|

|

| 24.1 |

|

Power of Attorney (included on signature page). |

| |

|

|

| 99.1 |

|

Amended and Restated Seacoast Banking Corporation of Florida 2013 Incentive Plan. |

Exhibit 5.1

One Atlantic Center

1201 West Peachtree Street

Atlanta, GA 30309-3424

404-881-7000

Fax: 404-253-8330

www.alston.com

August 26, 2015

|

Seacoast Banking Corporation of Florida |

|

| 815 Colorado Avenue |

|

| Stuart, Florida 34994 |

|

| Re: |

Registration Statement on Form S-8 – |

| |

Amended and Restated Seacoast Banking Corporation of Florida 2013 Incentive Plan |

Ladies and Gentlemen:

We have acted as counsel

to Seacoast Banking Corporation of Florida, a Florida corporation (the “Corporation”), in connection with the above-referenced

Registration Statement on Form S-8 (the “Registration Statement”) to be filed on the date hereof by the Corporation

with the Securities and Exchange Commission (the “Commission”) to register under the Securities Act of 1933, as amended

(the “Securities Act”), 1,700,000 shares of the Corporation’s common stock, $0.10 par value per share (the “Shares”),

which may be issued by the Corporation pursuant to the Amended and Restated Seacoast Banking Corporation of Florida 2013 Incentive

Plan (the “Plan”). We are furnishing this opinion letter pursuant to Item 8 of Form S-8 and Item 601(b)(5) of Regulation

S-K under the Securities Act.

In connection with

our opinion below, we have examined the Amended and Restated Articles of Incorporation of the Corporation and the subsequent Articles

of Amendment thereto, the Amended and Restated By-laws of the Corporation, records of proceedings of the Board of Directors deemed

by us to be relevant to this opinion letter, the Plan and the Registration Statement. We also have made such further legal and

factual examinations and investigations as we deemed necessary for purposes of expressing the opinion set forth herein. In our

examination, we have assumed the genuineness of all signatures, the legal capacity of all natural persons, the authenticity of

all documents submitted to us as original documents and the conformity to original documents of all documents submitted to us as

certified, conformed, facsimile, electronic or photostatic copies.

As to certain factual

matters relevant to this opinion letter, we have relied conclusively upon originals or copies, certified or otherwise identified

to our satisfaction, of such other records, agreements, documents and instruments, including certificates or comparable documents

of officers of the Corporation and of public officials, as we have deemed appropriate as a basis for the opinion hereinafter set

forth. Except to the extent expressly set forth herein, we have made no independent investigations with regard to matters of fact,

and, accordingly, we do not express any opinion as to matters that might have been disclosed by independent verification.

Atlanta • Brussels • Charlotte

• Dallas • Los Angeles • New York • Research Triangle • Silicon Valley • Washington, D.C.

August 26, 2015

Page 2

Our opinion set forth

below is limited to the Florida Business Corporation Act.

This opinion letter

is provided for use in connection with the transactions contemplated by the Registration Statement and may not be used, circulated,

quoted or otherwise relied upon for any other purpose without our express written consent. The only opinion rendered by us consists

of those matters set forth in the sixth paragraph hereof, and no opinion may be implied or inferred beyond the opinion expressly

stated. This opinion letter is rendered as of the date hereof and we make no undertaking and expressly disclaim any duty to supplement

or update the opinions rendered herein, if, after the date hereof, facts or circumstances come to our attention or changes in the

law occur which could affect such opinions. We note specifically that the Shares may be issued from time to time hereafter, and

our opinion is limited to the applicable laws, including the related rules and regulations, as in effect on the date hereof.

Based on the foregoing,

it is our opinion that the Shares that may be issued under the Plan are duly authorized, and, when issued by the Corporation in

accordance with the terms of the Plan, will be validly issued, fully paid and non-assessable.

We consent to the filing

of this opinion letter as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we are

within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of

the Commission thereunder.

| |

Sincerely, |

| |

|

| |

ALSTON & BIRD LLP |

| |

|

| |

/s/ Alston & Bird LLP |

Exhibit 23.2

Consent of Independent Registered Public

Accounting Firm

The Board of Directors

Seacoast Banking Corporation of Florida:

In connection with the Form S-8 registration

statement to be filed by Seacoast Banking Corporation of Florida and subsidiaries (the Company), we consent to the use of our report

dated March 17, 2014, with respect to the consolidated balance sheet of the Company as of December 31, 2013, and the related consolidated

statements of income, comprehensive income (loss), cash flows, and shareholders’ equity for each of the years in the two-year

period ended December 31, 2013, incorporated herein by reference.

/s/ KPMG LLP

August 26, 2015

Miami, Florida

Certified Public Accountants

EXHIBIT 23.3

CONSENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration

Statement on Form S-8 pertaining to Seacoast Banking Corporation of Florida Amended and Restated Seacoast Banking Corporation of

Florida 2013 Long-Term Incentive Plan of our reports dated March 16, 2015 with respect to the consolidated financial statements

Seacoast Banking Corporation of Florida and the effectiveness of internal control over financial reporting appearing in the Annual

Report on Form 10-K Seacoast Banking Corporation of Florida for the year ended December 31, 2014.

/s/ Crowe Horwath LLP

Crowe Horwath LLP

Fort Lauderdale, Florida

August 26, 2015

Exhibit 99.1

AMENDED

AND RESTATED

SEACOAST

BANKING CORPORATION OF FLORIDA

2013

Incentive PLAN

AMENDED

AND RESTATED

Seacoast

Banking Corporation of Florida

2013 INCENTIVE PLAN

| ARTICLE 1 PURPOSE |

1 |

| |

1.1 |

General |

1 |

| |

1.2 |

History |

1 |

| ARTICLE 2 DEFINITIONS |

1 |

| |

2.1 |

Definitions |

1 |

| ARTICLE 3 EFFECTIVE TERM OF PLAN |

7 |

| |

3.1 |

Effective Date |

7 |

| |

3.2 |

Term of Plan |

7 |

| ARTICLE 4 ADMINISTRATION |

7 |

| |

4.1 |

Committee |

7 |

| |

4.2 |

Actions and Interpretations by the Committee |

8 |

| |

4.3 |

Authority of Committee |

8 |

| |

4.4 |

Delegation |

9 |

| |

4.5 |

Indemnification |

9 |

| ARTICLE 5 SHARES SUBJECT TO THE PLAN |

10 |

| |

5.1 |

Number of Shares |

10 |

| |

5.2 |

Share Counting |

10 |

| |

5.3 |

Stock Distributed |

10 |

| |

5.4 |

Limitation on Awards |

11 |

| ARTICLE 6 ELIGIBILITY |

11 |

| |

6.1 |

General |

11 |

| ARTICLE 7 STOCK OPTIONS |

11 |

| |

7.1 |

General |

11 |

| |

7.2 |

Incentive Stock Options |

12 |

| ARTICLE 8 STOCK APPRECIATION RIGHTS |

13 |

| |

8.1 |

Grant of Stock Appreciation Rights |

13 |

| ARTICLE 9 RESTRICTED STOCK, RESTRICTED STOCK UNITS AND DEFERRED STOCK UNITS |

14 |

| |

9.1 |

Grant of Restricted Stock, Restricted Stock Units and Deferred Stock Units |

14 |

| |

9.2 |

Issuance and Restrictions |

14 |

| |

9.3 |

Dividends on Restricted Stock |

14 |

| |

9.4 |

Forfeiture |

14 |

| |

9.5 |

Delivery of Restricted Stock |

14 |

| ARTICLE 10 PERFORMANCE AWARDS |

15 |

| |

10.1 |

Grant of Performance Awards |

15 |

| |

10.2 |

Performance Goals |

15 |

| ARTICLE 11 QUALIFIED STOCK-BASED AWARDS |

15 |

| |

11.1 |

Options and Stock Appreciation Rights |

15 |

| |

11.2 |

Other Awards |

15 |

| |

11.3 |

Performance Goals |

16 |

| |

11.4 |

Inclusions and Exclusions from Performance Criteria |

17 |

| |

11.5 |

Certification of Performance Goals |

17 |

| |

11.6 |

Award Limits |

17 |

| ARTICLE 12 DIVIDEND EQUIVALENTS |

17 |

| |

12.1 |

Grant of Dividend Equivalents |

17 |

| ARTICLE 13 STOCK OR OTHER STOCK-BASED AWARDS |

18 |

| |

13.1 |

Grant of Stock or Other Stock-Based Awards |

18 |

| ARTICLE 14 PROVISIONS APPLICABLE TO AWARDS |

18 |

| |

14.1 |

Award Certificates |

18 |

| |

14.2 |

Form of Payment of Awards |

18 |

| |

14.3 |

Limits on Transfer |

18 |

| |

14.4 |

Beneficiaries |

19 |

| |

14.5 |

Stock Trading Restrictions |

19 |

| |

14.6 |

Acceleration upon Death or Disability |

19 |

| |

14.7 |

Effect of a Change in Control |

20 |

| |

14.8 |

Acceleration for Other Reasons |

21 |

| |

14.9 |

Forfeiture Events |

21 |

| |

14.10 |

Substitute Awards |

21 |

| ARTICLE 15 CHANGES IN CAPITAL STRUCTURE |

21 |

| |

15.1 |

Mandatory Adjustments |

21 |

| |

15.2 |

Discretionary Adjustments |

22 |

| |

15.3 |

General |

22 |

| ARTICLE 16 AMENDMENT, MODIFICATION AND TERMINATION |

22 |

| |

16.1 |

Amendment, Modification and Termination |

22 |

| |

16.2 |

Awards Previously Granted |

23 |

| |

16.3 |

Compliance Amendments |

23 |

| ARTICLE 17 GENERAL PROVISIONS |

23 |

| |

17.1 |

Rights of Participants |

23 |

| |

17.2 |

Withholding |

24 |

| |

17.3 |

Special Provisions Related to Section 409A of the Code |

24 |

| |

17.4 |

Unfunded Status of Awards |

26 |

| |

17.5 |

Relationship to Other Benefits |

26 |

| |

17.6 |

Expenses |

26 |

| |

17.7 |

Titles and Headings |

26 |

| |

17.8 |

Gender and Number |

26 |

| |

17.9 |

Fractional Shares |

27 |

| |

17.10 |

Government and Other Regulations |

27 |

| |

17.11 |

Governing Law |

27 |

| |

17.12 |

Severability |

27 |

| |

17.13 |

No Limitations on Rights of Company |

27 |

AMENDED

AND RESTATED

Seacoast

Banking Corporation of Florida

2013 INCENTIVE PLAN

ARTICLE 1

PURPOSE

1.1. GENERAL.

The purpose of the Seacoast Banking Corporation of Florida 2013 Incentive Plan (the “Plan”) is to promote the success,

and enhance the value, of Seacoast Banking Corporation of Florida (the “Company”), by linking the personal interests

of employees, officers, directors, consultants and advisors of the Company or any Affiliate (as defined below) to those of Company

shareholders and by providing such persons with an incentive for outstanding performance. The Plan is further intended to provide

flexibility to the Company in its ability to motivate, attract, and retain the services of employees, officers, directors, consultants

and advisors upon whose judgment, interest, and special effort the successful conduct of the Company’s operation is largely

dependent. Accordingly, the Plan permits the grant of incentive awards from time to time to selected employees, officers, directors,

consultants and advisors of the Company and its Affiliates.

1.2 HISTORY.

The Plan was originally adopted by the Board on February 19, 2013, and was approved by the shareholders on May 23, 2013. The

Plan was amended by the Board on February 26, 2015, to increase the number of shares authorized to be issued pursuant to the Plan,

and such amendment was approved by the shareholders on May 26, 2015.

ARTICLE 2

DEFINITIONS

2.1. DEFINITIONS.

When a word or phrase appears in this Plan with the initial letter capitalized, and the word or phrase does not commence a sentence,

the word or phrase shall generally be given the meaning ascribed to it in this Section or in Section 1.1 unless a clearly different

meaning is required by the context. The following words and phrases shall have the following meanings:

(a) “Affiliate”

means (i) any Subsidiary or Parent, or (ii) an entity that directly or through one or more intermediaries controls, is controlled

by or is under common control with, the Company, as determined by the Committee.

(b) “Award”

means an award of Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Deferred Stock Units, Performance

Awards, Other Stock-Based Awards, or any other right or interest relating to Stock or cash, granted to a Participant under the

Plan.

(c) “Award

Certificate” means a written document, in such form as the Committee prescribes from time to time, setting forth the terms

and conditions of an Award. Award Certificates may be in the form of individual award agreements or certificates or a program document

describing the terms and provisions of an Award or series of Awards under the Plan. The Committee may provide for the use of electronic,

internet or other non-paper Award Certificates, and the use of electronic, internet or other non-paper means for the acceptance

thereof and actions thereunder by a Participant.

(d) “Beneficial

Owner” shall have the meaning given such term in Rule 13d-3 of the General Rules and Regulations under the 1934 Act.

(e) “Board”

means the Board of Directors of the Company.

(f) “Cause”

as a reason for a Participant’s termination of employment shall have the meaning assigned such term in the employment, severance

or similar agreement, if any, between such Participant and the Company or an Affiliate; provided, however, that if

there is no such employment, severance or similar agreement in which such term is defined, and unless otherwise defined in the

applicable Award Certificate, “Cause” shall mean any of the following acts by the Participant, as determined by the

Committee: gross neglect of duty, prolonged absence from duty without the consent of the Company, material breach by the Participant

of any published Company code of conduct or code of ethics; or willful misconduct, misfeasance or malfeasance of duty which is

reasonably determined to be detrimental to the Company. With respect to a Participant’s termination of directorship, “Cause”

means an act or failure to act that constitutes cause for removal of a director under applicable Florida law. The determination

of the Committee as to the existence of “Cause” shall be conclusive on the Participant and the Company.

(g) “Change

in Control” means and includes the occurrence of any one of the following events:

(i) during

any consecutive 12-month period, individuals who, at the beginning of such period, constitute the Board of Directors of the Company

(the “Incumbent Directors”) cease for any reason to constitute at least a majority of such Board, provided that any

person becoming a director after the beginning of such 12-month period and whose election or nomination for election was approved

by a vote of at least a majority of the Incumbent Directors then on the Board shall be an Incumbent Director; provided,

however, that no individual initially elected or nominated as a director of the Company as a result of an actual or threatened

election contest with respect to the election or removal of directors (“Election Contest”) or other actual or threatened

solicitation of proxies or consents by or on behalf of any Person other than the Board (“Proxy Contest”), including

by reason of any agreement intended to avoid or settle any Election Contest or Proxy Contest, shall be deemed an Incumbent Director;

or

(ii) any

person becomes a Beneficial Owner, directly or indirectly, of either (A) 35% or more of the then-outstanding shares of common stock

of the Company (“Company Common Stock”) or (B) securities of the Company representing 35% or more of the combined voting

power of the Company’s then outstanding securities eligible to vote for the election of directors (the “Company Voting

Securities”); provided, however, that for purposes of this subsection (ii), the following acquisitions of Company

Common Stock or Company Voting Securities shall not constitute a Change in Control: (w) an acquisition directly from the Company,

(x) an acquisition by the Company or a Subsidiary, (y) an acquisition by any employee benefit plan (or related trust) sponsored

or maintained by the Company or any Subsidiary, or (z) an acquisition pursuant to a Non-Qualifying Transaction (as defined in subsection

(iii) below); or

(iii) the

consummation of a reorganization, merger, consolidation, statutory share exchange or similar form of corporate transaction involving

the Company or a Subsidiary (a “Reorganization”), or the sale or other disposition of all or substantially all of the

Company’s assets (a “Sale”) or the acquisition of assets or stock of another corporation or other entity (an

“Acquisition”), unless immediately following such Reorganization, Sale or Acquisition: (A) all or substantially all

of the individuals and entities who were the Beneficial Owners, respectively, of the outstanding Company Common Stock and outstanding

Company Voting Securities immediately prior to such Reorganization, Sale or Acquisition beneficially own, directly or indirectly,

more than 35% of, respectively, the then outstanding shares of common stock and the combined voting power of the then outstanding

voting securities entitled to vote generally in the election of directors, as the case may be, of the entity resulting from such

Reorganization, Sale or Acquisition (including, without limitation, an entity which as a result of such transaction owns the Company

or all or substantially all of the Company’s assets or stock either directly or through one or more subsidiaries, the “Surviving

Entity”) in substantially the same proportions as their ownership, immediately prior to such Reorganization, Sale or Acquisition,

of the outstanding Company Common Stock and the outstanding Company Voting Securities, as the case may be, and (B) no person (other

than (x) the Company or any Subsidiary, (y) the Surviving Entity or its ultimate parent entity, or (z) any employee benefit plan

(or related trust) sponsored or maintained by any of the foregoing) is the Beneficial Owner, directly or indirectly, of 35% or

more of the total common stock or 35% or more of the total voting power of the outstanding voting securities eligible to elect

directors of the Surviving Entity, and (C) at least a majority of the members of the board of directors of the Surviving Entity

were Incumbent Directors at the time of the Board’s approval of the execution of the initial agreement providing for such

Reorganization, Sale or Acquisition (any Reorganization, Sale or Acquisition which satisfies all of the criteria specified in (A),

(B) and (C) above shall be deemed to be a “Non-Qualifying Transaction”); or

(iv) approval

by the shareholders of the Company of a complete liquidation or dissolution of the Company.

(h) “Code”

means the Internal Revenue Code of 1986, as amended from time to time. For purposes of this Plan, references to sections of the

Code shall be deemed to include references to any applicable regulations thereunder and any successor or similar provision.

(i) “Committee”

means the committee of the Board described in Article 4.

(j) “Company”

means Seacoast Banking Corporation of Florida, a Florida corporation, or any successor corporation.

(k) “Continuous

Service” means the absence of any interruption or termination of service as an employee, officer, director, consultant or

advisor of the Company or any Affiliate, as applicable; provided, however, that for purposes of an Incentive Stock

Option “Continuous Service” means the absence of any interruption or termination of service as an employee of the Company

or any Parent or Subsidiary, as applicable, pursuant to applicable tax regulations. Continuous Service shall not be considered

interrupted in the following cases: (i) a Participant transfers employment between the Company and an Affiliate or between Affiliates,

or (ii) in the discretion of the Committee as specified at or prior to such occurrence, in the case of a spin-off, sale or disposition

of the Participant’s employer from the Company or any Affiliate, or (iii) any leave of absence authorized in writing by the

Company prior to its commencement; provided, however, that for purposes of Incentive Stock Options, no such leave

may exceed 90 days, unless reemployment upon expiration of such leave is guaranteed by statute or contract. If reemployment upon

expiration of a leave of absence approved by the Company is not so guaranteed, on the 91st day of such leave any Incentive Stock

Option held by the Participant shall cease to be treated as an Incentive Stock Option and shall be treated for tax purposes as

a Nonstatutory Stock Option. Whether military, government or other service or other leave of absence shall constitute a termination

of Continuous Service shall be determined in each case by the Committee at its discretion, and any determination by the Committee

shall be final and conclusive; provided, however, that for purposes of any Award that is subject to Code Section

409A, the determination of a leave of absence must comply with the requirements of a “bona fide leave of absence” as

provided in Treas. Reg. Section 1.409A-1(h).

(l) “Covered

Employee” means a covered employee as defined in Code Section 162(m)(3).

(m) “Deferred

Stock Unit” means a right granted to a Participant under Article 9 to receive Shares (or the equivalent value in cash or

other property if the Committee so provides) at a future time as determined by the Committee, or as determined by the Participant

within guidelines established by the Committee in the case of voluntary deferral elections.

(n) “Disability”

of a Participant means that the Participant (i) is unable to engage in any substantial gainful activity by reason of any medically

determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous

period of not less than 12 months, or (ii) is, by reason of any medically determinable physical or mental impairment which can

be expected to result in death or can be expected to last for a continuous period of not less than 12 months, receiving income

replacement benefits for a period of not less than three months under an accident and health plan covering employees of the Participant’s

employer. If the determination of Disability relates to an Incentive Stock Option, Disability means Permanent and Total Disability

as defined in Section 22(e)(3) of the Code. In the event of a dispute, the determination of whether a Participant is Disabled will

be made by the Committee and may be supported by the advice of a physician competent in the area to which such Disability relates.

(o) “Dividend

Equivalent” means a right granted with respect to an Award pursuant to Article 12.

(p) “Effective

Date” has the meaning assigned such term in Section 3.1.

(q) “Eligible

Participant” means an employee (including a leased employee), officer, director, consultant or advisor of the Company or

any Affiliate.

(r) “Exchange”

means any national securities exchange on which the Stock may from time to time be listed or traded.

(s) “Fair

Market Value,” on any date, means (i) if the Stock is listed on a securities exchange, the closing sales price on the principal

such exchange on such date or, in the absence of reported sales on such date, the closing sales price on the immediately preceding

date on which sales were reported, or (ii) if the Stock is not listed on a securities exchange, the mean between the bid and offered

prices as quoted by the applicable interdealer quotation system for such date, provided that if the Stock is not quoted on an interdealer

quotation system or it is determined that the fair market value is not properly reflected by such quotations, Fair Market Value

will be determined by such other method as the Committee determines in good faith to be reasonable and in compliance with Code

Section 409A.

(t) “Full-Value

Award” means an Award other than in the form of an Option or SAR, and which is settled by the issuance of Stock (or

at the discretion of the Committee, settled in cash valued by reference to Stock value).

(u) “Good

Reason” (or a similar term denoting constructive termination) has the meaning, if any, assigned such term in the employment,

consulting, severance or similar agreement, if any, between a Participant and the Company or an Affiliate; provided, however,

that if there is no such employment, consulting, severance or similar agreement in which such term is defined, “Good Reason”

shall have the meaning, if any, given such term in the applicable Award Certificate. If not defined in either such document, the

term “Good Reason” as used herein shall not apply to a particular Award.

(v) “Grant

Date” of an Award means the first date on which all necessary corporate action has been taken to approve the grant of the

Award as provided in the Plan, or such later date as is determined and specified as part of that authorization process. Notice

of the grant shall be a provided to the grantee within a reasonable time after the Grant Date.

(w) “Incentive

Stock Option” means an Option that is intended to be an incentive stock option and meets the requirements of Section 422

of the Code or any successor provision thereto.

(x) “Independent

Directors” means those members of the Board of Directors who qualify at any given time as (a) an “independent”

director under the applicable rules of each Exchange on which the Shares are listed, (b) a “non-employee” director

under Rule 16b-3 of the 1934 Act, and (c) an “outside” director under Section 162(m) of the Code.

(y) “Non-Employee

Director” means a director of the Company who is not a common law employee of the Company or an Affiliate.

(z) “Nonstatutory

Stock Option” means an Option that is not an Incentive Stock Option.

(aa) “Option”

means a right granted to a Participant under Article 7 of the Plan to purchase Stock at a specified price during specified time

periods. An Option may be either an Incentive Stock Option or a Nonstatutory Stock Option.

(bb) “Other

Stock-Based Award” means a right, granted to a Participant under Article 13, that relates to or is valued by reference to

Stock or other Awards relating to Stock.

(cc) “Parent”

means a corporation, limited liability company, partnership or other entity which owns or beneficially owns a majority of the outstanding

voting stock or voting power of the Company. Notwithstanding the above, with respect to an Incentive Stock Option, Parent shall

have the meaning set forth in Section 424(e) of the Code.

(dd) “Participant”

means an Eligible Participant who has been granted an Award under the Plan; provided that in the case of the death of a Participant,

the term “Participant” refers to a beneficiary designated pursuant to Section 14.4 or the legal guardian or other legal

representative acting in a fiduciary capacity on behalf of the Participant under applicable state law and court supervision.

(ee) “Performance

Award” means any award granted under the Plan pursuant to Article 10.

(ff) “Person”

means any individual, entity or group, within the meaning of Section 3(a)(9) of the 1934 Act and as used in Section 13(d)(3) or

14(d)(2) of the 1934 Act.

(gg) “Plan”

means the Seacoast Banking Corporation of Florida 2013 Incentive Plan, as amended from time to time.

(hh) “Qualified

Performance-Based Award” means an Award that is either (i) intended to qualify for the Section 162(m) Exemption and is made

subject to performance goals based on Qualified Business Criteria as set forth in Section 11.2, or (ii) an Option or SAR having

an exercise price equal to or greater than the Fair Market Value of the underlying Stock as of the Grant Date.

(ii) “Qualified

Business Criteria” means one or more of the Business Criteria listed in Section 11.2 upon which performance goals for certain

Qualified Performance-Based Awards may be established by the Committee.

(jj) “Restricted

Stock” means Stock granted to a Participant under Article 9 that is subject to certain restrictions and to risk of forfeiture.

(kk) “Restricted

Stock Unit” means the right granted to a Participant under Article 9 to receive shares of Stock (or the equivalent value

in cash or other property if the Committee so provides) in the future, which right is subject to certain restrictions and to risk

of forfeiture.

(ll) “Section

162(m) Exemption” means the exemption from the limitation on deductibility imposed by Section 162(m) of the Code that is

set forth in Section 162(m)(4)(C) of the Code or any successor provision thereto.

(mm) “Shares”

means shares of the Company’s Stock. If there has been an adjustment or substitution pursuant to Article 15, the term “Shares”

shall also include any shares of stock or other securities that are substituted for Shares or into which Shares are adjusted pursuant

to Article 15.

(nn) “Stock”

means the $0.10 par value common stock of the Company and such other securities of the Company as may be substituted for Stock

pursuant to Article 15.

(oo) “Stock

Appreciation Right” or “SAR” means a right granted to a Participant under Article 8 to receive a payment equal

to the difference between the Fair Market Value of a Share as of the date of exercise of the SAR over the base price of the SAR,

all as determined pursuant to Article 8.

(pp) “Subsidiary”

means any corporation, limited liability company, partnership or other entity of which a majority of the outstanding voting stock

or voting power is beneficially owned directly or indirectly by the Company. Notwithstanding the above, with respect to an Incentive

Stock Option, Subsidiary shall have the meaning set forth in Section 424(f) of the Code.

(qq) “1933

Act” means the Securities Act of 1933, as amended from time to time.

(rr) “1934

Act” means the Securities Exchange Act of 1934, as amended from time to time.

ARTICLE 3

EFFECTIVE TERM OF PLAN

3.1. EFFECTIVE

DATE. Subject to the approval of the Plan by the Company’s shareholders within 12 months after the Plan’s adoption

by the Board, the Plan will become effective on the date that it is adopted by the Board (the “Effective Date”).

3.2. TERMINATION

OF PLAN. Unless earlier terminated as provided herein, the Plan shall continue in effect until the tenth anniversary of the

Effective Date or, if the shareholders approve an amendment to the Plan that increases the number of Shares subject to the Plan,

the tenth anniversary of the date of such approval. The termination of the Plan on such date shall not affect the validity of any

Award outstanding on the date of termination, which shall continue to be governed by the applicable terms and conditions of the

Plan.

ARTICLE 4

ADMINISTRATION

4.1. COMMITTEE.

The Plan shall be administered by a Committee appointed by the Board (which Committee shall consist of at least two directors)

or, at the discretion of the Board from time to time, the Plan may be administered by the Board. It is intended that at least two

of the directors appointed to serve on the Committee shall be Independent Directors and that any such members of the Committee

who do not so qualify shall abstain from participating in any decision to make or administer Awards that are made to Eligible Participants

who at the time of consideration for such Award (i) are persons subject to the short-swing profit rules of Section 16 of the 1934

Act, or (ii) are reasonably anticipated to become Covered Employees during the term of the Award. However, the mere fact that a

Committee member shall fail to qualify as an Independent Director or shall fail to abstain from such action shall not invalidate

any Award made by the Committee which Award is otherwise validly made under the Plan. The members of the Committee shall be appointed

by, and may be changed at any time and from time to time in the discretion of, the Board. Unless and until changed by the Board,

the Compensation and Governance Committee of the Board is designated as the Committee to administer the Plan. The Board may reserve

to itself any or all of the authority and responsibility of the Committee under the Plan or may act as administrator of the Plan

for any and all purposes. To the extent the Board has reserved any authority and responsibility or during any time that the Board

is acting as administrator of the Plan, it shall have all the powers and protections of the Committee hereunder, and any reference

herein to the Committee (other than in this Section 4.1) shall include the Board. To the extent any action of the Board under the

Plan conflicts with actions taken by the Committee, the actions of the Board shall control.

4.2. ACTION

AND INTERPRETATIONS BY THE COMMITTEE. For purposes of administering the Plan, the Committee may from time to time adopt rules,

regulations, guidelines and procedures for carrying out the provisions and purposes of the Plan and make such other determinations,

not inconsistent with the Plan, as the Committee may deem appropriate. The Committee may correct any defect, supply any omission

or reconcile any inconsistency in the Plan or in any Award in the manner and to the extent it deems necessary to carry out the

intent of the Plan. The Committee’s interpretation of the Plan, any Awards granted under the Plan, any Award Certificate

and all decisions and determinations by the Committee with respect to the Plan are final, binding, and conclusive on all parties.

Each member of the Committee is entitled to, in good faith, rely or act upon any report or other information furnished to that

member by any officer or other employee of the Company or any Affiliate, the Company’s or an Affiliate’s independent

certified public accountants, Company counsel or any executive compensation consultant or other professional retained by the Company

to assist in the administration of the Plan. No member of the Committee will be liable for any good faith determination, act or

omission in connection with the Plan or any Award.

4.3. AUTHORITY

OF COMMITTEE. Except as provided in Section 4.1 and 4.5 hereof, the Committee has the exclusive power, authority and discretion

to:

| |

(b) |

Designate Participants; |

(c) Determine

the type or types of Awards to be granted to each Participant;

(d) Determine

the number of Awards to be granted and the number of Shares or dollar amount to which an Award will relate;

(e) Determine

the terms and conditions of any Award granted under the Plan;

(f) Prescribe

the form of each Award Certificate, which need not be identical for each Participant;

(g) Decide

all other matters that must be determined in connection with an Award;

(h) Establish,

adopt or revise any rules, regulations, guidelines or procedures as it may deem necessary or advisable to administer the Plan;

(i) Make

all other decisions and determinations that may be required under the Plan or as the Committee deems necessary or advisable to

administer the Plan;

(j) Amend

the Plan or any Award Certificate as provided herein; and

(k) Adopt

such modifications, procedures, and subplans as may be necessary or desirable to comply with provisions of the laws of the United

States or any non-U.S. jurisdictions in which the Company or any Affiliate may operate, in order to assure the viability of the

benefits of Awards granted to participants located in the United States or such other jurisdictions and to further the objectives

of the Plan.

Notwithstanding any

of the foregoing, grants of Awards to Non-Employee Directors hereunder shall (i) be subject to the applicable award limits set

forth in Section 5.4 hereof, and (ii) be made only in accordance with the terms, conditions and parameters of a plan, program or

policy for the compensation of Non-Employee Directors as in effect from time to time that is approved and administered by a committee

of the Board consisting solely of Independent Directors. The Committee may not make other discretionary grants hereunder to Non-Employee

Directors.

4.4. DELEGATION.

The Board or the Committee may, by resolution, expressly delegate to a special committee, consisting of one or more directors who

may but need not be officers of the Company, the authority, within specified parameters as to the number and terms of Awards, to

(i) designate officers and/or employees of the Company or any of its Affiliates to be recipients of Awards under the Plan, and

(ii) to determine the number of such Awards to be received by any such Participants; provided, however, that such

delegation of duties and responsibilities to an officer of the Company may not be made with respect to the grant of Awards to eligible

participants (a) who are subject to Section 16(a) of the 1934 Act at the Grant Date, or (b) who as of the Grant Date are reasonably

anticipated to be become Covered Employees during the term of the Award. The acts of such delegates shall be treated hereunder

as acts of the Board and such delegates shall report regularly to the Board and the Compensation Committee regarding the delegated

duties and responsibilities and any Awards so granted.

4.5. INDEMNIFICATION.

Each person who is or shall have been a member of the Committee, or of the Board, or an officer of the Company to whom authority

was delegated in accordance with this Article 4 shall be indemnified and held harmless by the Company against and from any

loss, cost, liability, or expense that may be imposed upon or reasonably incurred by him or her in connection with or resulting

from any claim, action, suit, or proceeding to which he or she may be a party or in which he or she may be involved by reason of

any action taken or failure to act under the Plan and against and from any and all amounts paid by him or her in settlement thereof,

with the Company’s approval, or paid by him or her in satisfaction of any judgment in any such action, suit, or proceeding

against him or her, provided he or she shall give the Company an opportunity, at its own expense, to handle and defend the same

before he or she undertakes to handle and defend it on his or her own behalf, unless such loss, cost, liability, or expense is

a result of his or her own willful misconduct or except as expressly provided by statute. The foregoing right of indemnification

shall not be exclusive of any other rights of indemnification to which such persons may be entitled under the Company’s charter

or bylaws, as a matter of law, or otherwise, or any power that the Company may have to indemnify them or hold them harmless.

ARTICLE 5

SHARES SUBJECT TO THE PLAN

5.1. NUMBER

OF SHARES. Subject to adjustment as provided in Sections 5.2 and Section 15.1, the aggregate number of Shares reserved and

available for issuance pursuant to Awards granted under the Plan shall be 3,000,000. The maximum number of Shares that may be issued

upon exercise of Incentive Stock Options granted under the Plan shall be 800,000. From and after the Effective Date, no further

awards shall be granted under the Company’s 2000 Long-Term Incentive Plan or the Company’s 2008 Long-Term Incentive

Plan (the “Prior Plans”) and the Prior Plans shall remain in effect only so long as awards granted thereunder shall

remain outstanding.

5.2. SHARE

COUNTING. The maximum number of Shares covered by an Award shall be subtracted from the Plan share reserve as of the Grant

Date, but shall be added back to the Plan share reserve in accordance with this Section 5.2.

(a) To

the extent that an Award is canceled, terminates, expires, is forfeited or lapses for any reason, any unissued or forfeited Shares

originally subject to the Award will be added back to the Plan share reserve and again be available for issuance pursuant to Awards

granted under the Plan.

(b) Shares

subject to Awards settled in cash will be added back to the Plan share reserve and again be available for issuance pursuant to

Awards granted under the Plan.

(c) To

the extent that the full number of Shares subject to a Performance Award is not issued by reason of failure to achieve maximum

performance goals, the unearned Shares originally subject to the Award will be added back to the Plan share reserve and again be

available for issuance pursuant to Awards granted under the Plan.

(d) Substitute

Awards granted pursuant to Section 14.10 of the Plan shall not count against the Shares otherwise available for issuance under

the Plan under Section 5.1.

(e) Subject

to applicable Exchange requirements, shares available under a shareholder-approved plan of a company acquired by the Company (as

appropriately adjusted to Shares to reflect the transaction) may be issued under the Plan pursuant to Awards granted to individuals

who were not employees of the Company or its Affiliates immediately before such transaction and will not count against the maximum

share limitation specified in Section 5.1.

(f) The

following Shares may not again be made available for issuance as Awards under the Plan: (i) Shares not issued or delivered as a

result of the net settlement of an outstanding Option or SAR, (ii) Shares used to pay the exercise price or withholding taxes related

to an outstanding Option or SAR, or (iii) Shares repurchased on the open market with the proceeds of the exercise price of an Option.

5.3. STOCK

DISTRIBUTED. Any Stock distributed pursuant to an Award may consist, in whole or in part, of authorized and unissued Stock,

treasury Stock or Stock purchased on the open market.

5.4. LIMITATION

ON AWARDS. Notwithstanding any provision in the Plan to the contrary (but subject to adjustment as provided in Article 15):

(a) Options.

The maximum aggregate number of Shares subject to Options granted under the Plan in any 12-month period to any one Participant

shall be 200,000.

(b) SARs.

The maximum number of Shares subject to Stock Appreciation Rights granted under the Plan in any 12-month period to any one Participant

shall be 200,000.

(c) Restricted

Stock or Restricted Stock Units. The maximum aggregate number of Shares underlying Awards of Restricted Stock or Restricted

Stock Units granted under the Plan in any 12-month period to any one Participant shall be 200,000.

(d) Other

Stock-Based Awards. The maximum aggregate number of Shares associated with Other Stock-Based Awards granted under the Plan

in any 12-month period to any one Participant shall be 200,000.

(e) Cash-Based

Awards. The maximum aggregate amount that may be paid with respect to cash-based Awards under the Plan to any one Participant

in any fiscal year of the Company shall be $1,000,000.

(f) Awards

to Non-Employee Directors. The maximum aggregate number of Shares associated with any Award granted under the Plan in

any 12-month period to any one Non-Employee Director shall be 200,000.

ARTICLE 6

ELIGIBILITY

6.1. GENERAL.

Awards may be granted only to Eligible Participants. Incentive Stock Options may be granted only to Eligible Participants who are

employees of the Company or a Parent or Subsidiary as defined in Section 424(e) and (f) of the Code. Eligible Participants who

are service providers to an Affiliate may be granted Options or SARs under this Plan only if the Affiliate qualifies as an “eligible

issuer of service recipient stock” within the meaning of §1.409A-1(b)(5)(iii)(E) of the final regulations under Code

Section 409A.

ARTICLE 7

STOCK OPTIONS

7.1. GENERAL.

The Committee is authorized to grant Options to Participants on the following terms and conditions:

(a) EXERCISE

PRICE. The exercise price per Share under an Option shall be determined by the Committee, provided that the exercise price

for any Option (other than an Option issued as a substitute Award pursuant to Section 14.10) shall not be less than the Fair Market

Value as of the Grant Date.

(b) PROHIBITION

ON REPRICING. Except as otherwise provided in Article 15, without the prior approval of shareholders of the Company: (i) the

exercise price of an Option may not be reduced, directly or indirectly, (ii) an Option may not be cancelled in exchange for cash,

other Awards, or Options or SARs with an exercise or base price that is less than the exercise price of the original Option, or

otherwise, and (iii) the Company may not repurchase an Option for value (in cash or otherwise) from a Participant if the current

Fair Market Value of the Shares underlying the Option is lower than the exercise price per share of the Option.

(c) TIME

AND CONDITIONS OF EXERCISE. The Committee shall determine the time or times at which an Option may be exercised in whole or

in part, subject to Section 7.1(e), including a provision that an Option that is otherwise exercisable and has an exercise price

that is less than the Fair Market Value of the Stock on the last day of its term will be automatically exercised on such final

date of the term by means of a “net exercise,” thus entitling the optionee to Shares equal to the intrinsic value of

the Option on such exercise date, less the number of Shares required for tax withholding. The Committee shall also determine the

performance or other conditions, if any, that must be satisfied before all or part of an Option may be exercised or vested.

(d) PAYMENT.

The Committee shall determine the methods by which the exercise price of an Option may be paid, the form of payment, and the methods

by which Shares shall be delivered or deemed to be delivered to Participants. As determined by the Committee at or after the Grant

Date, payment of the exercise price of an Option may be made in, in whole or in part, in the form of (i) cash or cash equivalents,

(ii) delivery (by either actual delivery or attestation) of previously-acquired Shares based on the Fair Market Value of the Shares

on the date the Option is exercised, (iii) withholding of Shares from the Option based on the Fair Market Value of the Shares on

the date the Option is exercised, (iv) broker-assisted market sales, or (iv) any other “cashless exercise” arrangement.

(e) EXERCISE

TERM. Except for Nonstatutory Options granted to Participants outside the United States, no Option granted under the Plan shall

be exercisable for more than ten years from the Grant Date.

(f) NO

DEFERRAL FEATURE. No Option shall provide for any feature for the deferral of compensation other than the deferral of recognition

of income until the exercise or disposition of the Option.

(g) NO

DIVIDEND EQUIVALENTS. No Option shall provide for Dividend Equivalents.

7.2. INCENTIVE

STOCK OPTIONS. The terms of any Incentive Stock Options granted under the Plan must comply with the requirements of Section

422 of the Code. Without limiting the foregoing, any Incentive Stock Option granted to a Participant who at the Grant Date owns

more than 10% of the voting power of all classes of shares of the Company must have an exercise price per Share of not less than

110% of the Fair Market Value per Share on the Grant Date and an Option term of not more than five years. If all of the requirements

of Section 422 of the Code (including the above) are not met, the Option shall automatically become a Nonstatutory Stock Option.

ARTICLE 8

STOCK APPRECIATION RIGHTS

8.1. GRANT

OF Stock Appreciation Rights. The Committee is authorized to grant Stock Appreciation

Rights to Participants on the following terms and conditions:

(a) RIGHT

TO PAYMENT. Upon the exercise of a SAR, the Participant has the right to receive, for each Share with respect to which the

SAR is being exercised, the excess, if any, of:

(1) The

Fair Market Value of one Share on the date of exercise; over

(2) The

base price of the SAR as determined by the Committee and set forth in the Award Certificate, which shall not be less than the Fair

Market Value of one Share on the Grant Date.

(b) PROHIBITION

ON REPRICING. Except as otherwise provided in Article 15, without the prior approval of shareholders of the Company: (i) the

base price of a SAR may not be reduced, directly or indirectly, (ii) a SAR may not be cancelled in exchange for cash, other Awards,

or Options or SARs with an exercise or base price that is less than the base price of the original SAR, or otherwise, and (iii)

the Company may not repurchase a SAR for value (in cash or otherwise) from a Participant if the current Fair Market Value of the

Shares underlying the SAR is lower than the base price per share of the SAR.

(c) TIME

AND CONDITIONS OF EXERCISE. The Committee shall determine the time or times at which a SAR may be exercised in whole or in

part, including a provision that a SAR that is otherwise exercisable and has a base price that is less than the Fair Market Value

of the Stock on the last day of its term will be automatically exercised on such final date of the term, thus entitling the holder

to cash or Shares equal to the intrinsic value of the SAR on such exercise date, less the cash or number of Shares required for

tax withholding. Except for SARs granted to Participants outside the United States, no SAR shall be exercisable for more than ten

years from the Grant Date.

(d) NO

DEFERRAL FEATURE. No SAR shall provide for any feature for the deferral of compensation other than the deferral of recognition

of income until the exercise or disposition of the SAR.

(e) NO

DIVIDEND EQUIVALENTS. No SAR shall provide for Dividend Equivalents.

(f) OTHER

TERMS. All SARs shall be evidenced by an Award Certificate. Subject to the limitations of this Article 8, the terms, methods

of exercise, methods of settlement, form of consideration payable in settlement (e.g., cash, Shares or other property), and any

other terms and conditions of the SAR shall be determined by the Committee at the time of the grant and shall be reflected in the

Award Certificate.

ARTICLE 9

RESTRICTED STOCK, RESTRICTED STOCK UNITS

AND DEFERRED STOCK UNITS

9.1. GRANT

OF RESTRICTED STOCK, RESTRICTED STOCK UNITS AND DEFERRED STOCK UNITS. The Committee is authorized to make Awards of Restricted

Stock, Restricted Stock Units or Deferred Stock Units to Participants in such amounts and subject to such terms and conditions

as may be selected by the Committee. An Award of Restricted Stock, Restricted Stock Units or Deferred Stock Units shall be evidenced

by an Award Certificate setting forth the terms, conditions, and restrictions applicable to the Award.

9.2. ISSUANCE

AND RESTRICTIONS. Restricted Stock, Restricted Stock Units or Deferred Stock Units shall be subject to such restrictions on

transferability and other restrictions as the Committee may impose (including, for example, limitations on the right to vote Restricted

Stock or the right to receive dividends on the Restricted Stock). These restrictions may lapse separately or in combination at

such times, under such circumstances, in such installments, upon the satisfaction of performance goals or otherwise, as the Committee

determines at the time of the grant of the Award or thereafter. Except as otherwise provided in an Award Certificate or any special

Plan document governing an Award, a Participant shall have none of the rights of a shareholder with respect to Restricted Stock

Units or Deferred Stock Units until such time as Shares of Stock are paid in settlement of such Awards.

9.3 DIVIDENDS

ON RESTRICTED STOCK. In the case of Restricted Stock, the Committee may provide that ordinary cash dividends declared on the

Shares before they are vested (i) will be forfeited, (ii) will be deemed to have been reinvested in additional Shares or otherwise

reinvested (subject to Share availability under Section 5.1 hereof), or (iii) in the case of Restricted Stock that is not subject