Filed by Noble Energy, Inc.

(Commission File No. 001-07964)

Pursuant to Rule 425

Under the

Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: Rosetta Resources, Inc.

Commission File No.: 000-51801

This filing

relates to the proposed merger of a subsidiary of Noble Energy with Rosetta pursuant to the terms of an Agreement and Plan of Merger, dated as of May 10, 2015 (the “Merger Agreement”), by and among Noble Energy, Rosetta and Bluebonnet

Merger Sub Inc. The Merger Agreement is on file with the Securities and Exchange Commission as an exhibit to the Current Report on Form 8-K filed by Noble Energy on May 11, 2015, and is incorporated by reference into this filing.

|

|

|

| THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us |

|

|

|

|

| ©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. ‘Thomson

Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

|

|

MAY 20, 2015 / 3:35PM, NBL - Noble Energy Inc at UBS Global Oil and Gas Conference

CORPORATE PARTICIPANTS

Ken Fisher Noble Energy, Inc. - EVP & CFO

CONFERENCE CALL PARTICIPANTS

Bill Featherston

UBS - Analyst

PRESENTATION

Bill

Featherston - UBS - Analyst

Okay. We’re going to get started with our next presentation, Noble Energy who always has a lot to say with a

terrific resource base in the US in the Niobrara and Marcellus and then a deep offshore portfolio, but even more to say today on the heels of their pending transaction with Rosetta, which was announced last week.

Here to tell us about it is Ken Fisher, who is the Executive Vice President and CFO. So with that, I’ll hand it off to Ken.

Ken Fisher - Noble Energy, Inc. - EVP & CFO

Thanks, Bill. Appreciate everybody’s time and interest. It’s been a busy year so far at Noble and hopefully provide a good update for you. As you

look into this year, we’re excited about a lot of new infrastructure coming on in the DJ Basin with Lucerne-2 plant from DCP, our own Keota gas plant and then a number of compression projects all starting up over the next few months that gives

us a big opportunity there.

We’re also progressing three Gulf of Mexico projects, two of which will come on this year Big Bend and Dantzler in the

third-fourth quarter time frame for Big Bend and then Dantzler right at the end of the year. Those will add about 20,000 barrels a day of LLS oil production and next year we’ll bring Gunflint on as well.

We continue, I’ll talk a little bit about it in a minute, but we continue to make progress with the new government in Israel in terms of getting a

sanctionable investment climate and then also we’re quite active this year on exploration with our first Cretaceous test in West Africa offshore Cameroon, which will be a third quarter spud, and then a June spud on our first well on the

Falklands with a second to follow up later in the year, so quite a bit of activity. And then of course last week we announced and are very excited about adding the ROSE assets to the portfolio. So try and take you through that and then happy to take

any questions.

First of all we maintain — we try to stay strong through the cycle and keep our balance sheet strong, liquidity strong. This served

us very well in 2009 in the financial crisis. Being in strong shape really allowed us to create a lot of value through the sanction of the Tamar project, the Aseng project in West Africa and the Alen project also West Africa. So about $6 billion

worth of projects sanctioned in a pretty tough time for the industry and they all hit schedule, hit the budget and had operated very reliably and added a lot of value and cash flow to the portfolio. So as we went through this year that’s the

way we are thinking about this. Ensure we maintain our balance sheet in good shape, strong liquidity and the ability to manage through whatever the environment throws at us. And we maintained our investment grade rating as well and were reaffirmed

after the ROSE transaction both on our rating and our outlook.

So we feel good about that and are also very well hedged, particularly compared to lot of

the peer group for 2015 going into 2016 and then our Israeli asset at Tamar is a very nice hedge because it’s very insensitive to oil price. So that continues to be a very nice source of cash generation.

And I think the one point — this is a chart I put together for the visit with the rating agencies earlier this year and I mean we’re in this for the

long haul and we have a demonstrated track record of success both in terms of reserve growth, production growth and then actually cash growing faster than our production or reserves growth and we understand how to manage through the cycle.

2

|

|

|

| THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is

prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

|

|

MAY 20, 2015 / 3:35PM, NBL - Noble Energy Inc at UBS Global Oil and Gas Conference

So with the ROSE transaction, as I said, very excited about that, we add two new

essentially basins to the family. And it really allows us to leverage our onshore expertise. We’ve had technical teams looking at different opportunities in the US and Canada over the last few years. These were clearly two of the areas that we

found the most interesting and this transaction allows us to get a very nice position in each play.

It adds about 1,800 gross horizontal locations to the

portfolio. About 10 years in the Eagle Ford and 20 years in the Permian and 1 billion barrels net unrisked resource potential and we can grow these assets over the next three or four years at a 15% growth rate within the cash flow that comes from

the assets. So we feel very good about that.

Metrics were quite good in terms of historic metrics on a transaction basis and then this will be cash flow,

production, reserves accretive to us as we move through the next few years and it’s an opportunity to really leverage the technical expertise and talent we have both from the G&G standpoint and then from a major project development basis.

We’ll use the — where we piloted IDP concept in the DJ Basin we’ll bring that down to, in particular, the Permian acreage as that’s

very early days. It gives us the ability to really plan that development on an IDP-type basis. We expect the transaction to close in third quarter.

So

this a little picture of the acreage. As I mentioned that most of the production today comes from the Eagle Ford. We’ll be modifying the development plan a little bit there to concentrate over the next few years in South Gates Ranch, very

prolific wells and we’ll also modify the spacing of wells based on our technical analysis which then allows us to be in a sense a little more capital efficient and we’ll continue to try and push maximize lateral lengths as well there.

And then at the Permian, as I said, we’ll apply the IDP concept and start a more significant development than the current plan with ROSE. And this adds

— this will be essentially the third largest — on a combined basis, the third largest producing area for the Company as we bring it on board. It pushes our liquids content of year-end proved reserves up by about 5 percentage points and it

comes with very nice economics. The wells will be drilled in the Gates Ranch area probably some of the best in the portfolio comparing very favorably to what we see up in the best areas of the DJ. And the Permian, early days, but we see those wells

doing quite well today with a lot of upside potential.

This is simply the things, I think I mentioned most of this, but these are the things where we see

us bringing value to the development in these assets and allows us essentially to generate that 15% plus growth rate over the next few years within cash flow. So this year’s plan, [first we’ll bake year] 2016, about $350 million of capital

for the assets and then about $500 million a year in the next couple of years, and then it will deliver this production outlook. So take it up to about 100,000 barrels a day by 2018 which estimated at the time that probably — has probably the

second largest core area after the DJ in our portfolio.

A little bit around the rest of the portfolio. As I mentioned the DJ I think continue to be very

excited about that, running four rigs, seeing very good results up there in terms of drilling performance and really pushing to drill as many long laterals as we can. Somewhere between 40% and 50% of the program will be the extended reach lateral

wells this year. And then as I mentioned, you’ve got a 200 million a day gas plant coming on with Lucerne-2. Our Keota gas plant coming on as well and then three big compressor station projects, all of which should help in terms of the

legacy production on the vertical side and just generally the production outlook overall.

This is a look at our drilling performance over the last few

years in terms of total footage drilled per day and then spud to rig release is the line graph there. So what’s really interesting is, as we went from 10 rigs to four rigs this year, dropped the program from about $2 billion to about $1 billion

program. We’re seeing — we can drill 70% of the total footage this year with those four rigs. So a significant improvement in — ongoing improvement in drilling performance. And then where — a few years ago when the vertical days

it was eight or nine days to drill a vertical well we’ve drilled an extended reach well in seven days, so continue to see that. And that’s something I think we can bring very, very quickly to the ROSE assets as they come into the family.

In the Marcellus, we continue to work very closely with the consol folks on what the optimal spending there in the current environment. So our original

$2.9 billion of capital for this year, that was assuming a $900 million plus up in the Marcellus, where we’re focused now is more — just under $700 million and this still — asset continues to perform very well. Production continues to

grow nicely. We continue to see good well performance, but given the environment, this is not an area where we want to spend a lot more money than that as we move until we see prices move to a different environment. So I think that’s kind of

the key and we will continue to work with our partners out there.

3

|

|

|

| THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is

prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

|

|

MAY 20, 2015 / 3:35PM, NBL - Noble Energy Inc at UBS Global Oil and Gas Conference

Gulf of Mexico, as I mentioned, the three green highlighted projects will come on line.

These are all subsea tieback projects. If you look with the exception of Gunflint, which had a moratorium impact in terms of the project timing around appraisal drilling, you’ve got wells that have discovery to production cycle times very

favorable to industry average and very nice economics as I said, LLS pricing and not much infrastructure cost in terms of development.

So we’ll

bring Big Bend on in 4Q and Dantzler by the end of the year. Each of those will add about 10,000 barrels a day net to Noble and then Gunflint comes on line again mid next year and that’s somewhere between 5,000 and 10,000 barrels a day

depending on capacity of the host facility. So this will add a nice production addition at the end of the year and really sets us up for a nice growth rate.

What we’ve communicated at the beginning of the year is this year’s capital spend guidance about $2.9 billion and we can — given that we

don’t have recurring capital here in the Gulf of Mexico on these projects we can grow the business next year in the $2.2 billion to $2.3 billion capital range prior to the ROSE transaction. So these set us up very nicely.

And then West Africa continues to be a very nice performer and cash generator and then we will drill in Cameroon in the third quarter the Cretaceous prospect

at Cheetah. So this is pretty shallow water depth, as you see about 85 feet. So if this is a commercial discovery, this is something that we could I think do very well in terms of getting it on production quickly. And this is the first test on our

acreage — Cretaceous test on our acreage there, so the exploration team is excited to see what may come from that.

And then in Israel we continue to

work very closely with the government. Obviously we were disappointed by the anti-trust announcement in December. Since that time we’ve a spent a lot of engagement time and what we’re seeing with the new government is very clearly a desire

to get a clear path for gas development in place quickly. If you follow the news over there, there was a article today in Globes and it highlighted the fact that the article quoted $126 billion of revenue from the gas to the country over 20 years

and $54 billion of it go into the state treasury. So there is a huge incentive for the country to get the gas on. And so what we’ve seen since the December time frame is an inter-ministerial group working together justices, ministry, energy and

water, the Antitrust Commissioner, Ministry of Economy and Ministry of Environment and working collectively to get us to a place where the antitrust issue is resolved, where we have the right development approvals, export approvals and then the

ability to move forward with the project sanction. So I think as Dave mentioned on our call a couple weeks ago cautiously optimistic that that gets done in the early days of the new government.

And so with that then the ball will be in our court to complete the gas marketing activity. We see in the range of about 3 Bcf a day of demand in the region

from Jordanian gas, domestic Egyptian gas, additional gas in Israel and then the potential for LNG back-fills in Egypt. So significant amount of what I’d call latent gas demand that we can then firm up some of that on contract which would allow

then a project sanction. And so I think that’s.

In the meantime we continue to, as I mentioned, have very nice cash generation from our assets in

Israel, not susceptible to oil price, so kind of a nice hedge. And that also then gives us flexibility as we’d like to say ring fence the development. So we’re not putting additional capital into the Eastern Med, in other words, in a sense

the existing cash flows can help fund and handle the future development.

And then on exploration, just Wood Mac study from last year, we’ve had an

ongoing commitment to exploration through time. Probably in the range of 15% of our capital each year gets put into exploration and we’ve had significant value creation from that over the last few years with the Douala Basin successes in West

Africa and then discover in the Levant resources there. So if you look at it, over the last 10 years we have one of the top success rates and a very good finding and development cost type of outlook. And as I said we’re committed to continue

that exploration even in a lower capital environment where we’re doing the exploration in both Cameroon and then also in the Falkland.

So major

acreage positions in the Falklands, over 10 million gross acres. We will grow our first well there spudding. I think it should be in June at Humpback which is cretaceous prospect and would derisk some of the nearby area. And then the next

prospect we farmed into this [array of block] recently and that’s adjacent to the Sea Lion discovery. So we’ll have these things to report on over the next couple of quarters.

4

|

|

|

| THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is

prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

|

|

MAY 20, 2015 / 3:35PM, NBL - Noble Energy Inc at UBS Global Oil and Gas Conference

So with that, I think, happy to take any questions.

QUESTIONS AND ANSWERS

Unidentified Audience Member

(inaudible - microphone inaccessible)

Ken Fisher - Noble Energy, Inc. -

EVP & CFO

Yes, sure. A couple of couple things. One, I think a lot of that will come out in the proxy which should come out pretty soon. So I

don’t think I want to go into too much transaction detail. But we have essentially two teams that look at opportunities. So we have one that looks offshore opportunities around the world and we’ve had a team that’s looked at

unconventional opportunities in the US. And so they did a lot of basin screening. So when this came to us, I think we had a pretty good base line of the areas and then we spent time on technical due diligence and what value we could bring to the

assets with what we saw. So I think that’s how we assess the opportunity. In terms of the commercial details I think you can hear that in the proxy or read that in the proxy.

In terms of the way we thought about it we felt we could add a couple of onshore core areas and handle that very well within the existing structure

efficiently and with the capabilities we have and we’ve operated the Marcellus and the DJ under one structure over the last few years to ensure that the information flow and the learnings and the methodologies are shared and transferred. So I

think we will operate this asset similarly try to do it as an onshore use all the best practices, all the ideas. In terms of — it certainly fills in growth with that Israel projects slipping a year or two depending on timing this is providing

very clear linear growth for the next couple of years. And as we looked at it we can do it within cash flow. So that was a very attractive part of it as well.

And then we like the diversity. I think the diversity through time has served us well and the ability to optimize capital in a given year back in the

moratorium time frame we could spend more in the DJ as Israel — as we changed the plan a little bit there we can allocate capital differently. So we like that. And so those were all elements of the thinking along with, frankly, how much value

you can create, are these returns going to rank in the portfolio and can we bring value to these assets in a sense differential value to these assets.

Unidentified Audience Member

(inaudible - microphone inaccessible)

Ken Fisher - Noble Energy, Inc. -

EVP & CFO

Sure. I guess it’s probably a long — you could spend a lot of time on this, but historically starting in 2008, we started

gas production in 2004, they started to buy gas for Egypt in 2008 and then the Egyptian gas went offline in 2011. So we became the only domestic gas supplier, they do buy LNG, and have been for the last couple of years. The antitrust allegations

were specific about our farm-in of Leviathan that was approved by the government. So we’ve always felt that that was not an appropriate issue or it wasn’t something that the government had approved our entry. So we felt our legal position

was very strong.

At the same time we recognized that practically we were a monopoly and we were not against having a competitor, frankly that we think it

would be good. So we agreed with the Antitrust Commissioner to divest Tanin and Karish and we had that signed agreement and that was what happened in December that that was essentially not progressed to the tribunal for final approval. So with that

then that created too much uncertainty for us to be able to progress further investment. So the messages that we laid out — we were happy to address the competitive situation, but we would not do it in a way that would sacrifice value to us by

some kind of short-term forced divestment, and two we were not going to reopen existing agreed multi-year contracts.

5

|

|

|

| THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is

prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

|

|

MAY 20, 2015 / 3:35PM, NBL - Noble Energy Inc at UBS Global Oil and Gas Conference

And then we demobilized the team on Leviathan and so I think it was clear that we wouldn’t commit further capital until these issues were resolved. I think the government took a

multi-disciplinary approach to this as they assessed the situation and the timing of development and they’ve — this inter-ministerial group has been looking at what’s the right thing to do for the whole country, what is the best

outcome. Antitrust is an element of that, but it’s not the only element and the value comes from developing the resource. So what we’ve seen over the last few months has been a lot of hard work by this inter-ministerial group, both at the

leadership and at the staff level to address the various elements of the thing. And our sense is that there will be a workable solution that will come out of this that will allow us to make further investment and both expand Tamar and develop

Leviathan and antitrust have an element of that, but it won’t be the only element.

Clearly we’re committed or we were willing to and are

willing to divest Tanin and Karish which is about 3 Tcf of gas and there were some liquids as well. So that’s certainly something that we would consider and be willing to do. It’s something we committed to do in the consent decree.

And then we do not — as we demonstrated with the Woodside discussions, we do not feel compelled we have to hold 39.66% of Leviathan nor technically do we

need 36% of Tamar. You could still be the operator of those projects at a lower working interest. So we’re not going to do anything that would hurt value there, but we certainly have some flexibility to deal with that as part of the overall

solution.

Bill Featherston - UBS - Analyst

And I have a

quick question on the Niobrara. I think you did — or in the DJ, 116,000 barrels a day in the first quarter and then the full-year guidance is 106,000 barrels a day. But you have so much midstream infrastructure coming on in the middle part of

this year. And we’ve seen other operators really see a volume uplift when that happened. So should we assume that four rigs is not enough to hold production flat.

Ken Fisher - Noble Energy, Inc. -

EVP & CFO

Well, I think what Gary said, I think is somewhere around between four and five rigs is probably sufficient to hold production flat

and we’re not making — we’re quite hopeful about and pleased the new infrastructure is coming on, but we haven’t assumed a big uplift in that. So potentially you get — you may have a little better performance. When we built

the plan for this year and guidance, I think we were reasonably prudent in what we assumed for the impact of the new infrastructure.

Bill Featherston - UBS - Analyst

And a quick follow-up on Rosetta transaction, you referenced 15% growth for the next several years. Did you say the CapEx for that would be $350 million to

$500 million (multiple speakers)?

Ken Fisher - Noble Energy, Inc. - EVP & CFO

Yes, in the range of $500 million for the next couple years.

Bill Featherston - UBS - Analyst

Any other questions for Ken?

Ken Fisher - Noble Energy, Inc. -

EVP & CFO

I think I have eight more one-on-ones, so I think I’ll get plenty of opportunity.

6

|

|

|

| THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is

prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

|

|

MAY 20, 2015 / 3:35PM, NBL - Noble Energy Inc at UBS Global Oil and Gas Conference

Bill Featherston - UBS -Analyst

Please join me in thanking Noble.

Ken Fisher - Noble Energy, Inc. -

EVP & CFO

Thanks.

DISCLAIMER

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without

obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based,

companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those

stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies’ most recent SEC filings. Although the companies may indicate and believe that the assumptions

underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY’S CONFERENCE CALL

AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY

RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY’S CONFERENCE CALL ITSELF AND THE APPLICABLE

COMPANY’S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2015, Thomson Reuters. All Rights

Reserved.

7

|

|

|

| THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is

prohibited without the prior written consent of Thomson Reuters. ‘Thomson Reuters’ and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. |

|

|

Forward Looking Statements

This communication contains certain “forward-looking statements” within the meaning of federal securities laws. Words such as

“anticipates”, “believes,” “expects”, “intends”, “will”, “should”, “may”, and similar expressions may be used to identify forward-looking statements. Forward-looking statements

are not statements of historical fact and reflect Noble Energy’s and Rosetta’s current views about future events. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger

involving Noble Energy and Rosetta, including future financial and operating results, Noble Energy’s and Rosetta’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements

that are not historical facts, including estimates of oil and natural gas reserves and resources, estimates of future production, assumptions regarding future oil and natural gas pricing, planned drilling activity, future results of operations,

projected cash flow and liquidity, business strategy and other plans and objectives for future operations. No assurances can be given that the forward-looking statements contained in this communication will occur as projected and actual results may

differ materially from those projected. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual results to differ materially from those

projected. These risks and uncertainties include, without limitation, the ability to obtain the requisite Rosetta shareholder approval; the risk that Rosetta or Noble Energy may be unable to obtain governmental and regulatory approvals required for

the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger, the risk that a condition to closing of the merger may not be satisfied,

the timing to consummate the proposed merger, the risk that the businesses will not be integrated successfully, the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than

expected, disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers, the diversion of management time on merger-related issues, the volatility in commodity prices for crude oil and

natural gas, the presence or recoverability of estimated reserves, the ability to replace reserves, environmental risks, drilling and operating risks, exploration and development risks, competition, government regulation or other actions, the

ability of management to execute its plans to meet its goals and other risks inherent in Noble Energy’s and Rosetta’s businesses that are discussed in Noble Energy’s and Rosetta’s most recent annual reports on Form 10-K,

respectively, and in other Noble Energy and Rosetta reports on file with the Securities and Exchange Commission (the “SEC”). These reports are also available from the sources described above. Forward-looking statements are based on the

estimates and opinions of management at the time the statements are made. Noble Energy undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

This communication also contains certain historical and forward-looking non-GAAP measures of financial performance that management believes are good tools for

internal use and the investment community in evaluating Noble Energy’s overall financial performance. These non-GAAP measures are broadly used to value and compare companies in the crude oil and natural gas industry. Please also see Noble

Energy’s website at http://www.nobleenergyinc.com under “Investors” for reconciliations of the differences between any historical non-GAAP measures used in this presentation and the most directly comparable GAAP financial measures.

The GAAP measures most comparable to the forward-looking non-GAAP financial measures are not accessible on a forward-looking basis and reconciling information is not available without unreasonable effort.

The SEC requires oil and gas companies, in their filings with the SEC, to disclose proved reserves that a company has demonstrated by actual production or

conclusive formation tests to be economically and legally producible under existing economic and operating conditions. The SEC permits the optional

disclosure of probable and possible reserves, however, we have not disclosed our probable and possible reserves in our filings with the SEC. We use certain terms in this presentation, such as

“discovered unbooked resources”, “resources”, “risked resources”, “recoverable resources”, “unrisked resources”, “unrisked exploration prospectivity” and “estimated ultimate

recovery” (EUR). These estimates are by their nature more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized. The SEC guidelines strictly

prohibit us from including these estimates in filings with the SEC. Investors are urged to consider closely the disclosures and risk factors in our most recent Form 10-K and in other reports on file with the SEC, available from Noble Energy’s

offices or website, http://www.nobleenergyinc.com.

Additional Information And Where To Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In

connection with the proposed merger between Noble Energy and Rosetta, Noble Energy will file with the SEC a Registration Statement on Form S-4 that will include a proxy statement of Rosetta that also constitutes a prospectus of Noble Energy. Rosetta

will mail the proxy statement/prospectus to its shareholders. This document is not a substitute for any prospectus, proxy statement or any other document which Noble Energy or Rosetta may file with the SEC in connection with the proposed

transaction. Noble Energy and Rosetta urge Rosetta investors and shareholders to read the proxy statement/prospectus regarding the proposed merger when it becomes available, as well as other documents filed with the SEC, because they will contain

important information. You may obtain copies of all documents filed with the SEC regarding this transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from Noble Energy’s

website (www.nobleenergyinc.com) under the tab “Investors” and then under the heading “SEC Filings.” You may also obtain these documents, free of charge, from Rosetta’s website (www.rosettaresources.com) under the tab

“Investors” and then under the heading “SEC Filings.”

Participants In The Merger Solicitation

Noble Energy, Rosetta, and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from

Rosetta shareholders in favor of the merger and related matters. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Rosetta shareholders in connection with the proposed merger will be

set forth in the proxy statement/prospectus when it is filed with the SEC. You can find information about Noble Energy’s executive officers and directors in its definitive proxy statement filed with the SEC on March 27, 2015. You can find

information about Rosetta’s executive officers and directors in its definitive proxy statement filed with the SEC on March 26, 2015. Additional information about Noble Energy’s executive officers and directors and Rosetta’s

executive officers and directors can be found in the above-referenced Registration Statement on Form S-4 when it becomes available. You can obtain free copies of these documents from Noble Energy and Rosetta using the contact information above.

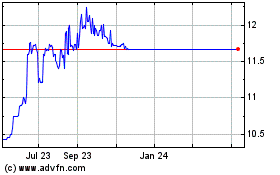

Rose Hill Acquisition (NASDAQ:ROSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rose Hill Acquisition (NASDAQ:ROSE)

Historical Stock Chart

From Apr 2023 to Apr 2024